WORLD TRADE ORGANIZATION

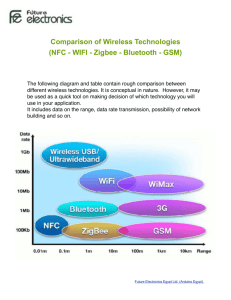

advertisement