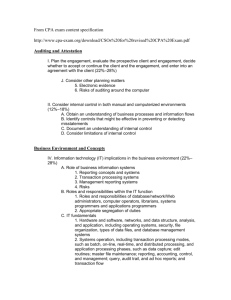

Bank Transaction Code sets description

advertisement