(FNBFIN61A) Prepare and bank receipts

advertisement

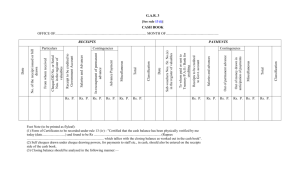

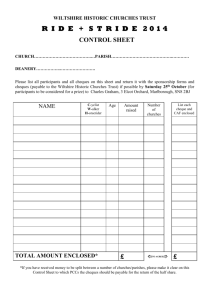

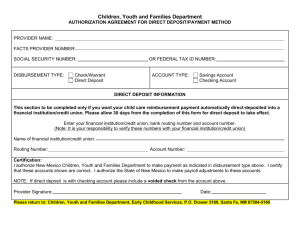

Prepare and bank receipts - FNSICACC304A To gain competency in this unit you are required to describe the functions involved in preparing and banking financial receipts. The following exercises are designed to enable practice in the following: FNSICACC304A/01 - Batch monetary items 1.1 Items are batched completely and accurately 1.2 Batch items are matched to initial receipt records precisely FNSICACC304A/02 - Prepare deposit facility 2.1 Deposit facility selected is appropriate to the banking method used 2.2 Batch is balanced with deposit facility without error FNSICACC304A/03 - Lodge flows 3.1 Security and safety precautions are taken appropriate to the method of banking in accordance with company policy and industry and legislative requirements 3.2 Proof of lodgement is obtained and filed in accordance with company procedures Note prepared for Quicken by Ken Boyle – Educational Consultant Page 1 PRACTICE EXERCISE 1: You are the Accounts clerk of Photographics Ltd and are about to bank the day’s takings consisting of both cash and cheques. You are required to: TASK 1: Using the QuickBooks file - Photographics Ltd, complete and print the deposit section QuickBooks is a fully integrated small business accounting package. To open the sample company double -click on the QuickBooks icon The QuickBooks Navigator will appear for the sample company titled “Photographics Ltd” If the this company does not appear you will need to select - File – Open company Click on Photographics Ltd The following details the cheques received today to be banked with the notes and coins. Cheques received March 1, 2008. C Nguyen drawn on National Bank, Geelong, A Sainsbury drawn on Westpac, Wodonga, P Jones drawn on Commonwealth Bank, Malvern, R Lamm drawn on ANZ Bank, Coburg, $407.00 $49.50 $2295.00 $573.10 Chq no 156831 Chq no 337895 Chq no 88556 Chq no 113456 Note prepared for Quicken by Ken Boyle – Educational Consultant Page 2 To record these transactions into your Photographics Ltd QuickBooks data file complete the following steps: Select the Home screen and click on the Receive Payments icon. Use the drop down arrow to choose C Nguyen. Choose Cheque from the Pmt. Method section. Key in the date and amount. In the Deposit To section select Undeposited Funds Place a tick in the column. Note prepared for Quicken by Ken Boyle – Educational Consultant Page 3 Then click on Save and New and complete the entry for A Sainsbury Then click on Save and New and complete the remaining two entries. Note prepared for Quicken by Ken Boyle – Educational Consultant Page 4 Then click on Save and Close. The next step is to prepare the deposit slip for the bank takings. Click on the Record Deposits Icon. Then click on Print. Click on Save & Close. ($9841.85 in total will be banked). Note prepared for Quicken by Ken Boyle – Educational Consultant Page 5 TASK 2: Complete the cash summary calculation sheet of notes, coins and cheques for the daily cash takings of March 1, 2008. Notes $100 50 20 10 5 Cash summary slip March 1, 2008. Number 11 25 112 96 154 Total Coins 2 1 0.50 0.20 0.10 0.05 Value 32 52 44 152 256 65 Total Total cash Cheques received Total Total deposit cash & cheques Note prepared for Quicken by Ken Boyle – Educational Consultant Page 6 TASK 3: Complete both sides of the deposit slip and deposit butt as at March 1, 2008. Deposit slip (front side) BANK OF PLENTY BANK OF PLENTY DATE / / DEPOSIT ABN 81 455 222 533 DATE Branch Name Plenty Central / / Deposited for credit of For credit of Photographics Ltd Cash Cash Cheques Bankcard/ Mastercard/ VISA/Other Cheques Paid in by (signature) Bankcard/ Mastercard/ VISA/Other TOTAL No cheques Total $ $ 047 564 87 5436 Teller Deposit slip (reverse side) Bank use only Third party cheques explanation Details of cheques (proceeds will not be available until cleared) Drawer (account name on cheque) Bank Branch Amount Bank use only 100 Details of cheques 50 20 10 5 Coin Cash Total Note: This deposit will be transferred under the banks internal procedures. The bank will not be held responsible for delays in transmission. Total $ Note prepared for Quicken by Ken Boyle – Educational Consultant Page 7 PRACTICE EXERCISE 2: 1. Give two advantages of using a night safe. 2. Why should cash be banked daily and intact? 3. Name the document on which details of electronic banking are shown. 4. List the forms in which money comes into a business. 5. Name the document completed or produced when credit card transactions are banked. 6. Describe how notes should be prepared for banking. 7. Name the document completed when a customer pays by credit card. 8. Why should cheques be marked “not negotiable”? 9. Name the book in which details of funds to be banked are entered. 10. List four advantages for the organization and two for the customer when EFTPOS facilities are used. 11. What is meant by the term “post-dated cheque”? 12. What is the difference between the terms “or bearer” and “or order”? 13. What is the difference between a debit card and a credit card? 14. What is a merchant summary used for? 15. List three basic security measures you should use when going to the bank with money. Note prepared for Quicken by Ken Boyle – Educational Consultant Page 8 Note prepared for Quicken by Ken Boyle – Educational Consultant Page 9