Microsoft Word version

advertisement

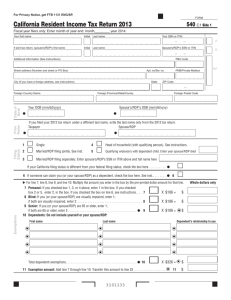

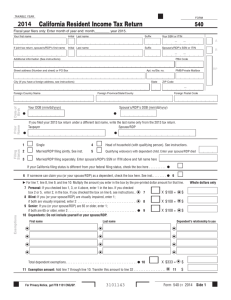

Senate Appropriations Committee Fiscal Summary Senator Christine Kehoe, Chair SB 651 (Leno) Hearing Date: 05/16/2011 Amended: 04/25/2011 Consultant: Jolie Onodera Policy Vote: Judiciary 3-2 _____________________________________________________________________ BILL SUMMARY: SB 651 would eliminate the requirement that domestic partners have a common residence in order to establish a registered domestic partnership (RDP). _____________________________________________________________________ Fiscal Impact (in thousands) Major Provisions 2011-12 2012-13 2013-14 Fund Secretary of State registration Minor, absorbable one-time costs General Income tax revenue loss Unknown; potentially significant revenue loss in excess of $110 - $825 per one percent increase in RDPs General Health benefits for increased enrollees Unknown; potentially significant costs of $550 per 100 new RDPs General Unemployment insurance Minor, absorbable costs annually Special* *Unemployment Fund _____________________________________________________________________ STAFF COMMENTS: This bill meets the criteria for referral to the Suspense File. Under existing law, in order to register as a domestic partnership with the Secretary of State, two people must 1) have a common residence; 2) not be married to someone else or be a member of another domestic partnership; 3) not be related by blood in a way that would prevent them from being married to each other in this state; 4) be at least 18 years of age; 5) be members of the same sex, or if members of the opposite sex, one or both persons must be over the age of 62; and, 6) both persons must be capable of consenting to the domestic partnership. This bill would eliminate an existing difference between domestic partners and married spouses by eliminating the requirement that domestic partners have a common residence. By removing this existing requirement, this bill would expand the number of persons who may establish and register a domestic partnership, and extends the legal rights and economic benefits of domestic partners. The Secretary of State indicates there are 110,498 individuals registered as domestic partners, based on 55,249 RDP filings. It is unknown how many additional RDPs will result due to the provisions of this bill as data is not collected by the Secretary of State for those individuals who have previously been denied due to the common residency requirement or have not applied due to the existing registration requirements. However, even a one percent increase in RPDs would represent approximately 1,100 individuals or 550 RDP filings. The Secretary of SB 651 (Leno) Page 2 State indicates minor and absorbable costs to revise the RDP filing form and update the agency website. The Secretary of State has not identified any cost savings as a result of this proposed change in eligibility criteria. Several domestic partnership laws enacted in prior years granted domestic partners additional rights and benefits in order to achieve parity between marriage and domestic partnerships in California. AB 26 (Migden) 1999 created the official domestic partnership registry and among other things, granted health benefits to domestic partners of state employees. By increasing the number of potential registered domestic partnerships could result in increased health benefit costs to the state of an unknown amount. The Public Employees Retirement System (PERS) has indicated for any employee who adds a spouse or domestic partner to his or her health plan would cost $5,500 more annually in health benefits and an unknown amount for retiree and survivor’s health benefits as afforded by the state. It is unknown how many of the new RDP filings would have a member employed by the state, but every 100 applicable new RDP filings would result in $550,000 annually in increased health benefits. SB 1827 (Migden) 2006 created the State Income Tax Equity Act which allowed registered domestic partners to file joint income taxes in order to receive the same financial protection afforded to married couples. According to the Franchise Tax Board, the average income tax benefit for married filing jointly versus those filing as single or head of household could range from $200 to $1,500 per year depending on the income levels of each individual. For every one percent increase in registered domestic partnerships who so choose to file could result in income tax revenue loss of up to $110,000 to $825,000 annually. Additional taxpayer benefits extended to RDP and RDP's dependents including the exclusion from gross income for specified medical expenses and health insurance benefits could result in additional lost tax revenue of an unknown, but potentially significant amount. The Employment Development Department indicates that although there would likely be some increase in unemployment insurance (UI) claims due to more individuals meeting the requirements for a valid domestic partnership, any increase would likely be very minor. Less than one percent of all UI benefit eligibility issues adjudicated involve an individual who quit due to domestic reasons, which includes quitting work to move with a spouse, imminent spouse, registered domestic partner, or imminent registered domestic partner, as well as other circumstances such as lack of child care or caring for an ill family member. It is not anticipated that this bill would result in a significant increase in UI claims.