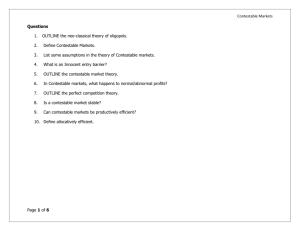

Contestable Markets

advertisement

How does the threat of competition affect a firm’s behaviour? Topic 3.3.10 How does the threat of competition affect a firm’s behaviour? Topic 3.3.10 Students should be able to: • • Define contestability and understand how the threat of new entry may influence behaviour and market performance of existing firms. Understand the relationship between sunk costs and the degree of contestability — examples may include banking, airline industry and petrol retailing. Key Concepts – Contestable Markets Contestable Market Hit and run entry Sunk costs Where an entrant has access to all production techniques available to incumbents and entry decisions can be reversed without cost When a business enters an industry to take advantage of temporarily high (supernormal) market profits. Sunk costs cannot be recovered if a business decides to leave an industry. The existence of sunk costs makes a market less contestable. Contestable Markets • Contestable markets are constantly changing • Contestable markets can be seen at a local, regional, national and international level • In a contestable market, the number of size distribution of businesses in the industry is less important • More focus is given to the threat of entry from rivals • Almost all markets are contestable to some degree • Technology has the potential to change contestability • E.g. the barriers to entry in many markets are widely thought to have lowered because of digital advances • Contestable markets often show high dynamic efficiency Conditions for a Contestable Market • Pool of new entrants willing and ready to enter the market Absence of sunk costs Access to technology Low consumer loyalty Low legal barriers • No significant entry or exit costs • Access to the available technology • High rates of customer churn Contestable Markets in Action! • Nov 2015: Apple 'to launch peer-to-peer payment app' in competition with PayPal • Nov 2015: The Gym Group, one of the UK's low-cost fitness chains and it is now listing on the stock market to fund future expansion • Nov 2015: Uber taxi app to launch in Edinburgh • Nov 2015: Amazon begins a new chapter with opening of first physical bookstore • Oct 2015: Metro Bank Takes Step Towards £1bn Listing • Oct 2015: Argos launches Same Day Delivery • Oct 2015: Sainsbury's tests out 'micro-stores' for busy shoppers Generic Drugs and Contestability Leading global generic drug manufacturers by market share 2013 Top 10 generic drug manufacturers - worldwide market share in 2013 Market share 0.0% 5.0% 10.0% 15.0% Teva Pharmacetical 13.4% Novartis 11.9% Actavis 9.1% Mylan 8.6% Aspen Pharmacare 4% Sun Pharmaceutical 3.9% Hospira 3.5% Daiichi Sankyo 3.2% Sanofi 3.1% Note: Worldwide Lupin 2.5% Each medicine has an approved name called the generic name. For example, paracetamol is a generic name. There are several companies that make this with brand names such as Panadol®, Calpol® A Contestable Oligopoly? Market share of mobile handset manufacturers in the UK in June 2014 35.0% 5 firm concentration ratio = 84.4% 31.8% 30.0% Market share 25.0% 22.9% 20.0% 16.9% 15.0% 10.0% 6.7% 7.4% 6.1% 5.0% 3.7% 2.4% 2.1% Motorola LG 0.0% Samsung Apple Nokia Sony HTC RIM Other Hotel rooms & Airbnb listings in New York Hotel rooms Airbnb listings 120000 Number of available rooms 100000 99,250 97,400 94,235 80000 60000 40000 20000 6,585 10,963 12,446 0 2012 2013 2014* Sunk Costs • Sunk costs cannot be recovered if a business decides to leave an industry. Examples include: – Capital inputs that are specific to an industry and which have little or no resale value. – Money spent on advertising, marketing and research and development projects that cannot be carried forward into another market or industry. – Money spent in building expensive and complex IT systems that are subsequently ditched because they are unworkable • When sunk costs are high, a market becomes less contestable. High sunk costs act as a barrier to entry of new firms because they risk making huge losses if they decide to leave a market. • In markets such as fast-food restaurants, sandwich bars, hairdressing salons and local antiques markets there are low sunk costs so the barriers to exit are low. Core Examples of Sunk Costs 1. Asset-write-offs – e.g. the expense associated with writingoff the value of plant and machinery, stocks and the goodwill of a consumer brand 2. Closure or project cancellation costs including redundancy costs, contract contingencies with suppliers and the penalty costs from ending leasing arrangements for property 3. The loss of business reputation and goodwill - a decision to leave a market can seriously affect goodwill among previous customers, not least those who have bought a product which is then withdrawn and for which replacement parts become difficult or impossible to obtain. 4. A market downturn may be perceived as temporary and could be overcome if and when the economic or business cycle turns and conditions become more favourable Examples of Sunk Costs • Nov 2015: Redcar owner loses £530m on steel plant liquidation Retail Contestability – Rise of Aldi & Lidl • Lidl is following a strategy of rapid organic growth • Aldi - world’s leading limited assortment grocery, with total sales of €61bn in 2013, followed by Lidl at €59bn • Together, the two German discounters have more than 20,000 stores across Europe, the US and Australia. Lidl is present in 26 European markets • Majority of their products are own-label, rather than brands - gives them purchasing power with suppliers. • The range suppliers are asked to provide is narrower – perhaps four to six products compared with 30-40 at a large grocer – driving efficiencies and big volumes Contestable Markets – Price and Profit • The more contestable a market is, the more likely that an allocatively efficient outcome is achieved • The threat of entry affects the behaviour of firms • Often smaller disruptive businesses challenge the monopoly power of existing businesses • The threat of entry is as important as actual competition Pricing – Options in Contestable Markets Cost & Price In the left hand diagram draw in the profit maximising output and price (label it Q1 and P1.) Highly Contestable Market – Profit Maximising Output Price > Average Cost Supernormal profits High profits send signals to other suppliers MC P1 AC AR C1 MR Q1 Output (Q) Pricing – Possible Long Run Equilibrium? Cost & Price In the long run if the market is highly contestable which level of price and output is probable? (Label this Q2 and P2). Highly Contestable Market – Profit Maximising Output MC P1 AC P2 AR C1 MR Output (Q) Q1 Q2 When AC = AR, normal profits made, a return sufficient to keep factor inputs in their present use Pricing – Maximising Revenue In the right hand diagram show the price and output for a firm that seeks to maximise total revenue Cost & Price Highly Contestable Market – Pricing to Maximise Revenue MC AC AR MR Output (Q) Pricing – Revenue Maximisation In the right hand diagram show the price and output for a firm that seeks to maximise total revenue Cost & Price Highly Contestable Market – Pricing to Maximise Revenue Revenue maximised when marginal revenue = zero MC P1 AC AR MR Output (Q) Pricing – Revenue Max – Lower Profits In the right hand diagram show the price and output for a firm that seeks to maximise total revenue Cost & Price Highly Contestable Market – Pricing to Maximise Revenue Revenue maximised when marginal revenue = zero Still some super normal profits made MC Revenue max means a lower profit margin is made – usually good for consumer welfare – but profit has value too! P1 AC AR C1 Lower price and higher output than MC=MR MR Output (Q) Key Barriers to Contestability Economies of scale Vertical integration Control of important technologies Expertise and reputation Brand loyalty Exit Costs – Barriers to Exit Asset write-offs Lost consumer goodwill Redundancy costs Policies to Increase Contestability Deregulation of an industry Open up networks of monopolies Tough rules on predatory pricing Policies on international trade Contestable Markets – Evaluation Points • The threat of competition may be a powerful an influence on the behaviour of existing firms • If a market is contestable, industry structure and firm behaviour is determined by the threat of competition - 'hit-and-run' entry • A highly contestable market will resemble perfect competition, regardless of the number of firms, since incumbents behave as if there were intense competition. How does the threat of competition affect a firm’s behaviour? Topic 3.3.10