Calling Sue - farrell

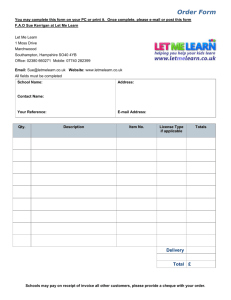

advertisement

Calling Sue – Some Comments regarding the Questions 1. What were the gaps between the customers’ expectations and perceptions in the process described? There was a significant mismatch between customers’ expectations and perceptions, that is poor perceived quality. Although the problems were eventually sorted out the events may have left a sour taste in the mouth of the customer, making them even more wary of the bank and any future offers. Looking at each of the gaps in turn: Gap 1: The customer’s specification-operation’s specification gap There does not appear to have been a mismatch between what we can assume to be the operational specification (new cheque books within seven days, automatic transfer of balances, overdraft facility, annual travel insurance, gold card and the use of a PBC), as promised by Sue, and the customers’ requirements. We do not, however, know what the internal specification was for these activities. It is possible that the standards were not as needed, which would lead to such a gap. Gap 2: The concept-specification gap It is difficult to know if there was a mismatch between the service concepts developed by the bank and the detailed specification of the products and services. One assumes not. The problem of which we are acutely aware pertains to gap three. Gap 3: The quality specification-actual quality gap This is an important gap in this case. It appears that Sue was well aware of the problems that were often incurred in these transfers; she referred to these ‘computer problems’ but later admitted to problems with agency staff. Rather than warn the customers of the problems and setting appropriate expectations, she had promised something that she knew would be difficult to deliver. Was this a good idea? Yes, in so far as the transfer was undertaken and she kept the business, but ‘no’ in that she has created somewhat dissatisfied customers who are now even more wary of their relationship with the bank and who may, if they should experience another problem, terminate their valuable accounts. It is important to remember that all the other parts of the promise (we assume) were kept – annual travel insurance, gold card and so on. The problems that were experiences were only in the transfer process. However, particular promises had been made about this, which were not delivered. Gap 4: The actual quality-communicated image gap One might argue that there was no mismatch here. The customers were extremely wary about transferring their account because they had experienced problems with the bank in the recent past. However, the communication they received from Sue provided them with the reassurance they needed to make the decision, which as we know were rather hollow promises. 2. How were the customers’ expectations influenced from the outset? The customers were wary of making the changes to their accounts. They had experienced several other problems with the bank – remote and impersonal handling of their calls at a regional call centre, lack of access to their ‘trusted’ assistant bank manager and different telephone numbers for the two types of accounts. Their expectations were not high though they needed a solution to the problem that the bank had created for them. Sue, however, had a significant influence on their expectations by explaining that ‘there will be absolutely no problem’ and that they ‘should get the new cheque books within seven days’. They went ahead on the basis of trust. 3. What aspects of the bank’s service quality specification have been revealed to the customer? Are these reasonable for such an account? We can assume that the bank delivered on its promises to provide annual travel insurance, gold credit card and a larger overdraft facility, and such specifications should appear to be quite reasonable for such an account. The fact that errors are common at the processing centres due to the use of agency staff is not appropriate for any type of account. The prime concern of the bank's customers is an error-free service and this underpins customers’ relationship with the bank. The use of agency staff implies that the bank is having problems dealing with demand yet consultants such as Sue are pressing clients to make the changes, presumably trying to meet their own targets. This would suggest serious managerial problems in terms of coordination, target setting and capacity management. 4. Evaluate Sue’s reaction to the problems at every stage. Was the bank’s service recovery successful? Problem Sue’s response One cheque book arrived after 9 days Sue was not told of this problem. Business accounts had incorrect spellings and current account had wife’s initials reversed Sue apologized and ordered speedy dispatch of new ones assuring customers that they could use the old ones in the interim. She promised to confirm her actions which she did. The credit/cash cards arrived without the PINs Sue explained they would take a day or two. One week later they still had not arrived. Sue apologized, checked her records and suggested they had been lost in the post. Agreed to re-issue the cards. Names on envelope still incorrect, but correct names on cheque guarantee cards. Next letter was correctly addressed. Credit cards had expired and ATM would not accept PINs for the original cards Sue apologized and sent a bouquet of flowers. She also personally provided leather holders and cards and cheque books. Sue reacted as well as she could to each stage. The problems were systemic rather than personal, which these customers seem to have accepted. Although they were dissatisfied during the process, Sue appears to have done enough to appease them. Given that they have had no problems since, customer satisfaction appears to have been restored; however, any further problems, small or large, might well have led to a less measured response from the customers. 5. What costs have been created by these problems, and how do they compare with the underlying costs and root cause of the problem? The costs created by these problems include Sue’s time, though this is what she is paid for, the costs of rework (reproducing and reissuing the cards and cheque books), the costs of compensation (flowers, leather holders and delivery) and the costs to the customers (goodwill, inconvenience and embarrassment). The root causes of the problems are poor capacity management, lack of communication between departments and inappropriate target setting. Some of these, in particular capacity changes, could be expensive to deal with and the recovery procedures seemed to be being used to alleviate the problems in the short term. The critical issue is whether the bank dealt with these problems in the long term.