2013 End of Financial Year Newsletter

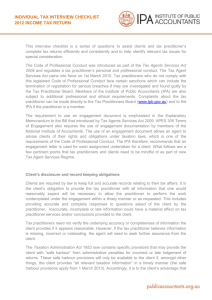

advertisement

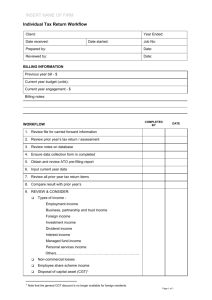

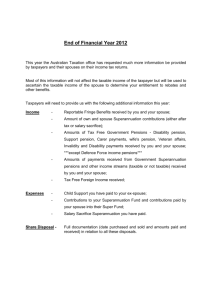

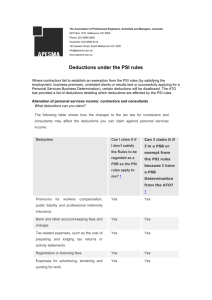

DOYLETIMMS Accounting and Business Services Client Newsletter 2013 13/06/13 Income Tax Changes for 2012/13 A large number of tax changes apply in the 2012/13 income year. A brief summary is provided in this newsletter. There may be some advantages in acting on some of these items before 30 June. If you think any of these changes may affect you, please contact us for more details. Taxable Payments Reporting - Building and Construction Industry From 1 July 2012, businesses in the building and construction industry need to report the total payments they make to each contractor for building and construction services each year. Please note that the definition of building and construction services is broad, it can include – alterations, design, excavation, assembly, maintenance, repairs and finishing. This list is not exhaustive. You need to report these payments to the ATO on the Taxable payments annual report. This report is due 21 July each year. The first Taxable payments annual report is due 21 July 2013 for payments made in the 2012-13 financial year. In this first year, if you lodge your activity statement quarterly, you can lodge by 28 July 2013. 2012/13 A For each contractor, you need to report the following details each financial year: o Contractors name o ABN o address o gross amount you paid for the financial year (this is the total amount paid inclusive of GST) o total GST included in the gross amount you paid. Doyle Timms Accounting & Business Services Client Newsletter 2013 ∣ 2 General Year End Tax Planning Strategies & Tips Small Business Owner Subject to cash flow requirements consider deferring income until after 30 June, especially if you expect lower income for 2013/14 compared to 2012/13. Ensure that you have complied with the requirements to claim a deduction in 2012/13: o Bad debts must be written off in your accounts before 30 June o Employer and/or self‐employed superannuation contributions must be paid to, and received by, the superfund before 30 June and must be within the contributions cap. o Accelerated depreciation changes - if the asset is first used, or installed ready for use, before 30 June, then – Items costing less than $6,500 excluding GST are now immediately deductible (up from $1,000). Motor vehicles costing $6,500 or more qualify for an upfront deduction of $5,000 + 15% of the remaining amount. o If you have any stock that is old, damaged or obsolete then scrap it and write it off before June 30. The written off amount forms an immediate tax deduction. Also start to review your stock in terms of the appropriate valuation method. You can value stock at the lower of cost, replacement or net market value. You may have stock that you don’t want to scrap but may be worth less than its cost price. The market value approach will give you the tax saving into this year. Have a look at your asset register and write off any plant or equipment that has been scrapped. Doing this will give you the tax benefit into the current year. If you are using a payroll software package to calculate the amount withheld from salary and wages ensure the tax rates are updated Over 60 and need a tax deduction in your business? Consider putting your Super into Transition to Retirement mode and take 10% pension and re-contribute for a tax deduction. Consider moving insurance cover into superannuation to maintain cover in hard times or make premiums more tax efficient. (Care to be taken as there are plenty of traps on this one.) Liability limited by a scheme approved under Professional Standards Legislation Doyle Timms Accounting & Business Services Client Newsletter 2013 ∣ 3 Personal / Family The tax‐free threshold for 2012/13 for Australian resident individuals is $18,200 (up from $6,000). When combined with the Low Income Tax Offset, residents pay no tax on incomes below $20,542. Higher thresholds apply to senior Australians and pensioners. For incomes above the thresholds, tax rates are slightly lower. Be smarter with Term Deposits and have them mature after the end of the financial year in the future Change savings accounts into the name of the lower income spouse before the start of the new financial year. Check superannuation contributions for year to date to see what leeway you have o From 1 July 2012, the concessional superannuation contribution cap is $25,000 regardless of your age o Consider personal contributions for you and/or spouse o Consider spouse contribution for spouse earning less than $13,800 for tax offset of up to $540 o Consider the superannuation co-contribution o Consider the Low Income Super Contribution (LISC). The LISC is additional to the existing super co‐contribution. If you have a Capital Gain then check other assets to see if you can trigger any losses to minimize gains. Make all donations in the name of the higher income earner. Means Testing of Private Health Insurance Rebate & Medicare Levy Surcharge o Tiered rates of private health insurance rebates now apply, based on your age and income. o If you don’t hold private health insurance, tiered rates of Medicare levy surcharge apply based on your income Companies ‐ Loss Carry‐ Back Companies that have paid tax in the past, that incur a loss in the 2012‐13 income year, may be able to obtain a refund of some of the tax previously paid. Multiple conditions apply. Other Tax Planning Considerations Contact us for advice if you have moved to or from Australia for an extended period. You may need to review your residency status for tax purposes. There are important tax consequences if you change residency. Removal of Capital Gains Discount for Non‐Residents - The government will remove eligibility for the 50% discount on capital gains earned after 8 May 2012 by non‐resident individuals and trusts on taxable Australian property, such as real estate and mining assets. You can preserve the discount for unrealised capital gains accrued up to 8 May 2012, if you have the asset valued as at that time. Trustees of trusts should ensure that all necessary documentation is completed before 30 June, where you intend to stream capital gains or franked distributions to specific beneficiaries. Liability limited by a scheme approved under Professional Standards Legislation Doyle Timms Accounting & Business Services Client Newsletter 2013 ∣ 4 Multiple Changes to Personal Tax Offsets “A major restructure A major restructure of personal tax offsets takes effect in 2012/13. If you have previously benefited from any of the following, you may have an increased tax liability for 2012/13: of personal tax offsets takes effect in 2012/13, including the Net Medical Net Medical Expenses Tax Offset – for incomes above $84,000 (singles) Expenses Tax Offset, or $168,000 (couples and families), the offset is 10% of out‐of‐pocket expenses MAWTO, Spouse Tax (down from 20%) and the threshold is now $5,000. & Offset.” The Mature Age Worker Tax Offset - is now restricted to taxpayers born before 1 July 1957, there is no change if you were already eligible for the tax offset in the 2011‐12 or earlier years. The Spouse Tax Offset is now limited to spouses born before 1 July 1952 (previously 1 July 1971). 4 Ways to Save on Accounting Fees Use accounting packages, we encourage software packages suck as Banklink, as it saves us time and you money. We are now a Gold Certified Banklink Specialist firm. Reconcile as many of your balance sheet accounts as possible, especially bank accounts Present your information in an organized and methodical way – review the checklist Maximize meetings by considering issues, questions and challenges prior to the meeting. Superannuation - Are You Ready for the 1 July Changes The Federal Government has introduced several pieces of legislation that come into effect from 1 July 2013. To make sure you're ready for these changes, we have outlined the new legislation that will impact you and your business. Payslip Reporting: Payslips will need to show amount, payment date and names of the superfund’s you are paying into on behalf of your employees for certain super contributions. New Super Guarantee Rate = 9.25% : The increase to the SG Levy from 9% to 9.25% from 1 July 2013. Age Limits for Super Contributions Removed : The age limit of 70 for the payment of SG contributions will be removed. Upper age limits abolished with tax deductions for all SG Contributions : You will be able to claim a tax deduction for SG contributions paid to employees who are aged 75 or more Liability limited by a scheme approved under Professional Standards Legislation Client Newsletter 2013 ∣ 5 Doyle Timms Accounting & Business Services ATO Compliance Program 2012-2013 The ATO are undertaking reviews of the following types of businesses (this is just a small sample of the ATO’s compliance program for 20122013, it represents what the ATO are capable of) – Plastering – ‘We are reviewing both business-to-business and business-to-consumer transactions, comparing information from hardware store trade accounts against their customers' purchasing records to detect cases where businesses are skimming cash or are outside the system’. Cafés –‘In particular, we are expanding our program of comparing information from coffee-supplier trade accounts against their customers' purchasing records to detect cases where café businesses are skimming cash or are outside the system’. Specific Occupations under ATO target for work expenses, the ATO has outlined three specific occupations that it will closely examine for work related expenses and deductions, these include – Plumbers IT managers Defence force non-commissioned officers We have saved the most important tip for last! Here it is: With the End of Financial Year almost upon us, how prepared are you? As with most things, preparation is the key! If you don’t know where to start or what you need to do, here are a couple of things ; o Speak to your Accountant about Tax Planning, if you haven’t done so already, and o Don’t wait until 1 July 2013 because if you need to take action on something it may be too late. Mark this event in your diary to do this on an annual basis! Geelong Office 72-76 Ryrie Street, Geelong (03) 5222 3200 CONTACT INFORMATION Baker Street, Wangaratta VIC 3677 ∣ Phone 03 5722 1996 ∣ Fax 03 5721 4001 ∣ doyletimms@doyletimms.com.au Colac 27 Office 90-98 Wallace Street, Colac (03) 5231 6711w.wccountom.a Liability limited by a scheme approved under Professional Standards Legislation