Trading in Commodity Futures: An Islamic Perspective*

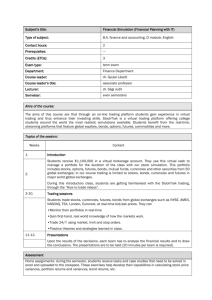

advertisement