The E-Commerce Cost-Benefit and Investment Appraisal Model

THE COSTS & BENEFITS

OF E-BUSINESS

REPORT

TO

SCOTTISH ENTERPRISE

February 2000

JLH Consulting

1.

INTRODUCTION TO THIS REPORT

Background to this Report

JLH Consulting was commissioned by Nigel Laurie at Glasgow Development Agency

(GDA) in January 2000 to develop an investment appraisal model, to help managers make better decisions with regard to investing in e-commerce.

Through its experience in running the e-Trade Package and providing support to

Glasgow companies, GDA had found that it was particularly difficult for companies in business-to-business markets to demonstrate the business case for investing in the implementation of e-commerce systems.

Objectives of the Assignment

The main aim of this piece of work has been to develop an investment appraisal model which can:

Help managers make objective and informed decisions as to whether or not to invest in e-commerce, so that they are aware of the costs, benefits and opportunity costs

Be used to convince Boards and potential funders to back such investments

Enable managers to track actual against projected costs and revenues

Methodology

The following research was conducted in the course of this assignment:

Desk research and Internet research including an extensive review of publications on investing in e-commerce and articles in journals and newspapers

A review of existing investment appraisal models within e-Trade and the Digital

Advantage programme

Interviews with Scottish companies which have implemented e-commerce systems or are considering whether to invest in e-commerce (Appendix )

Interviews with some suppliers, to find out what tools they are using when trying to convince companies to invest in e-commerce systems (Appendix )

Interviews with potential funders, such as banks, angels and venture capitalists

(Appendix )

Interviews with some of GDA’s e-commerce advisors and accountants, lawyers and other professional advisors providing assistance to companies (Appendix )

1

5.

6.

7.

Contents of This Report

This report summarises the key findings and conclusions from the consultancy work carried out by Julian Lawson Hill and Gordon Brown during January and February

2000.

The remainder of the report is structured as follows:

2.

3.

4.

Overview of Current Appraisal Models

Development of the E-Commerce Model

The Cost-Benefit Model

Quantifying Intangible Benefits

Risk and Sensitivity Analysis

Practical Tools

2

2.

OVERVIEW OF CURRENT APPRAISAL MODELS

Summary

Cost was identified in a U.S. study by Cahners In-Stat as the most common and greatest impediment to expanding e-commerce. Three basic cost concerns were identified:

Lack of funds for up-front implementation costs

Lack of monthly cash flows to maintain sites

The probability that there would not be a real return on investment

In reviewing what has been written in the press in this area, both in the United States and in the UK, we can conclusively say that companies on both sides of the Atlantic are finding it very difficult to justify the investment in e-commerce using current appraisal models.

Interestingly, most of those companies which have implemented or are in the course of implementing e-commerce solutions have not made detailed financial calculations or projections. They have just forged ahead with their investments.

The general consensus from those who are in favour of investing in e-commerce is that while the exact costs and benefits are difficult to measure, a good business case can be made in terms of the strategic benefits to companies from investing and the threats to businesses of not investing in e-commerce.

In Scotland as a whole, however, there are a lot of “e-com-sceptics”: Managing

Directors and Finance Directors who believe that it is only worth investing in ecommerce if there is a demonstrable effect on the bottom line. This scepticism suggests there is a need for a sound business model for e-commerce.

Current Investment Appraisal Models

A number of investment appraisal models have been used over the years to help managers and directors decide whether to invest in new plant, new processes and new technologies. Examples are:

Return on Investment

Return on Capital Employed

Payback

Cash Flow Analysis

Discounted Cash Flow

3

However there are problems in using any of these traditional methods without adaptation when considering an investment in e-commerce:

None of these traditional models is really comprehensive enough. A good model has to take into account a wide range of internal and external costs and benefits

The financial models over-emphasise the financial impacts and do not emphasise the overall impacts on the business

Some of the most important benefits of e-commerce are strategic benefits, which are difficult to quantify

It is difficult to put an accurate value on the reach of e-commerce in terms of potential customers

It is difficult to measure revenue and profitability attributable to the Web alone when other factors may also be important in the purchasing or supply chain

It is particularly difficult to forecast costs and benefits with a great degree of accuracy over time. It therefore becomes difficult to estimate discounted cash flows and other sophisticated financial models

Gut Feel

Most companies which have decided to invest in e-commerce have done so very much based on gut feelings:

If companies have perceived possible strategic benefits over their competitors they have invested in the e-commerce technology

Many e-commerce investments have also been implemented because of strategic threats from competitors

Several companies have just felt that it is worth taking a punt on e-commerce and are investing in it to see what return on investment it will bring, prior to investing more serious money

The E-Com Sceptics

Scottish businessmen are not generally noted for their wish to “take a punt” and this has been reflected in the GDA’s experience in the e-Trade Package. In constructing a model for e-commerce, it is important that various factors are included:

Where possible, costs and benefits should be quantified so that the effects on the bottom line is clear

4

The model should be balanced, so that it highlights the strategic and intangible benefits as well as the more tangible, financial costs and benefits

When the benefits of investing in e-commerce are not clear, two scenarios should be considered and worked through: the cost-benefits of investing in e-commerce and the impact on the business and the cost-benefits of doing nothing and the impact on the business in that case

The next section of this report goes on to look at the development of the E-Commerce model in more detail.

5

3.

DEVELOPMENT OF THE E-COMMERCE MODEL

Considerations in Developing the Model

When we were starting work on this project there were three considerations which we had in developing the model:

That it should take into account the heterogenous nature of Glasgow companies – all types of sectors and sizes of business, mixture of business-to-business and business-to-consumer markets

That it should be understandable, useable by and useful to marketing managers, managing directors and non-accountants

That it should be robust in terms of financial analysis and stand up to scrutiny from bankers, potential investors and financial managers

Glasgow Companies

Glasgow companies come in all shapes and sizes:

Medium and large sized companies, many of whom are well established and in

“traditional” Glasgow sectors such as engineering, industry and manufacturing

Smaller, fast growing companies, many of whom are in software, other high technology and service industries

Start-ups which are just getting under way

As in other economies, Glasgow has a mixture of companies servicing business-tobusiness and business-to-consumer markets. These companies have different commerce characteristics or attributes (shown in the box below):

Commerce Attributes

Business-to-Consumer

One-time, Occasional

Shopping, Browsing

Price, Availability

Buying Patterns

Buying Process

Buying Criteria

Business-to-Business

Repeat, Familiar

Ordering, Restocking

Service, Quality,

Delivery, Price

Transitory, Short-term

Usually Simple

Trading Relationship

Sales Transaction

6

Established, Ongoing

Often Complex

The model we have developed tries to take these characteristics into account, as well as the level of sophistication of the company with regards to e-commerce and its aspirations:

Client E-Commerce Sophistication

Customer-Facing

No experience of e-commerce and no web site at all

A basic brochure-ware site or on-line catalogue

A simple e-commerce site with on-line ordering

A more developed e-commerce site with on-line payment

Internal

No networking of internal systems

Basic networking of internal systems for internal issue

Linking of customers to internal systems

Linking of suppliers to internal systems

Full integration of customers and suppliers with the company’s systems

Other back-end features such as links to fulfilment, despatch, logistics etc.

Supplier-Facing

No links to suppliers

Basic information for suppliers

Full exchange of information with suppliers

On-line procurement

Use by Marketing Managers, Managing Directors and Non-Accountants

One of GDA’s main requirements was that the model should be understandable and useable by non-financial managers. This has been one of our main considerations in developing the e-commerce model.

We spoke to a number of Glasgow companies and also received a great deal of input from First Thursday members, many of whom are in the process of developing their own business plans. This greatly informed the development of the business model.

7

The idea of costs and benefits is widely understood by all businesspeople, not just accountants and economists, so this is the approach we have adopted in developing the model.

A checklist of the key costs and benefits was developed and is shown in the next section of the report.

Instructions and help on considering the main costs and benefits is given so that it is as easy as possible for a non-financial manager to use the checklist in his own situation.

The way in which the model should be used really depends on the target audience and what they will be expecting. At its simplest, the model might help the owner-manager consider the impact on his business; at an intermediate level, the checklist might help a manager to develop an outline business case presentation; and at its most sophisticated, the checklist can be used to help a non-financial manager develop a spreadsheet to justify the business case more formally in financial terms.

Robust Financial Analysis

One of GDA’s other requirements was that the model should be robust and stand up to scrutiny from bankers, potential investors and financial managers.

Again, the cost-benefit approach is recognised by accountants, corporate financiers and funders as being a sensible way for a company to consider the issues and present its business case.

In conducting the research for this project we have spoken to bankers, venture capitalists, angels, corporate financiers and a category of advisors which I have termed “fundfinders” for their input.

As a result, we have developed an Excel spreadsheet cashflow template, based on the cost-benefit approach, to help managers present a formal financial business case, should it be required.

8

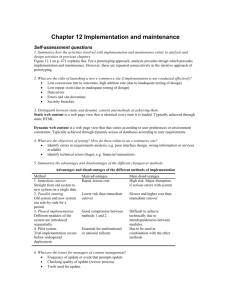

4.

THE COST-BENEFIT MODEL

The following two pages show the cost-benefit model which we developed, based on our review of the literature and extensive testing with companies and potential investors.

As explained previously this generic model has been designed with the following features:

The model is designed to be mainly used by existing businesses wanting to use ecommerce, but we have also tried to ensure it is applicable to dot.com start-ups

In designing it we have tried to consider as many different e-commerce business models as possible, using tangible and intangible benefits to build a balanced business model

At the same time, we have tried to keep the model relatively short and easy to use

The model is supposed to act as a prompt list for people to consider the issues

There is a "Help" section to guide users and explain any complicated issues

We have developed an Excel cash-flow analysis in parallel with this

Costs

The costs have been split into two categories as follows:

Implementation costs

Operational costs

Benefits

The benefits have been split into five categories:

Strategic business benefits

Tangible benefits

Tangible but non-financial benefits

Intangible benefits

Cost savings and cost avoidance

Risks and Sensitivity Analysis

The final section asks a number of questions related to sensitivity and risk analysis, which should be considered by companies as part of their consideration of ecommerce.

9

The E-Commerce Cost-Benefit and Investment Appraisal Model

Costs

Implementation Costs

Hardware costs, software costs, costs of integration with legacy systems

Costs of site development (in-house or outside consultants)

Project management costs

Staff costs (dedicated staff input required)

Training requirements

Internet access costs, hosting costs, domain registration fees

Initial marketing costs (traditional marketing methods, banner ads, registering with search engines, printing on literature, public relations)

Transaction costs

Costs of translations

Operational Costs

Site maintenance and development costs (in-house or outside consultants)

Costs of upgrading and adding capacity

Staff costs and costs of consultancy, if required

On-going staff training

Trouble-shooting

Internet access costs, hosting costs

Electricity and telecommunications costs

Security costs

On-going marketing costs (banner ads, e-mail shots, traditional marketing activities)

Fulfilment, distribution and delivery costs

Transaction costs

Costs of handling foreign enquiries (languages, currencies, VAT, duty)

Benefits

Strategic Business Benefits

Improved relationships with customers and trading business partners

Company’s image and credibility, meeting and exceeding customers’ expectations

Access to Global markets and new markets, international markets, new customers

Ability to tie in customers and suppliers

Accelerated product introductions

Threats of not investing in e-commerce, pre-empting actions by suppliers and competitors

Value of the business and creation of assets which would be valuable, could be sold on

Tangible Benefits

New customers and new markets

Increased market share

Cross-selling/ selling up

Increased revenues from sales

Revenues from advertisers

Move business into more profitable areas

10

Improved margin on direct business with customers

Reduced stock lead times

Improved stock control

Improved speed of processing

Improved accuracy of processing

Improved efficiency and productivity of staff

Tangible but non financial benefits

Improved communication between staff, customers and suppliers

Improved information on customers

Improved management information

Improved manufacturing information

Improved procurement information

Faster speed to market

Increase routes to market

Improved quality and accuracy of documents, reduced errors

Quicker turnaround of quotations and business proposals

Intangible Benefits

Improved customer service

Customer product tracking

Improved information on customers and feedback from customers

Improved customer satisfaction

Improved customer loyalty

Improved sales forecasting

Better materials requirements planning

Improved purchasing information

Improved production scheduling

Cost Savings and Cost Avoidance

Reduced communication costs (telephone, fax and postage)

Reduced costs of supplies

Reduced costs of procurement (staff time)

Reduced costs of sales literature and documentation

Reduced costs of trade exhibitions

Reduced costs of travel and time spent face-to-face with customers

Reduced costs of stock

Reduced costs of warehousing

Reduced costs of enquiry handling, order processing and administration

Risk and Sensitivity Analysis

How likely are the projected results?

By how much can they be wrong?

What are the risks to achieving these results?

What can we do to maximise the results?

Ability to ramp up or shut down activities as conditions dictate

Threats of not investing in e-commerce

Danger of alienating existing customers, agents, distributors, suppliers

11

5.

QUANTIFYING INTANGIBLE BENEFITS

Turning Intangible Benefits into Tangible Benefits

One of the most powerful techniques for strengthening the business case of an ecommerce investment is to attempt to convert intangible benefits (with no measurable monetary value) into tangible ones (with a defined monetary value).

£0

Unquantified

The Intangible-Tangible Value Continuum

£££££

Quantified

Benefits clear Benefits uncertain

No value/low value

INTANGIBLE

Real value

TANGIBLE

Do You Need To Quantify Them?

The key problem with the approach adopted by accountants and financial directors is that they look only at hard numbers such as costs, revenues, profitability and return on investment. However, the main benefits of investing in e-commerce may simply not be tangible.

By focusing in on the bottom line, there is a danger that the bigger, strategic picture is missed. It therefore makes sense to highlight the strategic issues as part of a balanced business case rather than prepare a line-by-line financial analysis. If there are particularly compelling business reasons why the company should be undertaking the investment, even though there is a negative or unacceptably low return on investment, these reasons should be stated.

The first question is therefore: do you need to quantify the strategic and intangible benefits at all?

12

Quantify the Value of the Benefit’s Effects

If you do have to attempt to quantify the intangibles, one method that may be used is to quantify the value of the benefit’s effects.

For example, “improved relationships with customers” may have a highly quantifiable effect on such things as customer loyalty and retention rates. One benefit may be to reduce the cost of sales; another may be to reduce marketing costs; another may be to increase the average order value; and new customers may be attracted by positive word of mouth.

The important thing is that the link between the effects is logical, the assumptions used are credible and therefore the target audience will find the case believable.

We have listed some of the most important of the benefit’s effects under the “tangible benefits” section of the model.

Look for Links to Tangible Benefits

A second way is to look the other way round for links between strategic and intangible benefits to tangible benefits, using the headings outlined in the model.

Value the Cost of Not Investing in E-Commerce

A third method of attempting to present the cost-benefits in a way in which the intangible elements are highlighted may be to consider two scenarios:

1.

The value of investing in e-commerce and the impact on the business

2.

The value and impact of carrying on business without making the investment

This may help tease out a quantifiable value for some of the strategic and intangible benefits, which can then be incorporated into the financial analysis.

Use a Scoring Matrix

A scoring matrix is another method which can be used to present a balanced business case by taking into account strategic and intangible benefits as well as financial criteria.

One method of scoring might be to consider the importance of each strategic or intangible attribute as far as the company is concerned and then the likely impact in terms of cost or benefit of implementing the e-commerce solution.

In using a scoring matrix to build the business case, members of the Board would probably have to be involved in agreeing the importance of each attribute and the impact e-commerce would have. It would make little sense to develop the scoring matrix without taking into account the beliefs of the Board at an early stage.

13

On the other hand, using a scoring matrix may help the person making the business case to focus in on those strategic and intangible benefits which are likely to be of most importance and interest to the company.

Example

In the following example, the importance of each attribute to the company is scored out of 10 (0 = not at all important to 10 =extremely important) and the potential impact of e-commerce from –10 to +10 (-10 = negative impact, 0 = neither positive nor negative impact and +10 = very positive impact)

Improved relationships with customers and trading business partners

Importance 9/10

Impact of e-commerce +8

Score: 9 x 8 = +72

Company’s image and credibility, meeting and exceeding customers’ expectations

Importance 6/10

Impact of e-commerce +5

Score: 6 x 5 = +30

Access to Global markets and new markets, international markets, new customers

Importance 2/10

Impact of e-commerce +9

Score: 2 x 9 = +18

So, in this case, the presenter should highlight the importance of improved relationships with customers and trading business partners.

Conclusion

First, managers responsible for preparing the business case for investing in ecommerce should consider their target audience.

While a financial analysis is important, the Managing Director, the Board and potential investors should consider the strategic benefits of e-commerce for their company and the extent to which e-commerce will help achieve the company’s strategic objectives.

If there is still a need to prepare a more detailed business case, there are several techniques which can help the manager to value the most important strategic and intangible benefits in financial terms.

14

6.

RISK AND SENSITIVITY ANALYSIS

Uncertainty and Risk

One of the biggest difficulties in preparing a good business case to justify an investment in e-commerce surrounds the uncertainty of future costs and benefits, revenues and profitability. It therefore makes it very difficult to determine the return on investment with any accuracy.

Uncertainties which might have major impacts on future projections include:

Estimated transaction volumes

Predicted future prices

Competitors’ actions

Changed market conditions

One other feature of e-commerce is the speed of change. Managers need to consider the flexibility of the business to respond and how quickly production and sales can be either ramped up or scaled down, depending on business generated through ecommerce.

Questions Which Might Be Asked

Senior managers and the Board might ask questions like these:

How likely are the projected results?

By how much can they be wrong?

What are the risks in achieving these results?

What can we do to maximise the results?

An Appropriate Response

The danger is that without some sort of risk and sensitivity analysis, senior managers and the Board may set higher “hurdle rates” or require shorter payback periods for ecommerce because of what they see as the inherent risks.

There are many complex methods of conducting risk and sensitivity analysis, but the most important thing to do is to identify those assumptions which have the most impact on the bottom line. These can then be varied and plausible pessimistic and optimistic scenarios produced.

At its most simple, a best case/worst case scenario can be produced. When placed alongside the assumptions, this will enable other managers to consider an e-commerce investment in the same way as any other business investment and decide accordingly.

Use of risk and sensitivity analysis can therefore improve the plausibility of the business case to sceptical business managers.

15

7.

PRACTICAL TOOLS

The Model

Returning to GDA’s objectives, we have tried to develop a model which:

Takes into account the heterogenous nature of Glasgow companies

Is understandable, useable by and useful to marketing managers, managing directors and non-accountants

Is robust in terms of financial analysis and can withstand scrutiny from bankers, potential investors and finance managers

For ease of use, we have split the generic cost-benefit model in two:

A model for existing businesses looking to implement e-commerce

A model for new dot.com start-ups

The cost-benefits for both are the same, but we have attempted to highlight what we believe to be the most important attributes for each group.

Help Section

A “Help” section has been developed to provide assistance to business managers unfamiliar with any terms covered in the model.

Use of the Model

As indicated in one of the previous sections, we would see the model being used potentially in three ways:

To aid managers in the thinking process and to help them consider the costs and benefits of e-commerce for their business

As an outline for presentations to senior managers and the Board

As the basis of calculations for a spreadsheet which will present the financial data simply and concisely

The Spreadsheets

Two cash flow spreadsheets have been developed in line with the two versions of the generic model: one for existing businesses; the other for dot.com start-ups.

16

In developing the spreadsheets we have attempted to stay as close to the cost-benefit model as possible so that managers can slot in values quickly and easily.

Although normally a cash flow analysis would be required over three years for business planning purposes, many of those we spoke to felt that it would be very difficult to project more than two years ahead. Consequently, the spreadsheets cover two years.

A feature of the spreadsheets is a one page financial summary which can be used for discussions with senior managers and directors. The detail behind this summary page lies within the two pages of month-by-month analysis.

Simple questionnaire

One other tool which we have developed is a simple financial questionnaire which is designed to prompt users at the beginning of the process and help them determine the level of depth of financial analysis needed.

GDA’s e-Trade Website

We would recommend that GDA puts up the following elements on its e-Trade website:

The financial questionnaire

The E-commerce Models

The “Help” Section

The Excel Spreadsheets

This report (for users who require more background)

17