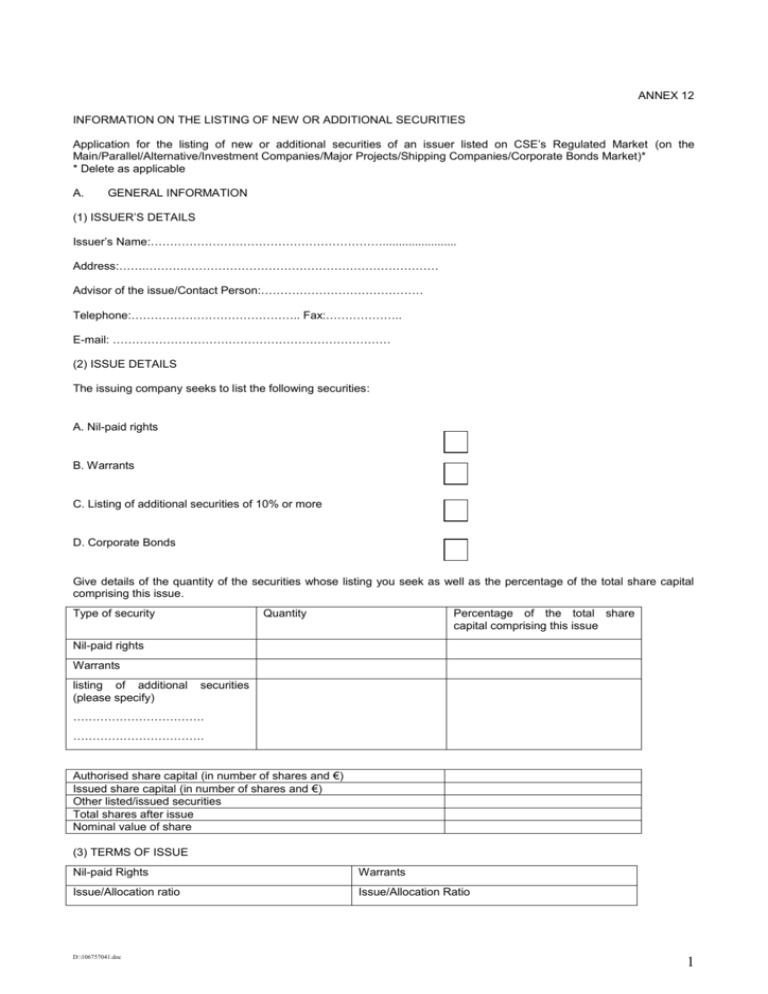

Annex 12: Information for the listing of new or additional securities

advertisement

ANNEX 12 INFORMATION ON THE LISTING OF NEW OR ADDITIONAL SECURITIES Application for the listing of new or additional securities of an issuer listed on CSE’s Regulated Market (on the Main/Parallel/Alternative/Investment Companies/Major Projects/Shipping Companies/Corporate Bonds Market)* * Delete as applicable Α. GENERAL INFORMATION (1) ISSUER’S DETAILS Issuer’s Name:……………………………………………………....................... Address:…….……….………………………………………………………… Advisor of the issue/Contact Person:…………………………………… Telephone:…………………………………….. Fax:……………….. E-mail: ……………………………………………………………… (2) ISSUE DETAILS The issuing company seeks to list the following securities: Α. Nil-paid rights Β. Warrants C. Listing of additional securities of 10% or more D. Corporate Bonds Give details of the quantity of the securities whose listing you seek as well as the percentage of the total share capital comprising this issue. Type of security Quantity Percentage of the total share capital comprising this issue Nil-paid rights Warrants listing of additional (please specify) securities ……………………………. ……………………………. Authorised share capital (in number of shares and €) Issued share capital (in number of shares and €) Other listed/issued securities Total shares after issue Nominal value of share (3) TERMS OF ISSUE Nil-paid Rights Warrants Issue/Allocation ratio Issue/Allocation Ratio D:\106757041.doc 1 Date of readjustment of the company’s share price (ex-rights date) Date of readjustment of the company’s share price (ex-warrants date) Record date for the issue of nil-paid rights Record date for the issue of warrants Date of dispatch of Letter of Allocation Date of dispatch of Letter of Allocation Trading Period of Nil-paid Rights on the Stock Exchange Date of Commencement of Trading of Warrants on the Stock Exchange Transfer of Nil-paid Rights Transfer of Warrants Date of suspension and delisting Date of suspension and delisting Date, Procedure and Price of Exercise of Nil-paid Rights Date/Period, Procedure and Price of Exercise of Warrants Readjustment of the price of exercise and of the number of warrants (subdivision, consolidation, bonus issue) Participation in other issues Date of Expiry of Warrants (Suspension and Delisting) Date of issue and dispatch of Letters of Allocation for fully paid shares Date of issue and dispatch of Letters of Allocation for fully paid shares Commencement of trading of new shares on the Stock Exchange Commencement of trading of new shares on the Stock Exchange Allocation of non-exercised Nil-Paid Rights Allocation of non-exercised Warrants CORPORATE BONDS Β. Size of issue, nominal value and split Registration and transfer Status and subordination Claims in case of winding-up Deferred payment of interest Payment of interests (interest rate, date of interests payment, interest calculation basis) Alternative interest payment mechanism Exchange with secondary capital securities, change in terms, redemption Untimely payment Allocation of securities to non-permanent residents of Cyprus (if applicable) Trust Document Notices and announcements Additional issues Listing on the CSE and trading/transfer of titles BOARD OF DIRECTORS BOARD OF DIRECTORS Full Name C. DEVELOPMENT OF THE ISSUER Briefly state the issuer’s growth since its last publication of a Prospectus/Company’s Profile to this day and make reference to material facts (e.g. takeovers, etc.) ……………………………………………………………………………………………………………………………… ………………………………………… D:\106757041.doc 2 State all court disputes, arbitrations or interruptions of activities which may have or have had in the recent past a significant impact on the issuer’s financial condition. ……………………………………………………………………………………………………………………………… ………………………………………… D. CHANGE IN SHARE CAPITAL State the amount of the issued capital, the number and the categories of shares representing it and their main characteristics. ………………………………………………………………………………………………………………………………… …………………………………………… State the resolutions, authorisations and approvals under which the securities have been or shall be issued. ………………………………………………………………………………………………………………………………… …………………………………………… Ε. MAIN SHAREHOLDERS (at the date of this Informative Document) AFTER THE INCREASE PRIOR TO INCREASE TOTAL SHAREHOLDER TOTAL DIRECTLY INDIRECTLY DIRECTLY INDIRECTLY SHARES % SHARES % Shareholder Α Shareholder Β Public TOTAL Remark: 1. Also state the total number of shares held by the members of the Board of Directors and the company’s senior executives. F. PRESENTATION OF THE INTENDED USE OF RAISED CAPITAL State the amount and the way in which the raised capital is intended to be used in relation to the issuing company’s strategic plan. …………………………………………………………………………………………………………………………………………… ………………………………… G. FINANCIAL INFORMATION State whether the last auditors’ report contains any reservation or statement of weakness to express an opinion or material uncertainty or whether the investors’ attention is drawn thereto (Qualification on the auditors’ report). Make the necessary references. If YES, please explain. …………………………………………………………………………………………………………………………………… ……………………………… Η. OTHER INFORMATION ON THE ISSUER’S SECURITIES Free Transfer Is there any restriction as regards the transfer of new titles by any shareholder of the company to another? Are there any agreements which may constrain the free transfer? If yes, please attach the copies to the CSE. ………………………………………………………………………………… ………………………………………………………………………………… Has the company granted special rights to any shareholder? Are there any significant agreements with the board of directors or major shareholders and persons associated thereto? If yes, please attach these agreements. D:\106757041.doc 3 …………………………………………………………………………………………………………………………………… ……………………………… In the case of shares, does the issuer ensure that any future issue shall be initially offered to the existing shareholders depending on the percentage that each one of them holds in the issuer’s capital, unless the shareholders otherwise decide with a special resolution? …………………………………………………………………………………………………………………………………… ……………………………… Are the securities proposed to be listed fully paid up? ………………………………………………………………………………………………………… …………… …………………………… I. OTHER INFORMATION ON THE ISSUER Market Capitalisation The market capitalisation of the securities to be listed amounts to €……………… and the own equity capital of the year ended on dd/mm/yy amounts to €………….. Number of securities: …………………. Exercise/Issue price: € ………… Average Trading Price: €………….. (of the half-year preceding the application) Corporate Governance Code i) ii) Does the company apply the Corporate Governance Code? Fully - Partly - Not at all In case there are any amendments in relation to the application of the Corporate Governance Code on behalf of the company, please state such amendments and attach the revised report on Corporate Governance. ………………………………………………………………………………………………………………………………… …………………………… Central Depository and Registry Is the issuer ready and able to hand its Register over to the Central Depository and Registry and fulfil any obligation thereof when undertaking or later keeping the Register or Registers of the registered holders of its securities? …………………………………………………………………………………………………………………………………… ……………………………… The Council of the Stock Exchange has the discretion to request additional details or information or clarifications. I ……………………………………………………………. (name) and (capacity) ……………………… of the issuer ……………………………………, solemnly declare, taking cognizance of the consequences of the law, that the answers to the above questions are true. Signature .……………………………. Chairman/Member of the Board of Directors/Secretary of the issuing company D:\106757041.doc 4 ADDITIONAL SPECIAL INFORMATION ON LISTING ON THE CORPORATE BONDS MARKET 1. Listing of shares from conversion or exchange of bonds If the bonds are converted or exchanged into shares or options to acquire shares, the shares to which they refer should be listed on the Stock Exchange or another organised market. Remarks:………………………………………………………………………………………………………………………… …………………………………………………………………………………………………………… 2. Appointment of Trustee Has the issuing company seen to the appointment of a competent person as a trustee for the protection of the interests and rights of bondholders? …………………………………………………………………………………………………………………………………… ……………………………… 3. Binding Document The issuing company has drawn and published a document binding by law* which provides that its amendment is not possible save with the consent of the beneficiaries of 75% of total bonds and which regulates or refers to the following: (1) The rights and obligations of the issuer against the beneficiaries or the representatives or trustees of beneficiaries. (2) The relation between the rights of the beneficiaries and the rights of the beneficiaries of other securities and bonds of the same issuer or other issuer on which the issuer or its funds depends. (3) The discounting reserves, the repayment procedure or other provisions relating to the amortisation of debt. (4) In the case of bonds whose repayment or partial repayment is guaranteed by a third party, a copy of the decision or document providing such guarantee. (5) The name or names of the representatives or trustees for the representation and protection of the interests of the beneficiaries, the terms of his replacement and his responsibilities. * In case the binding document has not previously been submitted to the CSE D:\106757041.doc 5