Review personal Insurance coverage inside super

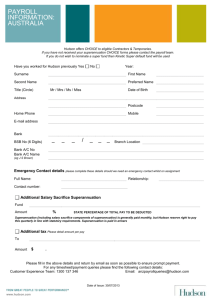

advertisement

Review personal Insurance coverage The only types of insurance cover that are available to members of superannuation funds are: Life Insurance; Total and Permanent Disability (TPD); and Temporary Salary Continuance (TSC) The insurance is usually provided by an insurance policy that is usually negotiated between the trustee of the superannuation fund and an insurer. The alternative is for the trustee is “self insure”. When insurance is offered to a group of superannuation fund members it is known as “group cover”. Members, when applying for insurance are usually obliged to provide some information about their health to the insurer. Insurance is used as a means of managing risk or minimising your exposure to potential financial loss. We would be pleased to assist in the evaluation of your exposure to risk and to arrange appropriate insurance on your behalf where appropriate. Below, we have included our recommendations with regard to specific risk management areas. Life Insurance An important aspect in planning for your retirement and building financial security is to ensure that you are protected against the unexpected. The only way that you can be 100% certain of having a lump sum paid to your loved ones in the event of your death is by having appropriate life insurance. Term Life Insurance provides a lump sum to your family, should you pass away during the term of the policy. Total and Permanent Disability Insurance You should also consider total and permanent disability cover, to maintain your family’s lifestyle in the event of your disablement. The definition and application of total and permanent disablement varies from insurer to insurer. However, three general variations are applied. Naturally the more generous the benefit, the more expensive the cover. The variations relate to the insured’s inability due to disability to perform: their usual occupation an occupation for which they are qualified by reason of education, training and experience any occupation Trauma Insurance With the remarkable advances in modern medicines, more and more people are now surviving major traumas such as heart attack, cancer, coronary artery surgery etc. However, the recovery period and the cost of care associated with such illnesses normally places extreme financial strain on the person suffering the illness. For this reason a relatively new form of insurance has recently been developed. Known as “Trauma Insurance”, “Crisis Care” or “Dread Disease Cover” this insurance pays a lump sum to the insured person upon diagnosis of one of a number of specified conditions. Such a payment will assist you and your dependants to be financially secure. While the payment may be used in any way you like, you may wish to pay for medical expenses not covered by Medicare or your health fund, to clear any liabilities you may have, or to take care of bills and expenses. This insurance cannot be provided in a superannuation fund because it would be paid in circumstances other than a condition of release. Income Protection As our income is generally seen as our biggest asset, it is extremely important that this asset is protected. Income Protection is designed to replace income in the event of illness or accident, which means less strain on savings, investment income and other assets. The maximum permissible cover is typically 75% of your personal exertion income (including salary sacrificed superannuation contributions). It is extremely important that any income protection policy recognises and covers your applicable employment structures and circumstances. Benefit periods for this type of insurance vary and as such alter the premium of policies. Typical benefit periods range from 2 years, 5 years, to age 55, 60, 65 and Lifetime. The waiting period before benefits are paid will also alter the premium for income protection insurance. A short waiting period is generally designed to suit those who could be in financial difficulties very quickly if their income stream stops. Your sick leave and annual leave entitlements should be taken into account in deciding the appropriate waiting period. Useful websites: Australian Prudential Regulation Authority (APRA) Australian Securities & Investment Commission The Reserve Bank Australian Taxation Office Australian Competition & Consumer Association Thomas Group Financial Planning www.apra.gov.au www.asic.gov.au www.rba.gov.au www.ato.gov.au www.accc.gov.au www.thomasgroup.com.au

![ppfpch14[1]](http://s2.studylib.net/store/data/009985604_1-c0b66de635cb1870fc47bf41c2314e94-300x300.png)