Gender Budgeting and Macroeconomic Policy

Gender Budgeting and Macroeconomic

Policy

Diane Elson, Chair Women’s Budget Group

Presentation to

WBG Training Day, January 30 th , 2015

Managing budget deficits/surpluses

• Government does not directly control deficit/surplus

• Controls only some aspects of expenditure e.g. social security rates and conditions but not total payments

• Controls only some aspects of taxation e.g. tax rates but not revenue

• Expenditure cuts can cut revenue too and make deficit worse

• Timing and speed of deficit reduction plan should be determined in relation to state of real economy- fast and untimely deficit reduction efforts can make a downturn worse and hamper recovery

• A balanced budget or a surplus is not necessarily a good thing

• Capitalist economies are inherently organized around credit and debt

• Government debt may be preferable to private debt and may more easily be rolled over- depends on specific context

• Currently UK government has no problem borrowing at low interest rates

Recent Developments at UK level

• Charter for Budget Responsibility passed by House of Commons on 13 th

Jan 2015 , supported by Conservative, Liberal Democrat and Labour parties

• Appears to commit next government to balance current account of budget by 2017/18

• Implies continued and massive cuts in public expenditure

• Osborne lecture to Royal Economic Society on 15 th Jan 2015 set out plans for further new fiscal policy rules for period after 2017/18 requiring government to operate an overall budget surplus thereafter in ‘normal times’

• Office for Budget Responsibility would decide when times are not ‘normal’

• Surplus in normal times is apparently required to reduce debt levels, as high debt levels leave economy vulnerable to ‘shocks’

• No recognition that likelihood of shocks depends on financial regulation and can be reduced by better regulation

Gender Dimensions of Budget Deficit/ Surplus

Gender differentiated impacts likely because:

• Social security payments make up a greater share of women’s incomes than men’s, as women earn less in the labour market

• Women pay less direct tax than men, as women earn less in labour market

• Women make greater use of public services than men, linked to greater care responsibilities and greater use of care services

• Higher proportion of women’s employment is in public sector than men’s

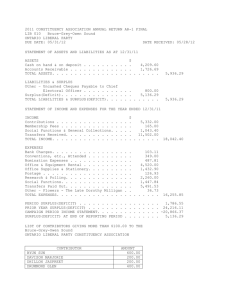

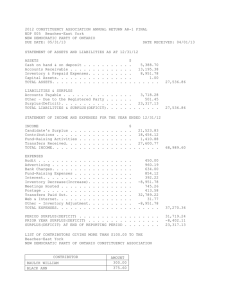

House of Commons Library research following AFS 2014 found that changes to direct taxes and social security introduced by Coalition

Government since 2010 had raised £26 bn, of which £22 bn was taken from women, 85% of the total

To redress this in future:

Cut spending on social security less, raise more revenue from wealthy people and companies

Impact on Different Households, Including

Indirect Taxes and Cuts to Spending on Services

Research by Howard Reed , member of UK Women’s Budget Group , shows total losses of for families in England as percentage of their household income , for all measures 2010-2015, are as follows:

• single parents lose 15.1%, single women parents 15.6%

• single pensioners lose 11.6%, single women pensioners 12.5 %

• couples with children lose 9.7%,

• single adults with no children lose 9.7%, single women 10.9%

• couple pensioners lose 8.6%

• couples with no children lose 4.1%.

The two groups in which women predominate, single parents and single pensioners, lose most.

Reducing Adverse Impact on Women of Cuts to

Public Services

• Conservative Party objective of achieving balance in budget current account by 2017/18 and aiming thereafter for an overall budget surplus means no chance of reversing the adverse impact

• Care services are not ‘protected’

• Labour Party objective of achieving balance in budget current account by 2017/18 but allowing a capital account deficit and borrowing for investment sounds better

• But investment is defined in the budget accounts as spending on construction of fixed assets

• May get more nurseries , hospitals and care homes - but no staff to operate them

Challenging Definitions of Public Investment in the System of National Accounts

• Feminists have already challenged the System of National

Account for ignoring unpaid work and the output it produces

• Now we must challenge the definition of investment, which has not caught up with the growing recognition of the importance of investment in people, their health, education, and well- being

• Care services do not just produce immediate benefits that are consumed as they are produced

• Care services produce long lasting returns like fixed assets do

• Feminist economists define care services as social infrastructure , for which borrowing should be permitted , like physical infrastructure

Investing in Life or Investing in Death?

• SNA classifications can be changed

• European System of National Accounts was revised in 2010

• Among the changes is that expenditures on weapon systems

(comprising vehicles and other equipment such as warships, submarines, military aircrafts, tanks, missile carriers and launchers etc.) have been classified as fixed capital formation

• Implication, in relation to Charter for Budget Responsibility:

UK government can borrow to build a new Trident submarine without breaching Charter, but not to develop high quality care services

• Gender budgeting requires we challenge this: we want investment in life not death