Cost Benefit Analysis: RDP vs Rental

advertisement

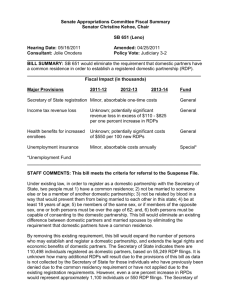

Social Housing Foundation Major Research and Findings 2008-2009 Presentation to the Parliamentary Portfolio Committee on Housing 26 August 2009 Cost Benefit Analysis RDP vs Social Rental Housing There is a great deal of focus on the short-medium term budgetary or public “fiscal” costs of housing development But what are real long term costs to government and society when we consider the broader economic, social and distributional impact of investing in various housing modes? This study compared the full range of costs and benefits of public investment in social rental housing with those of RDP housing. Purpose/objectives of the CBA The primary purpose of this assignment was to assess: the costs benefit comparison of social rental housing versus RDP housing the broader economic and fiscal implications of both delivery models The primary objective was to assess the most appropriate direction for government housing investment given scarce resources and the policy priorities, i.e. “the best spend of the last Rand”. As such the CBA focuses on the cost and benefits of the two housing delivery models to society as a whole rather than individual households. The secondary objectives of this assignment were to: Determine and quantify (where possible) the key economic effects; Understand the broader social and distributional effects; and Assess the performance of the two housing delivery models against an agreed policy framework Definitions of RDP & Social Rental RDP refers to housing built under the capital subsidy scheme, either individual or project-liked subsidies. is characterised by large scale housing delivery, typically of a free-standing nature on individual erven. Social Rental Housing refers to rental housing built under the institutional and new social restructuring grant subsidies. is typically medium to high density housing delivered on an institutional basis (i.e. institutional management, typically by a social housing institution - SHI). Motivation for the study In connection with a collaborative business case to support the upscaling of delivery of rental housing opportunities to meet the high level of demand. The goal is the delivery of 100 000 rental units (Social Housing and CRU) over 5 years to maintain this momentum until the demand curve levels out to a more consistent and manageable rate. National Treasury have raised concerns with the perceived higher cost of providing rental units as opposed to RDP units. Some officials at NT that as RDP units are less costly to develop, the budget would be better utilised producing more units overall, thereby satisfying more beneficiaries. Critical questions for the study What are the true medium and long term costs of implementing both models? - Land acquisition Infrastructure development and admin Range of “intangible” costs and benefits (inc socioeconomic secondary effects) What are the key economic effects? What are the broader social and distributional effects? How do both models perform against this policy framework? COST BENEFIT ANALYSIS Individual Revenues Project cost Financial Fiscal analysis CBA Economy Externalities • Rates/utilities • Bureaucratic costs • Transportation costs Economic Efficiency pricing CBA Operating Costs Sunk Cots Intangibles • Urban density • Human factor Policy analysis objectives Multipliers Social CBA LED Project challenges Intangible elements hard to quantify Long term effects of rental largely untested Different forms of RDP & rental (what is a true representative sample?) Very wide range of effects difficult to control for. Process/Progress Consortium head by Rhizome selected out of 8 bidders Broad-based Steering Committee was developed and active SHF Operations Team provided input Numerous drafts, sub-committee inputs, active engagement, etc Final report delivered in mid-2009 Structure of the Study Social & Distributional input: Financial input: Economic input: • Land acquisition costs • Capital expenditure • Maintenance costs • Infrastructure costs • Cost of amenities • … • Analysis primary and secondary effects • Analysis cause and effects project case • Statistical data • Economic data • Review of opportunity & transaction costs, externalities and transfer payments 1. Financial Analysis 2. Economic Analysis 3. Distributional effects 4. Policy implications Financial model CBA model Distributional effects Policy recommendations • Results CBA • Overview relevant actors in SH market Policy input: • Results CBA • Results distributional effects analysis • Analysis budgetary impact to Treasury Case Studies & Survey Six case studies were undertaken … Primary projects: Braamfischerville and Roodepoort Supplementary projects: Potsdam, Amalinda, Mhluzi / Tokologo and Hope City Projects selected on the following basis: Should represent a typical RDP or SRH project Should have been in existence / operational / occupied for at least a year Selection should offer a range of housing project examples with respect to location and city size Selection should provide a pair (RDP and SRH projects) within the same geographic area / municipal boundary Financial CBA Findings The per unit lifecycle financial costs of SRH are 2 to 2.5 times higher than RDP housing… Total financial costs to society Costs over full lifecycle (40 years) Construction and operational / maintenance costs Taking into account distortions, efficiency pricing, ‘sunk’ costs, marginal costs, land values, service leakages, etc. Economic CBA Findings When the financial lifecycle costs are combined with the wider economic costs and benefits on society, in general SRH is a better investment for society than RDP housing… These results represent the difference between all costs and benefits to society and are calculated by adding the value of economic effects to the difference in financial costs of RDP and SRH. Slide 13 CBA Outcomes 1/ The per unit lifecycle financial costs of SRH are 2.5 times higher than RDP housing… The higher lifecycle financial costs of SRH compared to RDP housing comes from their more central location on more expensive land, higher building standards, better maintenance and servicing. RDP also has some economic scale efficiencies since the projects involve much higher numbers of units… When the financial lifecycle costs are combined with the wider economic costs and benefits on society, then under certain conditions SRH is a better investment for society than RDP housing… The economic benefits of SRH compared to RDP appear to be mainly in transport savings, and to a lesser extent in reduced crime levels, and marginally improved education and employment. Location appears to play a strong role, with housing typology of less significance… CBA Outcomes 2/ Considering financial and economic costs, SRH is a significantly better investment than RDP when RDP housing is peripherally located. Where SRH and RDP projects are situated in similar locations in the city, the differences for society are less and the extra investment costs of SRH are not compensated by its advantages… RDP housing creates a substantial lifecycle cost burden to municipalities, while SRH does not create a municipal financial burden and instead passes on costs effectively to residents… RDP housing requires a greater total lifecycle subsidy of residents (smaller initial direct subsidies than SRH, but larger lifecycle indirect subsidies) than SRH. RDP is more redistributive, while SRH is more fiscally sustainable… SRH requires sufficient incomes of residents to pay for lifecycle costs, while RDP involves a much higher indirect lifecycle subsidy and therefore can cover also much lower income groups than SRH… Policy Implications The results do not justify exclusively choosing one housing form over the other since RDP and SRH generally target different groups (income levels, tenure preference, mobility, etc.) and have different intended effects… From a policy design perspective, the financial-economic and fiscal consequences of SRH versus RDP are related to the incentive structures created in each of the housing programmes… Projects can be optimized using the insights in the specific financial and economic costs and benefits caused by the project… With regard to lessons for housing policy optimization, choosing a favourable location for RDP and investing in security measures could minimize the difference in outcomes between SRH and RDP, thereby combining a positive outcome for society as a whole with providing housing for the poorest of the poor… Further Research Four critical themes from the study have been identified and policy/ discussion papers (“think pieces”) are being developed on these: 1) Location and Density 2) Public fiscal issues 3) Social indicators 4) Housing as a social/public assets Location and Density The CBA indicates that the viability and quality of outcomes of a housing intervention is largely dependent on 1) Its location in proximity to local infrastructure, access to services and economic opportunity; and 2) The density of the housing in relation to economyof-scale efficiencies This paper articulates issues of location and density per the CBA findings and density to help inform housing and urban development policy Public Fiscal Issues A critical CBA finding was that Local Government ends up carrying a long-term cost burden associated with RDP. This amounts to an “unfunded mandated” for municipalities for a product over which they have little control. This paper will address the key findings on public finance with particular emphasis on municipal finance. Developing Social Indicators for housing research The CBA showed that outcomes in RDP and social rental were primarily related to location and household income rather than housing typology The question remains how do we develop appropriate social indicators (e.g. in relation to health, education, safety, etc) that help us measure the impacts of various housing interventions. This paper will address this issue in the South African context Housing as a Social/Public asset There is a sense that that investment in RDP may be preferable to investment in social rental because RDP transfers and “asset” to the poor while rental does not. The CBA casts doubt on this concept, because (inter alia) RDP houses are rarely treated as an “asset” The cost of maintaining the house is often very burdensome for the owner Most of the RDP stock does not really fall into the scope of the commercial rental housing market. This paper critically examines the concept of a social or public asset in housing