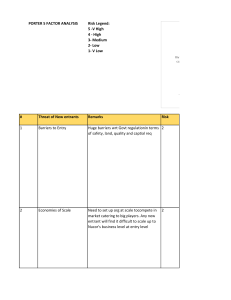

Evaluate Nucor's strategy using Porter's Competitive

advertisement

1. Evaluate Nucor's strategy using Porter's Competitive Strategy Framework. “Nucor achieved its position…by carefully monitoring costs and paying attention to the needs of its markets. This strategy of providing customers with a competitive product at competitive prices has brought success and growth to Nucor, in sales, income, and stock price.” Michael Porter offers the five forces model as a way of adding sophistication to this analysis of the environment. The five forces are; industry competitors, new entrants, bargaining power of customer, bargaining power of buyers, and substitutes. The first is industry competitors, which is the intensity of rivalry among firms in the industry. There are two basic types of competition; price and quality. Nucor focused on the manufacturing segment know as minimills and thus saved on costly labor, raw materials, and the capital-intensive machinery necessary to produce steel from iron ore. “Nucor was able to expand sales from the minimills by keeping costs below its competitors.” Also, another means of maintaining quality control and costs was a “highly decentralized organizational structure.” Corporate staff was kept to a minimum and individual plant-level mangers were given authority on decisions. By using the minimills and keeping the corporate staff to a minimum, costs would be kept at a minimum and quality would still be maintained; thus keeping the industry competitors in a need to keep up. The second is new entrants which were threats of new competitors entering the market. As was said before; the minimills and minimum corporate staff helped keep prices below competitors. In addition, the risk of adapting an untested German process for manufacturing flat steel also paid off and helped get the company ahead of the competitors. This process was quite a risk for the Nucor Company but Ken Iverson, CEO, made the decision and luckily it paid off. Again by keeping price down and quality up, new entrants were kept from coming in and if they did decide to enter it would take them a lot to get up to Nucor’s level. The third and fourth are the bargaining power of consumer and buyers and these two are controlled by also keeping the costs down and the quality up. As long as Nucor carefully monitored costs and paid attention to the needs of its markets, then it had the upper hand in the decisions of the company because as long as they keep the top standing as cheapest and best quality production, then the consumer and buyers have no where else to go and thus can only follow what Nucor decides and therefore gives it the upper-hand. The fifth force is substitutes which is the threats of substitute products or services. This also is answered with; as long as prices are kept at a low and quality kept at a high then Nucor has the upper hand and people would have no need to go and find other substitutes elsewhere. 2. Evaluate Nucor based on Miles and Snow's Adaptive Model. “The Miles and Snow adaptive model of strategy formulation suggests that organizations should pursue product/market strategies congruent with the external environments. A well chosen strategy, in this sense, allows one organization to successfully adapt to environmental challenges.” There are four strategies; the prospector strategy, the defender strategy, the analyzer strategy, and the reactor strategy. “The prospector strategy involves pursuing innovations and new opportunities in the face of risk and with prospects for growth.” The risk of adapting an untested German process for manufacturing flat steel paid off and helped get the company ahead of the competitors but was quite a risk for the Nucor Company but Ken Iverson, CEO, who made the decision. Nucor also took a chance on the manufacturing segment know as minimills and thus saved on costly labor, raw materials, and the capital-intensive machinery necessary to produce steel from iron ore. “Nucor was able to expand sales from the minimills by keeping costs below its competitors.” “The defender strategy is where an organization avoids change by emphasizing existing products and current market share without seeking growth.” This was done through their “highly decentralized organizational structure.” Corporate staff was kept to a minimum and individual plant-level mangers were given authority on decisions. This structure was not changed even through expansion and increase in products. “The analyzer strategy seeks to maintain the stability of a core business while exploring selective opportunities for innovation and change.” Their “highly decentralized organizational structure” was never changed throughout their growth but Nucor was always trying to expand and take chances with products in order to get ahead. “The reactor strategy is primarily responding to competitive pressures in order to survive.” The strategy of providing customers with a competitive product at competitive prices has brought success and growth to Nucor, in sales, income, and stock price. This need to keep prices down and quality up, has always given Nucor an upper hand in competition. 3. Is Nucor capable of continuing its entrepreneurial spirit as it grows larger? “Nucor achieved its position…by carefully monitoring costs and paying attention to the needs of its markets. This strategy of providing customers with a competitive product at competitive prices has brought success and growth to Nucor, in sales, income, and stock price.” This strategy, yes, will keep Nucor capable of continuing its entrepreneurial spirit. But, as Nucor combines with U.S. steel, the company will have more and more responsibilities ad production and thus will need more staff in order to function properly and efficiently. Though, an entrepreneur should be willing to pursue opportunities in situations others view as problems or threats. This would be harder for a larger company, to take chances b/c if it were to fail, it would be harder fall and thus would produce a larger problem.