Corporate Taxation and Remittances

advertisement

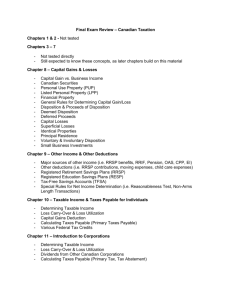

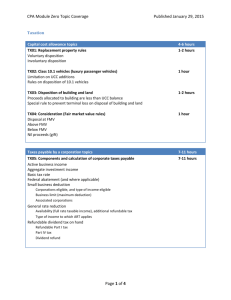

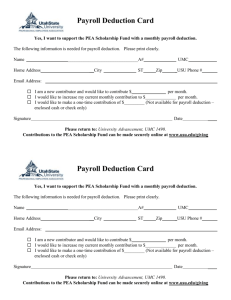

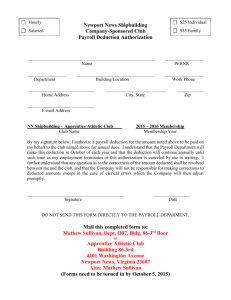

Corporate Taxation and Remittances Textbook: Canadian Tax Principles, Byrd and Chen, Pearson 2015-16 Edition Prerequisites: Introduction to Personal Tax Course Outline Learning Outcomes • Distinguish the legal forms and structures of organizations and their tax profiles • Calculate taxable income and taxes payable for Corporations utilizing Excel and tax preparation software • Understand the basics of taxation of corporate investment income • Demonstrate a basic understanding and application of selected other issues in corporate taxation o Acquisition of control o Association o Investment tax credits o Decision to incorporate o Tax reduction and deferral o Tax integration • Understand organizational requirements for HST/GST/commodity tax (registration, filing returns input tax credits, charging the tax, rebates, etc.) • Calculate and account for remittances • Understand and apply basic payroll legislation • Calculate and report government and third party remittances (CPP/EI/WCB/taxes) • Account for payroll and meet year-end requirements • Complete a record of employment Week 1: Overview of Corporate Taxation and Review of Concepts and Objectives 1.1 Explain and evaluate the tax and non-tax advantages and disadvantages to incorporation. Justify the decision to incorporate or not. 1.2 Identify and distinguish the different types of corporations and why the differences are important. 1.3 Review prerequisite concepts and calculations such as income or loss from a business, capital cost allowance, cumulative eligible capital and capital gains/losses that will factor into the corporate tax calculations. 1.4 Familiarize yourself with the Profile Tax Software for preparing the T2 Corporate Income Tax Return and Microsoft Excel (an assignment in Week 2 will begin to utilize the tax software). Last Updated June 2015 1.5 Familiarize yourself with the framework of the Corporate Tax Roadmap: Steps to Completing a Corporate Tax Calculation by hand. Week 2: Reconciliation of Accounting Net Income and Net Income for Tax Purposes 2.1 Understand the significant adjustments required to convert accounting net income to net income for tax purposes and the purpose for making the adjustments. 2.2 Reconcile accounting net income to net income for tax purposes and briefly explain why the adjustments are required (Schedule 1 on T2). 2.3 Review and understand calculations of adjustments such as capital cost allowances, capital gains/losses, cumulative eligible capital, reserves, etc. (Schedules 6, 8, 10 on T2). 2.4 Familiarize yourself with the Profile Tax Software and be able to prepare Schedules 1, 6, 8, 10 in the T2 Corporate Income Tax Return and Microsoft Excel. 2.5 Familiarize yourself with the Corporate Tax Roadmap: Step 1. Week 3: Taxable Income of a Corporation, Acquisition of Control Rules and Provincial Allocation of Income 3.1 Compute taxable income for a corporation (T2 Jacket). 3.2 Understand the charitable donation deduction and its limitations (Schedule 2 on T2) 3.3 Understand the types and related deductibility of losses from other years and have a basic understanding of the impact of the acquisition of control rules on those losses (Schedule 4 on T2) 3.4 Understand the deduction for dividends from taxable Canadian corporations and the taxation of foreign dividends (Schedule 3 on T2) 3.5 Briefly explain the process and calculation of allocating taxable income among provinces (Schedule 5 on T2). 3.6 Familiarize yourself with the Corporate Tax Roadmap: Steps 2 and 3. Week 4: Calculation of Part I Corporate Taxes Payable 4.1 Compute the basic tax payable, the general corporate rate reduction and the tax abatement under Part I, identifying common deductions in this process. 4.2 Calculate income from an active business and identify special situations where passive income is deemed active. 4.3 Calculate the small business deduction including the situation of an associated company and have a basic understanding of the types of income that qualify for the small business deduction. 4.4 Have a brief understanding of whether a corporation is eligible for the manufacturing and processing profits deduction, the investment tax credit and the foreign tax credit deduction. 4.5 Compute Part I tax on investment income (additional refundable tax). 4.6 Familiarize yourself with the Corporate Tax Roadmap: Steps 4-12. Week 5: Part IV Tax, Corporate Distributions, Integration and Tax Relationships 5.1 Calculate Aggregate Investment Income and compute the refundable portion of Part I tax payable on investment income and briefly explain the principles of underlying taxation of aggregate investment income. Last Updated June 2015 5.2 Compute Part IV tax payable, the balance in the refundable dividend tax on hand (RDTOH) account, and a dividend refund. 5.3 Have basic understanding on the principle of integration and effect of the distribution of corporate surpluses. 5.4 Compute the capital dividend account balance. 5.5 Have basic understanding of various tax relationships and implications of companies being: related, associated, affiliated and/or connected. 5.6 Have basic understanding of eligible and ineligible dividends and impact on shareholders remuneration/corporate distributions. 5.7 Familiarize yourself with the Corporate Tax Roadmap: Steps 6 (revisit), 13-15 5.8 At the end of this module, you should be able to complete a corporate tax calculation. Week 6: Goods and Services Sales Tax/Harmonized Sales Tax (GST/HST) 6.1 Understand organizational requirements for GST/HST (registration, filing returns, ITCs, rebates, etc) 6.2 Calculate and account for typical transactions and remittances. Week 7: Payroll Taxes and Remittances 7.1 Understand and apply basic payroll legislation 7.2 Calculate and report government and third party remittances (CPP/EI/WCB/taxes) 7.3 Account for payroll and meet year-end requirements 7.4 Complete a basic record of employment Week 8: Review of topics covered in Week 1-7 plus a practice exam Last Updated June 2015