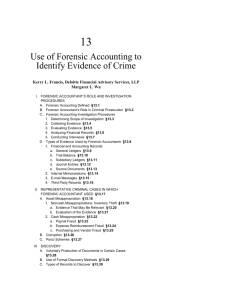

Forensic Accounting

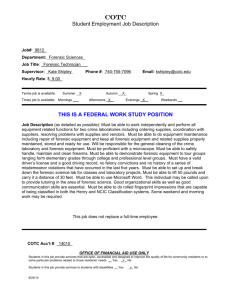

advertisement

Forensic Accounting This guidance was written by Rob Hampson, Associate Director, Grant Thornton Publication Date: 19 December 2011 Disclaimer This guidance has been drafted as an introduction to forensic accounting. It is no substitute for familiarising yourself with the relevant legislation and does not constitute legal advice. Whilst all reasonable efforts have been made to ensure that this guidance is accurate as at the date of publication, the AAT accepts no liability for loss caused to any person as a result of following this guidance. Page 1 of 13 Forensic Accounting The AAT recommends that you consult a solicitor or expert in forensic accounting if you are unsure of the meaning of any of the legal terms or explanations in this document. Contents (Ctrl+Click on an item below to go to directly to the page) What is Forensic Accountancy? Personal Injury Forensic Accounting Expert Witness Insurance Claims Matrimonial Investigations Criminal Defence Compulsory Purchase Orders and Compensation Page 3 4 5 7 8 9 11 12 Page 2 of 13 WHAT IS FORENSIC ACCOUNTANCY? "Forensic" means suitable for use in a court of law and so forensic accountancy refers to all of the circumstances in which accountants might be asked to report to the courts. Forensic accountancy therefore covers a wide range of different circumstances but is often sub-divided into two groups: litigation support or expert witness; and investigations. LITIGATION SUPPORT Within England and Wales, expert witness work tends to arise from either civil litigation or criminal proceedings and is governed by the Civil or Criminal Procedure Rules. Instructions can come about as a result of a wide range of different types of commercial dispute, personal injury, divorce, and compulsory purchase orders, as well as in criminal proceedings. Whilst not necessarily associated with litigation, forensic accountants are also often instructed to assist with insurance claims. The instruction can come from just one party to the litigation or the expert may be instructed by both parties. The expert may be asked to provide informal advice to one or other of the parties but is typically asked to provide an independent, expert opinion concerning the accountancy related matters in a piece of litigation. The expert's opinion will be made available to the Court in order to assist the judge or jury reach their verdict and may be scrutinised by another forensic accounting expert and subject to cross examination within the court itself. INVESTIGATIONS Many investigations will lead to court proceedings and the investigator needs to be familiar with a wide ranging, and evolving, legal background. The forensic accountant can be instructed to undertake an investigation as a result of alleged theft, fraud and corruption and this can be necessary to support employee disciplinaries, criminal prosecution and the recovery of misappropriated assets in both the civil and criminal courts. The forensic accountant may also be instructed to provide training in fraud awareness, anti-money laundering and bribery and corruption. SKILLS REQUIRED The forensic accountant needs to be aware of the legal framework in which they operate as this will vary depending on the type of work they undertake. However, common to all forms of forensic accountancy is: the need to take a balanced approach, as a forensic accountant's work is likely to be scrutinised by other experts and the Court; a keen eye for detail; and strong skills in verbal and written communication as most forensic accountancy assignments begin with a written report and may end in the expert giving verbal evidence. Return to contents page Page 3 of 13 PERSONAL INJURY FORENSIC ACCOUNTING Forensic accountants who specialise in personal injury work are instructed to address quantum (the financial value) in personal injury, fatal accident, clinical negligence and industrial disease claims. These types of instruction can result in a wide range of losses which the forensic accountant may be asked to quantify. For example, as well as calculating the loss of earnings incurred immediately after injury, the forensic accountant may be asked to quantify the loss of potential future income. These forms of loss can also include lost pension income. Where an individual has died as a result of their injury, the forensic accountant may also be asked to quantify the income the deceased's dependents would have benefitted from, but for the injury. SKILLS AND ATTRIBUTES REQUIRED Whilst knowledge of the UK and, sometimes, overseas tax regimes can be relevant to many forms of forensic accountancy, this is especially true of those who specialise in personal injury work. This is because claims for lost earnings and pensions should be made net of tax as any compensation received by an individual is not taxable. An enquiring mind, as information provided is not always as it seems and is often incomplete, together with an understanding of the law and procedures involved in personal injury litigation is a requirement. It is also beneficial to have excellent writing skills to clearly explain the calculations. A strong stomach is a bonus. This is because the work often involves reading medical evidence, which includes details of injuries sustained, to ascertain the period of loss and ability to work since the incident. HINTS AND TIPS Whatever the form of litigation, the forensic accountant should read all of the evidence provided to them carefully. This is also true of personal injury specialists who will read the medical evidence, including witness statements provided by doctors and health specialists. These will often provide information concerning the Claimant's background, such as their career, and their working prospects and therefore earnings following their injury. USEFUL REFERENCES AND WEBSITES Butterworth's Personal Injury Litigation Service or Kemp & Kemp The Quantum of Damages: Both are very useful publications, primarily produced for personal injury lawyers but have very good sections on what can be claimed and the methodology of calculating claims as well as case law in respect of quantum. Actuarial tables for use in Personal Injury and Fatal Accident Cases (Ogden Tables) published by HMSO Return to contents page Page 4 of 13 EXPERT WITNESS WHAT IS AN EXPERT WITNESS? An expert witness is a professional who has a high level of knowledge in a certain area, such as medicine, surveying or accountancy. Because of their expertise, they are called upon to give their independent expert opinion to the Courts. A forensic accountant will therefore be hired by parties to a dispute to provide their expert opinion in relation to the accounting aspects of a dispute. WHAT ARE THE DUTIES OF AN EXPERT WITNESS? The duties of an expert witness are set out in the Civil Procedure Rules, Part 35 and accompanying Practice Direction 351. Among other things, the expert witness must recognise that they have an overriding obligation to the Court. This can be a challenge for many experts who have been appointed by just one party to the proceedings. This is because the expert needs to be prepared to give an independent opinion, even if that does not support his or her client's case. It is also important that the expert restricts himself to matters within his or her expertise. Although it may be tempting to try and help the Court by addressing areas on the edge of their expertise, the expert should be careful not to. Unless the Court directs otherwise, the expert accountant will need to provide a written report. This should set out the substance of the expert's instructions, written or verbal, and include a statement that the expert understands and has complied with his or her duty to the Court. Having produced a written report, it is quite likely that an expert instructed by one of the parties to the litigation may be directed to discuss matters with the other side's expert. Where possible, the experts should identify those areas where they can agree and set out those areas where they disagree and why. WHEN MIGHT AN EXPERT WITNESS BE INSTRUCTED? The area of expertise of a forensic accountant is not limited to the traditional understanding of what an accountant does, i.e. the preparation and audit of company accounts, or the preparation of tax returns. There is a range of reasons why an expert might be instructed. Some of the reasons associated with civil litigations are summarised here: Breach of contract In the event that one party fails to fulfil a contract, it may mean that another party suffers financial loss. A forensic accountant may, therefore, be instructed to quantify the loss of profits caused by a breach of contract, caused perhaps by the failure to deliver materials or complete a construction contract, on time or at all. Breach of warranty The purchase and sale of companies tends to be governed by sale and purchase agreements. These contain various financial warranties. The forensic accountant may be instructed to consider whether the warranty has been breached and to quantify the financial impact on the parties. Professional negligence A forensic accountant might be asked to comment on the work of their peers. This might be necessary in order to help the Court to consider whether an auditor or tax specialist has been negligent. The forensic accountant may also be asked to quantify the financial impact of the alleged negligence. 1 http://www.justice.gov.uk/guidance/courts-and-tribunals/courts/procedure-rules/civil/contents/parts/part35.htm Page 5 of 13 SOURCES OF INFORMATION (CIVIL LITIGATION) Civil Procedure Rules, Part 35 Civil Procedure Rules, Practice direction 35 Expert Code of Practice Appendix 11 to Commercial Court Guide Commercial Court Guidance on Long Trials IBA Rules on the Taking of Evidence in International Arbitration Commercial Court Guide (9th edition) Return to contents page Page 6 of 13 INSURANCE CLAIMS INTRODUCTION An insurance policy is a contract between an insurer and a policy holder. It details the claims that an insurer is required to pay following incidents impacting upon property, goods or the business of the insured in return for a premium paid. There are many different types of insurance that exist, ranging from personal insurance (eg life insurance, motor insurance, travel insurance, home insurance) to business insurance (eg property damage cover, directors' and officers' insurance, business interruption insurance). Examples of insured incidents include fires, floods, earthquakes, hurricanes, theft. However, many insurance policies include exclusions, for example damage caused by terrorism. HOW IS A FORENSIC ACCOUNTANT INVOLVED? Forensic accountants assist with the quantification of claims and are usually involved in the more complicated claims or claims of a high value and can assist the policy holder or the insurer to present or to defend a claim. The forensic accountant's work is based on the terms of the insurance policy, for example a policy for business interruption might include an "indemnity period". This means that in the event of damage to a business property, if the policy holder has lost profits, it can only claim them for an agreed period, as defined in the policy. Forensic accountants are also often asked whether they think a claim may have been brought fraudulently. In this case a forensic accountant will apply fraud screening processes to assess the likelihood of a claim being fraudulent. "Under insurance" is an issue that forensic accountants are often instructed to consider. In this case a premium might have been paid for a certain level of insurance that was not enough for the business or person. In this case a settlement may be reduced for the extent of under insurance. Should the quantum of an insurance claim be disputed, a forensic accountant may be called upon to provide an expert opinion as to the value of the claim within civil proceedings. Forensic accountants are often asked to prepare calculations for use in negotiations or formal mediations. WHO INSTRUCTS A FORENSIC ACCOUNTANT? There are many sources of instructions for forensic accountancy assistance in relation to insurance claims. In the early stages of a claim requests for assistance can be received from insurers, loss adjusters, policy holders or brokers. Once a claim becomes litigious, lawyers will also seek to instruct forensic accountants on behalf of a policy holder or insurer. SOURCES OF INFORMATION More information can be found on the internet from organisations such as the Chartered Institute of Loss Adjusters, the Insurance Fraud Bureau and the insurers, themselves. Return to contents page Page 7 of 13 MATRIMONIAL The forensic accountant may be instructed within family proceedings. Most commonly, this is associated with marriage or financial proceedings. MARRIAGE Although, not currently legally binding, many couples enter pre-nuptial agreements in order to help to facilitate an orderly separation, should one prove necessary. Increasingly, therefore, the forensic accountant may be instructed to value an unincorporated business or company shares. This is required to assist with the preparation of the pre-nuptial agreement to confirm the value of assets held prior to marriage. DIVORCE Financial proceedings follow from a married couple's intention (or petition) to divorce. This is where accountants are most often involved in family proceedings. Forensic accountancy work undertaken in matrimonial cases is varied, but most frequently involves the valuation of an unincorporated business or company shares. This valuation is then used in assessing the value of assets to be divided between the parties on divorce. In addition to valuations, a forensic accountant may be asked to comment on the liquidity of that value, that is, what value can realistically be extracted from a business without its day to day operations being compromised. A forensic accountant can also be asked to comment on the tax consequences of extracting funds, and thus the most tax efficient way to do so. Other areas of forensic work Other areas of matrimonial work where a forensic accountant might be appointed involve: investigating personal finances and asset tracing valuing personal assets such as pensions and share options restructuring businesses and personal arrangements. THE EXPERT'S DUTIES Expert work performed for matrimonial cases is governed by Part 252 of the Family Procedure Rules 2010 (FPR), which is similar to Part 35 of the Civil Procedure Rules (CPR). The main difference regards the provision of written questions to experts. Under CPR, questions can be raised up to 28 days after the date of expert's report, whereas, within matrimonial proceedings, questions must be raised within 10 days. In order to contain costs, Courts frequently provide for the appointment of a single joint expert, that is an expert that is provided with information by both parties to the divorce. They report to the Court taking into account the information provided by each side, and costs are likely to be met equally by each party. THE ADVISORY CAPACITY As with other forms of litigation, forensic accountants may be instructed to act as an advisor in matrimonial cases, ie not reporting to the Court. This is particularly common in matrimonial work because of the tendency to appoint a single joint expert, rather than experts appointed separately by both parties. For example, a forensic accountant may be asked to "shadow" the single joint expert and review the expert's report and to help prepare questions for the expert. Return to contents page 2 http://www.legislation.gov.uk/uksi/2010/2955/part/25/made Page 8 of 13 INVESTIGATIONS An investigation is the process undertaken to establish whether an act, intention to act or omission may have given rise to a civil or criminal liability and, if it has, the collection of evidence, or material to identify those responsible and how they will be dealt with in terms of redress and/or sanction. Any investigator needs, therefore, to know what points he or she needs to prove, whilst doing so in an acceptable and ethical fashion whilst maximising his or her chances of success using the most up to date methods available to them. LEGISLATION – POINTS TO PROVE The forensic accountant instructed to undertake an investigation needs, therefore, to be aware of the points they need to prove in order to identify and collect the necessary evidence. This will vary depending on the type of investigation a forensic accountant has been asked to consider. Some of the most relevant legislation includes: The Theft Act 1968-1996 The Fraud Act 2006 The Bribery Act 2010. THE ETHICAL DIMENSION Any investigation may have financial or reputational ramifications for the subject of the investigation. The Courts also take a dim view of tainted evidence which is presented to them, as well as the investigator responsible for its collection. The forensic accountant needs to ensure that evidence collected during an investigation has been collected in a proportionate, open, ethical and transparent manner. Amongst other things, the investigator should be familiar with his or her responsibilities within: the Human Rights Act 1998 (in particular the parts of Code C which address "cautioning" and "questioning"); the Police and Criminal Evidence Act 1984; and the Regulation of Investigatory Powers Act 2000. DIGITAL FORENSICS Investigations involve the collection and review of many different sources of evidence. These can be paper based or come from interview. However, in many cases, information technology is a key source of evidence and sometimes locates the "smoking gun". Many forensic accountants therefore work closely with digital forensics specialists in order to collect evidence from sources such as laptops, mobile phones, and tablets. A well trained digital forensics expert should be able to help the forensic accountant retrieve otherwise deleted information, data mine voluminous documents for the forensic accountant to review and map data in an easily understood format. In many instances, the forensic accountant may be the first to come across digital forensic evidence. In order to ensure that this is subsequently admissible in a court as evidence, the forensic accountant should be aware of the Association of Chief Police Officer's Guidance3. SOURCES OF INFORMATION Fraud forums have been set up across much of the UK and are often an excellent source of information as well as networking opportunities. The North East Fraud Forum was one of the first. Its website includes news and tips on fraud prevention: www.northeastfraudforum.co.uk. 3 www.met.police.uk/pceu/documents/ACPOguidelinescomputerevidence.pdf Page 9 of 13 The Universities of Portsmouth and Teesside both offer post graduate courses in fraud risk management as well as sources of more information. Professional services firms, such as Grant Thornton also provide bespoke training to investigators. Return to contents page Page 10 of 13 CRIMINAL DEFENCE The role of a forensic accountant will also extend to criminal defence matters. Broadly, this covers situations where an individual, or group of individuals, are either charged with, or have been convicted of, a criminal offence. Where the defendant has been charged with alleged criminal acts, the prosecuting authorities will set out specific details of the charges levelled against the individuals and the relevant legislation under which the criminal act is said to have taken place. The forensic accountant's role will entail review of the specific charges levelled and provision of an expert opinion based on analysis of the available evidence. RANGE OF OFFENCES There are many criminal charges in which a forensic accountant may be required to provide evidence. The most readily recognisable would be cases involving theft, fraud and false accounting. However, accounting experts may also be engaged in cases involving, for example: prosecutions by Trading Standards - such as charges arising from protection under misleading marketing regulations, where it is an offence to provide advertising that misleads traders. prosecutions by the tax authorities - such as tax evasion, including for example, VAT "missing trader fraud". confiscation orders - following a drive by the government to strip criminals of financial gains from criminal acts, confiscation orders under the Proceeds of Crime Act 2002 ("POCA"). even, murder cases - where the prosecution's case includes elements of financial motive. BURDEN OF PROOF & GIVING EVIDENCE It is important to understand that criminal cases require evidence to be provided that proves "beyond reasonable doubt" that a criminal act has taken place. This is in contrast to civil cases where the burden is on the "balance of probabilities". As such, the forensic accountant will need to be clear as to what evidence is relied upon and the assumptions applied in arriving at their opinion. More often than not criminal cases will be heard in Court in trial by a jury, in contrast with civil cases which are heard by a Judge or similar authority. Therefore, this will impact on the way in which an expert gives evidence and the manner in which they are cross examined. LEGAL AID Given the impact of criminal cases on individuals it may well be the case that the defendant is unable to fund the cost of their defence and will rely on legal aid from the public purse. This is administered by the Legal Services Commission ("LSC"). If this is the case, the instructing solicitor will require detailed written quotations and prior approval for funding of expert fees from the LSC. SOURCES OF INFORMATION The following legislation will provide a useful point of reference for common criminal charges: The Theft Act 1968-1996 The Bribery Act 2010 The Fraud Act 2006. The Companies Act 2006. Proceeds of Crime Act 2002. The Business Protection from Misleading Marketing Regulations 2008. Page 11 of 13 Some useful websites include: www.legalservices.gov.uk www.cps.gov.uk www.justice.gov.uk www.legislation.gov.uk Return to contents page Page 12 of 13 COMPULSORY PURCHASE ORDERS AND COMPENSATION This is a niche area of forensic accounting which involves assessing the compensation due to businesses that have been forced to move out of their premises to make way for new developments. WHAT IS A COMPULSORY PURCHASE ORDER? When a new development is planned, for example a new road is to be built, or a town centre is to be developed, the local authority (or other relevant body) will need to acquire the necessary land. Any businesses that are being run from the land in question are required to make way for the new development. Their land is acquired by way of a Compulsory Purchase Order (CPO) and they are then forced to vacate their premises. Of course, they are entitled to compensation for any loss they suffer, and it is the role of the forensic accountant to assist with the assessment of that loss. LOSSES SUFFERED A forensic accountant is usually instructed when the business is not able to find alternative premises to which it can relocate, and therefore has to close down (it is said to have been "extinguished"). The business owner is then entitled to the loss of the future profits he would have earned from the business. The loss has been described as4: " the value to the claimant of the loss of his ability to derive a future profit out of the premises from which he has been dispossessed." The forensic accountant will assess this loss of future profits, which will essentially involve valuing the business, and in turn, valuing the goodwill of the business. VALUING THE BUSINESS The business will usually be valued by applying a multiple to the maintainable profits of the business, although discounted cash flow methods can also be adopted. In carrying out the valuation, the forensic accountant will take account of factors such as how long the business has been in operation, the trend in historic profits and future prospects (but for the CPO). This may involve examining any budgets and forecasts that are available, the level of competition, gearing, barriers to entry to the industry, and any other risks associated with the business or the industry. VALUE OF THE LAND Where the business owns the land that is being acquired, it will be entitled to the market value of the land. This will be assessed by a surveyor rather that a forensic accountant since the valuation of land is outside the scope of an accountant's expertise. The forensic accountant will need to liaise closely with the surveyor to ensure that there is no duplication of the losses assessed. SOURCES OF INFORMATION The Compulsory Purchase Association provides a forum for surveyors, public authorities, lawyers, accountants and others involved in compulsory purchase to meet and share ideas. http//www.compulsorypurchaseassociation.org. Return to contents page 4 R C Walmsley - Reynolds v Manchester City Council [1979] Page 13 of 13