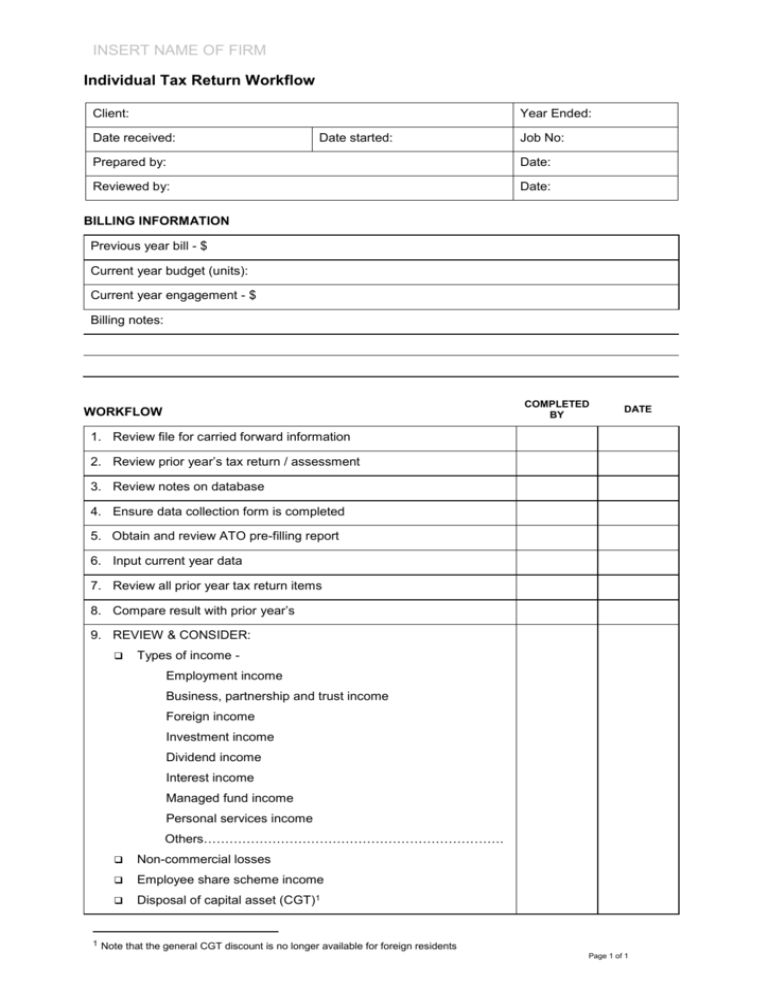

Individual Tax Return Workflow Sheet

advertisement

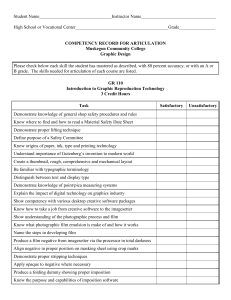

INSERT NAME OF FIRM Individual Tax Return Workflow Client: Year Ended: Date received: Date started: Job No: Prepared by: Date: Reviewed by: Date: BILLING INFORMATION Previous year bill - $ Current year budget (units): Current year engagement - $ Billing notes: COMPLETED BY WORKFLOW DATE 1. Review file for carried forward information 2. Review prior year’s tax return / assessment 3. Review notes on database 4. Ensure data collection form is completed 5. Obtain and review ATO pre-filling report 6. Input current year data 7. Review all prior year tax return items 8. Compare result with prior year’s 9. REVIEW & CONSIDER: Types of income Employment income Business, partnership and trust income Foreign income Investment income Dividend income Interest income Managed fund income Personal services income Others……………………………………………………………. 1 Non-commercial losses Employee share scheme income Disposal of capital asset (CGT)1 Note that the general CGT discount is no longer available for foreign residents Page 1 of 1 INSERT NAME OF FIRM Dividends and capital gains streamed from a trust estate Franking credits Offset (rebates):Superannuation – personal / spouse Dependent spouse offset Senior’s and Pensioner’s offset Foreign income tax offset Franking credit offset Medical expenses rebate (subject to eligibility) Private health insurance offset (subject to income testing) Low income tax offset (reduced following tax rate changes) Mature age workers offset Others……………………………………………………………. PAYG instalments ATO interest paid or received (check ATO prefill report) Depreciation methods and rates (rental depreciation) Quantity surveyors report. If so, provide letter of instruction on file for the QS to prepare in accordance with relevant tax rulings and legislation. Small business entity concessions 10. Ensure all items to be carried forward are clearly noted and include information which will impact future year returns Page 2 of 2