Chapter 4 Lecture-3

advertisement

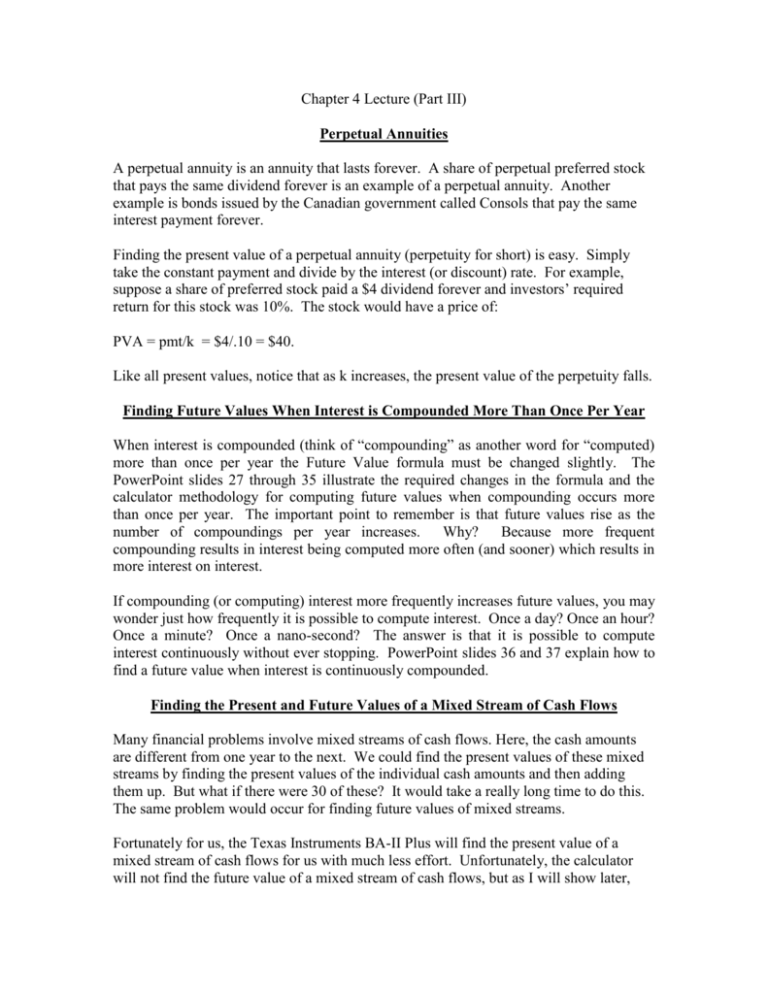

Chapter 4 Lecture (Part III) Perpetual Annuities A perpetual annuity is an annuity that lasts forever. A share of perpetual preferred stock that pays the same dividend forever is an example of a perpetual annuity. Another example is bonds issued by the Canadian government called Consols that pay the same interest payment forever. Finding the present value of a perpetual annuity (perpetuity for short) is easy. Simply take the constant payment and divide by the interest (or discount) rate. For example, suppose a share of preferred stock paid a $4 dividend forever and investors’ required return for this stock was 10%. The stock would have a price of: PVA = pmt/k = $4/.10 = $40. Like all present values, notice that as k increases, the present value of the perpetuity falls. Finding Future Values When Interest is Compounded More Than Once Per Year When interest is compounded (think of “compounding” as another word for “computed) more than once per year the Future Value formula must be changed slightly. The PowerPoint slides 27 through 35 illustrate the required changes in the formula and the calculator methodology for computing future values when compounding occurs more than once per year. The important point to remember is that future values rise as the number of compoundings per year increases. Why? Because more frequent compounding results in interest being computed more often (and sooner) which results in more interest on interest. If compounding (or computing) interest more frequently increases future values, you may wonder just how frequently it is possible to compute interest. Once a day? Once an hour? Once a minute? Once a nano-second? The answer is that it is possible to compute interest continuously without ever stopping. PowerPoint slides 36 and 37 explain how to find a future value when interest is continuously compounded. Finding the Present and Future Values of a Mixed Stream of Cash Flows Many financial problems involve mixed streams of cash flows. Here, the cash amounts are different from one year to the next. We could find the present values of these mixed streams by finding the present values of the individual cash amounts and then adding them up. But what if there were 30 of these? It would take a really long time to do this. The same problem would occur for finding future values of mixed streams. Fortunately for us, the Texas Instruments BA-II Plus will find the present value of a mixed stream of cash flows for us with much less effort. Unfortunately, the calculator will not find the future value of a mixed stream of cash flows, but as I will show later, this is not a major problem. Slides 74 through 77 illustrate the procedure for finding the present value of a mixed stream of cash flows. Take a moment to examine the slides and see if you get the same answers I got. Incidentally, the F fields in the cash flow worksheet (F01, F02, F03, etc., ) refer to the frequency with which the cash flows occur in a row. For example, if the cash flow at time 1 occurs twice in a row, then F01 would be 2. If the cash flow at time three occurs five times in a row, then F03 would be 5. Also to clear out the CF button (cash flow worksheet) in preparation for working another problem, hit 2nd CLR WORK (the CLR WORK button is at the bottom row left). You must be in the worksheet for this operation to work. An interesting exercise is to look at slide 80. Without using your calculator can you tell which cash flow has the highest present value? Cash flow A or cash flow B? Using your calculator, see if you can find the present values of both of the cash flows on slide 80. PV of cash flow A = $1,251.25 PV of cash flow B = $1,300.32 Notice the PV of cash flow B is higher. The only difference between cash flows A and B is that the first and last cash flows ($100 and $300) are switched. Since the larger of these ($300) occurs at time 1 for cash flow B and at time 5 for cash flow A, the present value of cash flow B is higher. Here is another mixed-stream example for practice. Use a discount rate of 12% to find the present value of the cash flow stream. TIME CASH FLOW 0 1 2 3 4 5 6 0 $200 $200 $500 $500 $500 $200 The present value you should be getting is PV = $1,441.93 Button sequence: Hit CF (second row from top) Hit 2nd CLR WORK (to clear out cash flow worksheet) 7 $100 Hit down arrow (top row) once. You will see CO1 Hit 200 then hit ENTER button (top row) Hit down arrow Hit 2 then hit ENTER button (F01 = 2 since the 200 occurs twice in a row) Hit down arrow Hit 500 then hit ENTER button Hit down arrow Hit 3 then hit ENTER button (F02 = 3 since the 500 occurs three times in a row) Hit down arrow Hit 200 then hit ENTER button Hit down arrow Hit 1 then hit ENTER (this step is unneeded since the default for the frequency field is 1) Hit down arrow Hit 100 then hit ENTER button Hit NPV button (second row from top) Hit 12 then hit ENTER button Hit down arrow Hit CPT button (left top row) Suppose we wanted to find the future value of the cash flows (at time 7) on the time line shown above? Finding the future value of the cash flows is easy once we know their present value. Recall: FV = PV(1 + k)N The calculator reminder is: FV = PV(FVIF, N, K%) Clear out your third row (2nd CLR TVM also be sure your P/Y AND C/Y are set to 1) then tell the calculator what you know: 1441.93 PV 7 N 12 I/Y CPT FV FV = $3,187.65 Finding Interest (or Discount) Rates Suppose I make you the following offer: You give me $1,000 now in exchange for my promise to give you $2,000 in 10 years. Is this a good deal for you? The answer depends on the return this deal offers and whether that return compensates you adequately for the risk you are taking (e.g., inflation over the 10 years, the fact I might now pay you the $2,000). If you have a present value, a future value and a time period, you can find the implied return because we have discussed two formulas that reduce this type of problem to just one unknown in the rate of return: FV = PV(1 + K)N For which the calculator reminder is: FV = PV(FVIF, N, K%) And PV = FV/(1 + K)N For which the calculator reminder is: PV = FV(PVIF, N, K%) Since we know the present value ($1,000) and the future value ($2,000) and the time period (10 years) in the deal I offered you, we can use our calculator to find the implied rate of return. Hit 2nd CLR TVM Hit 2nd P/Y (make sure P/Y = 1) Hit down arrow (make sure C/Y = 1) Hit 2nd QUIT Hit 1000 Hit +/- (this places a minus sign in front of the 1,000. This is absolutely necessary. When solving for an interest rate the PV must be entered as a negative number). Hit PV Hit 2000 Hit FV Hit 10 Hit N Hit CPT then I/Y Answer 7.18% If you believe I am a good credit risk, you might be comfortable with this deal. If not, you could insist on a higher rate of return by asking that I pay you more than $2,000 at year 10. Finding the Return on an Annuity Suppose I make you another offer. You give me $1,000,000 now and I will pay you $1,000 per month for the next 30 years. What rate of return would you receive on this deal? Here we know the PVA ($1,000,000), the PMT ($1,000) and the number of payments (30 X 12 = 360). The present value annuity (PVA) formula reduces this to one unknown (I will simply refer to the calculator reminder). P/Y = 12 (because we have monthly payments) PVA = PMT(PVIFA, N X 12, K%) $1,000,000 = $1,000(PVIFA, 30 X 12, K%) Hit 2nd CLR TVM Hit 2nd P/Y Hit 12 then hit ENTER Hit 2nd QUIT Hit 1,000,000 then hit +/Hit PV Hit 1,000 Hit PMT Hit 360 Hit N Hit CPT I/Y Answer 5.92% (This is the approximate rate of return on insurance annuities) One more deal: Suppose I ask you to give me $5,000 per month for the next 20 years. At the end of 20 years I offer to pay you a lump sum of $5,000,000. What rate of return would you earn? Here we know the FVA ($5,000,000), the number of payments (= 20 x 12 = 240) and the payment amounts ($5,000). The future value annuity formula (FVA) reduces this problem to one unknown in the interest rate: P/Y = 12 (because we have monthly payments) FVA = PMT(FVIFA, N X 12, K%) $5,000,000 = $5,000(FVIFA, 20 X 12, K%) Hit 2nd CLR TVM Hit 2nd P/Y Hit 12 then hit ENTER Hit 2nd QUIT Hit 5,000,000 Hit FV Hit 5,000 then hit +/- (Since there is no PV in this problem, the payment must be entered in as a negative.) Hit PMT Hit 240 Hit N Hit CPT I/Y Answer: 12.08% You may see a problem on the exam where you are given the present value, the future value and the number of years (or the number of payments), but no interest or discount rate. This is your hint that you will need to find the rate yourself. Effective Annual Rates Suppose you shopping for a bank certificate of deposit and you learn that the First National bank of Possum Trot offers a 5-year CD that pays a nominal rate (a nominal rate is a quoted rate you can see) of 3% compounded monthly (i.e., the interest is computed monthly) and the First State bank of Chicken Scratch offer a 5-year CD that pays a nominal rate of 2.95% compounded daily. Which bank CD would increase your money the most? Its difficult to compare bank CD rates when banks compounded interest at different frequencies. One solution to this problem is to compute the effective annual rate provided by both banks. The effective annual rate (EAR) answers the following question: What interest rate, compounded once per year, would provide the same wealth increase as a nominal rate compounded more than once per year? In effect, effective annual rates annualize nominal rates compounded more often than once per year. Once the bank CDs rates in the example above are annualized, we can more easily compare them. Slides 85 through 90 provide the formulas for finding the EAR. I will use that information to find the EARs for the banks in the example above. The formula for the EAR is: EAR = (1 + knom/m)m -1 Where: knom is the nominal rate m is the number of times interest is compounded per year. Examine the formula to find out what it tells you about the relationship between EAR and the number of compoundings per year. It tells you, all other things remaining the same, that as m rises, the EAR rises. For the First National Bank of Possum Trot: EAR = (1 + .03/12)12 – 1 = 3.04% On the calculator hit 2nd ICONV (look above the #2 button on the keypad) You will see NOM = Now hit 3 (not .03) then hit ENTER Hit the down arrow twice You will see C/Y (compoundings per year) Hit 12 then hit ENTER Hit up arrow once You will see EFF (effective annual rate) Hit CPT You should see the answer of 3.04% For the First National Bank of Chicken Scratch: EAR = (1 + .0295/365)365 – 1 = 2.99% (I assume you are still in ICONV worksheet; if not hit 2nd ICONV) Hit up or down arrow (doesn’t matter which one) until you see NOM again Hit 2.95 then hit ENTER Hit down arrow twice Hit 365 then hit ENTER Hit up arrow once Hit CPT You should see the answer 2.99% Clearly the we would be slightly better off by putting our money in the First National bank of Possum Trot. Suppose the State Bank of Corn Sqeezins pays a nominal rate of 4% compounded continuously. To find the EAR when interest is compounded continuously, we would have to use a different formula: EAR = ek – 1 where e is the antilog function = 2.7183 and k is the nominal rate. The EAR in this example would be found as follows: Punch the nominal rate (as a decimal) in the key pad .04 Hit 2nd ex (find ex above the LN button six rows down on the left column) Subtract 1 from your answer to get .0408 or 4.08%.