2011 Final Exam Review

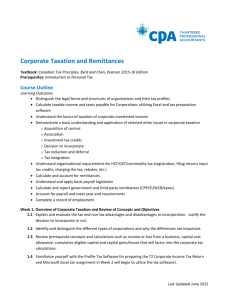

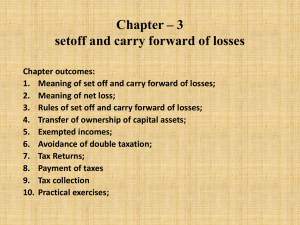

advertisement

Final Exam Review – Canadian Taxation Chapters 1 & 2 - Not tested Chapters 3 – 7 - Not tested directly Still expected to know these concepts, as later chapters build on this material Chapter 8 – Capital Gains & Losses - Capital Gain vs. Business Income Canadian Securities Personal Use Property (PUP) Listed Personal Property (LPP) Financial Property General Rules for Determining Capital Gain/Loss Disposition & Proceeds of Disposition Deemed Disposition Deferred Proceeds Capital Losses Superficial Losses Identical Properties Principal Residence Voluntary & Involuntary Disposition Small Business Investments Chapter 9 – Other Income & Other Deductions - Major sources of other income (i.e. RRSP benefits, RRIF, Pension, OAS, CPP, EI) Other deductions (i.e. RRSP contributions, moving expenses, child care expenses) Registered Retirement Savings Plans (RRSP) Registered Education Savings Plans (RESP) Tax-Free Savings Accounts (TFSA) Special Rules for Net Income Determination (i.e. Reasonableness Test, Non-Arms Length Transactions) Chapter 10 – Taxable Income & Taxes Payable for Individuals - Determining Taxable Income Loss Carry-Over & Loss Utilization Capital Gains Deduction Calculating Taxes Payable (Primary Taxes Payable) Various Federal Tax Credits Chapter 11 – Introduction to Corporations - Determining Taxable Income Loss Carry-Over & Loss Utilization Dividends from Other Canadian Corporations Calculating Taxes Payable (Primary Tax, Tax Abatement) - Refundable Tax on Investment Income for CCPCs Tax Reductions (General Rate Reduction, Small Business Deduction, M & P Deduction) Provincial Tax & Multi-Provincial Tax Integration of Corporate & Individual Taxation (i.e. Effect of Dividend Tax Credit) Chapter 12 – Organization, Capital Structures and Income Distribution - Tax Treatment – Debt vs. Equity Sale of Shares Back to the Corporation Transferring Assets to Corporation (FMV) Transferring Assets at Tax Value (Section 85 rollover) Chapter 13 – Canadian-Controlled Private Corporation (CCPC) - - - Taxation of Income Earned by CCPC - Active Business Income - Specified Investment Business Income - Capital Gains - Personal Services Business Income - Dividends Advantages & Disadvantages of Incorporation Loans to Shareholders Limitation of Small Business Deduction (Rules of Associated Corporations) Overall Tax Calculation for CCPC - Similar to other corporations - Small Business Deduction - Refundable Tax Refundable Dividend Tax on Hand (RDTOH) Account & Dividend Refund Chapter 14 – Multiple Corporations & Reorganization - Corporate Reorganizations (Asset Transfer, Amalgamation & Wind-Up) Reorganization of Share Capital Holding Corporations & Intercorporate Investments Chapter 15 – Partnerships - Taxation of Partnership Income & Partnership Interests Chapter 16 – Limited Partnerships & Joint Ventures - Taxation of Partnership Income & Partnership Interests Loss Utilization – Limited Partners vs. General Partners No testing of joint ventures Chapter 17 – Trusts - Taxation of Trusts – Inter Vivos, Testamentary, Spousal Determining Taxable Income & Taxes Payable for Trusts Income Allocation & Beneficiaries 21 Year Rule Chapter 18 – Business Acquisitions & Divestitures – Assets vs. Shares - Taxation of Business Acquisition & Divestiture – Shares – Vendor & Purchaser - Calculating Capital Gain (Loss) on Sale of Shares - Capital Gain Deduction (if QSBC) - Calculate Taxable Income & Taxes Payable - Taxation of Business Acquisition & Divestiture – Assets – Vendor & Purchaser - Calculate Taxable Income on Disposal of Assets - Calculate Taxes Payable - Calculate Total Dividend & Taxable Dividend - Calculate Taxes Payable on Dividend - Calculate Capital Gain (Loss) on Disposal of Shares - Determine if Capital Loss is Eligible for ABIL - Tax Planning – Holding Companies & Intercorporate Investments Chapters 19 – 21 - Not tested