Q3 2015 Wealth Management Service Moderate Portfolio Fund Fact

advertisement

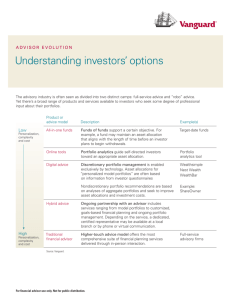

September 2015 Moderate Model Portfolio Q3 2015 Registered in England and Wales, number 7239722. Registered office: as above. Avidity Wealth Management Ltd is an appointed representative of CAERUS Financial Limited, Building 120, Windmill Hill Business Park, Swindon SN5 6NX which is authorised and regulated by the Financial Conduct Authority 2 Moderate Model Portfolio – Q3 2015 Key Facts The Model Portfolio Service for Avidity Wealth Management was established in October 2010. Asset allocation is provided by Avidity and sourced from Ibbotson. Morningstar OBSR populates the asset allocation with funds it considers appropriate and attractive as a result of its in-depth, qualitatively-driven research process. The objective is to deliver outperformance in each of the asset classes of the Portfolio over the long term. Investment Objective The investment objective, as provided by Ibbotson, is as follows: The Moderate Portfolio will best suit the investor who seeks relatively stable growth from their investable assets offset by a low level of income. An investor in the balanced risk range will have a higher tolerance for risk and/or a longer time horizon than either of the income or cautious investors. The main objective of an individual within this range is to achieve steady portfolio growth while limiting fluctuations to less than those of the overall stock markets. Asset Allocation1 Performance from 31/12/2008 – to quarter end Growth Total Return, Tax UK Net, In GBP The Custom Benchmark (CB) used to measure performance is a composite that reflects Ibbotson’s asset allocation output. It is amended over time in line with Ibbotson’s output (last updated in May 2013). As at the end of the quarter the benchmark is composed of the following: 4% BBA LIBOR GBP 3 Months/3% IPD UK All Property/8% FTSE Gilts All Stocks/10% IMA £ Corporate Bond Average/4% FTSE Index-Linked All Stocks/10% IMA Global Bond Average/25% FTSE All Share/8% FTSE World Europe ex UK/13% S&P 500/6% MSCI Emerging Markets/5% MSCI AC Far East ex Japan/4% Topix. Please refer to the information in the footer below regarding performance. Please refer to the information in the footer below regarding performance. How to choose the correct portfolio for you – the risks and costs We have aligned ourselves with two key strategic partners to offer you a portfolio that is designed to provide you with the correct balanced of risk and return. Although there are many, some of the more risks that I would like to draw your attention to are: Risk of capital – the risk that you will have returned back to you less than your original investment Purchasing power – the risk that your money is devalued by inflation Market – this risk reflects the tendency for investments to move with the market or entire industrial group or for a particular security, as a result of factors such as economic, political or social events – also known as systematic risk Financial – this risk is associated with the finances of the company. Does it have too much debt (the recent declaration of bankruptcy by Enron is a prime example) Interest rate – this risk involves how changes in interest rates may affect your investment Default – this risk is the chance that the company you are invested in will be unable to service the debt Foreign currency – this risk is that a change in the relationship between the values of the UK Pound and the value of the currency of the country in which your investment is held will affect your holding. This is an important risk for international investing 3 The costs There are known costs for portfolio management: Cost of investing – these can be broken down as such: Cost of product Cost of funds Cost of advice Tax – tax drains on portfolio performance over time Cost of not reviewing – perhaps one of the greatest costs on fund management and this refers to the cost of purchasing an investment and not reviewing it. As investments go in and out of favour, if a portfolio is not reviewed then it is possible for poor investments to be held for too long within the portfolio offsetting gains or causing a loss. How our portfolio reduces the cost and risk to your money – common benefits We have designed our portfolio to limit the risk associated with making investments and to provide you with multiple benefits. The “Moderate range” portfolio has the following risk mitigating benefits: Maximising the chance of your fund maintaining its purchasing power – we have invested in a selection of asset classes that when combined, provide your portfolio with a good chance of maintaining its purchasing power. Although we are comfortable that this blend is appropriate for you, it is important that you recognise there is no guarantee that the growth of your fund will match inflation and as you are in investments that contain an element of risk to capital it is possible that you could receive back less than you originally invested. Reduction of risk through diversification across asset allocation – the portfolio is diversified to the asset allocation detailed in the pie chart above. This reduces the risk by investing in a range of assets or sectors. A commonly accepted academic theory by Brinson et al states that asset allocation decisions are the primary determinant of portfolio returns, above market timing and stock selection. With this in mind, we have engaged the services of Morningstar who provide us with the correct asset split for moderate investor risk tolerance. Reduction of risk through diversification across company – the portfolio contains a selection of “collective” investments. Effectively this means that each individual investment that we recommend – i.e. the Avidity Wealth Management Moderate Portfolio contains a selection of investments. By blending funds in this way, we diversify across funds as well as across individual investment spreading the risk across many investments. Sterling denomination – the portfolio is contained within Sterling denominated investments which reduce the cross currency risk. Reducing the tax drain – given your current and expected future situation, we will structure your investments in a tax efficient form. We can review your tax efficiency on an annual basis as part of our review service and will take advantage where possible of the various tax efficient routes to invest. Reducing the cost of non-review – as part of our service we can offer a review in which we can review your attitude to risk, the asset allocation that your investments are within and the individual funds that you are invested in. We recommend that you partake fully in this review. Minimise the cost of investing – in our analysis we have analysed the cost of investments and on balance, we have opted to implement a Wrap Platform which provides you with initial and annual discounts on funds whilst allowing us to place any investments that may be appropriate for you going forward. The costs of these funds on and off platform are listed below. How our portfolio reduces the cost and risk to your money – specific benefits and risk As with most things in life, investing is about providing balance between conflicting issues. The portfolios have been designed to be consistent across asset allocation and mandate and we are confident that each of the portfolios are appropriate for a moderate risk profile. 4 Avidity Wealth Management Moderate Portfolio To provide our clients with a multitude of benefits, we have blended together a portfolio that contains holdings that are designed to be actively managed and reviewed quarterly by OBSR. We have complemented this with passive satellite funds to provide your portfolio with exposure to other markets. The satellite funds are provided by Vanguard. Avidity Wealth Management Moderate Portfolio % Asset Allocation Asset class Suggested % Fund Weight 7 Cash 7 Cash Property 5 Threadneedle UK Property Trust 3 M&G Property Portfolio 2 Fixed Interest UK Gilts 5 Royal London UK Government Bond Vanguard UK Government Bond 3 2 UK Corporate 8 UK Inflation-linked 4 Global Investment Grad ex UK 10 Fidelity Strategic Bond M&G Strategic Corporate Bond Vanguard Investment Grade Bond L&G All Stocks Index-Linked Gilt Indx Vanguard UK Infl-Linked Gilt Index Invesco Perpetual Global Bond Vanguard Global Bond 2.4 2.4 3.2 1.6 2.4 6.4 3.6 Check 7 5 27 UK Equity 27 Europe Equity North America Equity Emerging Markets Equity Asia Dev Ex Japan Japan Equity 8 10 6 4 6 Vanguard FTSE UK All Share Old Mutual Alpha UK CF Woodford UK Equity Income AXA Fram, UK Select Opportunities M&G Recovery Investec UK Special Situations 10.8 4.2 4.2 2.4 2.1 3.3 27 Henderson European Select Opps Jupiter European Special Situations Vanguard Developed Europe ex UK 3.0 2.4 2.6 8 HSBC American Index JPM US Equity Vanguard US Equity Income 2.6 3.0 4.4 10 Lazard Emerging Markets M&G Global Emerging Markets Vanguard Emerging Market Stock 3.2 1.2 1.6 6 Fidelity South East Asia 3.0 Vanguard Pacific Ex Japan 1.0 4 Schroder Tokyo Vanguard Japan Stock 3.0 3.0 6 Advantages Blend of advantages – this portfolio offers a blend of advantages offered by the Vanguard and OBSR portfolios Liquidity – the funds can be traded easily which means you can have access to your capital at anytime Exposure – by combining these portfolios, you are able to gain maximum exposure to the markets, through active and passive management Cost – by combining the two portfolios, you benefit from a cheaper annual charge which is lowered due to the use of the Vanguard funds, yet you still get the exposure to actively managed funds provided by OBSR 5 Disadvantages Potential tax – the income and gains from these funds are subject to taxation. To minimise the effects of these we will recommend that you use tax efficient wrappers and that we managed out any gain through capital gains tax planning Potential variation from index – as the fixed interest funds employ a strategy of samplification as opposed to full replication, there may be the potential for variation from the index (Vanguard funds) Potential returns below the index – as these funds are actively managed, it is possible for the manager to underperform the index and his peers (OBSR funds) FCSC Protection – only the UK based funds are subject to FSCS protection. The Irish based funds however, benefit from the appointment of an independent custodian which in effect ring fences the assets from that of the provider to provide a robust level of protection (Vanguard funds) The cost of this portfolio Asset Manager Asset Vanguard Vanguard Vanguard Vanguard Vanguard Vanguard Vanguard Vanguard Vanguard Vanguard Cash AXA Framlington CF Woodford Fidelity Fidelity Henderson HSBC Invesco Perpetual Investec JPM Jupiter Lazard L&G M&G M&G M&G M&G Old Mutual Royal London Schroder Threadneedle Emerging Markets Stock FTSE UK All Share Global Bond Japan Stock Pacific Ex Japan UK Inflation Linked Gilt UK Investment Grade Bond US Equity Index UK Government Bond Idx FTSE Dev Eur ex UK UK Select Opportunities UK Equity Income South East Asia Strategic Bond European Select Opportunities American Index Global Bond UK Special Situation US Equity Income European Special Situations Emerging Markets All Stocks Index-Lined Gilt Index Feeder of Property Portfolio Global Emerging Markets Recovery Strategic Corporate Bond Alpha UK Equity UK Government Bond Tokyo UK Property Trust Weighting % 1.60 10.80 3.60 3.00 1.00 2.40 3.20 4.40 2.00 2.60 7.00 2.40 4.20 3.00 2.40 3.00 2.60 6.40 3.30 3.00 2.40 3.20 1.60 2.00 1.20 2.10 2.40 4.20 3.00 3.00 3.00 Fund Management Charge Wrapper Charges 0.27 0.08 0.15 0.23 0.23 0.15 0.15 0.10 0.15 0.12 0.00 0.83 0.65 1.01 0.67 0.85 0.17 0.62 0.74 0.93 1.03 1.07 0.15 1.07 1.01 0.90 0.66 0.785 0.44 0.85 0.81 0.40 0.40 0.40 0.40 0.40 0.40 0.40 0.40 0.40 0.40 0.00 0.40 0.40 0.40 0.40 0.40 0.40 0.40 0.40 0.40 0.40 0.40 0.40 0.40 0.40 0.40 0.40 0.40 0.40 0.40 0.40 Who should purchase this portfolio? This portfolio should be considered by an investor that is: Somebody that wants a blend of benefits of active and passive funds Happy that only the UK fund based portion (of Vanguard funds) and the entire OBSR fund selection is covered by the FSCS Happy that the combination of asset classes provides enough protection from downward movements in one specific market Happy to pay their stamp duty and pre-set diluted level on an individual basis, rather than it being taken from the fund (Vanguard funds only) 6 How Avidity Wealth Management recommend this portfolio is implemented We recommend that this portfolio is implemented in the following way: Through the Avidity Wealth Management Wrap to enable us to enable us to access the funds in an administrative efficient way Re-balanced at a frequency agreed with your adviser Is placed in a tax efficient wrapper The OBSR fund selection is reviewed on a regular basis to ensure the continued stability of the fund manager