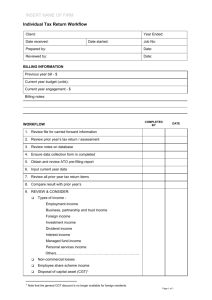

Individual tax return instructions supplement 2013

advertisement