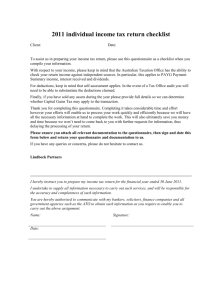

Individual Tax Return Checklist 2003

advertisement

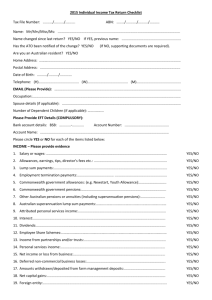

INDIVIDUAL TAX RETURN CHECKLIST (Office Use) Client Name: «firstname» «lastname» Prepared by: Accounting Year: 2010 Checked by: Start Date: «date» CLIENT DETAILS: Have you checked with the appropriate person WHAT ENTITY you should INPUT YOUR TIME to in the time ledger? (Firm policy is to bill the main company of the group) Client Reference ____________ Current Home Address: YES □ «address1» «address2» If Fee from Refund – Postal Address to be C&N Telephone Number: «bizphone» Spouse Name: «relatedRef» Email Address: «email» «homephone» «mobile» Occupation: Queries to ask Client: Cleared 1 2 3 4 5 6 Notes for 2010 & General Notes: Disclaimer: These notes are intended to be a guide only. Business Intranet Systems Pty. Ltd. (BIS), its directors, employees and consultants expressly disclaim any and all liability to any person, whether a purchaser or not, for the consequences of anything done or omitted to be done by any such person relying on a part or the whole of the contents. Do not act on the information without first obtaining specific advice regarding your particular circumstances from a tax professional. © 2006 Business Intranet Systems Pty Ltd. This document is protected by international copyright laws. It is for your internal use only. Unauthorised distribution or reproduction of this information, or any part of it, may result in severe civil and criminal penalties, and will be prosecuted to the maximum extent possible under the law. INCOME - all items relate to the 2008/2009 year – Introduction TR Code Please mark "y" "n" or "n/a" where relevant - Link 1&2 Salary / Wages /Director’s fee and other allowances?(ensure RFBA is included in tax return) Link Link 3&4 Lump Sum or Eligible termination payments due to roll-over, termination, compensation or legacy? If YES go to "ETP Worksheet" (All ETP’s to be included, see ATO web for those paid 12mths after termination) Link Link 5 Commonwealth of Australia government allowance & payments such as Newstart, youth allowance & Austudy 6 Australian government Pensions / allowances? If YES, calculate the un-deducted purchase price. Check the deductible amount and the 15% tax offset (If client is over 60 years do not include) 7 Australian annuities and Superannuation income streams (If client is over 60 years do not include ) 8 Australian Superannuation Lump Sum Payments 9 Attributed Personal Services Income 10 Reportable Fringe Benefit Amounts Link 11 Interest ( Also check Tax Agent Portal for interest paid by ATO) Interest for Non-residents? Did you pay non-res. withholding tax? Link Link 12 Dividends? (or Friendly Society Bonuses) (Check details from website if payment advice is missing) Link Link 13 Partnership or Trust distribution? (Unit, Cash Management, Deceased Estate) Claim any directly related deductions in the deductions area of this section. Link Link 14 Personal Services Income – Did the client pass PSI tests? If no, complete item 13 of tax return. PSI Losses to be claimed at D15 Label J – Other Deductions. Link 15 Business? If YES go to "Sole Trader Worksheet" Check the ATO web (or link) to see if the client is eligible for the Small Business Entity Concessions P2P19 Link Link - Is the client registered for GST? - If YES ensure all income & expenses are GST exclusive - Check gross income reconciles back to BAS - Check Wages reconciles with BAS and PAYG Summary - Check on PAYG Summary for allowance paid - Check super contribution - Check GST has been taken up for sale of capital asset - Check private % has been taken out for all expenses. eg motor vehicle expenses - Compare income and expenses with prior year tax return and note any large variance. - Check for prior year losses carried forward 16 Has you sole trader business worksheet made a loss? (if YES ensure this business meets at least one of the four tests below to ensure it Link Prepared By: Checked By: isn't classified by ATO as a hobby) Link i. Assessable income test - the activity produces an assessable income of at least $20,000 ii. Profit test - the activity has produced a taxable income in 3 out of the past 5 years iii. Real property test - the value of real property (i.e. land & buildings), used in the business is at least $500,000. iv. Other assets test - the value of certain other assets (excluding cars, motorcycles and similar vehicles) used in the business, is at least $100,000 (P9) Did this business (inc Partnership) have a deferred loss last year? If YES do they meet one of the criteria to offset the loss against business income in 2009? (Ensure relevant sections are completed in tax return) Link 17 Net farm management deposits or withdrawals Link 18 Did the client dispose of any assets during the year? (e.g. Shares, land) or Did the client receive any capital distribution from managed funds? NOTE 1: If asset was acquired before 1st October 2000 and was held for at least a year before sale then the 50% disc on CGT will apply, or the difference between the sale price and the frozen indexed cost base as at 21 Sept 2000. NOTE 2: If property built after May 1998 need add back depreciation when disposing rental property. NOTE: Building/Structural Allowance is to be added back regardless if the 2.5% PC Depn expense has been claimed or not. NOTE 3: If the client sold their home, did they ever claim a deduction for a business conducted from that home? (e.g. Interest) if YES there may be CGT implications Link Link Check any Capital Losses Carried Forward 19 Foreign Entities Link 20 Foreign Source income, asset or property – include foreign employment income and pension, distribution from managed funds. You may need to convert to Australian currency Check whether foreign tax credits are applicable. Link Link 21 Rental Income* (ATO focus audit area) Address 1 2 3 4 5 Purchase Date Ownership Trust (Y/N) Link NOTE: Pre-purchase inspection, travel or investment advice is nondeductible and cannot be capitalised. Other areas to be aware of: Special Body Corporate Levies not deductible Fees paid on deposit bond and bank guarantees now deductible Note: Check Land Tax threshold, lodge land tax return for assessment if necessary. NSW tax – free threshold $359,000 ( most trusts have NIL threshold ) QLD tax – free threshold $350,000 ( trust ) $599,999 ( individuals ) ACT tax – no free threshold VIC tax – free threshold $225,000 SA tax – free threshold $110,000 TAS tax – free threshold $25 000 Link Link WA tax – free threshold $250,000 21 Bonuses from life insurance companies and friendly societies 22 Other Income - Jury Service, Employee Share Plan, Sickness & Accident policy payments, foreign exchange gain, scholarship awards 23 Forestry Managed Investment Schemes (FMIS) Link EXPENSES D1 Work related car deductions? Link NOTE: Depreciation for MV as of 10/5/07 is 25% DV RATES FOR 200? / 200? INCOME YEAR Small car - not exceeding 1600cc = 58 cents per KM Medium car - exceeding 1600cc but not 2600cc = 69 cents per KM Large car - exceeding 2600cc = 70 cents per KM Logbook Method – Business % ________ Check MTG for other 2 methods if above methods does not apply D2 Did client incur any expenses for travel relating to their work, including accommodation, meals, incidentals etc (A diary must be kept if travel is more than 6 nights in a row) Link D3 Does the client have a logo uniform or wear protective clothing? Does the client work outdoors, if so have they incurred expenses in relation to protection from sunlight ( sunscreen, sunglasses etc) *Tinted Prescription sunglasses can be claimed in D3 and T9 Link D4 Has the client incurred any self education expenses - If so ensure it directly relates to their current employment Link Has the client incurred any of the following expenses:- Link D5 i. Tools & Equipment (e.g. Computer, printer) Depreciate if over $300 ii. Home Office Link iii. Union Fees Link iv. Overtime Meal (Only claimable if Grp Cert has Meal Allowance) Link v. Telephone/Mobile/Internet? (Check for private %) Link vi. Stationary/Journals/Publications/Briefcases? vii. Seminars Link D7 Interest & Dividend Deductions? ( eg: share trading courses) Note: Share Software to be Depreciated at effective life of 2.5 yrs Link D8 Gifts or Donations? Link Did the client participate in any fund-raising events organised by Deductible Gift Recipient? Must satisfy: 1) Contribution more than $250 & 2) Value of benefit must NOT exceed $100 and 10% of contribution Link D9 Cost of Managing tax affairs? Including travel to accountants office (request how many kilometres & engine size) Link D10 Australian Film Incentives? Link D11 Deductible amount of un-deducted purchase price of a foreign pension or annuity Link D12 Personal Superannuation Contributions (need fund details) D13 Deduction for Project Pool Link D14 Forestry Managed Investment Scheme Deductions (FMIS) D15 Other Deductions – eg: Income Protection & Sickness Insurance, PSI Losses and post cessation business expense Note: All Other deductions are likely to trigger an audit TAX OFFSETS T1 Spouse Child-keeper Housekeeper Link Link Link T2 Senior Australian Link T3 Pensioner (claim if client is of pension age but not able to claim SATO) Link T4 Superannuation Annuity & Pension (15% Rebate) Link T5 30% Private Health Insurance - Does the client have Private Health Insurance? If YES request the private health insurance statement for 2006 to advise us of necessary information. Check Tax Offset Link T6 Ongoing baby bonus claim - Were any of the children born after 1 July 2002 and before 1 July 2005? If YES calculate Baby Bonus and complete baby bonus schedule in tax return. Check Base Year and number of eligible days *Baby Bonus is phasing-out from 1 July 2005 (See new Maternity Payment) Maternity Payment and future child care benefits are claimed with Centrelink or FAO but not the tax system NOTE 30 % Childcare Tax Rebate:Change in 2007/2008 budget sees the FAO processing payment – not done through the tax return / ATO T7 Superannuation contributions on behalf of your spouse - Did you contribute to a superfund on behalf of your spouse? If so, is your spouse’s taxable income less than $13,800, if YES how much did you Link Link Link contribute? T8 Zone or Overseas forces Link T9 Medical Expense rebate - (Did the clients net medical expenses exceed $1,500 EXCLUDING Cosmetics etc.). If YES ensure 20% rebate is claimed for amount over $1,500 – ensure it is paid to a legally qualified medical practitioner Link Link T10 Parent, spouse’s parent or invalid relative Link T11 Land care and water facility Link T12 Mature Age Worker Tax Offset – computer automatically calculates if applicable Is the client over age 55? Is net income from WORKING less than $63,000? Link T13 Entrepreneurs Tax Offset T14 Other Tax Offests – See ATO M1 Medicare levy reduction or exemption Link M2 Medicare levy surcharge ( if client not covered by hospital cover for the full year, check if surcharge applies) Complete Spouse details if applicable. Link A1 Under 18 excepted net income Link A2 Part Year Tax – free threshold – for ceased being a full time student, beginning or ending residency, tax free NO LONGER APPLICABLE Link Is the client receiving all their entitlements relating to their children or partner through the Family Assistance Office (FAO)? If NO: Please request the following details for Partner & children Check Tax Agent Portal for FAO status Link Name and Date of Birth of ALL Name Date of Birth Income (Complete relevant details relating to Family Tax Benefit (FTB) in tax return check thresholds in Taxpack to ensure client in entitled) Do you have a HECS Debt or are you part of the Student Financial Supplement Scheme (SFSS) If YES ensure debt is included in return Check Tax Agent Portal Link Check if client has paid any PAYG Instalments Link Check client’s last year taxable income Check whether client is eligible for Super Co-contribution Note: NOT required to report in the tax return Link