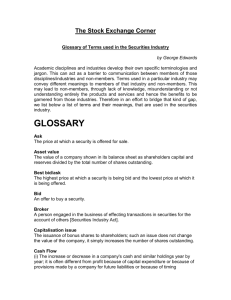

Capital Market Regulatory Insight - P.S.Rao & Associates

advertisement

Capital Market Related Topics, Regulatory Insights and Exchange Related issues PSRAO & ASSOCIATES LEGAL FRAMEWORK Companies Act, 1956 Securities Contract (Regulation) Act, 1956 Securities And Exchange Board of India Act, 1992 Legal Framework Listing Agreements The Depositories Act, 1996 All the Rules & Regulations IMPORTANT SEBI REGULATIONS • • • • • • • • • SEBI ( ISSUE OF CAPITAL AND DISCLOSURE REQUIREMENTS) Regulations, 2009 SEBI ( ISSUE AND LISTING OF DEBT SECURITIES) Regulations, 2008. SEBI ( PROHIBITION OF INSIDER TRADING ) Regulations, 1992 SEBI ( MERCHANT BANKERS ) Regulations, 1992 SEBI ( UNDERWRITERS ) Regulations, 1993 SEBI ( REGISTRARS TO AN ISSUE AND SHARE TRANSFER AGENTS ) Regulations, 1993 SEBI ( BANKERS TO AN ISSUE ) Regulations, 1994 SEBI ( SUBSTANTIAL ACQUISITION OF SHARES AND TAKEOVERS ) Regulations 1997 (Takeover Code) SEBI ( PROHIBITION OF FRADULENT AND UNFAIR TRADE PRACTICES RELATING TO SECURITIES MARKET ) Regulations, 2003 Fund Raising in a Company at Different Stages Depository Receipts with the underlying being Shares, Foreign Currency Bond convertible into shares, Depository receipts with the underlying being shares. GDR, FCCB & ADR Shares Shares / PCD / FCD Shares Shares / Warrants / Follow-on Public FCD / PCD Issue Rights Issue QIP Existing Shareholders Private Placement Shares Seed Capital Venture Capitalist Personal Contribution, Family, Friends, Angel Investors Customer, Supplier, Competitor QIB FIIs, FI, Banks, Insurance Cos, MF, HNI, Individuals including NR Promoters, Financial IPO Shares Investor, Strategic Warrants / Investor Private FIIs, FI, Banks, Insurance Shares Equity Cos, MF, HNI, Individuals including NR Venture Private Equity investors Capital Shares FII, Hedge funds and FII, US QIB Strategic Investmen t IPO: Initial Public Offer QIP: Qualified Institutions Placement GDR: Global Depository Receipts FCCB: Foreign Currency Convertible Bond ADR: American Depository Receipts Economy of the Country Money Supply Interest Rate Corporate Results Global Capital Market Scenario Foreign Funds Inflow Strength/Weakness of the Local Currency FUND RAISING OPTIONS Initial Public Offer An Offer of SPECIFIED SECURITIES by an unlisted issuer to the public for subscription and includes offer for sale of specified securities to the public by any existing holders of such securities in an unlisted issuer. Applicability: SEBI ( ICDR) Regulations, 09. QIP A designation of a securities issue given by the Securities and Exchange Board of India (SEBI) that allows an Indian-listed company to raise capital from its domestic markets without the need to submit any pre-issue filings to market regulators. ( Circular issued on May 8, 2006). Applicability: SEBI ( ICDR) Regulations, 09. RIGHTS ISSUE FPO An offer of SPECIFIED SECURITIES by a listed issuer to the shareholders of the issuer as on the record date fixed for the said purpose. Applicability: SEBI ( ICDR) Regulations, 09. An offer of SPECIFIED SECURITIES by a listed issuer to the public for subscription and includes an offer for sale of specified securities to the public by any existing holders of such securities in a listed issuer. BONUS ISSUES. A premium or gift, usually of stock, by a corporation to shareholders’ or “an extra dividend paid to shareholders in a joint stock company from surplus profit.” APPLICABILITY: SEBI (ICDR) regulations,’09 Applicability: SEBI ( ICDR) Regulations, 09. Preferential Allotment An issue of SPECIFIED SECURITIES by a listed issuer to any select person or group of persons on a private placement basis and does not include an offer of specified securities made through a public issue, rights & bonus issue, ESOP, ESPS or QIP or sweat equity or Depository receipts. Applicability: SEBI ( ICDR) Regulations, 09. Debt Securities IDR A non-convertible debt securities (NCD) which creates or acknowledges indebtedness, and include debenture, bonds and such other securities of a body corporate or any statutory body, security receipts and securitized debt instruments. Applicability: SEBI ( Issue and Listing of Debt Securities) Regulations, 08. An Indian Depository Receipt is an instrument denominated in Indian Rupees in the form of a depository receipt created by a Domestic Depository (custodian of securities registered with the SEBI) against the underlying equity of issuing company to enable foreign companies to raise funds from the Indian securities Markets. APPLICABILITY: SEBI (ICDR) regulations,’09 Note: Specified securities means Equity, convertible Securities. ( Partly Convertible Debentures PCD & Fully Convertible Debentures FCD Investor Categories QIB means; •A MF, VCF, FVCF •Foreign Institutional investor •Public Financial Institution •Scheduled commercial bank •Multilateral and bilateral development financial institution •State Industrial development corporation •Insurance Company •Provident Fund ( Min Corpus 25 Cr ) •Pension fund ( R 25 Cr ) •National Investment Fund •Insurance funds setup and managed by the Dept of Posts, India” as per the amendment of SEBI (ICDR) Reg, 09 on 12th November,2010) Retail Investor means an investor who applies or bids for specified securities for a value of not more than Rs. 2 Lakh (as per the amendment of SEBI (ICDR) Reg, 09 on 12th November,2010) Non Institutional investor means an investor other than a retail individual investor and qualified institutional buyer SEBI ( ICDR) REGULATIONS, 2009 COMMON CONDITIONS FOR PUBLIC ISSUES AND RIGHTS ISSUES Applicability of ICDR Regulations Public Issue Rights Issue of a listed company Preferential Allotment of a listed company Issue of a bonus shares by a listed company QIP & IDR General Conditions Promoter, director etc., not debarred from accessing the capital market by SEBI. The issuer of Convertible Debt Securities Shall not be in the willful defaulters list of RBI & shall not have defaulter in payment of principal or interest amount for 6m. Company shall make a listing application to SE for listing and should choose a Designated SE. Company Shall enter into an agreement with Depositories ( NSDL / CDSIL) Company shall not have any partly paid up shares. Company shall make firm arrangements of finance towards 75 %. Record date must be announced well in advance mentioning the purpose. Appointment of MB and Other Intermediaries The issuer shall appoint one or more merchant bankers and shall also appoint other intermediaries in consultation with the lead MB. Filing of Offer Document The issuer shall submit the draft prospectus / RHP enclosing certain documents. The MB give due diligence certificates. In – principle approval from Stock exchange The issuer must obtain the in-principle approval at least from one of the recognised SE having nation wide trading platform SEBI ( ICDR ) Regulations, 2009 COMMON CONDITIONS FOR PUBLIC ISSUES AND RIGHTS ISSUES Issue Opening date Within 12 months from the date of issuance of OBSERVATIONS from SEBI Underwriting & Minimum Subscription The issuer may appoint Syndicate Members to the extent of the minimum subscription. The Minimum subscription shall not be less than 90% of the offer through offer document. Appoint of Syndicate Member mandatory in case of Issue through Book Building Mechanism. Call money The issue shall be made fully paid up within 12 months from the date of allotment. This 12 months not applicable where the size of the issue is more than Rs. 500 Cr, wherein the call money shall be at least 25%. Filing of Offer Document The issuer shall submit the draft prospectus / RHP enclosing certain documents. The MB give due diligence certificates. In – principle approval from Stock exchange The issuer must obtain the in-principle approval at least from one of the recognised SE having nation wide trading platform INITIAL PUBLIC OFFER ( IPO) – ICDR REG, ‘09 Eligibility criteria for Unlisted Companies for I P O Option I: Net tangible assets, profitability and net worth track record Net tangible assets of at least Rs.3 Crores in the preceding 3 full years, not more than 50% held in monetary assets Option II: No net tangible assets, profitability and net worth track record Issue through book building route with at least 50% allotted to QIBs Or ‘Project’ has at least 15% participation by Financial institutions/banks of which 10% comes from appraiser and at least 10% of issue size allotted to QIBs + + Track record of distributable profits in terms of Section 205 of Companies Act, 1956 (excl extra ordinary items) for 3 out of preceding 5 years + Net worth of at least Rs. 1 Crore in each of the preceding 3 full years Minimum post issue face value capital of the Company shall be Rs 10 Crores or Compulsory market making for at least 2 years • Book building route mandatory with 50% QIB participation if all issues during the same financial year (including proposed IPO) > 5X pre-issue net worth Exemptions from SEBI Eligibility Norms Banking company Correspondent new bank (“public sector banks”) Infrastructure company Whose project is appraised by a FI/ IDFC/ IL&FS or bank which was earlier an FI 5% of the project cost is financed by the appraiser(s)/ institutions jointly or severally Rights issues Listing criteria of Bombay Stock Exchange Limited For large cap companies: Post Issue paid up equity capital - Rs. 3 Crores Issue size - Rs. 10 Crores Post Issue market capitalization – Rs. 25 Crores Initial Public Offer ( IPO) – ICDR Reg, ‘09 Pricing Pricing There exists free pricing. The issuer may determine the price in consultation with the lead merchant banker or through book building process. Specified securities may be offered at different prices, subject to the following: Differential Pricing Price and price band Face Value of Equity Shares Retail individual investors or retail individual shareholders may be offered specified securities at a price lower than the price at which net offer is made to other categories of applicants. difference shall not be more than ten per cent of the price offered to other categories In Book built issue, the price of the specified securities offered to an anchor investor shall not be lower than the price offered to other applicants. In composite issue, the price of specified securities offered in public issue may be different from the price offered in rights issue and justification for such price difference shall be given in the offer document. The issuer may mention a price or price band and floor price or price band in the red herring prospectus and determine the price at a later date before registering the prospectus with the ROC. If floor price or price band is not mentioned in the RHP, the same shall be announced at least two working days before the opening of the bid in IPO and one working day bin FPO. Such announcement shall contain relevant financial ratios and a statement titled “BASIS OF ISSUE PRICE” in the prospectus. The cap on the price band shall be less than or equal to 120% of the floor price. ( Cap includes cap on the coupon rate in case of convertible debt instruments ). Floor price shall not be less than the face value. Issuer company free to fix the face value of the shares offered, subject to : If price of share is Rs. 500 or more, then face value can be less than Rs. 10 but should be more than Re. 1 If price of share is less than Rs. 500, then the face value must be Rs. 10. Initial Public Offer ( IPO) – ICDR Reg, ‘09 Reservation on a competitive basis Employees Shareholders Business Associates New Company Permanent employees of the Issuer and promoting companies Shareholders of the promoting companies Persons who have business association with the Issuer, as depositors, bondholders and subscribers to services Existing Company Permanent employees of the issuer company Shareholders of group companies Limit as a % of Issue size 10%* 10% 5% Available for bidding in net Public issue Yes Yes No * Firm allotment + Reservation • No reservation can be made for the issue management team, syndicate members, their promoters, directors and employees and for the group/associate companies of issue management team • Net Public Offer” i.e. the size of the offer, net of reservations and firm allotments, if any, has to be greater than 10% of post issue capital Initial Public Offer ( IPO) – ICDR Reg, ‘09 Promoters’ Contribution and Lock-in Requirements At least 20% of post-IPO capital of the company to be held by the Promoters, which is referred to as Promoters’ contribution The Promoters’ can comply with the Promoters’ contribution condition by bringing in the full amount of promoters contribution, including premium, at least one day prior to the issue opening date Securities ineligible for computation of promoters’ contribution are those that are Acquired for consideration other than cash and revaluation of assets or capitalization of intangible assets is involved Promoters’ contribution A result of bonus issues out of revaluation reserves or reserves without accrual of cash resources or against shares which are ineligible for computation of promoter contribution Acquired by the promoters at a price lower than the IPO price during the preceding 1 year from the date of filing the DRHP with SEBI, unless the difference in price is brought in. However, this is not valid if these acquired shares result from an inter-se promoter transfer and (i) such shares were acquired by the transferor promoter during the past 1 year at or more than the IPO price; or (ii) such shares were acquired by the transferor promoter prior to the past 1 year Ineligible shares acquired in pursuance to a scheme of merger or amalgamation approved by a High Court shall be eligible for computation of promoter’s contribution Compliance with norms for Promoters’ contribution shall be required at the time of filing the DRHP with SEBI Initial Public Offer ( IPO) – ICDR Reg, ‘09 Promoters’ Contribution and Lock-in Requirements Lock-in Requirements (Unlisted companies) Entire pre-IPO capital locked in for 1 year from date of allotment in IPO (exempt for (a) Venture Capital Funds which have held shares for a minimum of 1 year; (b) pre-IPO shares held by employees which were issued under ESOP or ESPS before the IPO). Transfer of locked-in shares among pre-IPO shareholders allowed, provided lock-in continues with transferee Promoter’s holding up to 20% of post-IPO capital locked-in for 3 years from the date of allotment in IPO and excess promoter’s holding locked-in for 1 year Pledged securities held by promoters shall not be eligible for computation of Promoters’ contribution Pledge Other locked-in securities may be pledged only with Banks/ FIs as collateral provided the pledge is a term of sanction If securities are locked-in as Promoters’ contribution, the same may be pledged if the loan has been granted by such Banks/ FIs for the purpose of financing one or more objects of the Issue Continuous Listing and Offer for Sale Requirements Continuous Listing Offer for Sale Minimum post–IPO market cap of Rs. 10 bn and total number of shares issued 20 million, where the IPO is in terms of Rule 19(2)(b) Only securities held for more than one year can be offered for sale Bonus shares issued during last one year may not be eligible for offer for sale Corporate Governance Requirements Composition of Board of Directors Reconstitution of the Board of Directors At least one-half non executive Directors One-third independent Directors in case of a non-executive Chairman One-half independent Directors in case of an executive Chairman One-half independent Directors in case non-executive Chairman being a promoter or related to the promoters or persons occupying management positions at the Board level or at one level below the Board Committees of the Board Audit Committee Should comprise at least three members Two-thirds of the members shall be independent Directors At least one Director should have financial and accounting knowledge Committee Chairman to be an independent Director Shareholder’s/Investor Grievance Committee A board committee under the chairmanship of a non-executive director Redressal of shareholder and investors complaints like transfer of shares, non-receipt of balance sheet, non-receipt of declared dividends etc. Remuneration Committee (optional) Should comprise at least three members Have all non-executive Directors Committee Chairman to be an independent Director A report on Corporate Governance to be included in the Annual Report of the Company Clause 49 requirements of the Listing Agreement of the Stock Exchanges to be met at the time of filing the DRHP with SEBI Instances in the past where DRHP filed with SEBI by certain PSUs without Clause 49 compliance, with an undertaking to comply with the same prior to opening of the Issue Key Parties and Responsibilities for an IPO Intermediary Structure Book Runners’ Legal Counsel Legal Counsels IPO Grading Agency Broker / Syndicate BRLM Registrars Escrow Bankers Issuer Company / Selling Shareholder Printers Advertisin g Agency Arrangement Coordination Rights Issue SEBI approval of prospectus not required if: • Issuer company is listed for last three years • Average market cap is greater than Rs 5,000 Crores • 95% of investor grievances redressed (till last quarter) • No SEBI proceedings pending • Entire shareholding in dematerialized form Rights Issue – ICDR Reg, ‘09 Rights issue, Record Date and Restriction Rights issue means an offer of specified securities by a listed issuer to the shareholders of the issuer company as on the record fixed for the said purpose. Rights issue and Record Date Restriction Letter of offer, Pricing & Period The issuer company shall announce a record date for determining the shareholders eligible to apply for securities. The company shall not withdraw the rights issue after announcement of record date. If done so, it shall not make an application for listing any securities on RSE for 12 months from RD. (Exception - Convertible securities ) If the issuer company has outstanding fully or partly convertible debt instruments at the time of making the rights issue. The equity shares reserved for Fully or partially convertible debt instrument holders shall be issued at the time of conversion of such instruments on the same terms on which the equity shares offered in the rights issue were issued. The letter of offer and the application shall be despatched through RP or SP 3 days before opening of issue. Shareholder who has not received the application form may apply in writing on a plain paper along with application money. The issue price needs to be decided before the record with and shall be determined in consultation with the designated stock exchange. Rights issue shall be open for a minimum period of 15 days and maximum period of 30 days. Bonus Issue – ICDR Reg, ‘09 Conditions, Restrictions, Completion It is authosized by its articles of association for issue of bonus shares, capitalisation of reserves, etc.: • Conditions Provided that if there is no such provision in the articles of association, the issuer shall pass a resolution at its general body meeting making provisions in the articles of associations for capitalisation of reserve; It has not defaulted in payment of interest or principal in respect of fixed deposits or debt securities issued by it; It has sufficient reason to believe that it has not defaulted in respect of the payment of statutory dues of the employees such as contribution to provident fund, gratuity and bonus; The partly paid shares, if any outstanding on the date of allotment, are made fully paid up. Restrictions No issuer shall make a bonus issue of equity shares if it has outstanding fully or partly convertible debt instruments at the time of making the bonus issue, unless it has made reservation of equity shares of the same class in favour of the holders of such outstanding convertible debt instruments in proportion to the convertible part thereof. The equity shares reserved for the holders of fully or partly convertible debt instruments shall be issued at the time of conversion of such convertible debt instruments on the same terms or same proportion on which the bonus shares were issued. Bonus shares only against reserves, etc. if capitalised in cash The bonus issue shall be made out of free reserves built out of the genuine profits or securities premium collected in cash only and reserves created by revaluation of fixed assets shall not be capitalised for the purpose of issuing bonus shares. Without prejudice to the provisions of sub-regulation (1), the bonus share shall not be issued in lieu of dividend. An issuer, announcing a bonus issue after the approval of its board of directors and not requiring shareholders’ approval for capitalisation of profits or reserves for making the bonus issue, shall implement the bonus issue within fifteen days from the date of approval of the issue by its board of directors: Completion • Provided that where the issuer is required to seek shareholders’ approval for capitalisation of profits or reserves for making the bonus issue, the bonus issue shall be implemented within two months from the date of the meeting of its board of directors wherein the decision to announce the bonus issue was taken subject to shareholders’ approval. Once the decision to make a bonus issue is announced, the issue can not be withdrawn. PREFERENTIAL ALLOTMENT – ICDR REG, ‘09 Preferential Allotment, Pricing , relevant date & SE Preferential issue means an issue of specified securities by a listed issuer to any select person or group of persons on a private placement basis and does not include an offer of specified securities made through a public issue, rights issue, bonus issue, ESOP, ESPS, QIP, Sweat equity or depository receipts. Pricing Price not less than the higher of the following: The average of the weekly high and low of the closing prices of the related shares quoted on the stock exchange during the six months preceding the relevant date; OR The average of the weekly high and low of the closing prices of the related shares quoted on a stock exchange during the two weeks preceding the relevant date. “relevant date" means the date thirty days prior to the date on which the meeting of general body of shareholders is held Stock Exchange means a stock exchange in which the highest trading volume in respect of the shares of the company has been recorded. Preferential Allotment – ICDR Regulations, 09 Lock-in Requirements & Eligibility for Preferential Allotment Lock in (78) Eligibility for Preferential Issue (72 (2)) Lock-in Requirements Lock-in of 1 year from the date of allotment shall be applicable for all preferential allotments made to all categories of Allottee including promoters Shares allotted on preferential basis to promoters/promoter group shall be locked in for 3 years from the date of allotment Overall lock-in for promoter holding shall not exceed 20% of the post issue capital Lock-in already complied shall be reduced while calculating lock-in on shares arising upon conversion, etc. Pre-preferential allotment holding of the allottee shall also be kept under lock-in from the relevant date up to 6 months from the date of making preferential allotment Locked in securities can be transferred inter se amongst Promoters/Promoter Group or to a new promoter or person in control of the Company subject to SAST and subject to continuation of lock-in the hands of the transferees for the remaining period •Conditions for continuous listing must be complied with •Should be fully paid-up securities •Pre-allotment Shareholding of the allottee to be in demat form •The shareholders should not have sold their shares during 6 months prior to the relevant date. Preferential Allotment – Other Regulatory Provisions SEBI ( SUBSTANTIAL ACQUISITION OF SHARES AND TAKEOVERS ) REGULATIONS Shares cannot be allotted to a person, who together with persons acting in concert with him, would be entitled to exercise more than 55% of the voting rights of the Company post-allotment of the share capital COMPANIES ACT, 1956 Return of allotment of Shares in Form 2 to be filed with ROC Further listing of securities issued under Preferential allotment with the Stock Exchanges STAMP ACT Requisite stamp duty as per State Stamp Act should be paid on the securities issued under preferential allotment Preferential Allotment – Listing Agreement Clause 24(a): In-principle approval Issuer to obtain ‘in-principle’ approval for listing before issuing further shares or securities. Clause 43: Quarterly statement Issuer to furnish a statement on a quarterly basis indicating the variations between projected utilisation of funds and/ or projected profitability statement made by it or object/s stated in the explanatory statement to the notice for the general meeting for considering preferential issue of securities and the actual utilisation of funds and/ or actual profitability. Clause 40A (iii) No preferential allotment can be made, if such allotment or offer result in reducing the non-promoter holding below the limit of public shareholding specified under DIP Guidelines Clause 43: Quarterly statement The statement shall be given for each of the years for which projections are provided in the explanatory statement & shall be published in newspapers simultaneously with the quarterly financial results as required under clause 41. If there are material variations between the projections and the actual utilisation/ profitability, the company shall furnish an explanation therefor in the advertisement and shall also provide the same in the Directors’ Report. CLAUSE 49 Quarterly disclosure of uses/application of funds raised by Preferential Allotment Annual Statement of funds utilised for purposes other than stated purposes – certified by statutory auditors to the Audit Committee till such time, money raised is fully spent QIP – ICDR REG, 09. Definition, conditions, Placement Document & Min. Number Definition QIP means allotment of eligible securities by a listed issuer to QIBs on private placement basis in terms of Chapter VIII of ICDR Regulations, 2009. Conditions A special resolution The equity shares which are proposed to be allotted through QIP have been listed on a RSE (having nationwide trading terminal ) for atleast 1 year prior to passing of SR. Minimum public shareholding as specified in the listing agreement has to be complied with. Relevant date to be mentioned in the special resolution. Placement Document QIP shall be made on the basis of placement document as specified in Schedule XVIII. The placement document shall be furnished while seeking in-principle approval. Minimum No. of allottees Not to be less than; Two, where the issue size is less than or equal to Rs. 250 crores. Five, where the issue size is greater than Rs. 250 crores. Where, no single Allottee shall be allotted more than 50% of the issue size. QIP – ICDR REG, 09. Pricing, Restrictions on Allotment, Validity of SR Pricing The QIP shall be made at a price not less than the average of weekly high and low of the closing prices of the equity shares of the same class quoted on the stock exchange during the two weeks preceding the relevant date. Restriction on Allotment Min. of 10 % of eligible securities to be allotted to MFs. ( If not subscribed, can be allotted to other QIBs) No allotment to be made to a QIB who is a promoter or any person related to the promoter. The applicants in QIP shall not withdraw the bid after the closure of the issue Validity of Special resolution Allotment to be completed within a period of 12 months from the date of passing of SR. A subsequent QIP shall not be made until expiry of six months from the date of prior QIP. IDR – INDIAN DEPOSITORY RECIEPT The issuing company is listed in its home country. Eligibility for issuing IDR The issuing company is not prohibited to issue securities by any regulatory body. The issuing company has track record of compliance with securities market regulations in its home country. Conditions Issue size shall not be less than Fifty Crore Rupees. Procedures to be followed by each applicant shall be mentioned in the prospectus. Minimum application money shall be Twenty Thousand Rupees. At least Fifty percent of the IDR issued shall be allotted to QIB’s on proportionate basis. At any given time there shall be only one denomination of IDR of the issuing company. The balance fifty percent be allotted among the categories of non-institutional investors and retail individual investors including employees at the discretion of the issuer and the manner of allocation shall be disclosed in the prospectus. Allotment to investors within a category shall be on proportionate basis. For non-underwriting issues: Minimum subscription There should be a minimum subscription of 90% of the offer through offer document on the date of closure of the issue, or if the subscription falls below 90%, company have to refund all the amount received. If the company fails to repay within 15 days from the date of closure, the company is liable to pay the amount with an interest of 15% per annum for the period of delay. For underwritten issue: If the company does not receive the minimum subscription of 90% with in 60 days from the date of closure of the issue, the company shall refund the entire subscription amount along with 15% interest per annum for the period of delay beyond 60 days to the subscribers. Fungibility, Prospectus, Bid Data, Post issue reports & Finalisation Fungibility The IDR’s shall not be automatically fungible into underlying equity shares of issuing company. Filling of prospectus Due deligence certificate Payment of fees & Issue of advertisement. Display of bid data. The stock exchanges offering online bidding system for the book building process shall display on their website, the data pertaining to book built IDR issue, in the format specified, from the date of opening of the bid till at least three days after closure. Disclosure in prospectus and abridged prospectus The prospectus shall contain all material disclosures which are true, correct and adequate so as to enable the applicants to take an informed investment decision. The abridged prospectus shall contain the disclosures as specified in Part B of schedule XIX. Post issue reports The merchant banker shall submit post-issue reports to the board in accordance with subregulation (2) Initial Post issue report shall be submitted within 3 days of post closure of the issue; Final Post issue report shall be submitted within fifteen days of the date of finalization of basis of allotment or within fifteen days of refund of money in case of failure of issue. Undersubscribed issue The merchant banker shall furnish information in respect of underwriters who have failed to meet their underwriting development to the Board on the lines of the specified format. Finalisation of basis of allotment The executive director or managing director of the stock exchange where the IDR are proposed to be listed , along with the post issue lead merchant bankers and registrars to the issue shall ensure that the basis of allotment is finalised in a fair and proper manner. Issue of Specified Securities by Small and Medium Enterprises- SME Applicability and filing of Offer document Applicability An issuer whose post-issue face value capital does not exceed 20 crore rupees. Filing of Offer document and Due diligence Certificate The issuer making a public issue or rights issue of specified securities shall not file the draft offer document with the board provided the issuer company shall file a copy of the offer document with the Board through a merchant banker, simultaneously with the filing of the prospects with the SME exchange and the RoC or letter of exchange with the SME Exchange provided further that the Board shall not issue any observation on the offer document. The merchant banker shall submit a due-diligence certificate as per Form A of Schedule VI including additional confirmations as provided in Form H of Schedule VI along with the offer document to the Board. The offer document shall be displayed from the date of filing of terms of subregulation (1) on the websites of the board, the issuer, the merchant banker and the SME exchange where the specified securities offered through the offer document are proposed to be listed. Issue of Specified Securities by small and medium enterprises Underwriting & Minimum Number of Allottees Underwriting Minimum Number of Allottees The issue shall be 100% underwritten and not restricted to the minimum subscription level. The merchant banker shall underwrite at least 15% of the issue size on his/ their own account/s. The issuer in consultation with SEBI(Underwriters) Regulations, 1993 and the Merchant Banker may enter into an agreement with the nominated investor indicating therein the number of specified securities which they agree to subscribe at issue price in case of under-subscription. If other underwriters fail to fulfill their underwriting obligations or other nominated investors fail to subscribe to unsubscribed portion, the merchant banker shall fulfill the underwriting obligations. All the underwriting and subscription arrangements made by the merchant banker shall be disclosed in the offer document. The merchant banker shall file an undertaking to the Board that the issue has been hundred per cent. underwritten along with the list of underwriters and nominated investors indicating the extent of underwriting or subscription commitment made by them, one day before the opening of issue. No allotment shall be made pursuant to any initial public offer made under this Chapter, if the number of prospective allottees is less than fifty. Issue of Specified Securities by small and medium enterprises Migration to SME exchange / Main Board, Migration to SME exchange/ Main Board A listed issuer whose post-issue face value capital is less than 25 crore rupees may migrate its specified securities to SME exchange if its shareholders approve such migration by passing a special resolution through postal ballot to this effect and if such issuer fulfils the eligibility criteria for listing laid down by the SME exchange Provided that the special resolution shall be acted upon if and only if the votes cast by shareholders other than promoters in favour of the proposal amount to at least two times the number of votes cast by shareholders other than promoter shareholders against the proposal. Migration to Main Board Where the post issue face value capital of an issuer listed on SME exchange is likely to increase beyond twenty five crore rupees by virtue of any further issue of capital by the issuer by way of rights issue, preferential issue, bonus issue, etc. the issuer shall migrate its specified securities listed on SME exchange to Main Board and seek listing of specified securities proposed to be issued on the Main Board subject to the fulfilment of the eligibility criteria for listing of specified securities laid down by the Main Board: Provided that no further issue of capital by the issuer shall be made unless – (a) the shareholders of the issuer have approved the migration by passing a special resolution through postal ballot wherein the votes cast by shareholders other than promoters in favour of the proposal amount to at least two times the number of votes cast by shareholders other than promoter shareholders against the proposal; (b) the issuer has obtained in- principle approval from the Main Board for listing of its entire specified securities on it. Issue of Specified Securities by small and medium enterprises Market Making Market Making The merchant banker shall ensure compulsory market making through the stock brokers of SME exchange in the manner specified by the Board for a minimum period of three years from the date of listing of specified securities issued under this Chapter on SME exchange or from the date of migration from Main Board in terms of regulation 106H. The merchant banker may enter into agreement with nominated investors for receiving or delivering the specified securities in the market making subject to the prior approval by the SME exchange where the specified securities are proposed to be listed and r shall disclose the details of arrangement of market making in the offer document. The specified securities being bought or sold in the process of market making may be transferred to or from the nominated investor with whom the merchant banker has entered into an agreement for the market making provided that the inventory of the market maker, as on the date of allotment of the specified securities, shall be at least 5% of the specified securities proposed to be listed on SME exchange. The promoters’ holding shall not be eligible for offering to the market maker under this Chapter during the period specified in sub-regulation (1). Subject to the agreement between the issuer and the merchant banker/s, the merchant banker/s who have the responsibility of market making may be represented on the board of the issuer. DELISTING OF SECURITIES – SEBI ( DELISTING OF EQUITY SHARES ) REGULATIONS, 2009 Applicability, Kinds & Voluntary Delisting Applicability The SEBI ( Delisting of Equity shares ) Regulations, 2009 are applicable to delisting of equity shares of a company from all or any of the stock exchanges where such shares are listed. Kinds Voluntary Delisting : Delisting of equity shares of the company voluntarily on the application of the company. Compulsory Delisting: Delisting of equity shares of the company by the stock exchange of the company. Voluntary Delisting FROM ALL STOCK EXCHANGES A company may delist its equity shares from all the stock exchanges, provided an exit opportunity is given to the public shareholders. FROM ONE OR MORE STOCK EXCHANGES A company may delist its equity shares from one or more Recognized stock exchange and continue listing in other RSE. If the shares are delisted from one or more RSE but continues to stay listed in a RSE having nation wide trading terminal, EXIT OPPORTUNITY need NOT be given. If the shares are delisted from one or more RSE but continues to stay listed in a RSE not having nation wide trading terminal, EXIT OPPORTUNITY NEEDS to be given. DELISTING OF SECURITIES – SEBI ( DELISTING OF EQUITY SHARES ) REGULATIONS, 2009 Conditions and Procedure – Voluntary Delisting No Exit Opportunity to be given Exit opportunity to be given A board resolution needs to be passed. A public notice shall be published in two news papers. ( mentioning the SE from where the shares are delisted, reason for delisting & fact of continuation of listing on other RSE) An application to be given to the concerned recognized stock exchange. ( The application shall be disposed off by the SE within 30 working days ). The fact of delisting to be disclosed in the first annual report after delisting. Obtain prior approval of the board. Obtain prior approval of the share holders by a special resolution passed through postal ballot. The number of votes cast by public shareholders in favour of the resolution should be at least two times the votes cast against. Application to the concerned recognized stock exchange for in-principle approval. (Audit report as required under regulation 55 A of SEBI (Depositories and participants ) regulations, 1996 covering a period of 6 months prior to delisting ) Make a final application to the concerned RSE within one year of passing of special resolution. ( A proof that an exit opportunity had been given needs to be given ) Application to be disposed off by the RSE within 30 working days. DELISTING OF SECURITIES – SEBI ( DELISTING OF EQUITY SHARES ) REGULATIONS, 2009 Compulsory Delisting, Rights of Public shareholders & consequences. Compulsory Delisting The stock exchange, by order, may delist the equity shares of a company. The decision of delisting shall be taken by a panel to be constituted by the RSE. Before Passing an order, the RSE shall give a notice in at least two news papers, giving a time of 15 working days within which representations may be made by any person aggrieved by the proposed delisting. Before passing of order, The company shall be given a reasonable opportunity of being heard. The RSE shall consider the representations made before passing the order. Provisions relating to EXIT OPPORTUNITY are not applicable. After passing an order, the RSE shall give a notice in two newspapers stating the fact of delisting, name and address of the company, fair value of the equity delisted etc. Rights of Public shareholders The RSE shall appoint an independent fair valuer (s) to determine the value of the equity delisted. The promoters shall acquire the shares from the public at the fair value determined by the valuer. Consequences The whole time directors, promoters and the companies promoted by them shall not directly or indirectly access the securities market or seek listing for a period of 10 years. LISTING / STOCK EXCHANGE DEFINITIONS LISTING STOCK EXCHANGE Listing means admission of securities of an issuer to trading privileges (dealings) on a stock exchange through a formal agreement. The prime objective of admission to dealings on the exchange is to provide liquidity and marketability to securities, as also to provide a mechanism for effective control and supervision of trading. Stock exchanges represent the market place for buying and selling of securities and ensuring liquidity to them in the interest of the investors. The stock exchanges are virtually the nerve centre of the capital market and reflect the health of the country’s economy as a whole. LISTING AGREEMENT – Important Clauses Clause 16, 19, 20, 22 & 28. CLAUSE 16: Book Closure/ Record Date Books to be closed at least once in year. At least 30 days gap between two book closures. Intimate SE atleast 15 days ( 7 days for demat) before book closure / RD. Intimate to SE atleast 30 days before corporate actions. CLAUSE 19: Convening of board meeting for declaration / decision regarding: Dividend, issue of Rights shares, convertible debentures, buy back etc. Intimate atleast 7 days in advance about convening of the board meeting. Undertake to recommend to declare all dividend and / or cash bonuses at least 5 days before the commencement of the closure of its transfer books or the record date fixed for that purpose. CLAUSE 20 & 22: Decision regarding declaration of dividend, bonus, interest payment, buyback of securities, reissue of forfeited shares, etc. Furnish information to the stock exchanges within 15 minutes of the closure of the board meeting. CLAUSE 28: Change in form or the nature of the listed securities or change in the rights / privileges thereof. 21 days prior notice to be given to the stock exchange. Apply to the stock exchange for listing of the securities as changed, if exchange requires so. LISTING AGREEMENT – Important Clauses Clause 29, 30, 31, 23, 32 and 35 CLAUSE 29 & 30: Important Changes Change in general character or nature of the company’s business; Change in the company’s directors; Change of MD; Change of Auditors; to be promptly notified to the stock exchange. CLAUSE 31 & 23: Further issue of securities and other documents to be forwarded. To forward six copies of the annual reports, notices, resolutions and circulars relating to new issue of capital, three copies of all the notices, call letters, etc., including notices of meetings convened under section 391 or 394 R/w. section 391 of Companies Act. CLAUSE 32: CFS in the annual report, consolidate Financial statement and related party disclosures Cash flow statement to be prepared in accordance with AS 3 of ICAI and present it under the indirect method. Unabridged annual report to be sent to the member of the listed exchange on his request. Consolidated financial statement duly audited by the statutory auditors and file the same with the SE. Company will also make related party disclosures in its annual reports. CLAUSE 35: Shareholding pattern containing details of the promoters holding and non-promoters holding File with the exchange the shareholding pattern in the prescribed form within 21 days from the end of the quarter on a quarterly basis. (Amendment to Clause 35 has taken palce) LISTING AGREEMENT – Important Clauses Clause 40 A, 40 B and 41 CLAUSE 40 A AND 40 B: Conditions for continuous listing and takeover offer CLAUSE 41: Preparation and submission of financial results ( unaudited financial results ) To maintain on a continuous basis the public shareholding of atleast 25% of the total number of issued shares. The holding of the promoters should be reduced to less than 75% in a transparent manner acceptable to SEBI either through FPO or selling of the shares in secondary market or through a preferential allotment or through amalgamation or merger. The BOD of every listed company must submit to the stock exchange where the company’s shares are listed the unaudited financial or audited financial results once in every quarter before the expiry of 45 days, i.e., 30 April, 31 July, 31 October and 31 January. For the last quarter of the financial year the company can submit either unaudited results before 15 May or give an undertaking to the stock exchange that the audited results will be submitted before 30 May. These financial results must be approved by the audit committee in their meeting and recommend the same to the BOD. Within 15 mins of the approval by the BOD these results are to be submitted to the stock exchange. Within 48 hours a publication has to be given in two newspapers. Results are to be reviewed by the statutory auditors before approval by the audit committee and BOD. Limited review report given by the Statutory auditors on the unaudited financial results must be submitted to the SE within 45 days of the Board meeting. LISTING AGREEMENT – Important Clauses Clause 43 A, 47, 49 50 and 52 CLAUSE 43 A: Filing of deviations in the use of public issue proceeds Filing of deviations in the use of public issue proceeds and to appoint monitoring agency to monitor utilization of proceeds etc. CLAUSE 47: Appointment of Company Secretary as Compliance Officer A CS to be appointed to act as compliance officer responsible for monitoring the share transfer process and report to the company’s board in each board meeting. CLAUSE 49 : Corporate governance Board of directors and composition of board Code of conduct of the directors to be published on the website. Audit committee and its composition and frequency of its meeting. Disclosures CEO/CFO Certification Report on CG, quarterly compliance report. Compliance certificate from PCS or Company’s auditor. CLAUSE 50: Accounting Standard Company should comply with all the accounting standards issued by ICAI. CLAUSE 52: CFDS All the listed companies are required to file information with SE only through CFDS which is put in place jointly by BSE and NSE at www.corpfiling.co.in REPORT ON CORPORATE GOVERNANCE General Overview & General contents General Overview Contents The companies shall submit a quarterly compliance report to the SE within 15 days from the close of quarter as per the format prescribed in the clause. The report is required to be signed either by the Compliance officer or the CEO of the company Philosophy on Corporate Governance Composition of Board of Directors Board Meetings Audit Committee Remuneration Committee Investor Grievance Committee General Body Meetings Disclosures Means of Communication General Shareholder information Code of Business conduct Ethics for Directors and Management personnel, etc. TYPES OF LISTING Initial, public issue, rights issue, bonus & merger / amalgamation Initial Listing Listing for public issue Listing for Rights issue If the shares or securities are to be listed for the first time by a company on a stock exchange it is called initial listing. When a company whose shares are listed on a stock exchange comes out with a public issue of securities, it has to list such issue with the stock exchange. When companies whose securities are listed on the stock exchange ` issue securities to existing shareholders on rights basis, it has to list such rights issue on the concerned stock exchange. Listing of Bonus Shares Shares issued as a result of capitalisation of profit through bonus issue shall list such issues also on the concerned stock exchange. Listing for merger or amalgamation When new shares are issued by an amalgamated company to the shareholders of the amalgamating company, such shares are also required to be listed on the concerned stock exchange. Benefits of Listing Benefits Description High Liquidity and Depth Indian Stock Exchanges have a high number of listed companies and provide significant liquidity Additional recognition in case of presence in Sensex/ Nifty/ A group Flexibility for future capital raising opportunities Multiple choice: QIP, Rights, Follow-on public issue, GDR, ADR, FCCB Establishes profile Sharing history, business operations, strategy and growth plans helps develop franchise value Enables branding and customer awareness; provides access to retail investors; lenders have higher comfort with listed entities Positive impact on valuation Greater awareness amongst research analysts, fund managers, investment advisors Creates greater liquidity and market if part of the derivatives segment Wealth creation Ability to create wealth for promoters and shareholders Provides a benchmark for Company valuation Creation of currency Ability to create currency for strategic initiatives Leverage as currency for M&A, alliance etc. Employee incentivization Ability to serve HR initiatives; serves as an incentive mechanism for management and employees e.g.: ESOS/ ESPS Mechanism for tracking management performance Questions? Thank you !