The Following are the changes to be made to the IGC (Public GC

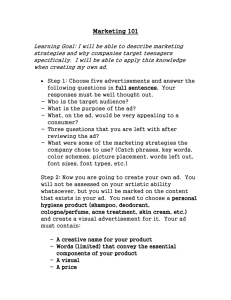

advertisement

The Following are the changes to be made to the IGC (Public GC changes follow) in CR-5-01657-01: 1. Make the following changes to the existing section called Other Parent is NCP: a. Rename to “Other Parent is NCP (Foster Care or Other Non-Parent Custody)”. b. Move from its current location between Other Parent Tax Settings and Monthly Income Information to a new location between Dependent Information and Tax Information. c. Keep as a collapsed section. 2. In the existing section Tax Information, next to the Tax Year drop down list, display the indicators NCP and Other Parent. Looking down the page all existing data entry boxes, whether visible or contained within existing collapsed sections, should line up Left Justified under each label. 3. Make the following changes to the existing question “Deduction type when NCP and Other Parent are married filing separately:” along with the existing radio buttons “Itemized Deductions” and “Standard Deductions”: a. Change the existing question to read “Deduction type when NCP and Other Parent are married to each other, filing separately.” b. Move to a new location. The new location will be in a new collapsed section called Other Tax Settings. This new section will be located within Tax Information and is discussed in item 4.k. The location of this question will be at the end of the Other Federal Tax Settings just below the federal tax check boxes and above the Other State Tax Settings. 4. Revise the existing section Tax Information so all the tax information for the NCP and Other Parent appear side by side rather than consecutively. a. At the top of the existing section entitled Tax Information and just below the Tax Year drop down list, display Federal Income Taxes. The font size, style and shading for Federal Income Taxes should be the same as it is currently. b. Under existing Federal Income Taxes display the title Federal Tax Filing Status: The font size and style and the alignment should be the same as it is currently. c. Next to Federal Tax Filing Status: display the tax filing drop down lists for both the NCP and the Other Parent. The tax filing drop down lists will appear side by side. Currently there is a default value for the tax filing status for each party. The default values shall not change. d. Just under Federal Tax Filing Status: display Federal Tax Exemptions: The font size and style and the alignment should be the same as Federal Tax Filing Status. e. Next to Federal Tax Exemptions: display the exemption entry boxes for the NCP and Other Parent. The entry boxes will appear side by side. Currently there is a default value for the number of exemptions for each party. The default values shall not change. f. Just under Federal Tax Exemptions: display State Income Taxes. The font size, style and shading for State Income Taxes should be of the same style as the Federal Income Taxes appearing in Tax Information above it. g. Just under existing State Income Taxes, display California Tax Filing Status. h. Remove (RDP Only) Add (Registered Domestic Partner Only) to California Tax Filing Status. The font size and style and the alignment should be the same as Federal Tax Filing Status. i. California Tax Filing Status (Registered Domestic Partner Only): display the existing drop down lists for the NCP and Other Parent. The drop down lists will appear side by side for each party. The current default values shall not be changed. j. Remove (RDP Only) from the side of each drop down list as the information is now spelled out in the title. (See 4.h.) k. Just under California Tax Filing Status (Registered Domestic Partner Only): create a new section called Other Tax Settings. This section is collapsed by default. The font should be the same as Federal Income Taxes. Within this section will be existing entry boxes, existing check boxes and existing questions that formerly resided in the existing collapsed sections called NCP Tax Setting and Other Parent Tax Settings. In this section the entry boxes and check boxes will all be displayed side by side for the NCP and the Other Parent. If space is needed to display the entry boxes and check boxes side by side, the words “Number of” can be removed and “California” can be shortened to ”CA”. The font size and style should be the same as the title bar called Tax Information. All current default values in the entry and check boxes shall not change. Display the title Other Federal Tax Settings at the top of the expanded section below Other Tax Settings. The font size, style and shading for Other Federal Tax Settings should be the same as it is currently. The following questions and check boxes will appear under Federal Tax Settings Number of Children for Child Care Credit Number of Children for Earned Income Credit Number of Children for Child Tax Credit Self Employment Taxes Federal Insurance Contributions Act Medicare Advanced Earned Income Credit If Married Filing Separately. Lived with Spouse Part of the Year Parent is Blind (Label has been modified to apply to either parent) Parent is 65 or Older (Label has been modified to apply to either parent) New Spouse is Blind (Label has been modified to apply to either parent) New Spouse is 65 or Older (Label has been modified to apply to either parent) Per item #3 above, the question “Deduction type when NCP and Other Parent are married to each other filing separately:” along with the existing radio buttons” Itemized Deductions” and “Standard Deductions” should be moved to this new location. Font size and style should be the same as the existing entry and existing check boxes in this section. Display the title Other State Tax Settings. The font size, style and shading for Other State Tax Settings will be the same as Other Federal Tax Settings as described above. The following questions and check boxes will appear under Other State Tax Settings: California Tax Exemptions ) (Registered Domestic Partner Only) Children for California Child Care Credit California State Income Taxes California State Disability Insurance California Dependency Credit for Dependent Parent(s) California Joint Custody Head of Household Credit California Renter’s Credit Other State Rate The radio button will remain Left Justified and next to the radio button title of “Other State Rate”. Other State Amount The radio button will remain Left Justified and next to the radio button title of “Other State Amount”. 5. Make the following changes in the existing section Monthly Income Information: a. Remove the titles/words Type and NCP ($) and Other Parent ($). The remaining space will be used for the Earned Income Amount as described in item d below. b. Rename the existing title bar called Wages/Salary to Calculate Wages/Salary. c. Rename “Earned Income Amount” to “Wages/Salary”. The font size and style should be the same as the title bar Monthly Income Information. d. e. Move the newly named Wages/Salary so that it appears above the section called Calculate Wages/Salary in the space that was previously occupied by Type and NCP ($) and Other Parent ($). This item will continue to function as it currently does. The existing “Imputed Income” should be moved from its current location just below “Disability (Taxable)” to the new location just below “YTD Range” inside the Monthly Income Information collapsed section. 6. Move the existing section, Public Assistance and Child Support Received to just below the New Spouse Other Income section. Change default to a collapsed state. 7. In the existing section Other Taxable Income, rename “Operating Losses and Other Income” to “Other Income (Retirement, Annuity, SS Other Relationship, Operating Losses, etc.):” No other changes are needed to this section. It will default to a collapsed state. 8. In the existing section Other Non-Taxable Income rename “Depreciation or Other:” to “Other (Depreciation, Military Benefits, etc.)” If there is not sufficient space for this label, an alternate name is possible, “Other (Depreciation, Military Ben, etc.)” 9. Rename the existing section called New Spouse Income to New Spouse Other Income. Keep it as a collapsed section by default. 10. Move the existing field called Wages/Salary in the existing section New Spouse Income so it is located outside and above the collapsed section with its new title of New Spouse Other Income. o Rename the field Wages/Salary to New Spouse Wages/Salary o The font size and style should be the same as New Spouse Other Income. o The field should continue to function as it currently does. 11. In the existing section Monthly Deduction Information, remove titles/words Type and NCP ($) and Other Parent ($). Move the titles/fields below this area up to save space; do not leave the space open. 12. Rename the existing section Retirement Contribution to Other Retirement Contributions. Keep it as a collapsed section by default. 13. Move the existing field and entry/text boxes called Mandatory Retirement Tax-Deferred that are currently located in the Retirement Contributions collapsed section so they are located above the section with the new title of Other Retirement Contributions. o The font size and style should be the same as Other Retirement Contributions. o The existing Mandatory Retirement Tax-Deferred should function as it currently does. 14. Rename existing Other Guideline Deductions to Job Related Expenses & Spousal Support Other Relationship. 15. Move existing State Adjustments from its current location between Monthly Hardship Deduction Expenses and Monthly Hardship Deduction Calculation to just below Alternative Minimum Tax Information (form 6251). a. This section should default as collapsed. b. Remove the title/words Type and NCP ($) and Other Parent ($). Move the titles/fields below this area up to save space; do not leave the space open 16. Rename existing Monthly Hardship Deduction Expenses to Extraordinary Health and Catastrophic Losses. The word “and” may be substituted with an ampersand if necessary to save space. a. This section should default as collapsed. b. Remove Type and NCP ($) and Other Parent ($). Move the titles/fields below this area up to save space; do not leave the space open 17. Rename existing Monthly Hardship Deduction Calculation to Hardship Children. o Line up the data entry/text boxes side by side instead of consecutive for NCP and Other Parent. (refer to how the Other Tax Settings were revised) 18. Move the Computation Method for Hardship to the collapsed Hardship Children section. It should continue to default to Match Presumed Child Support Per Capita. 19. Rename the existing section Computation Method for Child Support Add-Ons to Allocation for Child Support Add-Ons. This section should not expand or collapse. 20. Locate the allocation methods and the radio buttons just next to or below the title, Allocation for Child Support Add-Ons. a. The default should continue to be 50/50. b. The allocation methods should be renamed as follows: “Allocate 50/50” renamed to “50/50” “Allocate Family Code 4061(b)” renamed to “Prorate per Family Code 4061(b)” or if there is not sufficient room in the space, “Prorate per FC 4061(b)” “Allocate After Support” renamed to “After Support” The Following are the changes to be made to the Public GC in CR-5-01657-01: 21. The opening page has Dependent Information. Change the title of the existing question Number of Dependents to Use in the Calculation to Number of Children to Use in the Calculation. Change the existing phrase next to the drop down box that says Number of Dependents to Number of Children. This change will be made provided it does not change the method in which the page performs the calculation. 22. Make the following changes to the existing section called Parents Living Together Without Custody of Children: a. Move the existing section from its current location between Tax Information and Monthly Income Information to a new location between Dependent Information and Tax Information. b. Rephrase the existing check box question to “Check here if Parent 1 and Parent 2 are living together and neither have custody of the children. (Child(ren) in foster care or other non-parent custody)” This change will be made provided it does not change the method in which the page performs the calculation. 23. In the existing section Tax Information next to the Tax Year drop down list, display the indicators Parent 1 and Parent 2. Looking down the page all data entry boxes, whether visible or contained within collapsed sections, should be lined up Left Justified under each label. 24. Make the following changes to the existing question “Deduction type when Parent 1 and Parent 2 are married filing separately:” along with the existing radio buttons “Itemized Deductions” and “Standard Deductions” a. Change the existing question to read “Deduction type when Parent 1 and Parent 2 are married to each other filing separately.” b. Move to a new location. The new location will be in a new collapsed section called Other Tax Settings. This new section will be located within Tax Information and is discussed in item 25.k. The location of this question will be at the end of the Other Federal Tax Settings just below the federal tax check boxes and above the Other State Tax Settings. 25. Revise the existing Tax Information section so that all the tax information for Parent 1 & Parent 2 appears side by side rather than consecutively. a. At the top of the existing section entitled Tax Information, display Federal Income Taxes. The font size, style and shading for Federal Income Taxes should be the same as it is currently. b. Under existing Federal Income Taxes display the title Federal Tax Filing Status: The font size and style and the alignment should be the same as it is currently. c. Next to Federal Tax Filing Status: display the tax filing drop down lists for both Parent 1 and Parent 2. The tax filing drop down lists will appear side by side. Currently there is a default value for the tax filing status for each party. The default values shall not change d. Just under Federal Tax Filing Status: display Federal Tax Exemptions: The font size and style and the alignment should be the same as Federal Tax Filing Status. e. Next to existing Federal Tax Exemptions: display the exemption entry boxes for Parent 1 and Parent 2. The entry boxes will appear side by side. Currently there is a default value for the number of exemptions for each party. The default values shall not change. f. Just under Federal Tax Exemptions: display State Income Taxes. The font size, style and shading for State Income Taxes should be of the same style as the Federal Income Taxes appearing in Tax Information above it. g. Just under existing State Income Taxes, display California Tax Filing Status h. Remove existing (RDP Only) Add (Registered Domestic Partner Only) to California Tax Filing Status. The font size and style and the alignment should be the same as Federal Tax Filing Status. i. California Tax Filing Status (Registered Domestic Partner Only): display the drop down lists for Parent 1 and Parent 2. The drop down lists will appear side by side for each party. The current default values shall not be changed. j. Remove (RDP Only) from the side of each drop down list as the information is now spelled out in the title. (See 26.h.) k. Just under California Tax Filing Status (Registered Domestic Partner Only): create a new section called Other Tax Settings. This section is collapsed by default. The font should be the same as Federal Income Taxes. Within this section will be the existing entry boxes, existing check boxes and existing questions that formerly resided in the existing collapsed sections called Parent 1 Tax Setting and Parent 2 Tax Settings. In this section the entry boxes and check boxes will all be displayed side by side for Parent 1 and Parent 2. If space is needed to display the entry boxes and check boxes side by side, the words “Number of” can be removed and “California” can be shortened to ”CA”. The font size and style should be the same as the title bar called Tax Information. All current default values in the entry and check boxes shall not change. Display the title Other Federal Tax Settings at the top of the expanded section below Other Tax Settings. The font size, style and shading for Other Federal Tax Settings should be the same as it is currently. The following questions and check boxes will appear under Federal Tax Settings Number of Children for Child Care Credit Number of Children for Earned Income Credit Number of Children for Child Tax Credit Self Employment Taxes Federal Insurance Contributions Act Medicare Advanced Earned Income Credit If Married Filling Separately. Lived with Spouse Part of the Year Parent is Blind (Label has been modified to apply to either parent) Parent is 65 or Older (Label has been modified to apply to either parent) New Spouse is Blind (Label has been modified to apply to either parent) New Spouse is 65 or Older (Label has been modified to apply to either parent) Per item #25 above, the question “Deduction type when Parent 1 and Parent 2 are married filing separately:” along with the existing radio buttons” Itemized Deductions” and “Standard Deductions” will be moved to this new location. Font size and style should be the same as the existing entry and existing check boxes in this section. Display the title Other State Tax Settings. The font size, style and shading for Other State Tax Settings will be the same as the Other Federal Tax Settings as described above. The following existing questions and existing check boxes will appear under Other State Tax Settings: California Tax Exemptions (Registered Domestic Partner Only) Children for California Child Care Credit California State Income Taxes California State Disability Insurance California Dependency Credit for Dependent Parent(s) California Joint Custody Head of Household Credit California Renter’s Credit Other State Rate The radio button will remain Left Justified and next to the radio button title of “Other State Rate” Other State Amount The radio button will remain Left Justified and next to the radio button title of “Other State Amount 26. In the existing section Monthly Income Information, make the following changes: a. Remove title/words Type and Parent 1 ($) and Parent 2 ($). Do not leave the space open The space left behind will be used for the Earned Income Amount as described in item e below. b. Rename the existing title bar called Wages/Salary to Calculate Wages/Salary. c. Rename existing “Earned Income Amount” to “Wages/Salary”. The font size and style should be the same as the title bar Monthly Income Information. d. Move the newly named Wages/Salary so that it appears above the section called Calculate Wages/Salary in the space that was previously occupied by title/words Type and Parent 1 ($) and Parent 2 ($). This item will continue to function as it currently does. e. Existing “Imputed Income” should be moved from its current location just below “Disability (Taxable)” to the new location just below “YTD Range” inside the Other Monthly Income Information collapsed section. 27. Move the existing section, Public Assistance and Child Support Received to just below the New Spouse Other Income Section. Change default to a collapsed state. 28. In the existing section Other Taxable Income, rename “Operating Losses and Other Income” to “Other Income (Retirement, Annuity, SS Other Relationship, Operating Losses, etc.):” No other changes are needed to this section. It will default to a collapsed state. 29. In the existing section Other Non-Taxable Income, rename “Depreciation or Other:” to “Other (Depreciation, Military Benefits, etc.)” If there is not sufficient space for this label, an alternate name is possible, “Other (Depreciation, Military Ben, etc.)” 30. Rename the existing section called New Spouse Income to New Spouse Other Income. It shall remain a collapsed section by default. 31. Move the existing field titled Wages/Salary in the existing section New Spouse Income so it is located outside and above the collapsed section with the new title of New Spouse Other Income. o Rename the field to New Spouse Wages/Salary o o The font size and style should be the same as New Spouse Other Income. The field should continue to function as it currently does. 32. In the existing section Monthly Deduction Information, remove title/words Type and Parent 1 ($) and Parent 2 ($). Move the titles/fields below this area up to save space; do not leave the space open 33. Rename the existing section Retirement Contribution to Other Retirement Contributions and keep it a collapsed section by default 34. Move the existing field and data entry/text boxes called Mandatory Retirement Tax-Deferred that are currently located in the Retirement Contributions collapsed section so they are located above the section with the new title of Other Retirement Contributions. o The font size and style should be the same as Other Retirement Contributions. o The Mandatory Retirement Tax-Deferred should function as it currently does. 35. Rename existing Other Guideline Deductions to Job Related Expenses & Spousal Support Other Relationship. 36. Move existing State Adjustments from its current location between Monthly Hardship Deduction Expenses and Monthly Hardship Deduction Calculation to just below Alternative Minimum Tax Information (form 6251). a. This section should default as collapsed. The font size and style should be the same as Alternative Minimum Tax just above it. b. Remove title/words Type and Parent 1 ($) and Parent 2 ($). Move the titles/fields below this area up to save space; do not leave the space open. 37. Rename existing Monthly Hardship Deduction Expenses to Extraordinary Health and Catastrophic Losses. The word “and” may be substituted with an ampersand if necessary to save space. a. This section should default as collapsed. b. Remove Type and Parent 1 ($) and Parent 2 ($). Move the titles/fields below this area up to save space; do not leave the space open 38. Rename existing Monthly Hardship Deduction Calculation to Hardship Children. o Line up the data entry/text boxes side by side instead of consecutive for Parent 1 and Parent. 2 (refer to how the Other Tax Settings were revised). 39. Move the Computation Method for Hardship to the collapsed Hardship Children section. It should continue to default to Match Presumed Child Support Per Capita 40. Rename the existing section Computation Method for Child Support Add-Ons to Allocation for Child Support Add-Ons. a. This section should not expand or collapse. 41. Locate the allocation methods and the radio buttons just next to or below the Title, Allocation for Child Support Add-Ons. a. The default should continue to be 50/50. b. The allocation methods should be renamed as follows: “Allocate 50/50” renamed to “50/50” “Allocate Family Code 4061(b)” renamed to “Prorate per Family Code 4061(b)” or if there is not sufficient room in the space, “Prorate per FC 4061(b)” “Allocate After Support” renamed to “After Support”