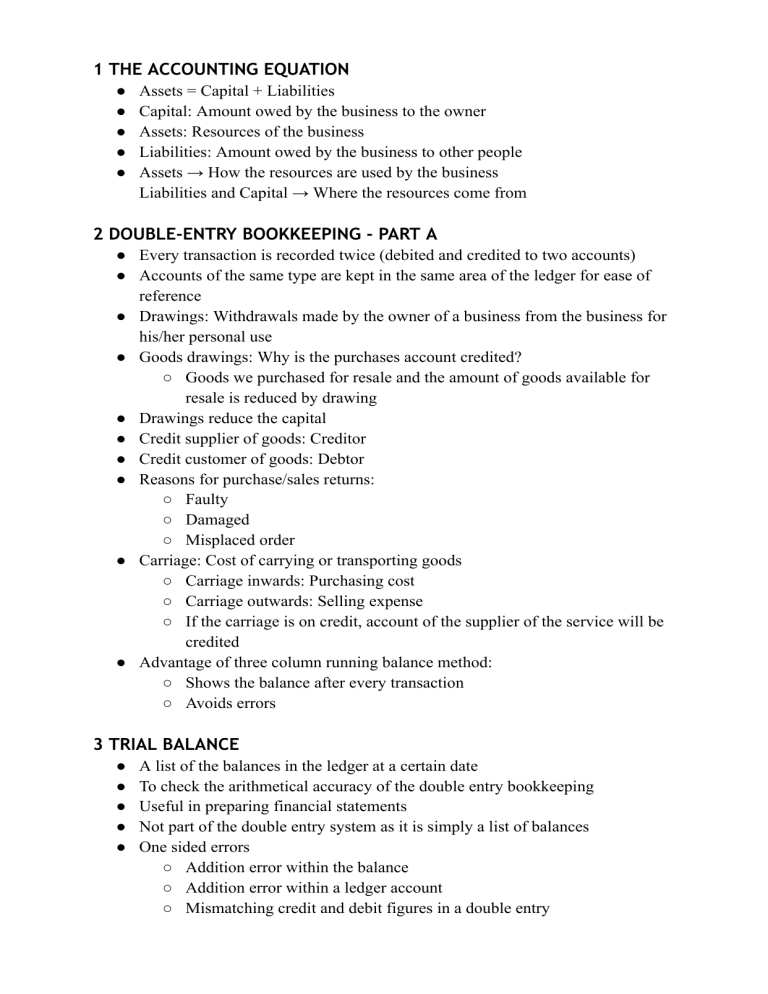

1 THE ACCOUNTING EQUATION ● ● ● ● ● Assets = Capital + Liabilities Capital: Amount owed by the business to the owner Assets: Resources of the business Liabilities: Amount owed by the business to other people Assets → How the resources are used by the business Liabilities and Capital → Where the resources come from 2 DOUBLE-ENTRY BOOKKEEPING - PART A ● Every transaction is recorded twice (debited and credited to two accounts) ● Accounts of the same type are kept in the same area of the ledger for ease of reference ● Drawings: Withdrawals made by the owner of a business from the business for his/her personal use ● Goods drawings: Why is the purchases account credited? ○ Goods we purchased for resale and the amount of goods available for resale is reduced by drawing ● Drawings reduce the capital ● Credit supplier of goods: Creditor ● Credit customer of goods: Debtor ● Reasons for purchase/sales returns: ○ Faulty ○ Damaged ○ Misplaced order ● Carriage: Cost of carrying or transporting goods ○ Carriage inwards: Purchasing cost ○ Carriage outwards: Selling expense ○ If the carriage is on credit, account of the supplier of the service will be credited ● Advantage of three column running balance method: ○ Shows the balance after every transaction ○ Avoids errors 3 TRIAL BALANCE ● ● ● ● ● A list of the balances in the ledger at a certain date To check the arithmetical accuracy of the double entry bookkeeping Useful in preparing financial statements Not part of the double entry system as it is simply a list of balances One sided errors ○ Addition error within the balance ○ Addition error within a ledger account ○ Mismatching credit and debit figures in a double entry ○ Single entry made instead of double entry ○ Transaction entered twice in the same account ● Two sided errors ○ Error of commission: ■ Transaction entered in the wrong account of the same class ○ Error of complete reversal: ■ Error has been made on the wrong side of each account ○ Error of omission: ■ Transaction has been completely omitted from the accounting records ○ Error of original entry: ■ Incorrect figure is used when a transaction is first recorded ○ Error of principle: ■ Transaction is entered in the wrong class of account ○ Compensating errors: ■ Occurs when two or more errors cancel each other out 4 DOUBLE-ENTRY BOOKKEEPING - PART B ● Division of ledger ○ Sales ledger ■ Contains debtors personal accounts ○ Purchases ledger ■ Contains creditors personal accounts ○ Nominal ledger ■ Real accounts and nominal accounts except debtors, creditors, cash and bank ○ Cash book ■ Contains cash and bank double entries ○ Advantages of the division of ledger: ■ Work can be shared between several people ■ Easy for reference as same types of account are kept together ■ Reduce the possibility of fraud ● Two-column cash book ○ Part of the double entry system ○ It is a book of prime entry ○ Contra entries ■ Appear on both sides of the cash book ● To record surplus cash paid into bank ● To record cash withdrawn from the bank for office use ○ Bank overdraft ■ Cash column ● Will always have a debit balance ● When there is no cash left in the cash account, the balance is nil ● Not possible to have a credit balance on a cash account ■ Bank column ● Can have a credit balance ● Bank might allow the business to have a bank overdraft ● In this case, the business owes the bank (liability) ● Three-column cash book ○ Has an extra cash discount column ○ Allowance given to the customer when an account is settled within a time limit set by the supplier ○ Discount allowed: Cash discount given by the business to the debtors ■ Expense ○ Discount received: Cash discount given by the creditors to the business ■ Income ○ At the end of the trading period: ■ Total each discount column ■ Debit the discount allowed total in the discount allowed a/c in the nominal ledger ■ Credit the discount received total in the discount received a/c in the nominal ledger ■ This represents the double entry for all the transaction involving these two accounts ○ Dishonoured cheque ■ Journal entry: Debtor’s Account Dr. To Bank Account ■ Reasons ● Inadequate balance in the debtor’s account ● Error on the cheque ● Types of bank accounts ○ Bank current account ○ Bank deposit account ○ Bank loan account 5 BUSINESS DOCUMENTS ● Entries in business records are made using business documents ● Invoice ○ Contains the: ■ Name and address of the customer & supplier ■ Date ■ Full details of the trade ○ Trade discount ● ● ● ● ● ■ Encourages customers to buy in bulk ■ Shown as a deduction in the invoice, unlike cash discount ○ Customer uses it to record purchases Supplier has a copy of the invoice to record sales Debit note ○ To inform the supplier of any shortages, overcharges or faulty goods ○ Issued to the supplier by the customer ○ A request to reduce the total of the original invoice ○ No entries are made in the books of accounts using a debit note. Credit note ○ Issued by the supplier to the customer when goods are returned, reported fault or there has been an overcharge ○ Contain full details of the goods returned or overcharged ○ Customer receives the credit note and records purchase returns ○ Supplier keeps a copy of the credit note and records sales returns Statement of account ○ Issued by the supplier to the customer ○ A summary of transactions for the month ○ No entries are made in the accounting records using a statement ○ Reminder to the customer of the amount outstanding ○ Can be checked against the customer’s records to ensure no errors have been made Cheque ○ A written order to a bank to pay a stated sum of money to the person or business name on the order ○ Cheque counterfoil is used to make entries in the books of account Receipt ○ Written acknowledgement of money received and acts as proof of payment ○ Customer receives a receipt when goods are paid for with cash 6 BOOKS OF PRIME ENTRY ● Books of original entry / Subsidiary books ● All the transactions are recorded in one of these books before the ledger accounts ● Sales journal ○ To record the credit sales of goods ○ Customer’s name is recorded in the details column and the invoice total in the amounts column ○ At the end of the month: ■ Credit sales account with the total of the sales journal ● Sales Returns journal ○ To record the sales returns of goods ○ Date, name of the customer and total of the credit note issued ○ At the end of the month, debit the sales returns account with the sales returns journal’s total ● Purchases journal ○ To record credit purchases of goods ○ Date, supplier’s name and total of the invoice ○ At the end of the month, debit the purchases account with the total of the purchases journal ● Purchase Returns journal ○ To record the purchase returns of goods ○ Date, name of the supplier and total of the credit note received ● Trade discount does not appear in the ledger accounts ○ Can be shown in the books of prime entry for information purposes only (not in the amount column) 7 FINANCIAL STATEMENTS - PART A ● A business’s main aim is to make profit ● Financial statements are used to calculate the profit or loss of the business: ○ Income statement ■ Trading account ● Gross profit is calculated (Sales - Cost of goods sold) ● Net Purchases: Purchases - Purchase returns + Carriage inwards - Goods drawings ● Cost of goods sold: Opening stock + Net purchases - Closing stock ● ‘Revenue’ is often used instead of ‘Sales’ ■ Profit and loss account ● Net profit is calculated (Gross profit + Other Incomes - All expenses) ■ Both are part of the double entry system ○ Balance sheet ■ Shows the financial position of the business ■ Not a part of the double entry system ● Every item in the trial balance usually appears once in a set of financial statements ● Any notes to a trial balance are used twice in a set of financial statements ● Transferring ledger account totals ○ Debited in the income statement : Credited in the ledger account ○ Credit in the income statement : Debited in the ledger account ● NOTE: Service businesses only prepare Profit and Loss Account 8 FINANCIAL STATEMENTS - PART B ● Balance sheet: A statement of financial position of a business on a certain date ○ Shows the business’ assets and liabilities ● Assets ○ Non-current assets ■ Arranged in increasing order of liquidity (most permanent are shown first) ○ Current assets ■ Arranged in increasing order of liquidity (furthest away from cash shown first) ● Liabilities ○ Capital: Owner’s investment in the business ○ Non-current liabilities ■ Not due for payment within the next 12 months ○ Current liabilities ■ Their values are constantly changing ■ Due for payment within the next 12 months 9 ACCOUNTING RULES ● Must be applied: ○ Financial results can be compared ○ For others to understand the financial position of the business ● Business Entity Concept ○ Business is treated as being completely separate from the owner of the business ○ Every transaction is recorded from the viewpoint of the business ● Duality Principle ○ Every transaction has two aspects ● Money Measurement Concept ○ Only information which can be expressed in terms of money can be recorded in the accounting records ○ Money is factual and does not rely on personal opinions ● Realisation Concept ○ Profit is regarded as being earned only when the legal title to goods or services passes from the seller to the buyer, who has then an obligation to pay for those goods ○ Emphasises the importance of not recording profits until it has actually been earned ● Consistency Concept ○ The same method must be used consistently from one accounting period to the next ○ If this is not followed, a comparison of the financial results from year to year is impossible, and the profit of the year can be distorted ● Matching Concept ○ Accruals Principle ○ The revenue of an accounting period is matched against the costs of the same period ● Prudence Concept ○ Principle of conservatism ○ Never anticipate a profit, but provide for all possible losses ○ Profits and assets should not be overstated, and liabilities and losses should not be understated ○ This principle overrules all other principles of accounting ● Going Concern Concept ○ It is assumed that the business will continue to operate for an indefinite period of time and that there is no intention to close down the business or reduce the size of the business by any significant amount ● Materiality Principle ○ Applies to items of very low value (not material) ○ Materiality differs for each business ○ Small expenses are grouped into one account: General/Sundry Expenses ○ Minor inventories of office supplies: Office expenses ● Historical Cost Concept ○ All assets and expenses are recorded in the ledger at their actual cost ○ Makes it difficult to compare transactions happening in different periods due to inflation ● Accounting Year Concept ○ As reports are required in regular intervals, the life of the business is divided into accounting periods- usually years ○ Allows meaningful comparisons to be made between different periods ○ Financial statements are prepared at the end of each accounting period ● Objectives in selecting accounting policies ○ Relevance ■ Information must help the users of financial statements to confirm or correct prior expectations about past events and also in forming, revising and confirming expectations about the future ○ Reliability ■ Capable of being depended upon by users as being a true representation of the underlying transactions and events which it is representing ■ Capable of being independently verified ■ Free from bias ■ Free from significant errors ■ Prepared with suitable caution being applied to any judgements and estimates which are necessary ○ Comparability ● ● ● ● ● ■ Can be useful if it can be compared with similar information about the same business for another accounting period or at another point of time ■ Comparable with similar information about other businesses ○ Understandability ■ Information provided must be clear ■ Depends on the abilities of the users of financial statements ■ Information must not be omitted from financial statements as it might make it too difficult for the users to understand Capital Expenditure ○ Money spent by a business on purchasing non-current assets and improving or extending non-current assets ○ Includes legal costs, carriage and cost of installing incurred in/during the purchase of NCAs ○ Will appear as a non-current asset in the balance sheet ○ Should not be charged as expenses ○ Cost (depreciation) will be matched against the annual revenue which the non-current asset has helped the business to earn Revenue expenditure ○ Money spent on running a business on a day-to-day basis ○ Ex: Administration expenses, selling expenses, financial expenses, cost of maintaining and running non-current assets, cost of goods purchased for resale ○ Will appear in the income statement ○ Will be matched against the revenue for that period If the capital and revenue expenditures are treated incorrectly, the profit will also be inaccurate Capital receipt ○ Occurs when a capital item (non-current asset, for example) is sold ○ Should not be entered in the income statement ■ However, the profit or loss of the sale will be entered in the income statement Revenue receipt ○ Sales or other income such as rent received, commission received, discount received and so on 10 OTHER PAYABLES AND OTHER RECEIVABLES ● Year-end adjustments: To present a more accurate view of the profit or loss of the business, and its financial position ● Only items related to that particular time period should be included in the income statement: the timing of the actual receipts and payments is not relevant – Accrual concept ● Amounts prepaid and accrued need to be adjusted ● Accrued expenses ○ Expenses due in the accounting period but remain unpaid at the end of the year (Benefit or service has been received during the accounting period but hasn’t yet been paid for) ○ According to the matching concept, any amount due but unpaid at the end of the financial year must be added to the amount paid (expenses) ○ Opening balance: Subtract Closing balance : Add to the income statement Current liability in the Balance Sheet ● Prepaid expenses ○ Payment has been made during the financial year for some benefit or service to be received in a future accounting period ○ Opening balance: Add to the income statement Closing balance : Subtract Current asset in the Balance Sheet ● Accrued income ○ Another person receiving the benefit or service from the business during the accounting period has not paid for that benefit or service by the end of the period → Income is accrued ○ Any amount due but not received at the end of the financial year must be added to the amount received ○ Opening balance: Subtract Closing balance : Add to the income statement Current asset in the Balance Sheet ● Prepaid income ○ A person had paid for a benefit or service from the business, but it has not been provided by the business at the end of the financial year ○ Opening balance: Add to the income statement Closing balance : Subtract Current liability in the Balance Sheet 11 DEPRECIATION AND DISPOSAL OF NON-CURRENT ASSETS ● Depreciation: Estimate of the loss in value of a non-current asset over its expected working life ● Cost of the non-current asset is spread over the years which benefit form the use of that asset (Matching concept) ● Non-current assets are recorded in their Net Book Value in the Balance Sheet (Prudence Concept) ● The prudence concept overrides the historical cost concept in this case ● Depreciation is a non-monetary expense ● Causes of depreciation: ● ● ● ● ○ Physical deterioration: Result of wear and tear due to the normal usage of the non-current asset ○ Economic reasons: ■ Asset is no longer able to meet the needs of the business – Inadequate ■ Newer and more efficient assets are available ○ Passage of time: ■ Arises when a non-current asset has a fixed life ○ Depletion ■ Worth of the asset reduces as value is taken from the asset Straight line method of depreciation ○ Same amount of depreciation each year ○ (Cost of asset - Residual value) / Number of expected years Reducing balance method of depreciation ○ The same percentage rate of depreciation is applied, but it is calculated on a different value each year ○ Cost - Depreciation = Net Book Value ○ The value of the asset can never fall to nil ○ Used when the asset is most beneficial in its early years Revaluation Method ○ For small items of equipment ○ Assets are valued at the end of each financial year, and the amount by which the value of the asset has fallen is the depreciation for the year Recording depreciation in the ledger ○ Asset account always has a debit balance ○ Provision for depreciation always has a credit balance ○ Purchase of a non-current asset: Asset a/c Dr. To Cash/Bank/Supplier a/c ○ Annual depreciation Income statement Dr. To Provision for depreciation a/c ○ Annual depreciation is recorded in the income statement ○ Used in balance sheet to find the net book value of the non-current asset ○ Disposal of non-current asset On the date of sale Asset disposal a/c Dr. To Asset a/c → Provision for depreciation a/c Dr. To Asset Disposal a/c → Cash/Bank/Customer a/c Dr. To Asset Disposal a/c At the year end Transfer any difference on the disposal of non-current asset account to the income statement (Profit or loss) 13 BANK RECONCILIATION STATEMENTS ● Bank statement ○ Sent at regular intervals by the bank to its customers detailing the transactions that have taken place during the period covered ○ A positive balance will appear as a credit balance, while an overdrawn balance appears as a debit balance ● Bank account ○ Money paid into the bank is debited, while money paid out of the bank is credited ● If the balance in the bank statement and the bank account disagree, it is necessary to reconcile them to explain the differences, using a bank reconciliation statement ● Reasons for disagreements between the bank account balance and the bank statement balance ○ Timing differences ■ Unpresented cheques ● Paid by the business; credited on the bank account but did not appear on the bank statement ● Payee has not paid the cheque into his bank account or the cheque is still in the banking system and has not yet been deducted from the business’ account ■ Uncredited deposits ● Paid into the business’ bank account; debited on the bank account but did not appear on the bank statement ● It usually takes a few days before the money paid into the bank is recorded in the customer’s account ○ Items not recorded in the cash book ■ Bank charges and bank interest ■ Dishonoured cheques ● Cheque paid into the bank may be returned as the drawer did not have sufficient funds in the account ■ Direct debits, credit transfers and standing orders ● From another person or from the business ○ Errors made by the business ○ Errors made by the bank ● A bank reconciliation statement is not part of the double entry records of the business ● Advantages of bank reconciliation: ○ ○ ○ ○ ○ Accurate bank balance is available in the bank account Errors in the BS or the CB are identified Discover fraud and embezzlement Uncredited deposits and unpresented cheques can be identified Stale cheques (older than 6 months) can be identified 14 JOURNAL ENTRIES AND CORRECTION OF ERRORS ● General journal: Anything which is not entered in one of the books of prime entry must be entered in the journal before being recorded in the ledger ● Not part of the double entry system as it is simply regarded as a diary in which transactions are noted before they are entered in the ledger ● Contains a narrative after each entry ● Opening journal entries: ○ Lists the assets owned by the business (debit column), the liabilities and the capital owed by the business (credit column) ● Purchase and sale of non-current assets are recorded in the general journal ● Non-regular transactions are recorded in the general journal ● Correction of errors ○ Two-sided errors ■ Not revealed by the trial balance ■ Error of commission ■ Error of complete reversal ■ Error of omission ■ Error of original entry ■ Error of principle ■ Compensating errors ■ These errors, when discovered, are corrected by means of a journal entry ○ One-sided errors ■ If the errors are not found immediately, the trial balance is balanced by inserting a suspense account (temporary account) ■ When all the errors have been found, the suspense account will automatically close ■ Draft financial statements can be prepared using a trial balance with a suspense account ■ A debit balance in the suspense account is regarded as an asset, and the credit balance in the suspense account is regarded as a liability (recorded in the balance sheet) ● Any errors made to items appearing in the trading account will affect the gross profit and the net profit. While any errors made to items appearing in the profit and loss account will affect the net profit (using a profit correction statement) ● Errors made to items appearing the balance sheet need to be amended too 15 CONTROL ACCOUNTS ● ● ● ● ● ● ● ● Prepared if the trial balance fails to match To check the arithmetical accuracy of the sales ledger and the purchases ledger Cannot identify two-sided errors Advantages of control accounts ○ Can assist in locating one-sided errors ○ Proof of the arithmetical accuracy of the ledger accounts they control ○ Balances in these accounts are the total of the trade receivables and total of the trade payables ○ Can be helpful in preparing draft financial statements ○ Reduce fraud as control account is prepared by someone who has not been involved in making entries in the sales and purchase ledger ○ Provide a summary of transactions affecting debtors and creditors Sales ledger control account ○ Contains transactions relating to all the debtors ○ Information to prepare the sales ledger control account is obtained from the books of prime entry ○ Information from the debtors’ ledger accounts must not be used as an error in the sales ledger would not be revealed in that case ○ Total of the balance on all the debtors accounts must agree with that of the total trade receivables account Purchase ledger control account ○ Contains transactions relating to all the creditors ○ Information to prepare the purchase ledger control account is obtained from the books of prime entry ○ Total of the balance on all the creditors accounts must agree with that of the total trade payables account Reasons for balances on both sides of the control account ○ Overpayment by the debtor/business ○ The debtor/business returning the goods after paying the account ○ The debtor/business paying in advance for the goods ○ Cash discount not being deducted before the payment Contra entries ○ Inter-ledger transfers or set-offs ○ Happens if the business is both a customer and a supplier to another business ○ Such a business will have two accounts, in our records ○ They may agree to set one account off against the other