Chapter 14 - Class Notes - Germantown School District

THE NATION’S SICK ECONOMY

(CHAPTER – 14 / SECTION -1)

Economic Troubles on the Horizon

As the economy grew, so did the desire to become wealthy. The appearance of an easy route came from the thought of buying stocks.

With product growth there were high business profits and a continuation of growth within the stock values of businesses.

People thought this industry growth and profit would never end. A lot of people borrowed money to invest in the New York Stock

Exchange. The amount of stock sold increased more than 400% from 1923 - 1928.

Industries In Trouble

Key industries barely made a profit; some industries lost business to foreign competition and new American technologies;

Some industries suffered from declining demand for their goods after World War I;

The coal industry declined because of the development of new sources of energy; new housing starts declined, affecting other businesses that depended on home construction.

The introduction of artificial Synthetic materials, such as rayon, hurt the cotton industry. Coupled with the over production of cotton caused a slump in the industry.

Similar “ sick” industries such as, the coal, lumber and textiles were economically depressed during the 1920’s. Many unskilled laborers were employed at these industries at this time.

Farmers Need A Lift

After World War I, demand for farm products fell drastically, as did prices;

Many farmers could not pay off their debts and lost their farms, which caused some rural banks to fail;

Congress passed federal price supports for farm products, but

President Coolidge vetoed them.

Many of the farmers produced more food than they could sell.

The end of the war saw an end to demand. Yet they still produced more to pay of the loans or debt. Food prices fell and nearly a half a million farmers lost their land.

Consumer Have Less Money To Spend

By making credit easily available, businesses encouraged

Americans to pile up a large consumer debt;

Faced with rising prices, stagnant wages, and high levels of debt, consumers decreased their buying.

In the 1920s, the widespread use of the home mortgage and credit purchases of automobiles and furniture boosted spending but created consumer debt.

People who were deeply in debt when a price deflation occurs are in serious trouble—even if they kept their jobs—they risk default. Prices and incomes fell 20-50%, but the debts remained at the same dollar amount.

As the debtors tightened their belts, consumer spending fell, and the whole economy weakened. With future profits looking poor, capital investment slowed or stopped. In the face of bad loans and worsening future prospects, banks became more conservative.

Federal Reserve tried to help the economy by actions that effectively cut the money supply by one-third from 1930 to

1931. With significantly less money to go around, businessmen could not get new loans and could not even get their old loans renewed, forcing many to stop investing.

When people decide to save more they spend less. Economists were increasingly calling for government to take up the slack by increasing government spending.

More than 9,700 American banks failed between 1929– 1933.

The bank failures caused many people to lose all of their savings, which they were dependent upon during these hard times.

Uneven Distribution of Wealth

Nearly half of American families earned less than the minimum amount needed for a decent standard of living, while the rich got richer;

This unequal distribution meant most consumers had too little money to buy the goods produced by American factories.

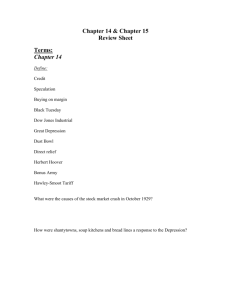

Stock Market Crashes

Many investors engaged in speculation and buying on margin, fueling the market upward and generating great wealth, but only on paper;

When the market crashed, many investors lost their life savings.

U.S. business boomed within the 1920’s with Americans owning cars, buying homes and seeking the available leisure opportunities.

Many people saw the

Dow Jones Industrial Average

as a way to further improve their status in life. This was the measurement of the nations 30 largest firms in the US.

There are two types of markets, a

Bull market

is a prolonged period of time when prices are rising in a financial market faster than their historical average.

A bull market tends to be associated with a market behavior of a group of market participants referred to as a herd.

______________________________________________________

A

Bear market

which is a prolonged period of time when prices are falling.

A bear market tends to be accompanied by widespread pessimism.

Investors anticipating further losses are motivated to sell.

Buying on Margin

is a risky technique involving the purchase of securities with borrowed money.

What this means is that instead of buying your stocks with the money you have, you could purchase them with cash down and the rest on credit.

For example, let's say you want 100 shares of Red Wagon stock.

The cost for 100 shares is say $15000. You put down 10% and make monthly payments.

Jones down the street is doing the same thing, as is Johnson,

Wilson, and Douglas.

Well, all this purchase of stock is pushing up the price. Now

100 shares of Red Wagon co. are worth $20000. In essence, you are paying off what you owe on the stock by its increase in value. So how can you lose on this?

Speculation

is a service provided to a market that by risking their own capital in the hope of profit. It became the thought as much as one had paid for a stock there would always be someone else that would pay more.

______________________________________________________

The Great Crash

On September 3, 1929 stock prices hit an all-time high but, shortly there after the stock prices began to fall. Again on October 24 large scale selling took place, but the stock rallied later in the day.

Then on

Black Tuesday

, October 29, 1929, five days after the

U.S. stock market crash, general panic set in that everyone with investments in the market tried to pull out of the market at once.

People that had bought on margin sold off their stocks to raise money to pay off their loans. Many people could not find buyers and the price per share of stocks fell faster. On that day some 16 million shares were sold and some 15 billion in stock value had been lost.

Why didn't they do anything about it if they knew a collapse was imminent? There was a policy which many followed, known as laissez-faire roughly translated means 'let things be' . It is an old economic term to describe a government policy of nonintervention.

It began on October 24, 1929 . 12,894,650 shares changed hands on the New York Stock Exchange-a record. To put this number in perspective, go back to March 12, 1928 when there was at that time a record set for trading activity of a total of 3,875,910 shares .

Another problem in all of this was communication. The ticker tape machine had gone through great amounts of perfections since its early applications in the 1870s-80s.

Telegraphic speed, the volume caused a delay in reports being sent out as much as one hour to an hour and a half.

Phones were just busy signals on hooks. It was causing crowds to gather outside of the NYSE trying to get in the communication.

Police had to be called to control the strangest of riot masses; the investors of business. It is not yet noon.

Black Tuesday was based in large part on credit, came due. In order to get out, you had to get your broker to sell your stock at market value.

Remember too, that people bought our stock on margin. They are paying interest on a loan for a stock which itself is being used as collateral.

Worldwide Shock Waves

The

Great Depression

was a worldwide economic downturn, starting in 1929, although its effects were not fully felt until late in 1930 and lasting through most of the 1930’s.

The most industrialized countries were affected the worst, including the U.S., Germany, Britain, France, Canada, and

Australia.

Cities that were hit hard were those especially based on heavy industry. Construction virtually halted in many countries.

Farmers and rural areas suffered as prices for crops fell by 40-

60%, mining and logging areas were perhaps the hardest hit because demand fell sharply and there was little alternative economic activity.

Businesses responded to less consumer spending by cutting back on production and lying off workers. This creates a vicious cycle: less investment, fewer jobs, less consumption and even less reason for business to invest.

In 1930 Congress passes the

Hawley-Smoot Tariff Act

, which established the highest protective tariff in US history.

Gross farm income in 1919 amounted to $17.7 billion. By 1921, exports to Europe had plummeted and farm income fell to $10.5 billion.

In the end, the tariff law raised the average American tariff rate to "some 40 %".

Five years after the passage of the tariff, American trading partners had raised their own tariffs by a significant degree.

France raised its tariffs on autos from 45 % to 100 %, Spain raised tariffs on American goods by 40 %, and Germany and

Italy raised tariffs on wheat.

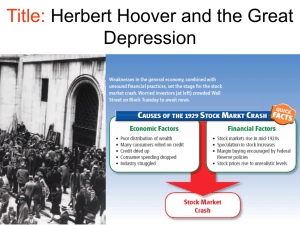

Causes of the Great Depression

Tariffs and war debt in foreign countries cut down any market potential for US goods

Farming sector falls apart

Availability of easy credit

Unequal distribution of wealth in the US

HARDSHIP & SUFFERING DURING

THE DEPRESSION

(CHAPTER – 14 / SECTION -2)

With the lack of any local jobs many men moved across the country in search of work. Wages were so low that many families were unable to meet their needs for existence. Lack of jobs, food and shelter often caused people to revert back to primitive ways of surviving.

Employment

Minorities and new immigrants were hit the hardest taking low paying jobs.

Many people found themselves out of jobs for years;

Women, African-American men, and Mexican-American men were discriminated against in the workplace and became targets of hostility.

Housing

Many unemployed people lost their homes; many homeless lived in the streets or in

shantytowns

The greatest fear among the middle class was the loss of their homes. Many people did lose their homes and used boxes of wood, cardboard, and any scraps of metal they could find. Some individuals even lived in water mains.

People named these makeshift housing camps

Hoovervilles

. It is a term describing a series of villages that appeared during the

Great Depression in the U.S. from 1929 through the 1930s and

1940s.

The government did not officially recognize these Hoovervilles and occasionally removed the occupants for technically trespassing on private lands.

Most of these unemployed residents of the Hoovervilles begged for food from those fortunate enough to have housing during this era.

Several other terms came into use during this era, such as

"Hoover blanket" (old newspaper used as blanketing)

"Hoover flag" (an empty pocket turned inside out)

"Hoover leather" was cardboard used to line a shoe with the sole worn through

A "Hoover wagon" was a car with horses tied to it because the owner could not afford gasoline.

Farming

The

Dust Bowl

was a series of dust storms in the central U.S. and

Canada in the mid to late 1930s, caused by a massive drought and decades of inappropriate farming techniques.

The fertile soil of the Great Plains was exposed through removal of grass during plowing. Topsoil across millions of acres was blown away because the indigenous sod had been broken for wheat farming and the vast herds of buffalo were no longer fertilizing the rest of the indigenous grasses.

On Nov.11, 1933, a very strong dust storm stripped topsoil from exposed SD farmlands in just one of a series of disastrous dust storms that year.

On May 11, 1934, a strong two-day dust storm removed massive amounts of Great Plains topsoil in one of the worst such storms of the Dust Bowl.

Dust clouds blew all the way to Chicago where filth fell like snow, dumping the equivalent of four pounds of debris per person on the city.

Several days later, the same storm reached cities in the east and that winter, red snow fell on New England.

In April of 1935, known as "Black Sunday", one of the worst

"Black Blizzards" occurred throughout the dustbowl, causing extensive damage, turning the day to night. Witnesses reported that they could not see five feet in front of them at certain points.

The drought caused a dramatic decrease in farm prices and income; many farmers lost ownership of their farms and were forced to become tenant farmers or farm laborers. Between 1929 & 1932 some 400,000 farms were lost to foreclosure.

Some farm families were somewhat better equipped to provide themselves with the basic necessities.

Race Relations

Intense competition for jobs sparked existing racial resentments into open hostility and violence;

In 1933, 24 African Americans were lynched

Thousands of Mexican Americans left the U.S. voluntarily or were deported.

Family Life

The Depression strengthened family ties, but also increased family tensions.

Some men abandoned their families, discouraged by their inability to provide for them.

Women also faced greater pressures to provide for themselves and their families. Everyday they would stand in lines waiting for whatever the

Soup Kitchens

could provide in the way of free food.

Most people resisted any outside assistance and clung to the sense of self pride. However, as times became worse people sought out help from any means.

A growing need feel upon churches, relatives and private organizations. The Red Cross and Salvation Army were a few of the relief groups that tried to help with

bread lines

.

The wealthy were unable to grasp the scope of the depression.

Some donated millions, but were amazed to find out that the money had run out within a few months .

Other business leaders were unsympathetic and blamed the bad times on the failure of others to save money or to spend their money wisely.

Physical Health

Poor and homeless people scavenged or begged for food or turned to soup kitchens and bread lines

Poor diet and lack of health care increased rates of serious health problems. Malnutrition and starvation grew more common.

Emotional Health

Many people became demoralized and turned to suicide as a way out of their life of horror.

Admissions to mental hospitals increased dramatically

People were forced to accept compromises that would affect the rest of their lives

Some people came to want financial security more than anything else in life. There was no federal system of

direct relief

in which a family or person could receive cash payments or food provided by the government.

New York City had the highest payout of any city with a family assistance payment of $2.39 per week.

Trying to Cope

Men:

The tradition of the man of house provides for the family took its toll. Who were once successful workers were now struggling to keep the family going. One, two and three years would pass and many would then give up and abandon their families altogether.

______________________________________________________

Women :

Many women would band together in an attempt to make ends meet for their families. As time went on women became the target of resentment if they had a job and their husbands did not.

The working married women became a target. Fire the married working women and hire the man, no unemployment – no depression.

Some 26 states introduced legislation to inhibit women from working.

A perception was that women had it easier than men during this time. In reality many women were starving to death and too ashamed to beg for any handouts they could have gotten.

______________________________________________________

Children

The children experienced the hardship in malnutrition. Many boys and girls sought to escape by boarding trains searching for jobs and adventure as they traveled across the country. Some 2,600 schools had shut down leaving some 300,000 students out of school.

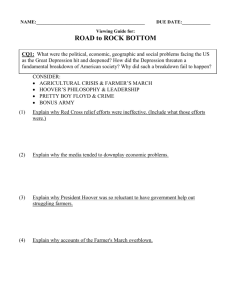

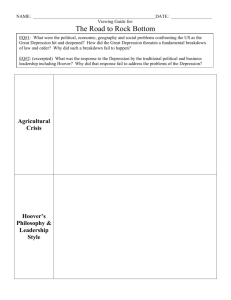

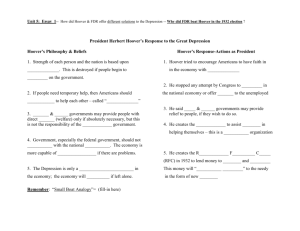

HOOVER STRUGGLES WITH THE

DEPRESSION

(CHAPTER – 14 / SECTION -3)

Hoover’s philosophy was that a chief function of government was to encourage voluntary cooperation among competing interest groups. Hoover also believed that the federal government should guide relief measures but not directly participate in them.

Hoover thought this would only last a short time and in fact told some business people that the depression was over. He believed that private organizations should be the source of ending the plight, not federal aid, and that the people would rise to the challenge.

Response and Economic Results

Hoover urged caution and for the key leaders to work together to provide solutions and to act in ways that would not make the economic situation worse.

Hoover also believed that business should operate without interference or involvement by the federal government.

He asked businesses to maintain wages, keep up production and to cooperate with the government to build confidence within the people.

______________________________________________________

Voter Response

Republicans lost control of the House of Representatives and saw their majority in the Senate dwindle to one vote.

Economic Situation

With no improvement in sight President Hoover was forced to act in trying to stimulate the economy. His best solution was the

Reconstruction and Finance Corporation

(RFC) .

The RFC was an Independent agency of the U.S. government which advanced $2 billion in loans to state and local governments and to banks, railroads, farm mortgage associations, and other businesses in hope of creating jobs .

He also cut federal taxes and encouraged the government to spend

150 million on public works projects, which were building hospitals, schools and roads.

One such project was the building of the Hoover Dam. The RFC was bogged down in bureaucracy and failed to disperse many of its funds. It failed to stem the tide of mass unemployment. The failure of the RFC helped to lead to the election of Franklin Roosevelt.

______________________________________________________

Helping Farmers

Depressed since the early 1920’s, farmers were in need of assistance from the government. Hoover was willing to offer assistance to farmers to purchase animal feed or farm equipment, but was not willing to give money to help clothe, shelter or feed their families.

Under President Hoover, the

Agriculture Marketing Act

of

1929 established the Federal farm Board with a revolving fund of half a billion dollars.

The original act was sponsored by Hoover in an attempt to stop the downward spiral of crop prices by seeking to buy, sell and store agricultural surpluses or by generously lending money to farm organizations.

The plan to purchase surplus crops and to store them for later use failed because the government could not buy enough of what was produced.

______________________________________________________

Helping Homeowners

President Hoover presses Congress for action wanting to encourage home construction, reduce foreclosures and support the idea of widespread home ownership.

The congressional response came in the form of the

Federal

Home Loan Bank Act

, whose role was to supervise a series of discount banks spread across the country. Initial capitalization of

$125 million was provided.

The intent of this system was to increase the supply of money available to local institutions that made home loans and to serve them as a reserve credit resource.

The law appeared to have a beneficial impact. The rate of foreclosures dropped noticeably after the banks began functioning, but the change came too late for thousands of families.

This measure also is credited with providing new jobs in the home construction industry. These actions proved to be too little too late and people began to blame Hoover for the Depression.

Bonus Army Action

In 1924 Congress passed the so-called bonus bill. This was to pay a bonus to all WWI veterans. The money then would be placed within a fund until 1945 at which time each veteran would receive an average of $1,000. Because of the Depression many veterans wanted their money now.

The

Bonus Army

was an assemblage of about 20,000 WWI veterans, their families, and other affiliated groups, who hoped that they could convince Congress to make payments that had been granted to veterans immediately.

The bill had passed the House of Representatives on June 15 but was blocked in the Senate. After the defeat of the bill, Congress appropriated funds to pay for the marchers' return home, which some marchers accepted.

Later the Washington police attempted to remove some remaining

Bonus Army protesters from a federal construction site. After police fatally shot two veterans, the protesters assaulted the police with blunt weapons, wounding several of them.

After the police retreated, Hoover orders the federal troops to remove the marchers from the general area.

The marchers were cleared and their camps were destroyed by the

12th & 3rd Infantry Regiment under the command of Major

George Patton and the overall command was through General

Douglas Mac Arthur .

Troops carried rifles with unsheathed bayonets and tear gas, were sent into the Bonus Army's camps. Douglas MacArthur felt this was a communist attempt to overthrow the government. Hundreds of veterans were injured, several were killed.

The visual image of US armed soldiers confronting poor veterans of the recent Great War alarmed and created an outrage within the

American people.

______________________________________________________

By the end of the rout:

Two veterans had been shot and killed An 11 week old baby was in critical condition resulting from shock from gas exposure

Two infants had died from gas asphyxiation An 11 year old boy was partially blinded by tear gas

One bystander was shot in the shoulder, one veteran's ear was severed by a Cavalry saber and one veteran was stabbed in the hip with a bayonet

At least twelve police were injured by the veterans. Over 1,000 men, women, and children were exposed to the tear gas, including police, reporters, residents of Washington D.C., and ambulance drivers.

______________________________________________________

Political Effect

Damaged his public image; assured the victory of Democratic candidate Franklin D. Roosevelt in the 1932 presidential election.