QW01_Matching_Internal - Intuit Financial Institutions

advertisement

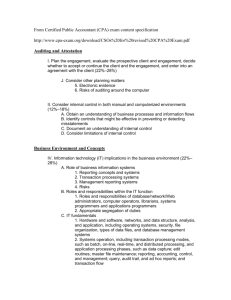

Matching Transactions from External Sources in Quicken for Windows Using Compare to Register Overview Matching Downloaded Transactions 1. Transaction Lists 2. The Primary Process 3. The Secondary Process 4. The Supplementary Process 5. Manually Matching 6. Matching Dates 7. Matching SRVRTIDs 8. Matching Check Numbers 9. Matching Payees 10. Transaction Matching Examples New Transactions 1. QuickFilling Categories from Memorized Transactions 2. Matching Payees in Memorized Transaction Lists Matching Improvements 1. Providing Downloaded Transactions Overview In Quicken for Windows, users can download an online account statement from their financial Intuit Confidential Page 1 institution. They can also retrieve transactions in several other ways:, a QIF file, transactions entered with QuickEntry, transactions from Quicken.com via WebEntry or Quicken.com Sync, and transactions from Pocket Quicken. When the user performs Compare to Register, Quicken attempts to match the transactions retrieved to existing transactions already recorded in the register to avoid duplicating transactions. Generally speaking, Quicken matches a transaction retrieved from an external source to transactions already in the register based on the amount, check number, payee, SRVRTID (if applicable) and date. For downloaded transactions (direct download and WebConnect from the financial institution), transactions can only match transactions in the register that were not previously downloaded from the financial institution. Transactions from other external sources can match any transaction in the register that meets the other criteria. For "New" transactions, Quicken attempts to find a matching payee in the Memorized Transaction List, in order to QuickFill the category. This algorithm is described in the section "New Transactions." This document explains the transaction matching processes, and what information needs to be provided by the external source to ensure optimal matching. Matching Transactions from an External Source Transaction matching consists of Primary, Secondary, and Supplementary processes. The processes work like a sieve; if a match isn't found by a process, the next process in the sequence attempts to find a match. If none of the processes find a match, the transaction acquires a "New" status, and if accepted, will be entered as a new transaction. The user can also choose to Manually Match an New transaction to one or more register transactions. Transaction Lists To perform a Compare to Register, Quicken uses two sets of transactions. The first set contains the transactions from the external source. This document refers to this set as the list of "external transactions". The second set of transactions comes from the account register. Quicken sorts through the transactions in the account register, weeding out all the transactions entered more than 90 days before today's date (system date), or more than 60 days before the earliest downloaded transaction, and all the transactions that have been previously downloaded for direct connect and WebConnect transactions. The remaining transactions populate the second set, hereafter called the list of "register transactions". When an external transaction is matched to a register transaction, Quicken "removes" both transactions from their respective comparison lists, and the external transaction is given a status of "Match" in the Compare to Register window. If it fails to match, it is given a status of "New". In either case the user can review the transaction prior to accepting it into the register. In the Primary and Secondary Processes, external transactions are compared one by one against Intuit Confidential Page 2 the transactions remaining in the list of register transactions. In the Supplementary Process, a register transaction is compared against the transactions remaining in the list of external transactions. Primary Matching Process The Primary Matching process compares amounts, SRVRTIDs (if applicable), and check numbers. Check numbers must be numeric; if they aren't, they're considered non-existent for the purposes of transaction matching. The Primary Matching Process compares each external transaction in the order in which they are received (which is usually sequentially by date) against each transaction remaining in the register transaction list. The Primary Process looks either for a mismatch, exact match, or a possible match. If an exact match is found, the external transaction is given a status of "Match", and the register transaction is "removed" from the comparison list. Quicken then moves on to the next external transaction, and begins the Primary Process again, starting at the top of the list of remaining register transactions. If a mismatch is found (e.g. amounts match but not check numbers), the Primary Process is repeated for the next sequential register transaction. Zero check numbers are ignored. If a possible match is found, the comparison drops into the Secondary Matching Process. Intuit Confidential Page 3 Secondary Matching Process The Secondary Match compares date and payee. If the result is an exact match on payee and the date falls within the accepted date range, the external transaction's status is changed to "Match", and the register transaction is "removed" from the comparison list. If the result is a No Match, Quicken moves on to the next register transaction, and begins the whole process again with the Primary Matching Process. If the result is a possible match, in that the Payees don't match exactly, the algorithm drops down to the Supplementary Matching Process. Supplementary Matching Process To find a possible better match for a register transaction, Quicken performs a third and final comparison process. The Supplementary Process repeats the Primary comparison, only in reverse. It compares the current possible match register transactions against each unmatched transaction in the external list. If it finds a better match than the previous Secondary process found, then it matches to that external transaction instead. A better match is based on check number or SRVRTID. If another transaction in the downloaded transaction list matches the check number or SRVRTID of the register transaction, it's considered a better match than the one returned by the Secondary process. Note that if the SRVRTIDs do not match but the check number does, it will still be considered a match. Manually Matching If the matching algorithm does not find a match, or the user wants to change the match it finds, the user can manually match the external transaction to one or more register transactions. The transactions available to be manually matched are register transactions whose date is one year or less before the external transaction’s date and no later than the system date. For downloaded transactions, only transactions that have not previously been downloaded can be manually matched. Intuit Confidential Page 4 Matching Rules Matching Dates A register transaction's date is considered a match if it is within one month before the external transaction's date or is after the external transaction’s date and no later than the system date. Thus, an external transaction with a date of 5/14/00 could possibly match only to register transactions dated between 4/15/00 and the system date. (For accounts enabled for online bill payment, an external transaction can match a register transaction on the next business day after the system date.) Matching SRVRTIDs A SRVRTID is a unique id assigned by a remote server to an online payment or online transfer. The SRVRTID is an optional tag in a statement download, so if it does not exist in the external transaction, this comparison is ignored. If, however, there is a SRVRTID in the external transaction, it must match the SRVRTID in the register transaction. If the values are not identical, there is no match, unless the check numbers match. If the values are identical, and the amounts and check numbers match, the transactions are matched. Matching Check Numbers If the external transaction has a three-digit check number, Quicken matches it to a register transaction with the same last three digits. For example, if you have external a transaction with check number 123, Quicken matches it to a register transaction with the check number 10123, or 7123, or 123, and so on. If the external transaction has a four-digit check number, Quicken matches it to a register transaction with the same last four digits. For example, if you have external a transaction with check number 1234, Quicken matches it to a register transaction with the check number 81234, or 1234, and so on. Special case for online payments: if the external transaction is from a financial institution using the OFX or NPC communication protocol and does not contain a check number, and the register transaction is an online payment with a check number, the transactions can match independent of check number. If neither transaction contains information in the check number field, or if the transactions contain text (e.g. DEP, TXFR, ATM), the algorithm moves on to compare Payees. Zero check numbers are ignored. Matching Payees When Quicken compares the text in Payee fields, it first strips out certain characters and characters following them. The strip characters are: Intuit Confidential Page 5 123456790!@#$%^()/\,. Note: The space character is also included in this list. Following this, a payee named "Chevron #1242" would result in the comparison text "Chevron". A payee named "A-1 Supplies" would become "A-Supplies". When the register and external payees have been stripped, Quicken performs the comparison by comparing the register's stripped Payee to the first X characters in the external transaction's stripped Payee, where X = the number of characters left in the register's stripped Payee name. Matching Payees Example Non-Matching Payees Example Intuit Confidential Page 6 If the prefix of the Payee name in the external transaction matches the comparison text retrieved from the Payee in the register transaction, the transactions are considered matched. Transaction Matching Examples Check Number Match For example, download a check and an ATM withdrawal on 2/20/99: Transaction Date (A) 2/15/99 Check Number Payee Amount #1523 XYZ Cable $50.00 ATM Withdrawal $50.00 (B) 2/18/99 In this case, the following unmatched transactions are in the register: Transaction Date (1) 1/31/99 (2) 2/10/99 (3) 2/15/99 Intuit Confidential Check Number #1523 Payee Amount Cash Withdrawal $50.00 My Cable $50.00 Cash Withdrawal $50.00 Page 7 Quicken matches (A) to (2) based on amount and check number (found in Primary match process), and (B) to (1) since it is the first unmatched transaction to meet the criteria for amount and date (found in Secondary match process). If (1) had already been matched by a previous download, (B) would match to (3). Online Payment Match This next example illustrates the special case check number matching for online payments. Download a transaction from an OFX or NPC FI without a check number. Transaction Date (A) Check Number 2/12/99 Payee Amount ABC Utility $50.00 In this case, the following unmatched transactions are in the register: Transaction Date (1) 2/8/99 Check Number Payee Amou nt #698* My Utility $50.00 * Online payment ATM Withdrawal $50.00 (2) 2/17/99 Quicken matches (A) to (1) based on amount and that (1) is an online payment. If (1) had not been an online payment, (A) would match (2). SRVRTID Match This next case illustrates matching transactions based on server-assigned transaction ID. Download a transaction without a check number but with a SRVRTID. Transaction Date Check Number (A) 2/12/99 SRVRTID (not displayed) Payee Amount 1860599 ABC Utility $50.00 Payee Amount ABC $50.00 In this case, the following unmatched transactions are in the register: Transaction Date Check Number SRVRTID (not displayed) (1) 2/8/99 #1001 (2) 2/17/99 #5001 1801009 ABC Utility $50.00 (3) 2/20/99 #5002 1860599 ABC Utility $50.00 In this case, (A) would match to (3) because the SRVRTIDs match. Intuit Confidential Page 8 "New" Transactions External transactions which don't find a match in the register using the steps detailed above show up in the Compare to Register window as transactions with a "New" status. They are listed after all the transactions with a "Match" status. QuickFilling Categories from Memorized Transactions When a "New" transaction is selected or accepted into the register, Quicken compares it against the list of Memorized Transactions. If it finds a match, it uses the category in the Memorized Transaction to QuickFill the New transaction entered in the register. This eliminates the need for the user to have to manually enter in the category. Users still have the option to override the QuickFill of the category by editing it in the register before or after they accept the downloaded transaction. If the external transaction contains a category and the Payee matches a transaction in the Memorized Transactions list, the category will be taken from the memorized transaction. If there is no matching Payee, the category will be taken from the external transaction. A match in this algorithm is based entirely on Payee name. The Payee name matching process for New transactions differs slightly from Payee name matching for external transactions. Matching Payees in Memorized Transactions The matching process here makes 2 passes. In the first pass, Quicken starts at the beginning of the Memorized Transaction list and looks for a Payee that matches the New transaction's Payee. To do this, it compares the Payee in the Memorized Transaction to the first X characters of the New transaction, where X is the number of characters contained in the Memorized Transaction's Payee Name. If it finds a match, it QuickFills the category for the Memorized Transaction into the New transaction entered in the register, and matching for the New Downloaded transaction is complete. Intuit Confidential Page 9 If no match is found in the first pass, Quicken makes a second pass through the Memorized Transaction List, starting with the first Memorized Transaction. In this step, Quicken removes all extraneous characters from both Payee names. The same stripping procedure is used as in matching Downloaded Payees to Register Payees. The characters stripped are: 123456790!@#$%^()/\,. The above list includes the space character. If the stripped result of the current Memorized Transaction's Payee is less than 4 characters long, this step is skipped, and Quicken moves on to the next Memorized Transaction in the list. If the comparison Payee is at least 4 characters long, the entire list of New downloaded Transactions is searched for any Payee that contains the comparison text anywhere in its Payee name. Once it finds a Payee that contains the comparison text, the match is made. This matching procedure is a case-insensitive match. Quicken needs a comparison string of at least 4 characters in order to make a valid match. With a comparison string of less than 4 characters, there is more chance of Quicken making an invalid match. Intuit Confidential Page 10 The transaction would match to the first matching payee in the list, which in the example above is "Brand or Better". If this algorithm doesn't find a match in the Memorized Transaction List, then a category isn't QuickFilled into the New transaction. Matching Improvements Intuit is continuously improving the transaction matching process, and the exact algorithm varies across clients. Financial institutions should not rely on the details of the matching algorithm. Rather, if a financial institution provides the recommended information as described below, transactions will continue to match appropriately in future releases of Quicken and other Intuit clients. Providing External Transactions To ensure optimal matching and provide the user with the most context, a financial institution should provide the following information for external transactions: Persistent, unique FITID Transaction amount Date posted and date user initiated the transaction Check number for payments SRVRTID for OFX online payments and online transfers Payee name Description or memo For OFX, transaction type with as much uniqueness as possible (e.g. POS rather than DEBIT for point of sale purchase) Intuit Confidential Page 11