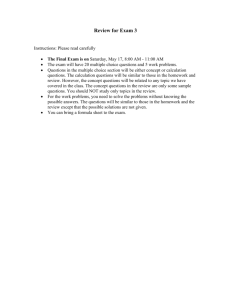

lecture notes

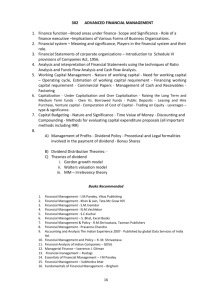

advertisement

CHAPTER 9 VALUATION OF COMMON STOCKS 9.1 Reading Stock Listings Dividend yield is defined as the annualized dollar dividend divided by the stock’s price, expressed as a percentage. Price/Earnings ratio is the ratio of the current stock price to earnings during the most recent four quarters. 9.2 The Discounted Dividend Model The Discounted Dividend Model (DDM) is defined as any model that computes the value of a share of stock as the present value of its expected future cash dividends. The risk-adjusted discount rate or the market capitalization rate (k) is the expected rate of return that investors require in order to be willing to invest in the stock. Using a one period model, the price of the stock can be give as: P0 = (D1 + P1)/ (1 +k) Where D1 is the expected annual dividend, P0 is the current price of the share and P1 is the expected ex-dividend price at the end of the year. Similarly, the price at the beginning of the second year can be given as: P1 = (D2 + P2)/ (1 +k) By substituting P1 from the above equation into the previous equation, we can express P0 in terms of D1, D2 and P2. P0 = D1/(1+k) + D2/(1+k)2 + P2/ (1 +k)2 By repeating these substitutions we get the general formula: P0 = D1/(1+k) + D2/(1 +k)2 + D3/(1 +k)3 + ... + Dn/(1 +k)n +Pn/(1 +k)n 9.2.1 Constant Growth Rate Discounted Dividend Model Here dividends are assumed to grow at a constant rate ‘g’. The model also assumes that the stock price also grows at the same rate as the dividends. D2 = D1 (1+g) D3 = D2 (1+g) = D1 (1+g)2 D4 = D3 (1+g) = D2 (1+g)2 = D1 (1+g)3 . . . Dn = Dn-1(1+g) = D1 (1+g)n-1 Pn = P0 (1+g)n The present value of a perpetual stream of dividends growing at a rate g is P0 = D1 / (k – g) The model is only valid when the growth rate is less than the market capitalization rate, k. What would happen to the stock price if g were greater than k? 9.3 Earnings and Investment Opportunities Growth per se does not add value. What adds value is the opportunity to invest in projects that will earn rates of return in excess of the market capitalization rate. Consider the following example of a firm with $100 in the book value of equity at time zero. The ROE of the firm equals 25% and the firm retains 40% of its earnings for future investments. The risk-adjusted discount rate or the market capitalization rate of the firm is 20% Book Value ROE Earnings $100 $110 $121 . . 25% 25% 25% . . $25 $27.5 $30.25 . . Earnings Retention Rate 40% 40% 40% . . Retained Earnings Dividends Paid $10 $11 $12.1 . . $15 $16.5 $18.15 . . It can be seen that the dividends are growing at a 10% rate. This rate is obtained by multiplying the ROE with the earnings retention rate, or 25% * 40% = 0.25 * 0.40 = 0.10 = 10% Hence, the growth rate of dividends is defined as: g = b * ROE b = earnings retention rate The price of the stock is given as: P0 = D1 / (k – g) = $15/(0.20 – 0.10) = $150 Note that D1 = E1 * (1 – b) = $25 * (1 – 0.40) = $15 Also, g = b * ROE Making the above substitutions, the price of the stock can be given as: P0 = E1 * (1 – b) / (k – (ROE *b)) Now, suppose ROE = k, or the return on equity equals the risk-adjusted cost of capital. Then, P0 = E1 * (1 – b) / (k – (k *b)) P0 = E1 * (1 – b) / (k (1 -b)) P0 = E1 / k Problem 1 We are given that DDM Corp has just paid a cash dividend of $ 2. i.e. D 0 = 2. We also know from the past that dividends can be expected to grow at the rate of 5% each year. i.e. g = 0.05. The market capitalization rate ( or the rate that we will use to discount the cash flows) for this stock is 13 % i.e. k = 0.13. Since dividends grow at 5%, the dividend to be paid out over the next year D 1 = D0 (1+g)=2*1.05 = $ 2.10 Using the constant growth rate dividend discount model we can find the intrinsic value of a share. P0 = D0 (1+g)/ k- g = 2.10 / (0.13 – 0.05) = 2.10/0.08 = $ 26.25 If the observed price was in fact $20, what would the appropriate growth rate and market capitalization rates be. (i) Adjusting the growth rate Here we calculate the growth rate that would result in the intrinsic value being $20 given that the market capitalization rate is 13% and last annual dividend paid out was $2 per share. 20 = 2 (1+g)/(0.13 –g) (1+g)/(0.13-g) = 10 1+g = 1.3-10g 11g = 0.3 g = 0.0273 or 2.73% (ii) Adjusting the market capitalization rate Here we calculate the market cap rate that would result in an intrinsic price of $20 assuming that the growth rate is 5% and the last annual dividend paid out was $ 2. 20 = 2(1 +0.05)/(k – 0.05) k - 0.05 = 2.10/20 k – 0.05 = 0.105 k = 0.155 or 15.5% Problem 2 We are given that Rusty Clipper Fishing Corp. is expected to pay a dividend of $5 this year. The expected market capitalization rate for this stock is given to be 10% per year. The current stock price is $25. We need to calculate the expected growth rate of dividends. Again from the constant growth rate dividend discount model P0 = D1 / (k- g) D1 = $5, k = 0.10, P0 = 25 25 = 5 /(0.1- g) 2.5 –25g = 5 25g = -2.5 g = -0.1 or –10% Problem 7 Dividend just paid by 2 Stage Co. = $ 1 Expected growth rate of dividend over the next 3 years = 25% Expected growth rate after 3 years = 5% Market capitalization rate = 20 % The underlying principle of the discounted dividend model is that the current price or the intrinsic price of the share is the present value of all future cash flows. The following table shows the future cash flows that arise from holding a share of 2Stage Co. Year 1 2 3 4 5 6 7 Dividend 1.25 1.5625 1.953125 2.05078 2.153319 . . Calculation 1* 1.25 1.25* 1.25 1.5625*1.25 1.953125*1.05 2.05078*1.05 . . Beyond year 3 the growth rate of dividends is constant at 5%. The price at the end of the 3rd year (or the beginning of the 4th year) P3 can be found using the constant growth rate DDM. P3 = D4 / (k-g) = 2.05078 /(0.2 – 0.05) = 13.671866 Effectively we have the following cash flows for the first 3 years Year 1 Year 2 Year 3 1.25 1.5625 1.953125 + 13.671866 (a) The intrinsic value of a share of 2Stage Co. stock is the present value of these cash flows. The discount rate is the market capitalization rate k = 20% P0 = 1.25/1.2 + 1.5625/1.22 + 1.953125/1.23 + 13.671866/1.23 P0 = 1.04167 + 1.08507 + 1.13028 + 7.91196 P0 = 11.17 (b) Dividend yield if the market price of the share is equal to the intrinsic value. Dividend yield is the annualized dollar dividend divided by the stock price. The dividend for year 1 is $ 1.25. Dividend yield = D1 / P0 = 1.25/ 11.17 = 0.112 or 11.2 % (c) Expected price 1 year from now. To find the price 1 year from now (P1), we need to calculate the value of all cash flows at time t=1 (1 year from now). We already know the cash flows for year 2 and beyond P1 = D2/(1 +k) + D3/(1+k)2 + P3/(1+k) 2 P1 = 1.5625 /1.2 + 1.953125/1.22 + 13.671866/1.22 P1 = 1.3020833 + 1.35633 + 9.49435 P1 = 12.15 The implied capital gain is (12.15 – 11.17) = 0.98 Capital gain as % of the current price is 0.98/11.17 = 0.88 or 8.8% We have calculated dividend yield to be 11.2% The dividend yield plus capital gain add up to 20%, which is the market capitalization rate. Note that capital gains yield of 8.8% is different from the dividend growth rates of 5% and 25%. 9.4 A Reconsideration of the Price/Earnings Multiple Approach Stocks that have relatively high P/E ratios because their future investments are expected to earn rates of interest in excess of the market capitalization rate are called growth stocks. It is not growth per se that produces a high P/E ratio, but rather the presence of future investment opportunities that are expected to yield rate of return in excess of the market’s required risk adjusted rate k. When ROE < k, then increasing the earnings retention rate (which increases the growth rate) will reduce both the price of the stock and the P/E ratio of the stock. When ROE < k, then reducing the earnings retention rate (which reduces the growth rate) will increase both the price of the stock and the P/E ratio of the stock. When ROE > k, then increasing the earnings retention rate (which increases the growth rate) will increase both the price of the stock and the P/E ratio of the stock. When ROE > k, then reducing the earnings retention rate (which reduces the growth rate) will reduce both the price of the stock and the P/E ratio of the stock. 9.5 Does Dividend Policy Affect Shareholder Wealth? In frictionless markets, in which there are no taxes and transaction costs, the wealth of shareholders is the same irrespective of the firm’s dividend policy. In the real world thee are several frictions that cause dividend policy to have an effect on shareholder wealth. These include taxes, regulations, cost of external finance and informational content of dividends. Answer to Problem 12 In reality however, they market could perceive the share repurchase as a sign of strong company performance. This could cause the share price to rise after the announcement 9.5.2 Stock Dividends - Stock Splits and Stock Dividends In the case of a stock dividend, the company distributes additional shares to each stockholder. The company does not pay out any cash and hence there are no tax effects. Stock Splits Answer to Problem 11 In the case of a stock split, theoretically the price should reduce in the same ratio as the split. i.e. if the number of outstanding shares doubles, the price after the split should be half. Empirically it has been observed that there is a small increase in the market value of the stock after the announcement of a split. This is explained by the informational content of the split. Outside investors could interpret the split as a positive sign that the company is doing well. Also the lower price of each share after the split could make it affordable to more investors. 9.5.3 Dividend Policy in a Frictionless Environment In 1961, Modigliani and Miller presented an argument to prove that in a frictionless financial environment, in which there are no taxes and no costs of issuing new shares of stock or repurchasing existing shares, a firm’s dividend policy can have no effect on the wealth of its current shareholders. Shareholders can achieve the effect of any corporate dividend policy by costlessly reinvesting dividends or selling shares of stock on their own. 9.5.4 Dividend Policy in the Real World Issues of taxes on dividends paid out, laws preventing share repurchase as a regular alternative to cash dividends, investment bankers’ fees for arranging external financing, etc., all make dividend policy relevant.