2014 EOFY Individuals - Young & Associates Taxation and

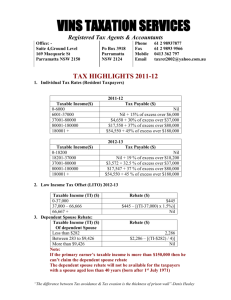

advertisement

Welcome to our End of Financial Year newsletter! With June 30 fast approaching, it's a good time to check and see how you are doing financially. Do you have your year-end financial strategies in place? Here are several tips, updates, and information to help you start your financial year right. Any questions or comments about this newsletter? Please feel free to contact our office should you require additional information. 1 July 2013 (2013/2014 income year) Personal Tax Rates The 2013/14 rates are the same as the 2012/13 year, as follows (not including the Medicare levy of 1.5%): 2013-14 Income Year Income Range $ $0 - $18,200 $18,201 - $37,000 $37,001 - $80,000 $80,001 - $180,000 $180,001 and over Tax Rate % Nil 19 32.5 37 45 Non-Residents The tax rates for non-residents are also remaining the same (please note that non-residents are not liable to pay the Medicare levy): 2013-14 Income Year Taxable income $ $0 - $80,000 $80,001 - $180,000 $180,001+ Tax payable $ 32.5% $26,000 + 37% of excess over 80,000 $63,000 + 45% of excess over $180,000 Car Expense Rates – First Increase in 5 Years The car expense rates per kilometre have been set for the 2013/14 year. They have been increased for the first time since 2008/09. Year Small Car Medium Car Large Car 2012/13 63c 74c 75c 2013/14 65c 76c 77c Please note, this newsletter is for guidance only and does not constitute specific advice, however do not hesitate to consult us should you need advice on specific matters. Ph 54791903 or email info@youngaccounting.com.au 25/06/2014 From 1 July 2014 (2014/2015 income year) Medicare Levy to Rise From 1 July 2014 the Medicare levy will rise from 1.5% to 2.0% to assist funding the National Disability and Insurance Scheme (NDIS) Temporary Budget Repair Levy A 3 year temporary levy on individuals with taxable incomes in excess of $180,000 per annum (and, therefore paying tax at the top marginal rate (currently 47% including the Medicare levy), will be introduced on 1 July 2014. From 1 July 2014 until 30 June 2017, the Temporary Budget Repair Levy will apply at a rate of 2% on an individual’s taxable income in excess of $180,000 per annum. Example of what this means for Individuals: 2014 2017 Income Years Taxable income $ TBR Levy Payable $180,000 or below Nil $200,000 2% of $20,000 ($400 levy payable) $300,000 2% of $120,000 ($2,400 levy payable) A number of other tax rates that are currently based on calculations that include the top personal tax rate will also be increased. These tax rates will be increased for the same period that the Temporary Budget Repair Levy is in place. Furthermore, to prevent high income earners from utilising fringe benefits to avoid paying the levy (eg. Through salary packaging) the FBT rate will be increased from 47% to 49% from 1 April 2015 until 31 March 2017 to align with the FBT year. eg. The cash value of benefits received by employees of public benevolent institutions and health promotion charities, public and not-for-profit hospitals, public ambulance services and certain other tax-exempt entities, will be protected by increasing annual FBT caps. In addition, the fringe benefits rebate will be aligned with the FBT rate from 1 April 2015. Mature Age Workers Tax Offset (MAWTO) The mature age worker tax offset will be abolished from 1 July 2014. The offset will be replaced by the expanded senior’s employment incentive payment called Restart. From 1 July 2014, a payment of up to $10,000 will be available to employers who hire a mature age job seeker, aged 50 years or over, who has been receiving income support for at least 6 months. Eligible employers will receive $3,000 if an eligible mature age person is employed full-time for 6 months and an additional $3,000 if employed for 12 months. Further $2,000 payments will be made after 18 months and 24 months full-time employment (maximum is therefore $10,000). The mature age worker offset is currently available to Australian resident individuals born before 1 July 1957 whose "net income from working" for the income year is $63,000 or less. The maximum offset is $500. Net medical expenses tax offset (NMETO) phase out Under recent amendments, the NMETO will be phased out between the 2014 and 2019 income years (inclusive), and will be ultimately repealed on 1 July 2019. Please note, this newsletter is for guidance only and does not constitute specific advice, however do not hesitate to consult us should you need advice on specific matters. Ph 54791903 or email info@youngaccounting.com.au 25/06/2014 From 1 July 2013, those taxpayers who received the offset in their 2012-13 income tax assessment will continue to be eligible for the offset for the 2013-14 income year if they have eligible out-of-pocket medical expenses above the relevant claim threshold. Similarly, those who receive the tax offset in their 2013-14 income tax assessment will continue to be eligible for the offset in 2014-15. The changes mentioned above will not apply to all taxpayers - the offset will continue to be available for taxpayers with out-of-pocket medical expenses relating to disability aids, attendant care or aged care expenses until 1 July 2019. Dependant Spouse Offset For the 2013/14 year, if you have a dependent spouse born before 1 July 1952 with an adjusted taxable income (ATI) of less than $10,166, you can claim a dependent spouse tax offset. 2014 will be the last income year that the dependent spouse offset can be claimed as it has now been phased out. The Dependant (Invalid & Carer) Tax Offset This was introduced from 01 July 2012 (the 2013 income year) to replace eight existing dependant-related tax offsets except the dependant spouse offset above. This is a non-refundable tax offset, which is broadly only available to taxpayers who maintain a dependant who is unable to work due to invalidity or carer obligations. NB Eligibility requirements must be met TAX TIPS: Spouse Superannuation Contribution Make a contribution to the Super Fund of your low-income or non-working spouse and you could qualify for a tax offset of up to $540 just for growing your Partner’s retirement savings! NOTE: The tax offset cuts out if your partner earns more than $13,800 this financial year. Prepay Interest If you’ve borrowed money to invest in, say for shares or a rental property, you may be able to save o this year’s tax by prepaying some or all of the annual loan interest. You can claim up to 12 months of prepaid interest on an investment loan! NOTE: Please contact your lender to see if your loan qualifies. Be Proactive & Prepared Collate together throughout the financial year, all your receipts for work related expenses that you have incurred. These include but are not limited to things like: · Union fees · Professional Association costs subscriptions · Stationery · Uniforms · Seminars Please note, this newsletter is for guidance only and does not constitute specific advice, however do not hesitate to consult us should you need advice on specific matters. Ph 54791903 or email info@youngaccounting.com.au 25/06/2014 The ATO advises that while it may email, SMS message or phone taxpayers, it will never ask for: · Personal details, such as driver’s licence, mother’s maiden name ; or · Credit card, including CVN or bank details If a taxpayer is in doubt about the authenticity of a call that they receive from the ATO, they should contact the ATO on one of its publicly listed numbers to verify the legitimacy of the call. Mobile phone Scams Mobile phone scams can differ in appearance and level of sophistication but will generally state the taxpayer is eligible for a refund and instruct them to clink on a link to submit a form to receive the refund. Email Scams These emails claim to come from the ATO and usually offer a tax refund. Generally they link to a bogus ATO website asking for personal and credit card details. By clicking the link on either of these scams taxpayers will potentially expose themselves to identity theft. Example of a current ATO email scam: Please note, this newsletter is for guidance only and does not constitute specific advice, however do not hesitate to consult us should you need advice on specific matters. Ph 54791903 or email info@youngaccounting.com.au 25/06/2014