Contestable Markets Understanding the nature of contestable

advertisement

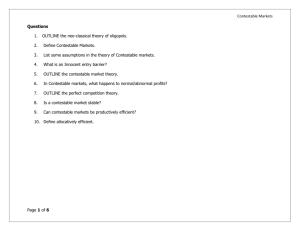

Contestable Markets Understanding the nature of contestable markets is crucial to answering theory of the firm questions. Many students confuse contestable markets with perfect competition - they are different and this revision note attemps to focus on some of the key aspects of contestability. Baumol has defined a contestable market as a market where: "An entrant has access to all production techniques available to the incumbents, is not prohibited from wooing the incumbent’s customers, and entry decisions can be reversed without cost.” For a contestable market to exist there must be low barriers to entry and exit so new suppliers to come into a market to provide fresh competition. For a perfectly contestable market, entry into and exit out must be costless. Even when it appears on first glance that a business is operating as an unfettered monopoly, the reality is that virtually every market is contestable to some degree even when it appears that the monopoly position of a dominant seller is unassailable. This can be important implications for the behaviour (conduct) of existing firms and then affects the performance of a market in terms of allocative, productive and dynamic efficiency. Contestable markets and perfect competition – the differences Contestable markets are different form perfectly competitive markets. For example, it is feasible in a contestable market for one firm to have price-setting power and for firms in a market to produce a differentiated product. There are three main conditions for pure market contestability: 1/ Perfect information and ability and / or the right of all suppliers to make use of the best available production technology in the market 2/ The freedom to market/ advertise and enter a market with a competing product 3/ The absence of sunk costs - this reduces the risks of coming into a market. Sunk costs are costs that have been committed by a business that cannot be recovered once a firm entered the industry In general markets have become more contestable in recent years – here are some real world examples that you might want to consider or use: Low cost airlines challenging the supremacy of the scheduled full service airlines Increasingly strong competition in the market for smart phones Internet browsers – Microsoft IE v Chrome (Google) v Firefox v Safari Supermarkets entering the digital music downloads market Opening up of the market for postal services The rise of generic drug production threatening the dominance of the pharma giants Online retailers competing with traditional high street retailers Constestable markets - price and output and welfare How might the contestability of a market affect the conduct and performance of businesses? It is worth emphasizing in essays and data questions that it is the actual behaviour of agents in the market that is more important that a simple picture of market share. MC £ (= S under perfect competition) Monopoly Pm Ppc Consumer surplus Deadweight welfare loss b a Producer surplus AR = D MR O Qm Qpc Q 6 In the diagram above a pure monopoly might price at Pm - the profit maximizing equilibrium. If a market is contestable, there is downward pressure on price, because the presence supernormal profits signals for new firms to enter the market and if the existing monopolist is producing at too high a price or has allowed their average total costs to drift higher. Then new entrants can undercut the monopolist and some of the abnormal profit will be completed away. Normal profit equilibrium occurs when average revenue equals average total cost (at output Qpc and price Ppc). A lower price and higher output causes an increase in consumer surplus. When markets are contestable – we expect to see lower profit margins than when a monopoly operates without competition. Indeed the thread of competition may be just as powerful an influence on the behaviour of the existing firms in a market than the actual entry of new businesses. If a dominant firm in a contestable market knows that new suppliers may come in - this may be sufficient for them to charge a price closer to the level we may expect from a competitive market structure. If a market is contestable, industry structure and firm behavior is determined by the threat of competition – ‘hit – and - run’ entry. The market will resemble perfect competition, regardless of the number of firms, since incumbents behave as if there were intense competition