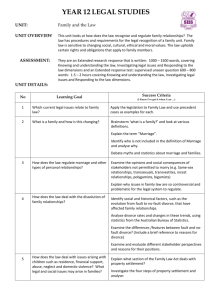

FAMILY LAW OUTLINE

advertisement

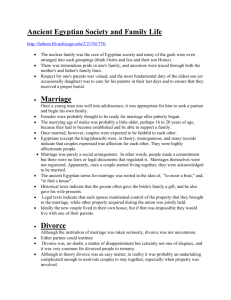

FAMILY LAW OUTLINE SPECTOR, SPRING 2001 I. RESTRICTIONS ON MARRIAGE A. The Traditional Restrictions: Bigamy 1. Not too many 2. Bigamous marriages are void. 3. Courts cannot adjust the rights b/c there was never a marriage to begin with. 4. The relationship of the parties should be treated as a quasi-partnership. They are partners with respect to the property acquired during cohabitation. 5. Often the problem arises b/c only spouses can bring wrongful death actions, iied actions, elective benefits of the estate and social security. 6. Same rules apply to common law marriages. B. The Constitutional Question 1. Marriage is a fundamental right under the 14th Amendment due process clause. State law which interferes with this right is subject to strict scrutiny. C. The Traditional Restrictions: Incest 1. Not too close 2. 43 OS 2: Marriages between ancestors and descendants of any degree, of a stepfather with a stepdaughter, a stepmother with a stepson, between uncles and nieces and aunts and nephews, except in cases where such relationship is only by marriage, between brother and sister of ½ and whole blood, and 1st cousins. Except that 1st cousins who are married in a state that recognizes 1st cousin marriages have a valid marriage. 3. Purposes: avoid deformed children and undue influence- policy reason in creating a stable family environment where the members are not looked upon as sexual objects. 4. Incestuous marriages are void marriages. D. Traditional Restrictions Age 1. 43 OS 3: Must be 18 to marry, of the opposite sex, Between the ages of 16-18 can marry with consent of parent 2. Voidable marriage- In Okla. a marriage that violates the age restriction becomes a common law marriage if the parties continue the marriage relationship after removal of the age impediment. 3. 43 OS 5: provides that instead of having parent or guardian sign an underage person can file for a marriage license and then wait 72 hours before getting married. 1 E. The Traditional Restrictions: Mental Capacity 1. 43 OS 128: Any person lacking age or understanding who marries can have the marriage voided for lack of capacity; also parent or guardian of person can have it voided; children born of the marriage are legitimate; cohabitation after incapacity ceases will be sufficient to ratify the marriage 2. Basically creates a voidable marriage which can only be attacked in an annulment proceeding before the impediment is removed. 3. Test: Whether mental incapacity at the time of marriage prevented person from comprehending the essential nature of a marriage contract and from giving his free and intelligent consent? F. The Traditional Restrictions: Same Sex 1. 43 OS 3.1: marriages between persons of same gender performed in another state are not recognized as valid 2. Ct will most likely apply chromosomal test which determines gender by genes; so once a man always a man 3. Defense of Marriage Act- Federal law does not recognize same sex marriages and does not require other states to recognize same sex marriages even if they are recognized in other states. 4. Vermont- civil unions, gives same sex couples the benefits and protections incident to marriage G. Void v Voidable Marriages 1. Void marriage: a. can be brought by a 3rd party b. legally never happened c. bigamy, incest and same sex marriages d. can be challenged even after the death of parties e. cohabitation does not ratify the marriage 2. Voidable marriages a. can be attacked only in a suit for annulment b. only while the disability remains c. must be brought in a timely fashion d. unless annulled in a timely fashion, it is a valid union from inception e. minors, incompetents, marriages without a license and fraud 3. Appellate Court can: a. can only overrule trial court if their ruling was against the clear weight of the evidence b. using equitable power the appellate court may: i. uphold the lower court ruling no matter what the reasoning as long as the correct ruling was made and any rational theory will support it ii. enter the correct judgment rather than remanding 2 II. FRAUD AND THE MARRIAGE RELATIONSHIP A. An annulment can be granted on the grounds of fraud. B. Elements of common law fraud: 1. material misrepresentation 2. made a positive assertion 3. which is either known to be false or made recklessly without knowledge of the truth 4. with the intent that it be acted upon 5. which is relied upon by a party to that party’s detriment C. The misrepresentations must go to the essential elements of marriage. This is a contract issue and fraud = rescission of the contract. D. Traditionally, heart of the marriage meant children, sex, or spouse pregnant by another man. The modern trend is to recognize other essentials. E. States with strict divorce laws expanded annulments by granting fraud in a variety of situations. However, Okla. has no fault divorce so annulments have declined. F. Reliance test: Without the fraudulent misrepresentation the party would not have acted in entering the marriage. Must be proved by clear and convincing evidence. Courts look at this on a subjective, case by case basis. G. Tort aspect: Fraudulent inducement into marriage a. as opposed to common law fraud the statute of limitations is different b. must prove detrimental loss and reliance on the promise c. damages for mental distress d. type of promise: not love, but fraud which goes to the economic interest H. In Okla. any fraud claim which would support an annulment would support a tort claim for fraud. III. FORMALITIES FOR A CEREMONIAL MARRIAGE A. 43 OS 4-37 B. Blood tests- test for syphillis, some states test for HIV C. When does marriage occur? Lower Ct found marriage occurred at time of vows, settled before App Ct heard the case. 3 IV. COMMON LAW MARRIAGE A. Party asserting common law marriage bears the burden of proving by clear and convincing evidence the following: 1. an actual and mutual agreement to be husband and wife a. a permanent relationship Justice Opala believes the only true element is mutual agreement, all others are evidence of intent 2. an exclusive relationship 3. cohabitation 4. parties must hold themselves out publicly as husband and wife a. can be shown by tax returns b. beneficiary designations c. and joint property B. Standard of review: Findings not disturbed against the great weight of evidence; Ct of Appeals can and will reweigh the evidence. If it appear the trial court could’ve come to the conclusion it does not matter what the reasoning is, the judgment will be affirmed. Court of Appeals can enter new judgment, they do not have to remand. C. Not necessary that the parties to a common law marriage created in Okla. be residents or domicilaries of Okla., nor do they have to cohabitate or maintain the common law relationship for any magical length of time. 4 V. MARRIAGE PRESUMPTIONS A. A rebuttable presumption exists that a ceremonial marriage is valid. B. A presumption also exists that a prior marriage of either party was terminated by death or divorce. 1. Normally, to prove a divorce did not occur you would go to every court in every place the person has lived and have the clerk verify a divorce was never granted. C. There is also a presumption of marriage from cohabitation. D. 43 OS 202: Husband must support himself and his wife out of the community property or his separate property or his labor. The wife must support the husband when he has not deserted her out of the community property or out of separate property when he has no community property and he is unable from infirmity to support himself. 1. This obligation has been enforced via necessaries in which 3rd parties extend credit to the wife. Under Okla. law for an item to be a necessary it must tend to relieve distress or promote comfort of the body or mind. Absent the necessaries doctrine the husband’s obligation is unenforceable outside the context of divorce or separation. E. Estoppel can prevent assertion of marriage even if you were never divorced. F. No common law divorce action. Common law marriages do not end without a formal divorce proceeding. 5 VI. REMARRIAGE A. 43 OS 123: Okla. is one of the last states to still forbid marriage within 6 mos. of a divorce, unless remarrying the person you divorced. B. A marriage that takes place within 6 mos. is voidable in an annulment proceeding. Once the 6 mos. is over it ripens into a valid marriage. Can marry in another state during the 6 mo. period, but you could be charged w/ bigamy if you come back to Okla. during the 6 mo. period. C. Exceptions to the 6 mo. rule: 1. remarriage to the person you divorced 2. Filing a petition to vacate the divorce decree will set aside the decree as if it never happened, therefore all property is marital again. However, if you remarry the same person the property division stands as it did in the divorce decree. D. Setting aside a divorce decree: VII. MAKING YOUR OWN DEAL: THE CONTRACT APPROACH A. In the absence of an actual marriage, parties can recover for the breach of an express contract if they voluntarily lived together and as long as the agreement does not rest on sex as consideration. B. The consideration should be for services normally compensated. C. Requires a showing of a stable and significant relationship arising out of cohabitation. D. In the absence of an express contract Cts can look to see if the actions constitute an implied contract of agreement of partnership or joint venture or some other understanding between the parties. Courts may also devise equitable remedies warranted by the facts. 6 VIII. DIVORCE A. Fault Divorce- 43 OS 101 1. Little reason for fault divorce today, does not increase the property or alimony award 2. Most Cts refuse to find a fault divorce. Most judges don’t want to hear evidence on this, but if the party insists the court must hear the evidence. 3. Some fault grounds, if proven, may be grounds for waiving the 90 day waiting period for a divorce with minor children involved under 43 OS 107.1. The grounds are abandonment for 1 year, extreme cruelty, habitual drunkenness, imprisonment, procurement of a foreign divorce decree, and insanity. 4. Defenses to fault divorce a. Condemnation- freely given pardon or forgiveness of marital offense, carrying with it the implied condition that it not be repeated, that the errant spouse treat the other with conjugal kindness and the spouse maintains good behavior. b. Recrimination- if conduct of both spouses has been such as to furnish grounds for divorce, neither is entitled to relief. c. Collusion- agreement between husband and wife that one of them shall commit or appear to have committed acts constituting a grounds for divorce. d. Insanity e. Connivance- plaintiff’s corrupt consent, express or implied, to offense charged against defendant 5. Arguments for having only fault divorce a. better for women in negotiating property distribution b. fewer divorces, people would work things out B. No Fault Divorce 1. Incompatibility is the only ground in Okla. a. Actionable incompatibility exists when such a conflict of personalities comes about as to destroy the legitimate ends of matrimony and possibility of reconciliation. Such a state may exist although the situation is considered serious by one spouse and less so by the other. 2. Some states recognize living separate and apart (probably for at least 6 mos.) a. if you are not exhibiting to the community that you are living separate and apart then a divorce on these grounds will not be granted 3. Legal separation- divide property, child support, alimony but Ct does not actually divorce the parties. Many people moving into Okla. file for legal separation until they have lived here 6 mos. and are eligible to file for divorce. 4. Covenant Marriages: only in Louisiana, couple agrees to have a special marriage license with counseling, effect is that divorce form a covenant marriage is extremely difficult. 7 IX. ROLE OF THE DIVORCE LAWYER A. Lawyer’s fees cannot be made contingent upon securing a divorce or the amount of property or alimony awarded. Contingent fees violate MPR 1.5(d) which prohibits contingent fees for domestic relations matters b/c it would discourage reconciliation. X. MULTI-STATE DIVORCE A. Major issues: 1. Does the court who gave the divorce have jurisdiction to do so? (Due Process) 2. Do other states have to recognize this divorce? (Full Faith and Credit) a. If the state of domicile of both parties grants divorce then other states must recognize it. Domicile- Intent to make somewhere your home and an intent to stay there. b. If the state of domicile of one party grants the divorce but both parties appear other states must recognize it. If party appears they are consenting to that court’s jurisdiction and will be barred from later contesting the jurisdiction. c. If the state of domicile of one party grants the divorce but the other party does not appear, then other states can decide whether or not to recognize it based on jurisdiction. Jurisdictional facts are always subject to collateral attack. In an ex parte divorce the court can only grant the divorce. They cannot deal with property distribution, etc. b/c they don’t have jurisdiction over the other party. B. Oklahoma grants divorce based on 6 mos. residency of either party. (43 OS 102) Parties cannot waive the 6 mo. requirement, it goes to subject matter jurisdiction of the court. C. International Divorces 1. Most states, especially in ex parte proceedings will not recognize a foreign divorce. This is especially true for the IRS. 2. However, it might still have an estoppel effect. 8 XI. DIVORCE PROCEDURE A. Venue 1. 2 places: where either of the parties lives 2. First to file wins venue 3. 43 OS 103: an action for a divorce or an annulment may be brought in the county in which either the plaintiff or the defendant has been a resident for at least 30 days; an action for separate maintenance may be brought in the county in which either party is a resident at the time of filing of the petition 4. Proceedings to modify the divorce decree ordinarily must be brought in the court which ordered the original decree. Exceptions: a. one party has moved away from Oklahoma and is domiciled in another state b. the child is physically and lawfully present within the county in which the motion to modify is filed c. the action is not brought for purposes of forum shopping d. the non-resident parent is properly served with process in order to confer personal jurisdiction upon the new court e. the movant demonstrates that it would be a burden to return to the court B. Fraud 1. Intrinsic- dealing with fraud within a judicial proceeding, includes perjury, forgery and false documents a. 2 years from date of decree to bring suit 2. Extrinsic- dealing outside a judicial proceeding a. 2 years from date of discovery to bring suit; known or should have known standard for discovery 3. Judgment dormancy- Divorce decree becomes dormant if no execution issues within 5 years of its rendition. You have 5 years to attempt to collect judgment. If you can’t you get another 5 years. But if you do nothing enforcement is barred. No dormancy for child support. 4. Fiduciary relationship ceases to exist between the husband and wife when the divorce petition is filed and the parties hire counsel. 9 C. Filing Procedures 1. Divorce petition a. file petition along with signed verification b. must serve on the other side 2. Cross- petition or answer a. Defendant must answer or cross-petition. b. Cross-petition is best b/c it prevents the petition or a temporary order from being dismissed by one party. 3. Temporary orders a. Governs parties lives during proceedings, b. Child support temporary orders cannot be modified retroactively, c. When final order comes about T.O. is gone, d. If part of the T.O. is not satisfied this must be addressed in the final order. e. T.O.’s are not appealable. 4. Temporary Restraining Orders a. situations: get child out of a dangerous situation OR one parent and child are leaving b. must have a hearing within 10 days c. Client and witness must testify that there is chance of irreparable harm d. Judge takes matter under advisement, drafts opinion which must decide all the issues in the case, terms of the judgment go into effect when decided unless the parties post a bond and supersede the judgment pending appeal XII. RELATIONSHIPS TO OTHER PROCEEDINGS A. Probate 1. Important to know when divorce is effective, because if they are still married the spouse has certain rights. 2. Divorce is effective upon announcement from the bench or signing of the letter order. The only way it is not effective is if one party is appealing the granting of the actual divorce, which is unlikely. B. Tort 1. Tort Actions against 3rd parties a. alienation of affections (only in effect in about ½ the states, but not Okla) b. criminal conversation- civil side of adultery (abolished in all states except NC) 10 2. Tort Actions against spouse a. assault and battery b. intentional infliction of emotional distress- must prove conduct was outrageous beyond the normal nastiness of a divorce case, adultery would not be enough c. tortious transmission of a venereal disease- (marriage not necessary here) brought under the theories of battery, fraud and negligence; consent might be a defense, also premarital sex crime defense d. Normally, divorce and tort action could be joined but probably not a good idea b/c no right to a jury trial in divorces. The only time res judicata may be a problem is if an overbroad settlement agreement state it is the full, final and complete settlement of all claims. e. One recovery rule: If alimony claim is based on the same theory as the tort claim, tort claim may be barred under one recovery rule. f. Collateral estoppel: if divorce is litigated and certain findings of fact are made, they may not be able to be re-litigated in a later tort case. C. Domestic Violence 1. Victim’s Protective Order: Obtaining a protective order a. civil matter in issuance, but enforcement is a criminal matter b. Order stays in effect until vacated by court, victim cannot waive the order c. Issued against family members, 22 OS 60.1 lists spouses, ex-spouses, parents of ex-spouses, grandparents, step parents, adopted parents, foster parents, children, grandchildren, step children, adopted children, foster children, persons otherwise related by blood or marriage, persons living in the same household or who formerly lived in the same household and persons who are biological parents of the same child. d. Can be obtained to prevent violence, stalking or harassing (stalking and harassing does not have to be a family member) e. Dating relationships are also covered (courtship or engagement relationship) f. File petition, judge can grant ex parte emergency order or a Temporary Restraining Order which will stay in place until the hearing on the protective order g. Police are required to ask someone who is a victim of domestic violence if they want a temporary restraining order. If so, call judge and if he grants it then it is only good until close of business the next day. h. Temp. orders can be obtained to stop child visitation. i. After temp order is served hearing must be held within 15 days j. Penalties for violation- 22 OS 60.6 (1st time-jail or fine, 2nd timemandatory 10 days, if injury then minimum of 20 days) k. If VPO is obtained for the purpose of harassing the defendant this is criminal and can be prosecuted. l. Foreign protective orders are given full faith and credit. 11 XIII INTRODUCTION TO PROPERTY DIVISION A. Economic issues faced by the court 1. Classify the property- joint or separate a. joint/ marital property- acquired after marriage by marital effort; presumption that property had during marriage is marital, person claiming assets as separate property has burden of proving separate property b. separate property- brought into the marriage, also property given to one spouse through inheritance or gift, may keep assets as separate property and trade it into another asset during marriage source of funds rule: trace the assets to where they came from and from what, not only money considered but marital labor. The title to the property is not dispositive. You must look to whether any marital labor went into the asset. Allows for both separate and marital interest in property. c. passive and active income: If separate property increases in value during the marriage the court will have to determine whether the increase is passive income (market changes) or active income (effort expended to improve asset). If it is passive income then the property does not change. If it is active income then the increase in value would be considered marital property b/c marital effort was expended. d. When does acquisition of marital property stop? Literal reading of the statute- stops at the pronouncement of divorce In reality- 2 other dates used; when the petition is filed or when the couple separates with no intention of getting back together (most courts use this rule) 2. Value of the property- assess what the property is worth 3. Distribute the property- ideally divide property in kind, however court can give property to one spouse and require that spouse to pay the other a sum of money deemed to be just and reasonable for their part of the property. This is called property division alimony. Division is a final judgment, not modifiable. If one party dies still owing property division alimony that debt passes to the estate. B. Community Property states 1. anything acquired during marriage is marital property, it is seen as co-owned C. Common law states/ Equitable Distribution 1. property acquired during marriage in one spouse’s name is that spouse’s property until divorce or death when the court can view the property as a whole and distribute it 2. whoever holds title has the right to do with it as they please during marriage 3. In Okla. all property the couple owns jointly is divided and property in one spouse’s name stays with that spouse, but if it is determined to be joint property there will be an offsetting property award 4. Oklahoma has been dividing property in this way since statehood. Hinges on a few sentences of one statute (43 OS 121) and the rest is case law. 12 IX. DEGREES AND LICENSES A. Oklahoma 1. professional degree not property and not subject to division, however the spouse’s contribution to a degree may be reimbursed with interest and inflation 2. Test is what would X have earned had she invested the money and not spent it on his education? 3. Restitution award is given as a property award and is not modifiable. 4. When are spouses not entitled to a restitution award? a. when they have received the benefit of the bargain, courts usually draw the line at 6-7 years after education is complete b. spouse seeking education contributes as much or more than other spouse c. earning capacity of the contributing spouse is so high that the contribution makes no impact on the lifestyle 5. Student loans- if acquired during marriage they are joint debt, subtracted from the portion of the marital estate the degree earning spouse is entitled to B. Measuring Restitution 1. cost value approach- (Okla. approach) calculates value of supporting spouse’s contributions, not only in terms of money for education and living expenses but also in terms of service rendered during the marriage; includes adjustments for inflation and interest 2. opportunity costs- court may consider the income the family sacrificed b/c the student spouse attended school rather than accepting employment 3. value of enhanced earning capacity- court may compensate according to present value of student spouse’s enhanced earning capacity. The problem with this approach is that it does not take into account market opportunities, individual career choices, and premature death. 4. Labor theory of value: court considers value of supporting spouse’s contribution to marriage at ½ of student spouse’s enhanced yearly earning power for as many years as the supporting spouse worked to support the student 13 X. PROFESSIONAL GOODWILL A. The ability to attract repeat customers or ability to earn more than the average business, ability to generate future income. B. Can be factored in as an element of the value of a business that is marital property C. Majority view is that goodwill is an element to be considered when calculating the value of a business that is a marital asset if it is distinct from the personal reputation. D. Okla. uses goodwill as a factor if goodwill would be considered when transferring or selling the business. If the goodwill depends on the continued presence of a particular individual it is not a divisible asset. 1. A buy sell agreement which sets a specific price for selling defeats a goodwill claim so long as the agreement was entered into for purposes other than the divorce. Ct will look to see how long agreement has been in place. 2. Double dipping argument is sometimes used. Argument is that future income is used to figure goodwill and also future income is used to figure alimony. E. Contingency Fees 1. Not to be considered when valuing a law practice because they may never be recovered XI. EMPLOYMENT BENEFITS A. Pensions Introduction 1. Marital property to the extent they were earned during marriage 2. Federal and state retirement plans are governed by statute. B. Private Pensions 1. governed by ERISA (businesses with 10 or more employees are governed by ERISA but smaller businesses can opt to fall under ERISA) a. Defined benefit plans Not a separate account for each employee, employer contributes to one large fund and is obligated to provide a certain monthly or annual benefit upon retirement until death b. Defined contribution plans Separate account for each employee to which the employer makes a specified annual contribution; generally the plan documents tell you how to calculate the amount of contribution; under this plan each employee must receive a quarterly statement of the value of the pension plan 2. Calculation of Pension Plan a. use an actuary b. present value is calculated as if employee is of retirement age today c. many things can effect the present value d. formula; number of years of expected benefit x the number of months at the monthly benefit amount (present value per month) 14 3. Distribution of pension plan a. present value method- (preferred method) pension is awarded to employee and other spouse is given marital assets equivalent thereto. If there is not sufficient marital assets you can do a Qualified Domestic Relations Order- makes the employer pay the non-employee spouse directly when the pension plan vests, must be approved by pension plan administrator b. deferred distribution method- present value need not be calculated, but it keeps the spouses tied together for a long time C. Public Pensions 1. Oklahoma statutes provide for QDRO’s 2. Federal civil service statutes use term “Order Acceptable for Processing” instead of QDRO 3. Military- direct payout only if you have been married for at least 10 years in the military D. Disability 1. Disability benefits are subject to replacement analysis; Ct looks to see what the benefit is replacing. If it is replacing what would be marital income then it is marital, if it is replacing separate or future income then it is separate. 2. Benefits received after separation are separate property. 3. Benefits that have a retirement quality should be classified as marital. 4. Disability military benefits cannot be found as marital property by federal law. E. Health Insurance 1. Courts can order employee spouse to retain kids on company health insurance with premiums to be split between parties. 2. Courts cannot order employee spouse to retain ex-spouse. 3. Consolidated Omnibus Budget Reconciliation Act- requires health care sponsors to continue divorced spouse under their plans for a number of years, at a higher premium F. Tort and Worker’s Compensation 1. Worker’s compensation is marital property only to the extent it reimburses for loss of income during the marriage. 2. Payment for loss of future earnings and medical needs is separate. 3. Pain and suffering awards are considered so personal they are separate property. 4. Non-injured spouse’s award such as loss of consortium is separate property. 5. When there is settlement or general verdict and the money is not split into what it has been awarded for the burden of proof is on the person alleging that part of it is separate property. 6. Lottery tickets- if the money to purchase the ticket came from marital funds then the winnings are marital 15 XII. TRANSACTIONAL PROBLEMS A. Two ways to receive separate property during marriage 1. Inheritance- if you did nothing to get it, it will remain separate a. Exception: If based on an exchange of service then it could be marital. Anything received as a result of marital effort will be marital 2. Gifts a. Gifts between spouses are separate. b. Gifts from third parties- To determine if it was a gift look to donative intent and who it was given to. If given to the couple it is marital. If given to one person then it is separate. B. What happens to separate property 1. If property started out as separate it remains separate so long as it can still be traced. If you can’t trace it the court may find that it has been commingled and will be considered marital property. 2. A loan taken out by one spouse, which is then used for the marital home is a marital debt. C. Joint Tenancy 1. If one spouse puts property in joint tenancy with other spouse it is presumed to be a gift, but the gift can be rebutted. Examples: placed in joint tenancy to secure mortgage, to avoid probate, fraud, separate agreement, etc. 2. Before Larman v Larman (above rule) presumption of gift could only be rebutted by fraud or separate agreement to the contrary. 3. Unsettled whether the presumption would apply to bank accounts placed in joint tenancy, probably look to see whether both spouses used the account. 4. If the presumption is not rebutted, then it is a gift to the marital estate or husband and wife each own half as their separate property. Most courts treat it as a gift to the marital estate. D. Income From and Appreciation in Value of Separate Property 1. If marital effort led to the increase in value then the increase is marital property. But if no marital effort was expended then the increase is separate. 2. Use same analysis for increase in property and income from separate property. 3. Increase in value which occurs because of the efforts of at least one spouse is marital. 4. If marital effort and non-marital effort contribute to the increase in value, both the marital estate and separate estate should receive property according to their contributions to the increase. a. Houses, businesses and pension plans are all subject to apportionment. 5. Trasmutation by use doctrine has almost been abolished. Just because something is used for marital purposes doesn’t make it marital 16 XII. VALUATION OF MARITAL PROPERTY A. Non-active assets- go up and down in value with no marital effort, value fixed at time of decree B. Active assets- change in value is due to marital effort, value fixed at the date of separation C. Trial court’s determination of value will not be overturned unless it is clearly against the weight of evidence. D. Valuing a Family Business 1. 3 ways to value; doesn’t matter which one so long as it is supported by the evidence a. Net asset method- doesn’t take into account the liabilities b. Market Value c. Investment or Earning Value- must consider how many years will be taken into account, doesn’t take into account the economy and its affect on the business 2. Debt- a court decision about who is to pay a debt is not binding on third parties or creditors XIII. DISTRIBUTION OF MARITAL PROPERTY A. B. C. D. E. Distribution can in kind or by offsetting monetary award Need or fault cannot be used to determine property division. Division does not have to be equal, only just and reasonable. (Equitable) Court must sever joint titles. However, parties can contract around this. Economic fault can be taken into account. If one party preserves the money, but the other dissipates the marital estate this will be considered. Money spent on an affair, gambling, drinking, etc. will be taken into account. F. Omitted property- stays with the person who has legal title to it; if it is in joint tenancy it stays in joint tenancy G. Drafting: mention who can live in the home while it is being sold, who pays the mortgage, who takes care of repairs, maintenance, taxes, insurance, who sells the house, what happens if house doesn’t sell and there should be a clause about person living in house not committing waste H. Best to give house to wife and a money judgment to husband for half the value when the house is sold 17 XIV. STANDARDS FOR THE ALIMONY AWARD A. Income based, not based on assets B. Tax consequences: deductible by obligor, included in income of obligee C. Statute (43 O.S. 121 & 134) reads that either spouse could pay alimony, but there are no cases where the court has made the wife pay alimony. D. 1970’s amendment deleted sex and fault as bases for alimony. All that is left is need. Alimony awarded when one spouse needs it and the other can afford it. 1. Mode of living determination- court should consider station in life and lifestyle prior to divorce, conduct of parties, earning capacity of husband, financial means and physical condition of wife and length of marriage; standard of review is abuse of discretion 2. Need must arise during the marriage, not before. Also temporary support cannot be awarded retroactively at trial. 3. Readjustment alimony- Alimony awarded to the wife during her post-marital economic readjustment period. 4. 7 factors commonly used to determine alimony: a. demonstrated need during the post-matrimonial economic readjustment period b. party’s station in life c. length of marriage and age of parties d. earning capacity of each spouse e. the parties physical condition and financial means f. the mode of living to which each spouse is accustomed g. evidence of spouse’s own income producing capacity and the time to make the transition to self support 18 XV. MODIFICATION OF ALIMONY A. When can it be terminated? 1. Death 2. Remarriage 3. Cohabitation is not sufficient alone but can trigger courts to look into changed circumstances B. Alimony cannot be awarded when the original decree did not award it. 1. Oklahoma has never considered question whether $1 can be awarded so that alimony can later be modified. C. Filing for modification 1. Must be done prior to alimony running out. 2. Change in circumstances must be substantial and consistent and must be a change not contemplated at the time of the original agreement. a. Issue to consider: wouldn’t a change not contemplated be one that arises outside of the marriage 3. If husband earns a great deal more after the divorce the alimony payment will not be increased as long as the award was based on the wife’s needs and all her needs were met. 4. If husband’s income goes down after the divorce and it is out of his control support alimony payments may be decreased. XVI. MARITAL AGREEMENTS A. Prenuptial/ Antenuptial agreements 1. Law firmly favors putting marriage on a business stand from the beginning. 2. What can be contracted for? a. what is to happen in case of death- forced shares, intestacy rights, probate homestead, and widow’s allowance can all be waived b. what is to happen at time of divorce- economic (property and alimony) can be dealt with (Cover both death and divorce b/c contracting only for divorce might be against public policy) 3. To be sure agreement is upheld: a. time- make sure you have enough time to draft a proper agreement and find out what they want b. lawyers for both sides- not required but advisable c. full and complete disclosure of assets- not required but advisable d. time to look over the agreement e. put in a choice of law clause f. non-waiver clause g. right to amend clause h. signing ceremony is not a bad idea 19 B. Post-nuptial agreement 1. Attempt to do the same thing as a prenuptial agreement 2. Problems: not clear that such agreements are valid in Oklahoma C. Separation Agreements 1. govern financial status during separation 2. If parties reconcile agreement is void D. Settlement Agreements 1. Parties can agree to things that a court cannot order a. Examples: joint ownership, child support beyond age 18, set up property division as alimony for tax purposes, might waive right to have alimony terminate upon remarriage to someone else 2. Any settlement agreement must be presented to the court for approval. 3. Grounds for attacking judgment- if it appears from the face of the judgment that court did not have jurisdiction to order the things it did, then the judgment could be attacked on jurisdictional grounds. That is why it is advisable to have a separate document showing agreement of the parties merged with the divorce decree. 4. Modifying Consent Decrees: If there is an agreement which settles the divorce the provisions included cannot be modified without consent, but the provisions not included will be subject to general law. 5. Not necessary to incorporate all of the marital settlement agreement into the divorce decree. The part not incorporated is a separate contract and can only be challenged on breach of contract grounds. 20 XVII. STANDARDS FOR CHILD SUPPORT A. Child support is an obligation for those people who are determined to be parents of the children. B. Any agreement to get around child support is void as against public policy. C. All child support guidelines come from Federal Law. In order to get federal funds the state must est. quantitative guidelines for setting child support. D. 2 major ways to figure child support 1. Wisconsin model: uses gross income and the number of children so it is very easy to figure. Doesn’t consider at all what the custodial parent makes. 2. Income shares approach: Proportional to the total income contributed by each parent. Protects children from the economic effects of divorce by taking into account the money spent on living expenses and the children’s activities. a. Oklahoma follows this (43 OS 118) E. What is Income? 1. Includes but is not limited to: a. wages b. commissions c. bonuses d. dividends e. severance pay f. pensions g. rent h. interest income i. trust income j. annuities k. social security benefits l. worker’s comp. benefits m. unemployment insurance benefits n. disability insurance benefits o. gifts and prizes 2. Exclusions: a. actual child support received for children not before the court b. temporary assistance for needy families c. Supplemental security income d. Food stamps e. General assistance from state supplemental programs 3. Self Employment a. Gross income is defined as gross receipts minus ordinary and necessary expenses for the operation of the business 4. One Time recovery money a. Court will stretch amount over 5 years or they will assume it was invested and base income on the interest it would accrue 5. Imputation of Income a. If you have no income court will still impose child support by education level or minimum wage standards 21 6. Deductions a. Child support paid out to other children not before the court will be deducted from income only in cases where payments are being made, must prove the payments are being made b. Alimony being paid out to other ex-wives is deducted. 6. Other Considerations a. In addition to base child support the court will add on dependent child medical insurance, child care costs, medical expenses not covered by insurance, and transportation costs. These will all be apportioned according to gross income of the parents. Qualified Medical Child Support Order- requires insurance company to keep kids on policy b. Table only goes to $15,000 combined monthly income. If the income exceeds this amount, court will award the highest amount on the table plus an additional amount. The additional amount will be determined by: Determine how much is needed to continue the lifestyle of the child Take top percent and multiply it by income Not used- top amount in guidelines plus medical expenses plus private school XVIII. MODIFICATION OF CHILD SUPPORT A. Modifications are given when there is a change in circumstances. (usually a change in circumstances) B. Most modifications are requested because of: 1. New families- request modification because of new financial responsibilities to new wife and kid, court will usually not modify or one marries richer the support obligations do not change because step parents don’t have a responsibility to take care of the child 2. New Jobs/ Occupations- sometimes modified; depends on whether the change was voluntary or involuntary. (Prison is seen as voluntary and child support will not be modified) C. Child support is modified as of the date of the petition, but cannot be modified retroactively. D. A past due child support payment is automatically a judgment. E. There are no equitable defenses to collection of back due child support. F. No relationship between visitation and child support. Can’t withhold visitation for unpaid child support and can’t withhold child support for visitation that has not been collected. G. Child support ends at 18 or high school graduation whichever is later. a. can continue past 18 only by agreement between the parents. b. If kid drops out of H.S. and begins work child support ends. c. Special needs children- should have an agreement about when support will end d. Child support also ends on death of payor, however in some states future child support can become a lien on the estate. Advisable to have payor take out a term life insurance policy w/ kid’s name on it. 22 XIX. MULTI-STATE CHILD SUPPORT A. UIFSA1. expanded long arm statute and once state has jurisdiction that state continues to have exclusive jurisdiction over child support matters so long as one parent remains in the state. 2. If both parents leave state w/ jurisdiction the state that can modify depends on who is seeking modification. The person seeking modification must be a nonresident of the state that is asked to modify. XX. ENFORCEMENT REMEDIES A. Contempt of court- must have a provision they have clearly violated. 1. Direct contempt- takes place in front of court 2. Indirect contempt- takes place outside of court, trial necessary 3. Civil contempt of court- sent to jail until they comply with court order a. must prove they have intentionally violated the order then burden shifts to payor to prove it was beyond their power to comply b. can be sent to jail or set up a purge clause which makes a person pay regular support and an additional amount each month to make up back child support B. Judgment- enforce like any other judgment C. Liens for Arrearage- 43 OS 135 D. Income Withholding E. Revocation or Suspension of Various Licenses as a remedy for non-compliance F. Revocation of driver’s license G. 18 USC 228- failure to pay child support to an out of state child 23