NBFCs

advertisement

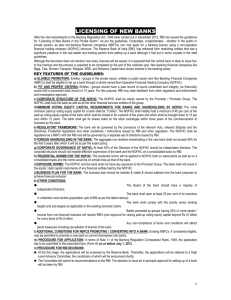

A Report on NBFCs in India A REPORT ON NBFCs IN INDIA 1 A Report on NBFCs in India TABLE OF CONTENTS Executive Summary .............................................................................................. 3 Non-Banking Financial Institutions (NBFIs) .......................................................... 4 Non-Banking Financial Company (NBFC) ............................................................ 5 NBFCs: Why are they required? ........................................................................... 5 Re-classification of NBFCs ................................................................................... 6 NBFCs are different from Banks ........................................................................... 7 Residuary Non-Banking Companies (RNBCs) ...................................................... 8 Ceiling on RNBCs taking Deposits........................................................................ 8 Interest Payment on Deposits ............................................................................... 8 Eligibility Criteria for Starting NBFC ...................................................................... 9 Capital Requirement ........................................................................................... 10 Net Owned Fund ................................................................................................. 10 Classification of NBFCs according to RBI ........................................................... 10 Regulations on NBFCs taking Deposits .............................................................. 11 Ceiling on NBFC-D (Taking Public deposits) ...................................................... 12 Ongoing Regulations: NBFCs-D (Holding Public Deposits) ................................ 13 Other Regulations: NBFCs-ND (Not Holding Public Deposits) ........................... 13 Directions given to NBFCs and its Auditors by RBI............................................. 15 A Special Mention : FDI in NBFC sector ............................................................. 16 References ......................................................................................................... 17 2 A Report on NBFCs in India Executive Summary India growth story is most talked about and why not? The country’s GDP is pegged to grow at a rate of more than 7.5%. India’s Stock market has given the best returns in the last 6-8 months of more than 60%. The household savings continues to be as high as 35% inspite of slowdown and recessionary pressures. Forex reserves have increased by more than 10billion $ in the 1st quarter and the total reserves are up, to 262 billion $. Current Budget focuses on reducing fiscal deficit by the measures of disinvestments and improving the infrastructure of the country. Overall the country is all set to grow at a rapid pace and the government has laid a strong foundation for this. Having realized this, one can strongly say that sufficient liquidity has to be maintained in the system to enhance credit and economic growth. NFBIs (Non Banking Financial Institutions) play an important role in realizing the economic growth. They have access to larger markets and provide financing for almost all activities. Think of buying an automobile, and one will find financing companies that provide EMIs at the doorstep. Think of buying any electronics, one would be amazed the number of financing companies that one can approach to make a deal. Thus the competitiveness of the companies combined with fierce penetration across the length of the country enables NBFIs to grow at a rapid pace. In the following document, NBFIs in India are discussed with a focus on NBFCs. The total assets managed by NBFCs amount to 95,727 crore as on June 2009. This accounts for around 9.1 % of assets of the total financial system [1]. Hence the business carried out by NBFCs is of great importance for overall development of the country. Thus RBI is implementing various schemes and policies for maintaining enough liquidity for funding requirements. Also various regulations are levied on NBFCs for making the overall system robust. [1] .Source: RBI 3 A Report on NBFCs in India Non-Banking Financial Institutions (NBFIs) Non-Banking Financial Institutions (NBFIs) play an important role in the Indian financial system given their unique position of providing complimentary and competitiveness to banks. They score over the traditional banks by providing enhanced equity and risk-based products. Fig1.The Hierarchy of NBFCs in India NBFIs Development Finance Institutions (DFIs) Investment Company Non-banking financial companies (NBFCs) Hire Purchase Leasing Insurance companies Equipment Leasing 4 Primary dealers (PDs) Loan Company Mutual Funds A Report on NBFCs in India Non-Banking Financial Company (NBFC) Non-Banking Financial Company (NBFC) is a company registered under the Companies Act, 1956. It is engaged in the business of loans, securities, insurance, chit funds etc They also provide products/services that includes margin funding, leasing and hire purchase, corporate loans, investment in non-convertible debentures, IPO funding, small ticket loans, venture capital etc. As in the diagram, NBFCs are classified into four categories 1. Hire- Purchase Leasing 2. Loan Company 3. Investment Company 4. Equipment Leasing Company Some of the prominent NBFCs in India are Infrastructure Development Finance Corporation (IDFC) Rural Electric Corporation ( REC) Industrial Finance corporation of India (IFCI ) GE Capital Till March 2009 there were 12,739 NBFCs out of which 336 NBFCs were permitted to accept public deposits [2] [2] Source: RBI Annual Report 2008-2009 NBFCs: Why are they required? NBFCs are required as they have a greater reach to various markets and have great efficiency in mobilizing funds. Generally banks to reduce their operational costs establish NBFC. NBFC enjoys many liberal policies by RBI in comparison with the commercial banks. However this scenario is changing. RBI now has strict measures for NBFCs also. 5 A Report on NBFCs in India Re-classification of NBFCs From December 6, 2006 NBFCs registered with RBI have been reclassified as 1. Asset Finance Company (AFC) 2. Investment Company (IC) 3. Loan Company (LC) Asset finance Companies (AFC) AFC are financial institutions whose principal business is of financing physical assets such as automobiles, tractors, construction equipments material handling equipments and other machines. Eg: Bajaj Auto Finance corp. , Fullerton India etc Investment Companies (IC) ICs generally are involved in the business of shares, stocks, bonds, debentures issued by government or local authority that are marketable in nature Eg: Stock Broking Companies, Gilt firms Loan Companies (LC) LCs are loan giving companies which operate in the business of providing loans. These can be housing loans, gold loans etc Eg: Mannapuram Gold Finance, HDFC 6 A Report on NBFCs in India NBFCs are different from Banks NBFCs cannot accept demand deposits ( Demand deposits are funds deposited in an institution, that are payable immediately on demand e.g.: Savings account, Current account etc) A NBFC cannot issue cheques, to their customers and is not a part of the payment and settlement system Deposit insurance facility of Deposit Insurance Credit Guarantee Corporation (DICGC) is not available for NBFC depositors They are allowed to accept/renew public deposits for a minimum period of 12 months and maximum period of 60 months. They cannot offer interest rates higher than the ceiling rate prescribed by RBI from time to time. (Currently the ceiling rate is 12.5%) They cannot offer gifts/incentives or any other additional benefit to the depositors. They should have minimum investment grade credit rating, from the credit rating agencies Fig2: Pulic Deposits in NBFCs & RNBCs 35000 INR (Crores) 30000 25000 Public Deposits 20000 15000 Expon. (Public Deposits) 10000 5000 20 10 20 08 20 06 20 04 20 02 20 00 19 98 0 Year Source:RBI, Note: The figures for 2009 & 2010 are estimated figures 7 A Report on NBFCs in India Residuary Non-Banking Companies (RNBCs) They form a part of NBFCs however their functioning is different from the regular NBFCs Residuary Non-Banking Company is a class of NBFC whose principal business is receiving of deposits, under any scheme or arrangement. The deposits received do not involve investment, asset financing, or loans. These companies are required to maintain investments as per directions of RBI, in addition to liquid assets. The functioning of these companies is different from those of NBFCs in terms of method of mobilization of deposits and requirement of deployment of depositors' funds Sahara Mutual Fund was the first RNBC started in India. Ceiling on RNBCs taking Deposits There is no ceiling on raising of deposits by RNBCs but every RNBC has to ensure that the amounts deposited and investments made by the company are not less that the aggregate amount of liabilities to the depositors To ensure the safely of public investments RNBCs are required to invest in a portfolio comprising of highly liquid and secured instruments viz. Central/State Government securities, fixed deposit of scheduled commercial banks (SCB), Certificate of deposits of SCB/FIs, units of Mutual Funds, etc Interest Payment on Deposits The amount payable by way of interest, premium, bonus or other advantage, by a RNBC in respect of deposits received shall not be less than 5% (to be compounded annually) on the amount deposited in lump sum or at monthly or longer intervals; and at the rate of 3.5% (to be compounded annually) on the amount deposited under daily deposit scheme. Further, an RNBC can accept deposits for a minimum period of 12 months and maximum period of 84 months from the date of receipt of such deposit. They cannot accept deposits repayable on demand. 8 A Report on NBFCs in India Eligibility Criteria for Starting NBFC Initial Procedure The Start up NBFC should be incorporated under the Companies Act, 1956 It should be registered with RBI, under Section 45-I of the RBI Act, 1934 The company is required to submit the application for registration in the prescribed format along with necessary documents for RBI's consideration. RBI then issues certificate of registration after satisfying itself that the conditions as enumerated in Section 45-IA of the RBI Act, 1934 are satisfied For registration with RBI, the company is required to fill the application, which can be downloaded from www.rbi.org.in/scripts/BS/viewforms.aspx. After downloading the EXCEL based application form, data should be keyed in, it can be uploaded in the RBI's Secure website https://secweb.rbi.org.in. Once uploaded, the company will get a CoR (Company Application Reference Number). Subsequently, the company should take the hard copy of the same with the supported documents and submit it to the concerned regional office. NOTE: Certain category of NBFCs like Venture Capital Fund/Merchant Banking Companies/Stock Broking Companies etc need not be registered with RBI they are governed by SEBI. Insurance companies holding a valid certificate of registration are regulated by IRDA, Housing finance companies regulated by National Housing Bank. Nature of Business The company should not have its principal business as (a) Agricultural operations (b) Industrial activity (b) The purchase or sale of any goods (other than securities) or the providing of any services (c) The purchase, construction or sale of immovable property, Moreover no portion of the income should be derived from the financing of purchases, constructions or sales of immovable property by other persons 9 A Report on NBFCs in India Capital Requirement The start up company should have a minimum net owned fund (NOF) of Rs 25 lakh which is raised to Rs 200 lakh from April 21, 1999. Net Owned Fund Paid-up capital and free reserves, minus accumulated losses, deferred revenue expenditure and other intangible assets Less, (i) Investments in shares of subsidiaries/companies in the same group/ all other NBFCs (ii) The book value of debentures/bonds/ outstanding loans and advances, including hire purchase and lease finance made to, and deposits with, subsidiaries/ companies in the same group, in excess of 10% of the owned funds. Note: NBFCs that were in existence who had previously NOF of Rs25 Lakhs (before the act) are given a time period of 3 years to attain a NOF of 200 Lakhs. However RBI can still extend this time period for an additional 3 years subject to the condition that such NBFCs should intimate the RBI about attaining the NOF within 3 months from the date of attainment Classification of NBFCs according to RBI NBFCs are classified into two categories (i) NBFC accepting deposits from customers (ii) NBFC which does not take deposits from customers NBFCs taking deposits from public are referred to as NBFC-D and those who dont take public deposits are referred to as NBFC- ND Those NBFCs NBFCs-ND with an asset size of Rs.100 crore and above (as per the last audited balance sheet) are designated as systemically important NBFCs- ND (NBFCs-ND-SI) NBFCs-ND-SI are advised to attain minimum CRAR of 12 per cent by March 31, 2010 and 15 per cent by March 31, 2011 10 A Report on NBFCs in India Regulations on NBFCs taking Deposits 1. All NBFCs are not entitled to accept public deposits. Only those NBFCs holding a valid certificate of registration with authorization to accept public deposits can accept/hold public deposits 2. New NBFCs are not allowed to raise public deposits for period of two years from the date of registration. After completion of two years, detailed review is taken of the company by the regulator 3. The NBFCs are allowed to accept/renew public deposits for a minimum period of 12 months and maximum period of 60 months. They cannot accept deposits repayable on demand 4. NBFCs cannot offer interest rates higher than the ceiling rate prescribed by RBI from time to time. The present ceiling is 12.5 per cent per annum. The interest may be paid or compounded at rests not shorter than monthly rests. 5. NBFCs cannot accept deposits from NRI except deposits by debit to NRO account of NRI provided such amount do not represent inward remittance or transfer from NRE/FCNR account. 6. NBFCs with net owned fund (NOF) of less than Rs. 25 lakhs (with or without credit rating) are not entitled to accept public deposits 7. Evaluation of the quality of management in respect of the promoters/directors is taken into consideration while giving allowance for taking public deposits Minimum Investment Level Credit Rating: The symbols of minimum investment grade rating of the Credit rating agencies are: Name of rating agencies Level of minimum investment grade credit rating (MIGR) CRISIL FA- (FA MINUS) ICRA MA- (MA MINUS) CARE CARE BBB (FD) FITCH Ratings India Pvt. Ltd tA-(ind)(FD) 11 A Report on NBFCs in India Ceiling on NBFC-D (Taking Public deposits) (i) NBFCs having Net Owned Fund (NOF) of more than 200 Lakhs Category of NBFC Ceiling on public deposits AFCs maintaining CRAR of 15% without 1.5 times of NOF or Rs 10 crore credit rating whichever is less AFCs with CRAR of 12% and having 4 times of NOF minimum investment grade credit rating LC/IC with CRAR of 15% and having 1.5 times of NOF minimum investment grade credit rating AFC= Asset Finance Company LC/IC= Loan Company/ Investment Company (ii) NBFCs having NOF more than 25 lakhs but less than 200 Lakhs Category of NBFC Ceiling on public deposits AFCs maintaining CRAR of 15% without credit rating AFCs with CRAR of 12% and having Equal to NOF (1xNOF) 1.5 times of NOF minimum investment grade credit rating LC/IC with CRAR of 15% and having Equal to NOF( 1xNOF) minimum investment grade credit rating 12 A Report on NBFCs in India Ongoing Regulations: NBFCs-D (Holding Public Deposits) . The NBFCs accepting public deposits should furnish to RBI: Audited balance sheet of each financial year and an audited profit and loss account in respect of that year as passed in the general meeting together with a copy of the report of the Board of Directors and a copy of the report and the notes on accounts furnished by its Auditors Statutory Annual Return on deposits - NBS 1 Certificate from the Auditors that the company is in a position to repay the deposits as and when the claims arise Quarterly Return on liquid assets Half-yearly Return on prudential norms Half-yearly ALM (Asset Liability Management) Returns by companies having public deposits of Rs 20 crore and above or with assets of Rs 100 crore and above irrespective of the size of deposits Monthly return on exposure to capital market by companies having public deposits of Rs 50 crore and above A copy of the Credit Rating obtained once a year along with one of the Half-yearly returns on prudential norms Other Regulations: NBFCs-ND (Not Holding Public Deposits) The NBFCs-ND having assets size of Rs 100 crore are required to submit a Monthly Return on important financial parameters of the company Board resolution to be passed to the effect that the company have neither accepted public deposit nor would accept any public deposit during the year 13 A Report on NBFCs in India General Norms: RBI Maintenance of Liquid Assets: Minimum level of liquid asset to be maintained by NBFCs is 15 % of public deposits outstanding as on the last working day of the second preceding quarter .Of the 15%, NBFCs are required to invest not less than 10% in approved securities and the remaining 5% can be in unencumbered term deposits with any scheduled commercial bank.. Thus, the liquid assets may consist of government securities, government guaranteed bonds and term deposits with any scheduled commercial bank. Creation and Maintenance of Reserve fund: All NBFCs are required to create a reserve fund and transfer not less than 20% of their net profit (before declaration of dividend) to the fund Submission of Certificate: All NBFCs should submit a certificate from their Statutory Auditors every year to the effect that they continue to undertake the business of NBFI requiring holding of CoR (Company Application Reference Number) under Section 45-IA of the RBI Act, 1934. Information Exchange: NBFCs are required to furnish the information in respect of any change in the composition of its board of directors, address of the company and its directors and the name/s and official designations of its principal officers and the name and office address of its auditors. Prudential Norms NBFCs should comply with RBIs policies and directions regarding prudential norms and Deployment of funds o Income Reconition o Accounting Standards o Classification of Assets 14 A Report on NBFCs in India o Provision for NPA (Non Performing assets) o Capital Adequacy o Declaration of Purpose, Quantum & Advances of Loan Directions given to NBFCs and its Auditors by RBI RBI is empowered to give directions to NBFCs and their auditors in matters related to 1) Profit and Loss account 2) Balance Sheet 3) Books of Accounts 4) Disclosure of liabilities 5) Any other matters or queries Special Audits can be done by the RBI of any NBFC and also appoint auditors for the same RBI can prohibit any NBFC for taking public deposit for violation of any provisions of RBI act Nomination facility for deposits held by a NBFC is introduced. It is on the lines of bank deposits If an NBFC is downgraded to below minimum investment grade rating, it has to stop accepting public deposit, report the position within fifteen working days to the RBI. Once downgraded, within 3 years It has to reduce the amount of excess public deposit to nil or to the appropriate extent permissible under paragraph 4(4) of NonBanking Financial Companies Acceptance of Public Deposits (Reserve Bank) Directions, 1998 15 A Report on NBFCs in India A Special Mention : FDI in NBFC sector FDI/NRI investments allowed in the following 19 NBFC activities shall be as per levels indicated below: Merchant banking Credit Reference Agencies Underwriting Credit rating Agencies Portfolio Management Services Leasing & Finance Investment Advisory Services Housing Finance Financial Consultancy Forex Broking Stock Broking Credit card business Asset Management Money changing Business Venture Capital Micro Credit Custodial Services Rural Credit Factoring Regulations for FDI in NBFCs Minimum Capitalization Norms for Fund based NBFCs: For FDI up to 51% - US$ 0.5 million should be brought upfront For FDI above 51% and up to 75% - US $ 5 million should be brought upfront For FDI above 75% and up to 100% - US $ 50 million out of which US $ 7.5 million should be brought upfront and the balance in 24 months Minimum capitalization norms for Non-fund based activities: Minimum capitalization norm of US $ 0.5 million is applicable in respect of all permitted non- fund based NBFCs with foreign investment Foreign investors to set up 100% operating subsidiaries without the condition to disinvest a minimum of 25% of its equity to Indian entities, subject to bringing in US$ 50 million as per minimum capitalization norms above (without any restriction on number of operating subsidiaries without bringing in additional capital) 16 A Report on NBFCs in India Joint Venture operating NBFC’s which have 75% or less than 75% foreign investment will also be allowed to set up subsidiaries for undertaking other NBFC activities, subject to the subsidiaries also complying with the applicable minimum capital inflow FDI in the NBFC sector is put on automatic route subject to compliance with guidelines of the Reserve Bank of India. References Web References www.rbi.org.in, accessed from 19th April to 23rd April 2010 nbfc.rbi.org.in, accessed from 19th April to 23rd April 2010 www.economywatch.com, accessed from 19th April to 23rd April 2010 Publications Statutory guide for Non Banking Financial Companies- Taxmann’s Publications 17