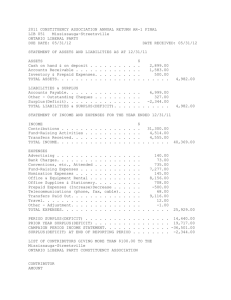

Financial Summary

advertisement

Council of Governors 2nd December 2015 Month 7 Financial Position 1. Introduction This paper provides an overview of the financial position for 2015-16 as at the end of October 2015 and a forecast for performance in the remaining months of the year 2. Year to date performance The table below sets out the year to date financial performance to date compared to the plan submitted to Monitor: £ M’s Plan Total Income Pay Non-Pay Total Expenditure EBITDA Year to Date £ M’s £ M’s Actual Variance % 254.80 264.01 9.21 3.61% (179.96) (71.84) (251.80) (181.41) (74.55) (255.96) (1.45) (2.70) (4.15) 1.65% 3.00 8.05 5.05 EBITDA % 1.18% 3.05% 1.87% Depreciation Interest income Dividends and other (5.44) 0.02 (4.78) (4.30) 0.03 (4.78) 1.13 0.00 0.00 Retained surplus/(deficit) excluding disposal Restructuring costs Impairment Profit on disposal Retained surplus/(deficit) (7.19) (1.01) 6.19 (1.81) 0.00 8.10 (0.90) (0.80) (1.01) 2.15 (0.66) 1.01 (1.01) (5.95) 0.24 To date the Trust’s financial position indicates: Overachievement on income by £9.21M due to additional contracts not included in the Monitor plan. Expenditure overspent by £4.15M against plan due to a combination of factors. This is partly due to schemes covered by the additional income such as winter pressures and IAPT. The main other cause of overspend is unachieved savings. The planned savings profile increases 1 in Q3 and again in Q4. The planned deficit to date is £0.90M. The actual deficit achieved to date is £0.66M. However, excluding restructuring and disposal the planned deficit is £7.19M and actual deficit only £1.01M. The in-month position is a surplus of £65K. Several favourable non-recurrent benefits have occurred this month. The underlying deficit is around £600K per month, as shown in the graph below. This is an improvement from that previously reported due to improved income in Jameson and Goodall. The Surplus and Forecast Surplus contain spikes for disposals and other one-off items, but the trends for July-September and November-March are fairly consistent. The underlying trend assumes no one-off items and that current income/expenditure continue without change. Future improvements are factored into the forecast where they are cash-releasing, shown as a reduction in the monthly deficit for Q3 (slightly less steep orange line). 2 3. Forecast £ M’s Plan Total Income Pay Non-Pay Total Expenditure Likely Out-Turn £ M’s £ M’s Forecast Variance 438.31 452.81 14.50 (302.67) (122.52) (425.19) (315.68) (125.87) (441.56) (13.01) (3.36) (16.37) EBITDA 13.13 11.25 (1.87) EBITDA % 2.99% 2.49% (0.51%) Depreciation Interest income Dividends and other Retained surplus/(deficit) excluding disposal I&E Surplus % Restructuring costs Impairment Profit on disposal Retained surplus/(deficit) (9.32) 0.04 (8.19) (4.34) (7.42) 0.05 (8.20) (4.32) 1.90 0.00 (0.01) 0.02 (0.99%) (0.95%) 0.04% (3.10) 0.00 8.10 0.66 (1,52) (1.01) 7.54 0.70 1.58 (1.01) (0.56) 0.04 % 3.31% (3.85%) EBITDA is expected to be £1.87M worse than plan. The bottom line is now expected to show a surplus of around £0.7M which is on plan. There are multiple factors to this, but the key contra is that the Trust has lower depreciation costs (below EBITDA) and has not met its savings target (on expenditure included in EBITDA). For non-operating costs we are also expected to underspend on restructuring, but have an unplanned impairment. Incidental costs on the second property sale will reduce the net profit on disposal. Due to an update to the Monitor risk framework (which changed from September) the line now holding most risk is I&E Surplus %. The plan was with for a 0.99% deficit which the Trust is currently expected to meet. Scenarios looking at the likelihood of savings achievement, redesign work in Q4, claw-back from commissioners on un-provided services, non-recovery of recharges to CGI, and the potential penalty from NWL’s performance notice have all been factored into best and worst case forecasts. These vary from a £4.2M surplus to a £5.8M deficit. The range of figures will close as we progress through the remainder of the year. 7. Conclusion The Board Governors are asked to note the year to date and in month financial performance and the assumptions being used to forecast the full-year position. Trevor Shipman -Director of Finance -25th November 2015 3