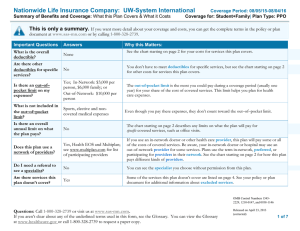

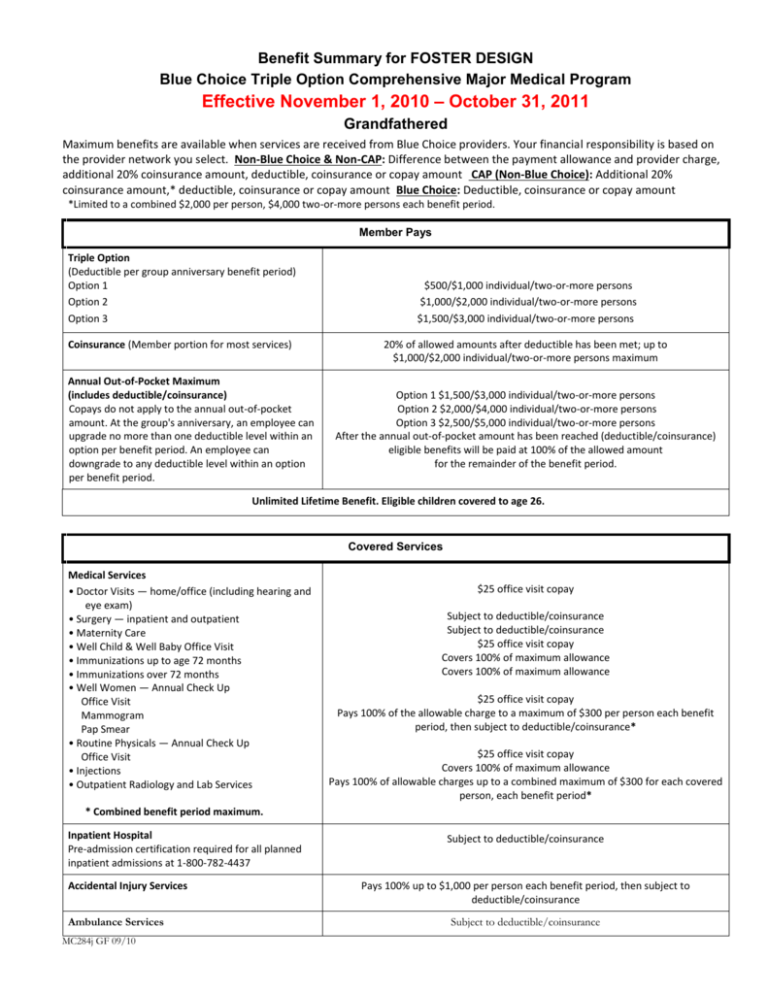

Comprehensive Major Medical Program

advertisement

Benefit Summary for FOSTER DESIGN Blue Choice Triple Option Comprehensive Major Medical Program Effective November 1, 2010 – October 31, 2011 Grandfathered Maximum benefits are available when services are received from Blue Choice providers. Your financial responsibility is based on the provider network you select. Non-Blue Choice & Non-CAP: Difference between the payment allowance and provider charge, additional 20% coinsurance amount, deductible, coinsurance or copay amount CAP (Non-Blue Choice): Additional 20% coinsurance amount,* deductible, coinsurance or copay amount Blue Choice: Deductible, coinsurance or copay amount *Limited to a combined $2,000 per person, $4,000 two-or-more persons each benefit period. Member Pays Triple Option (Deductible per group anniversary benefit period) Option 1 Option 2 Option 3 Coinsurance (Member portion for most services) Annual Out-of-Pocket Maximum (includes deductible/coinsurance) Copays do not apply to the annual out-of-pocket amount. At the group's anniversary, an employee can upgrade no more than one deductible level within an option per benefit period. An employee can downgrade to any deductible level within an option per benefit period. $500/$1,000 individual/two-or-more persons $1,000/$2,000 individual/two-or-more persons $1,500/$3,000 individual/two-or-more persons 20% of allowed amounts after deductible has been met; up to $1,000/$2,000 individual/two-or-more persons maximum Option 1 $1,500/$3,000 individual/two-or-more persons Option 2 $2,000/$4,000 individual/two-or-more persons Option 3 $2,500/$5,000 individual/two-or-more persons After the annual out-of-pocket amount has been reached (deductible/coinsurance) eligible benefits will be paid at 100% of the allowed amount for the remainder of the benefit period. Unlimited Lifetime Benefit. Eligible children covered to age 26. Covered Services Medical Services • Doctor Visits — home/office (including hearing and eye exam) • Surgery — inpatient and outpatient • Maternity Care • Well Child & Well Baby Office Visit • Immunizations up to age 72 months • Immunizations over 72 months • Well Women — Annual Check Up Office Visit Mammogram Pap Smear • Routine Physicals — Annual Check Up Office Visit • Injections • Outpatient Radiology and Lab Services $25 office visit copay Subject to deductible/coinsurance Subject to deductible/coinsurance $25 office visit copay Covers 100% of maximum allowance Covers 100% of maximum allowance $25 office visit copay Pays 100% of the allowable charge to a maximum of $300 per person each benefit period, then subject to deductible/coinsurance* $25 office visit copay Covers 100% of maximum allowance Pays 100% of allowable charges up to a combined maximum of $300 for each covered person, each benefit period* * Combined benefit period maximum. Inpatient Hospital Pre-admission certification required for all planned inpatient admissions at 1-800-782-4437 Accidental Injury Services Ambulance Services MC284j GF 09/10 Subject to deductible/coinsurance Pays 100% up to $1,000 per person each benefit period, then subject to deductible/coinsurance Subject to deductible/coinsurance Covered Services Outpatient Hospital Subject to deductible/coinsurance Emergency Room Services $100 copay per incident, then subject to deductible/coinsurance If admitted to the same hospital as an inpatient within 24 hours of initial visit, copay is waived and benefits are provided subject to deductible/coinsurance. Home Health Care/Hospice Pays 100% of allowable charges for Home Health Care; Hospice paid 100% with a $5,000 lifetime maximum. Freestanding Outpatient Facilities (Examples: surgery, renal dialysis) Subject to deductible/coinsurance Medical Equipment/Disposable Supplies Subject to deductible/coinsurance Short-term Therapies — Physical, Speech and Occupational, Respiratory and Cardiac Subject to deductible/coinsurance Mental Illness & Substance Use Disorders • Inpatient Services Requires pre-admission certification from New Directions Behavioral Health at 1-800-952-5906 Subject to deductible/coinsurance $25 office visit copay • Outpatient Services Prescription Drugs The quantity per prescription shall be the greater of a 34-day supply or 100 unit dosage, if defined as a maintenance drug • BlueRx Card - Retail Generic/brand formulary/brand non-formulary Diabetic Supplies are covered • BlueRx Mail (90-day supply) $15/$30/$45 copay $37.50/$75/$112.50 copay (Note: prior authorization and quantity limits may apply) Premiums are based on an effective date of November 1, 2010 with census and contract counts of 12 Employee, 2 Emp/Child(ren), 4 Emp/Spouse, 4 Emp/Dependents and 0 MER. BCBSKS reserves the right to adjust premiums accordingly should enrollment vary from the census. Exclusions: The following procedures and all related services and supplies are not covered under this program. Services provided directly for or relative to diseases or injuries caused by or arising out of acts of war, insurrection, rebellion, armed invasion, or aggression; duplicate benefits provided under federal, state or local laws, regulations or programs, except Medicaid; cosmetic or reconstructive surgery (except as stated in the certificate); any keratotomy procedures; charges for personal items; convalescent or custodial/maintenance care or rest cures; blood or payments to donors of blood; any service or supply related to the medical management of obesity; charges for services by immediate relatives or by members of your household; acupuncture and admissions for acupuncture; services related to temporomandibular joint dysfunction syndrome over the amount specified in the certificate; services or supplies related to sex changes, sexual dysfunctions or inadequacies; any medically-aided insemination procedure; services related to the reversal of sterilization procedures; mental illness or substance use disorder services provided by a non-eligible provider; hearing aids; eyeglasses or contact lenses (except after the removal of cataracts); unnecessary services and admissions; services or supplies which are experimental or investigative in nature; services not specifically listed as benefits in the certificate; services covered and payable by any medical expense payment provision of any automobile insurance policy. This is a brief summary of the coverage available under this program. It is not a legal document. The exact provisions of the benefits and exclusions are con tained in the certificate.