THE EVOLUTION OF FAMILY LIFE INSURANCE

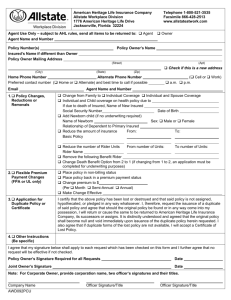

advertisement

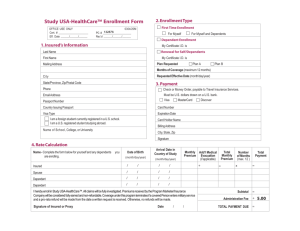

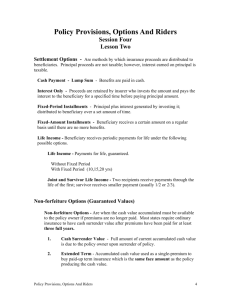

1 THE EVOLUTION OF FAMILY LIFE INSURANCE (JUST HOW MUCH IS TOO MUCH) By: James W. Neal, CEO Gold Cup Financial, Inc 2 THE EVOLUTION OF FAMILY LIFE INSURANCE “HOW MUCH IS TOO MUCH” Since its inception the life insurance industry has been an integral part of financial planning for the family. It has been used for burial expenses, the providing of an instant estate, and for planning for the unforeseen events of life such as early death or disability. I remember my Dad saying to me when I married my high school sweetheart, “Son the first thing you need to do is buy some life insurance.” Of course he never said how much or what type of life insurance was the best to buy, simply BUY SOME. Sad to say probably most of you have followed in similar foot steps when purchasing life insurance for the first time. Most articles that have been written about the purchase of Life Insurance have either been written by intellectuals that appear to be educated “beyond their intelligence” or by those who have a tendency to over-simplify the merits of this product thus reducing it to a “not so important” purchase. I have spent the better part of three decades sitting across kitchen tables, desks and even car hoods explaining the merits of this “miraculous” product, often experiencing the attitude that the prospect felt they knew as much as I did about its intrinsic worth. In retrospect I can see why this attitude is so prevalent in our society today. Life insurance is extremely versatile in its applications, as well as flexible in its types and combinations, and no T.V. or radio commercial, no single article or even company pamphlet can begin to solve the thousands of situations in which Life Insurance can be an instrument in solving family emergencies. With over 4 out of every 5 households being “under-insured”, and over 60% of the adult population having no personal life insurance (they are covered by 3 group insurance only) the need for personal life insurance is at an all time high. Multiply these facts by the ever changing economy with its escalating prices and the uneasiness of the job market, and it reaches an epidemic level. Thinking about purchasing Life Insurance is not one of those decisions that is foremost on our minds, is it? After all to think about Life Insurance you have to think about DYING!! One must face their own mortality to think about life insurance, and if you are a man especially a “young man” you feel as though you are invincible. Do not let me shock you but YOU ARE NOT!! Every year thousands of young men and women die for any number of reasons, from cancer to accidents, and more often than not leave a struggling family behind. The worst situation is that the family not only is grieving from the loss of Daddy or Mommy but now struggles with financial situations they never dreamed of having to face. No one intentionally desires to leave their families in this situation. When should you purchase Life Insurance? What type of plan should you purchase? These questions and hundreds of variations usually go through a person’s mind when deciding to purchase Life Insurance. There is an old adage that goes like this; “buy as much as you can, as young as you can, for as long as you can for as inexpensive as you can.” That is very simplistic yet contains much truth; albeit too vague when considering such a valuable purchase; however if you do not want to think too deeply about your purchase then this philosophy is as good as any, and better than most. 4 A Life Insurance Plan should be purchased as soon as possible when beginning a career, a marriage, a family or a business. It also should be reflected upon thoroughly when considering a major purchase such as a house with a mortgage, business property or expensive machinery (in this day and age many cars fit that criterion). Notice we speak of a plan not a policy. Too often a family just begins to buy policies without much consideration given to any type of planning, and although better than no protection that method tends to lead to an accumulation of policies without much of a strategy. Normally what happens is that this accumulation begins to look like a “bundle of trash” and after a short time is often treated like the “weekly garbage” and is thrown out or discontinued leaving the family without those policies valuable protection. Allow me to illustrate. In the mid-1970’s while working with a Life Insurance Company domiciled in the mid-west, whose target market was the farm family. I spent my days driving up and down the country roads visiting with these wonderful hard working mid-western farm families. On one such day in rural Buffalo Center, IA, I called on a young farm family with six children and very loving hard working parents, as with most small family farms in rural northern Iowa they raised a few hogs, cattle and did some row cropping mainly corn and soy beans. James Murra was a large man of German decent with absolutely huge hands and a heart to match. His wife was your typical farm wife who although busy with the six children was not adverse to pulling on a pair of coveralls and going to work outside in the barn or fields. The father like so many of his era had purchased between five to seven different policies over the years ranging from small whole life policies to even 5 smaller (more expensive) endowment plans. After talking with him extensively over the next several weeks we were able to develop a plan that would better cover his debt and provide income for his wife allowing her to remain on the farm and raise the children should he die prematurely. We were able to place a $250,000 program (rather substantial in the 70’s) as well as putting the existing policies on the paid up life insurance option giving him almost ten times his original coverage at the same or less annual cost. I remember Jim saying to me “I sure feel better with the plan I now have to protect my family.” As I left the Murra family farm that day, I believed I would deliver him his cash value check at age 65 rather than a death benefit; unfortunately however that was not to be the case for this family. Approximately seven months after that program was in place he developed pancreatic cancer and died within a relatively short period or time. The last I heard (I had moved from Iowa to Texas) the Murra family was able to pay off the loans and stay on the farm because to that Life insurance Program. Thousands upon thousands of stories like this one could be told by any number of insurance counselors and sales people substantiating the value of Life Insurance Protection. The real challenge and one that should be given a tremendous amount of consideration is the type of plan that is needed and purchased. Every family’s needs vary according to family size, age and financial circumstances. 6 Fundamentally there are two types of insurance plans: (1) Permanent (2) Term coverage’s. Permanent plans, in a “nut-shell” are defined as policies that are meant to be in force for the insured’s entire life. They generate Cash values over the years that may be used for emergencies throughout the life of the contract. Of course if used and not paid back the loan amount is deducted from the final death benefit. Often families will purchase a large permanent insurance plan to help subsidize their retirement years, or to assist in paying for higher education for their children. These are only two examples of why Permanent Life Insurance might be considered. Permanent Life Insurance has primarily three distinct yet very different types of plans. Whole Life Insurance Plans Universal or Flexible Premium Life Insurance TAX FREE retirement planning (go to: http://goldcup.thefamplan.com ) 0 Whole life is the oldest form of permanent plans and 25 years ago and longer there where many variations of this product. At the core of all whole life plans can be found the following characteristics. 1. Guaranteed premiums for the Life of the insured. These premiums are “set in stone” and cannot be changed without restructuring the entire contract. 2. Guaranteed Cash Values equaling the face amount of the policy at age 100 e.g. a $100,000 whole life policies’ guaranteed cash value would equal $100,000.00 at the insured age of 100. Cash values may be borrowed at “any” time and for “any” reason or use and repaid at a nominal interest to the insured. 7 3. Various and sundry settlement options should the insured decide not to keep the insurance for their entire lifetime. Universal Life or Flexible Premium Life Insurance is the most popular type of permanent Life Insurance sold today. It is also the “new boy” on the block” so to speak as its history only dates back to the late 1970 early1980’s. The core characteristics for these policies are: 1. Premiums are flexible. There are 3 basic premiums that the insured can choose at his or her discretion. Target premium: the premium designed to keep the policy and its values in tact for the insureds entire life. Minimum Premium: the bare essential to keep the policy in force for a given length of time, usually 17-30 years depending on the age of the insured at the time of purchase. Maximum Premium: the maximum amount of premium allowed in the IRS code to be paid into the plan without incurring income tax penalties. The insured can choose any premium between the minimum and maximum at any time. 2. Level or Increasing Death Benefit: The insured may choose between a level death benefit and an increasing death benefit that pays the beneficiaries the level death benefit plus the increasing cash values at the time of the death of the insured. 3. Cash Values that are internally affected by: The companies declared interest rate (with a minimum guaranteed interest). 8 An external indexed account such as the S & P 500. (Very popular option.) A combination of the two Pure “Cost of Insurance” for the insured’s age Company expenses which diminish and disappear over time, 4. As with the Whole Life Plans the settlement options are available. This is a very rudimentary overview of the types of Permanent Life Insurance policies available and is intended to draw the attention of the reader to the various aspects and not to fully educate. The most popular and widely purchased life insurance is TERM life. As its name implies it is purchase for a specified term of time i.e. 10, 20, 25 or 30 years. At the end of the stated term, the coverage is no longer in force or the death benefit valid. Although most term programs are now guaranteed renewable to age 95, at an increased premium of course, term Insurance is the least expensive and very good for situations where LARGE amounts of insurance are needed such as: 1) a mortgage, personal or business, 2) for income replacement for husband or wife to off set expenses while raising the children after the death of the spouse 3) for business buy sell agreements between business partners 4) to secure the repayment of loans. 9 Many individuals fall prey to the “group insurance dragon.” We call it a dragon because in essence it is just that, a DRAGON sitting in its ornate hideout looking to devour any who come within its range. Group insurance is a term product offered to many individuals at the workplace, AS LONG AS THEY REMAIN EMPLOYED!! The minute they leave, whether by choice, lay off or firing, they loose the coverage or have to convert it to an individual plan at considerable larger premiums. Group insurance lulls employees into an almost comatose slumber feeling content believing they are adequately covered. With the average person changing jobs a minimum of 5 times in a working life time Group insurance is a good additional benefit, but should NEVER be relied upon when considering a family or individual Life Insurance Protection program. A full 59% of Americans that own life insurance rely on group insurance ONLY for their families’ life insurance protection. 10 A recent LIMRA INTERNATIONAL Study indicated that nearly 60% of all adult Americans, that have life insurance, rely on their GROUP INSURANCE totally for their protection. This fact alone leaves their families vulnerable should they lose their jobs, and with the same study indicating that after only two years of a death half of the widows and one-third of the widowers are just getting by financially this problem looms large on the financial security of the American family. One final type of coverage to consider which is comparatively new yet one that most of the major “old line” Life Insurance companies are now developing are TERM WITH THE RETURN OF PREMIUM. In over a quarter of a century of experience in the Insurance Industry I believe this concept to be the GREATEST development to “hit” the life insurance industry scene bar none. Simply defined it guarantees a return of all premiums paid should the insured not die during the term period chosen. It out performs many the permanent life plans when you look at cash GUARANTEES in 15 to 20, or even 30 years, and at a fraction of the cost to the families. This is a product that most financial planners, bankers and insurance counselors are now recommending to their clients. Return of premium term is an idea whose time has come, and whenever that climate hits the business market its growth is outstanding. Businessmen are using its values for buy sell agreements and key man insurance as well as the working man who desires to protect his family and “hedge his bet” that he will live to the terms fulfillment. 11 One of the oldest and most trusted names in Life Insurance offers a 30 year old healthy male $500,000 of insurance coverage for as little as $38.50 per month. To add the “return of premium” option the premium increases to only $52.50/ month an increase of only $14.00 per month. Get your calculator or pad and pencil out and do the math as to the benefits of that additional $14.00/ per month. Over the 30 year period the prospective insured will pay only an additional $5,000 ($14.00 X 360 months); however for that additional input he will receive a GUARANTEED $18,900.00 ($52.50 X 360). The additional monthly funds guarantees $3.75 return for every additional dollar paid. I defy you to find a Mutual Fund Broker, Stock Broker or any other investment counselor that will guarantee you $3.75 for each dollar saved or invested with the saving rate of only $14.00 per month. Now for the REAL question “how much is too much?” This question has been at the heart of insurance industry for as many years as it has been in operation. That question varies according to the nature of the need for the insurance protection be it family income protection, mortgage protection, education planning etc. For our thoughts we will limit our discussion to the family unit and the various reasons for purchasing Life Insurance protection. 12 In the beginning life insurance was purchased for the purpose of paying for the funeral of the person choosing to be protected. In the embryo stages of the Life Insurance business the salesmen literally went door to door and after selling an individual or family would have to return month after month to collect the premium. They were known as “debit” insurance salesmen. Most of the major companies that have long and distinguished records began this way and a few actually still maintain a debit insurance force. This concept remained viable as long as extended families continued to care for the widow or widowers that could no longer maintain their standards of living through practical jobs or other sources of income; however as families began leaving the farm, small towns and factories (that often employed generation after generation) needs for other types of insurance policies became essential. As the “ordinary” business grew and matured, Life Insurance companies found new and expansive ways to market their product as well as visionary uses for its product. Throughout the years men and women have always asked “how much do I need?” and as long as they asked the questions the Life Insurance industry provided the answers, so that today Life Insurance contracts are varied and can become somewhat complex. Companies vary as to the amount they will allow an insured to purchase. No company desires to insure an individual to the point that they are truly worth more “dead than alive” to their beneficiaries. (A phrase that is heard all too often by most insurance sales people) All the companies have formulas as to the amount they allow; trying to cover all of them would be too cumbersome in this short treatise; so we will speak in broad generalities. 13 If you are a young average family with a dad, mom and 2.3 children (I do not know what to do with you .3 of a child), you will have different needs than a D.I.N.K family (dual income no kids). Speaking generically for the young family it is fair to imagine that you need somewhere between 10 to 15 times the chief bread winners annual income. For example if the man is primary income earner and mom a stay at home mom, and Dad earns 50,000 dollars per year than the family should have between $500K and $750K in Life Insurance protection. Most professional insurance and financial planners believe that a minimum of five times’ the insured’s annual income is the bare essential for financial recovery. Recovery being defined as “just getting back on one’s feet” financially leaving no extra money for any of the hopes and dreams the family once had dreamt. In the United States today only 61% of adult Americans even have Life Insurance protection, and of those that do the average amount is only three times their annual income. This amount barely covers mortgages and final expenses leaving little if any for on going living expenses or emergencies or medical bills. Ex. If the insured’s income is $50,000 per annum, financial planners recommend a minimum of $250,000 in Life insurance protection. The national average of those even having Life Insurance is only $150,000, leaving their families woefully short of the needed protection. If we assume a mortgage and the average amount of debt, with dad and mom both working and sharing in the income production, then perhaps eight (8) times each of their income would be sufficient. Please remember that every 14 situation is different and demands much thought, planning and the help of an insurance professional. Young couples or middle aged couples with no children to care or be responsible for pose a different set of circumstances when tallying the amount of life insurance needed. Most couples will want to always carry enough Life insurance protection to cover all debts and mortgages. In addition they should consider each others individual’s special needs that may be apparent. For example many ladies (for which my wife was one) have sacrificed career and “things” to stay home and rear the children and thus enter the work force later in life with a diminished earning potential. In this case the husband might want to “carry” additional protection to help supplement what his wife might earn. As you can be seen the amount of Life Insurance varies drastically based on each individuals needs and desires. This is why I believe an honest and sincere insurance counselor is a MUST in today’s economic climate. He or She can help you enormously navigate the waters of uncertainty, and make sure with the proper use of products available that you and your family can rest assured that in the event of an unforeseen death it can stay together and continue to live to the standard you have chosen. 15 Allow me to close with a short illustration: When death occurs, and it does for all of us: “YOUR attorney, for a fee, will allow you to keep what is already YOURS. Your clergy will be of comfort with prayers and tears, which is extremely important; HOWEVER IT WILL BE ONLY YOURLIFE INSURANCE COUNSELOR THAT SHOWS UP, AT THAT ALL IMPORTANT TIME, WITH THE MUCH NEEDED CASH YOUR FAMILY WILL NEED to help them make it through an already difficult time. MAY YOUR LIFE BE RICHLY BLESSED ILLUSTRATIONS: Family # 1: MEMBERS INCLUDE - DAD (primary income earner) ANNUAL INCOME: $60,000.00 -MOM (stay at home mom) -Three children ages 3, 5, 7 NEEDS: MORTGAGE OF $150,000 CREDIT CARD BILLS = $12,000 CAR NOTES OF = $ 21,000.00 GOALS: Wants to make sure that there is enough to cover debts and have enough money to cover educational expenses in the future RECOMMENDATIONS WOULD BE: “The Ultimate Income Plan” with benefits to include: 1. Immediate death benefit of $210,000 (enough to cover the mortgage, credit and car bills and final expenses and 3 months income to make it to SSn benefits. 2. Immediate monthly income of $2500.00 for 15 years to get the youngest through high school. 3. Final Lump sum of $100,000.00 to educate the children and help Mom get back in the job market 16 Family # 2: Consists of Husband and Wife with 3 grown children: AGES 45, 42 - Re-financed the house to make (FOR 15 YEARS) Improvements and take an extended Vacation. -They have minimal debt outside of the Mortgage. - Both are employed and income is no Challenge RECOMMENDATIONS MIGHT INCLUDE: 1. A FIFTEEN YEAR TERM WITH THE RETURN OF PREMIUM 2. $100,000 Universal Life with premiums payable for 20 years, with accelerated premiums; in order to allow the policy values to grow throughout their life times. 3. A policy that names their grand-children as contingent beneficiaries to assist with College funding should they die before competing their plans, Family # 3 Husband disabled from an accident and unable to help with family income due to a back injury age 50 Wife primary income source Between her earnings and his limited government disability they can live comfort ability now however death to either one of them would leave the surviving spouse in “dire straits”. Each of them has a small “Burial Life Insurance Plan.” Recommendation would be the monthly income life Policy which would pay the surviving spouse a monthly income for life to match the income needed to maintain the current standard of living. 17 These are only three of the thousands of applications for life insurance. Should you have questions about these or any other situations feel free to call toll free: Gold Cup Insurance 1-800-459-9640 661-392-4111 -orVisit us on the “web” at: www.goldcupfinancial.com