101 QUESTIONS IN ACCOUNTING

advertisement

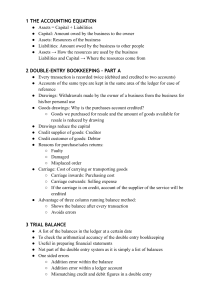

101 QUESTIONS IN ACCOUNTING UNIT 3 1. 2. 3. 4. 5. 6. 7. 8. 9. What are the steps in the accounting process? Distinguish between a current asset and a non-current asset. Distinguish between a current liability and a non-current liability. What do we mean by accrual accounting? What groups of people may be interested in accounting reports? Explain the difference between assets and expenses. Distinguish between a debtor and a creditor. What are the steps in a double entry accounting system? Distinguish between the following principles: reporting period, accounting entity, historical cost, going concern, conservatism and monetary unit 10. Distinguish between the following qualitative characteristics: relevance, reliability, materiality, comparability and understandability 11. What is meant by the accounting equation? Express in three different forms. 12. What is meant by double entry accounting? 13. Why do businesses offer credit customers discounts? 14. Distinguish between discount allowed and discount received. 15. Distinguish between input, processing and output. 16. Give an example of an input. 17. Give an example of processing. 18. Give an example of an output. 19. Why are business documents known as ‘source documents’? 20. What is an invoice? 21. What source document is used to show an internal business transaction? 22. What five common items should appear on documentary evidence? 23. Distinguish between a ledger and a journal. 24. What source of information is used when writing up the credit purchases journal? 25. What source of information is used when writing up the credit sales journal? 26. What source of information is used when writing up the cash receipts journal? 27. What source of information is used when writing up the cash payments journal? 28. What is a chart of accounts? 29. What is the purpose of a sundries column in the cash receipts and cash payments journals? 30. Can we have a ledger account called sundries? Why or why not? 31. Why does a sundries column not appear in our credit journal? 32. List three different types of documentary evidence. 33. Explain why the change in cash balance is different to net profit made by the business. 34. Why are R & E accounts closed to the profit/loss summary account at the end of the period? 35. What are the advantages of preparing a trial balance? 36. Give 3 reasons why your trial balance may balance but not be correct. 37. Give 3 advantages of preparing three monthly reports compared with annual reports. 38. What is the role of the general journal? 39. What is the purpose of a narration in the general journal? 40. Explain why purchases of non current assets are not recorded in the purchases journal. 41. Which ledger accounts are increased by recording an amount on the credit side? 42. Which ledger accounts are increased by recording an amount on the debit side? 43. Which journal would record the purchase of an asset on credit? 44. List the four types of adjusting entries. 45. What is the role of a closing entry in the general journal? 46. Why may it be necessary to prepare a correcting entry? 47. Define a prepaid expense 48. Define accrued expenses 49. Distinguish between balancing an account and closing an account? 50. Which accounts do we balance? 51. Which accounts do we close? 52. Explain the difference between cash purchases of supplies and supplies expense. 53. What do we mean by the term depreciation? 54. Why do we depreciate non-current assets? 55. Explain the straight line method of depreciation. 56. What are the formulas to the methods above? 57. What is the formula used to work out the depreciation rate? 58. What two accounts are affected by the depreciation balance day adjustment? 59. Which do we debit and which do we credit? 60. Explain what we mean by “Accumulated depreciation of vehicle.” 61. What two elements make up the cost of a non-current asset? 62. What do we mean by book value? 63. What is residual value? 64. Distinguish between adjusted gross profit and net profit. 65. Discuss the importance of the following accounting principles in the preparation of the profit and loss statement. The going concern, the reporting period and the conservatism principles. 66. Every balance day adjustment has a two-fold effect. Explain giving examples. 67. What is meant by the term effective life? 68. Which side (debit or credit) of the P&L Summary account would you find (a) revenue accounts, (b) expense accounts and (c) a net profit? 69. Explain the term bank overdraft. 70. Why is control over the asset CASH so important? 71. What is the difference between total equities and total assets? 72. What is the purpose of a 6-column worksheet? 73. You are required to record a $500 debtor’s payment in the cash receipts journal that includes a $50 discount. What amount would be found under the column headings Bank, Discount allowed and Debtors? 74. You are required to record a $600 creditor’s payment in the cash payments journal that includes a $20 discount. What amount would be found under the column headings Bank, Discount received and Creditors? 75. Explain what is meant by the perpetual inventory method of recording stock. 76. Explain two advantages of a perpetual inventory system. 77. Explain two disadvantages of a perpetual inventory system. 78. What two ledgers accounts are affected when recording the cost price of stock sold? 79. What two ledger accounts are affected when recording the selling price of stock sold (on credit)? 80. Explain what is meant by FIFO 81. What is the role of stock cards? 82. List 5 items that should be included on a stock card 83. In a stock card, should we record in the details section “sale” or the document number? Explain. 84. At what price should we record all stock movements in the stock cards? 85. What is the difference between capital and drawings? 86. Give two other words for stock. 87. Give 2 reasons a stock loss may occur. 88. Give 2 reasons why a stock gain may occur. 89. Why is it important to keep accurate stock records? 90. Explain the difference between gross profit and adjusted gross profit? 91. Explain the difference between gross profit and net profit? 92. What are the three classifications used in a Statement of Cash flows? 93. Give examples of inflows in each classification. 94. Give examples of outflows in each classification. 95. Explain the term cash equivalents. Pg 196. 96. Why is it important to analyse a statement of cash flows 97. What would be the debit and credit for the balance day adjusting entry to show insurance used during the period. 98. Why do we record balance day adjustments? 99. Which two accounts are closed to the capital account? 100. What is the difference between balance adjusting and correcting entries? 101. Explain the difference between prepaid expenses and accrued expenses. GOOD LUCK!