FedEx Financial Profile - Fulbrook Enterprises Home

advertisement

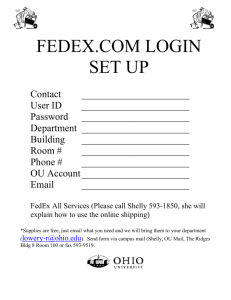

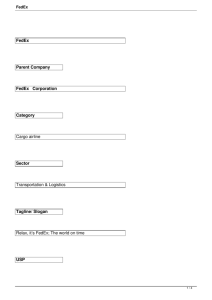

Christian Brothers University Financial Research Report: FedEx Corporation (FDX) A Paper Submitted to Dr. Judy Ramage, CPA For MSEM 603 Engineering Finance By Michael Fulton, PMP Memphis, Tennessee April 18, 2007 Mike Fulton MSEM 603, Spring 2007 Christian Brothers University April 18, 2007 Dr. Judy Ramage., CPA Christian Brothers University School of Business, Information Technology Department 650 East Parkway South Buchman Hall, Room 321 Memphis, TN 38104 Dr. Ramage, I chose FedEx Corporation for my research and found this to be an excellent way for me to learn more about my employer’s financial health. The tools and techniques taught in MSEM 603 have great value regarding my future goals. This paper uses some of these tools and techniques to evaluate FedEx as outlined in the research requirements for this class. The first section provides a brief introduction about FedEx Corporation and their role in the free trade world. The next section describes the research method used to gather news and financial information. The following two sections present the data and analysis. A 3-month news analysis reviews how daily press releases and news articles affect how FedEx’s stock is traded over the short-term. Understanding how investors react to news creates a volatility profile. This will help determine how closely FedEx’s stock must be monitored to make short-term decisions. A comparative financial analysis is performed on FedEx’s balance sheet and income statements from 2004, 2005, and 2006. The two key goals are to estimate FedEx management’s historical effectiveness and determine where the company may be headed. Picking FedEx seemed easy enough. Understanding how to research and evaluate FedEx’s financial data and significant news events was very challenging. Thank you, Mike Fulton Mike Fulton Financial Research Report on FedEx Corporation Introduction FedEx Corporation is a leading provider of transportation services for packages and freight to both residential and business customers operating under three primary business segments; FedEx Express, FedEx Ground, and FedEx Freight. In February of 2004, FedEx acquired a fourth business segment, FedEx Kinko’s, offering document solutions, e-commerce, business, and information services. Much of FedEx’s overnight domestic package services are provided through its hub in Memphis, Tennessee where its core business began in 1973 and still resides today. With access to over 220 countries and territories worldwide, FedEx is expanding its brand of services into a global network of free trade economies1. Most recently, FedEx has announced that beginning May 28th next-day domestic business services will be fully operational in China2. This business move has historical value to FedEx founder Fred Smith, who has seen China as an economic opportunity since the early 1980’s3. FedEx has 189,150 full time employees4 including the author who began work November 2006 in Memphis, TN; hired as Senior Aircraft Engineer in the Avionics and Electrical group. This research into FedEx’s corporate financials serves to educate myself, the author, and inform my readers about the historical, present, and potential earnings value and equity growth through ownership of FedEx stock. Federal Express was listed on the New York Stock Exchange in 1978 with the stock ticker FDX5. In 2000, the parent company is renamed “FedEx Corporation” “About FedEx: World Network”, FedEx Corporate Website, April 9, 2007 <http://fedex.com/us/about/overview/ worldwide/ index.html?link=2>. 2 “FedEx plans new domestic China service”, BusinessWeek.com, The Associated Press, March 19, 2007 http://www.businessweek.com/ap/financialnews/D8NVHCI80.htm>. 3 Ducker, Michael, Exec VP International, FedEx Express, Topic: China Strategy, Telephone Interview with Author, April 4, 2007, 10:45 am. 4 “Profile FedEx Corporation”, Yahoo Finance Website, April 9, 2007 < http://finance.yahoo.com/ q/pr?s=FDX> 5 “About FedEx: FedEx Historical Timeline”, FedEx Corporate Website, April 9, 2007 <http://fedex.com/us/about/ today/history/timeline.html>. 1 Page 1 Mike Fulton Financial Research Report on FedEx Corporation and remains as FDX. FedEx stock has split four times since 1980 and began payment of quarterly stock dividends in June of 2002. Investor support has grown and FedEx now resides as number six on Fortune Magazine’s most admired companies list in 20076. Research Method: Daily changes to the market price of FDX stock and any relevant news articles have been tracked since January 10th of 2007. The stock price fluctuations are evaluated to assess what economic events may have driven notable changes. These price drivers may be related to FedEx press releases or external factors. The goal is to understand what conditions cause trading volatility in the stock’s price, to access potential risks, and determine its overall stability in the equities market. The previous three years of income statements and balance sheets are reviewed with due diligence looking for warning signs or opportunities. Key statistics are reviewed and performance measures are calculated. The goal here is to form a financial opinion on the overall effectiveness of FedEx management. FedEx management has demonstrated confidence in the expanding free trade economies emerging in the Middle Eastern markets. Above all, FedEx’s special interest in China has far reaching impacts on long-term funding requirements and management’s strategy to control shortterm results. Attention on FedEx’s current financial condition and management’s direction is assessed for the present and potential worth to stockholder confidence in world markets. “America’s Most Admired Companies 2007”, CNNMoney.com, April 10, 2007, < http://money.cnn.com/ magazines/ fortune/mostadmired/2007/index.html>. 6 Page 2 Mike Fulton Financial Research Report on FedEx Corporation 3-Month News Analysis: On January 10th, FedEx’s stock opened on the New York Stock Exchange trading at $107.51. During the day’s trading activity, it hit a high of $107.89 and reached a low of $106.63. The final closing price at the bell was $107.59. The day’s trading volume was light with a total volume of 1,252,800 shares traded7. No significant news headlines events were released affecting the day’s trade. Each successive trading day following January 10th was observed for any stock activity related to news reports. Headline news fell into three primary categories: 1. News releases about FedEx internal activities. 2. News concerning external factors that have an affect on FedEx. 3. Any news affecting the stock market as a whole. The objective was to understand how investors react to news and then trade FedEx stock. With a bit of luck, a news volatility profile emerges and can be used to estimate potential short term and long term impacts on FDX stock holder’s equity. A graph, shown below in figure 1, is used to provide a snap shot of FedEx’s most recent closing price history. This graph exhibits a 3-month period beginning January 10th and ending April 13th. FedEx Closing Price History 10 January, 2007 through 13 April, 2007 $125 $120 $115 $110 $105 $100 4/4 4/11 3/28 3/21 3/14 3/7 2/28 2/21 2/14 2/7 1/31 1/24 1/17 1/10 $95 Figure 1: 7 “Historical Prices: FDX”, Yahoo Finance Website, April 14, 2007 < http://finance.yahoo.com/ q/hp?s=FDX> Page 3 Mike Fulton Financial Research Report on FedEx Corporation The daily stock price highs and lows are exhibited in figure 2 and the trading volume, in numbers of shares exchanged, is shown in figure 3. FedEx High/Low History FedEx Trading Volume History 10 January, 2007 through 13 April, 2007 Figure 2 4/4 4/11 3/28 3/21 3/7 3/14 2/28 2/21 2/14 2/7 1/31 1/24 1/17 4/4 4/11 3/28 3/21 3/7 3/14 2/28 0 2/21 1,000,000 $95 2/14 2,000,000 $100 2/7 3,000,000 $105 1/31 4,000,000 $110 1/24 5,000,000 $115 1/17 6,000,000 $120 1/10 $125 1/10 10 January, 2007 through 13 April, 2007 Figure 3 Stock data was downloaded from the YAHOO! Finance website and compiled to create the three graphs. During the 3-month evaluation period, the highest closing price was $120.97 and lowest was $106.07. There were 65 trading days during this timeframe. The average stock price was calculated at $111.68 with a standard deviation of $3.33. The largest change in price from the previous day’s close was +3.44% when 3,087,900 shares traded that day. The highest volume (5,472,500 shares) of trades in a given day yielded a -1.17% change in price. The lowest volume (961,900 shares) of trades in a given day yielded a -0.19% change. The greatest price swing from the high and low in a given day was $4.63. Overall, FedEx’s stock price exhibited stability. There has been a downward pressure on its price since its high on February 23rd. The following headline news activity is reported by numerous web based sources including YAHOO! and Google. These two companies are established as reputable providers of one stop links to historical news articles. They withstand public scrutiny regarding their reporting accuracy and are being used as a primary tool for this research. Key news events and FedEx corporate milestones are chosen as the most revealing news articles. A chart with a FedEx price timeline is shown with news release indicators referencing articles of interest. Page 4 Mike Fulton Financial Research Report on FedEx Corporation FedEx News History 10 January, 2007 through 13 April, 2007 F $125 E $120 G D H I JK L C A $115 B N N M $110 $105 $100 $95 1/1 1/17 1/24 1/31 2/7 2/14 2/21 2/28 3/7 3/14 3/21 3/28 4/4 4/11 Figure 4 Tuesday, January 16, 2007 A: - FedEx gets upgraded to ‘overweight’ by an analyst at J.P. Morgan.8 Previous Close: 108.86 Closing Price: 111.68 Open: 111.90 High: 112.90 Low: Volume: Wednesday, January 31, 2007 B: - FedEx acquires Indian air freight company.9 - Today’s strong buys article at Motley Fool.10 Previous Close: 109.21 Closing Price: 110.40 Open: 109.20 High: 110.46 Low: 108.40 Volume: Friday, February 2, 2007 C: - FedEx gets upgraded to ‘buy’ from ‘hold’ by an analyst at Deutsche Bank.11 111.13 3,118,300 1,974,100 Previous Close: 111.80 Closing Price: 113.70 Open: 109.20 High: 115.36 Low: Volume: 113.00 2,994,800 “Ahead of the Bell: FedEx Gets Upgrade”, Yahoo Finance Website, The Associated Press, January 16, 2007 <http://biz.yahoo.com/ap/070116/fedex_ahead_of_the_bell.html?.v=1 >. 9 “FedEx acquires Indian air freight company”, Yahoo Finance Website, BizJournals.com, January 31, 2007 <http://biz.yahoo.com/bizj/070131/1410878.html?.v=1 >. 10 “Today’s Strong Buys”, The Motley Fool Website, January 31, 2007 <http://www.fool.com/investing/smallcap/2007/01/31/todays-strong-buys.aspx>. 11 “Shares of FedEx Rise After Upgrade”, Yahoo Finance Website, The Associated Press, February 2, 2007 <http://biz.yahoo.com/ap/070202/fedex_mover.html?.v=1>. 8 Page 5 Mike Fulton Financial Research Report on FedEx Corporation Wednesday, February 14, 2007 D: - FedEx gets upgraded to ‘outperform’ by an analyst at Morgan Keegan.12 Previous Close: 113.45 Closing Price: 117.49 Open: 115.10 High: 118.15 Low: Volume: Friday, February 16, 2007 E: - FedEx declares quarterly dividend in the amount of $0.09 per share.13 Previous Close: 117.20 Closing Price: 116.96 Open: 117.50 High: 117.59 Low: Volume: Tuesday, February 27, 2007 F: - FedEx makes changes to employee’s pension plan and Files SEC form 8-K.14 - DOW Jones industrials drop 400 points. This is the largest 1 day drop since 9/11.15 116.90 Closing Price: 113.63 Open: 116.00 High: 116.39 Low: 112.50 2,766,200 Previous Close: 114.14 Closing Price: 114.16 Open: 113.05 High: 114.75 Low: 111.29 Volume: Thursday, March 9, 2007 H: - FedEx is upgraded by Stifel Nicolaus to ‘Buy’ from ‘Hold’.17 116.46 1,318,100 Previous Close: Volume: Thursday, March 1, 2007 G: - FedEx expands in China; buys out 50% stake in a joint venture.16 114.99 3,087,900 2,307,000 Previous Close: 113.59 Closing Price: 114.67 Open: 115.87 High: 116.76 Low: Volume: 114.11 1,478,400 “Ahead of the Bell: Upgrade for FedEx”, Yahoo Finance Website, The Associated Press, February 14, 2007 <http://biz.yahoo.com/ap/070214/fedex_ahead_of_the_bell.html?.v=1>. 13 “FedEx Corp. Board Declares Quarterly Dividend”, Yahoo Finance Website, Business Wire, February 16, 2007 <http://biz.yahoo.com/bw/070216/20070216005403.html?.v=1>. 14 “FedEx Making Changes to Pension Plan”, Yahoo Finance Website, The Associated Press, February 27, 2007 <http://biz.yahoo.com/ap/070227/fedex_retirement.html?.v=1 >. 15 “Stock market slump hits Memphis companies”, Yahoo Finance Website, BizJournals.com, February 27, 2007 <http://biz.yahoo.com/bizj/070227/1424207.html?.v=1>. 16 “FedEx Expands In China”, Forbes Website, Market Scan, March 1, 2007 <http://www.forbes.com/2007/03/01/ fedex-network-takeovers-markets-equity-cx_er_0301markets07.html?partner=yahootix>. 17 “Stifel Nicolaus Upgrades FedEx on Growth Opportunities, Pullback in Shares”, Yahoo Finance Website, The Associated Press, March 9, 2007 <http://biz.yahoo.com/ap/070309/fedex_ahead_of_the_bell.html?.v=1>. 12 Page 6 Mike Fulton Financial Research Report on FedEx Corporation Tuesday, March 13, 2007 I: - FedEx changes its by-laws for electing its board of directors.18 Previous Close: 115.14 Closing Price: 112.69 Open: 114.60 High: 115.05 Low: Volume: Monday, March 19, 2007 J: - FedEx Announces Next-Business-Day Domestic Express Service in China.19 Previous Close: 111.14 Closing Price: 112.48 Open: 112.25 High: 113.00 Low: Volume: Wednesday, March 21, 2007 K: - FedEx reports 2 percent dip in 3Q earnings.20 112.29 Closing Price: 110.99 Open: 109.20 High: 112.11 Volume: 109.00 5,472,500 Previous Close: 110.63 Closing Price: 112.71 Open: 110.63 High: 112.88 Low: 110.30 Volume: Thursday, March 29, 2007 M: - UBS analyst Elizabeth Mielke cut her price target on FedEx.22 112.48 1,528,100 Previous Close: Low: Friday, March 23, 2007 L: - FedEx files SEC form 10-Q quarterly report.21 112.69 2,088,900 2,005,400 Previous Close: 107.67 Closing Price: 107.70 Open: 108.60 High: 109.20 Low: Volume: 106.69 2,261,500 “FedEx Board Adopts Majority-Voting Standard for Election of Directors”, Yahoo Finance Website, Press Release March 13, 2007 <http://biz.yahoo.com/bw/070313/20070313005237.html?.v=1>. 19 “FedEx Announces Next-Business-Day Domestic Express Service in China”, FedEx Corporate Website, Press Release, March 19, 2007 <http://home.businesswire.com/portal/site/fedex-corp/index.jsp?epicontent=GENERIC&newsId=20070319006250&ndmHsc=v2*A1104584400000*B1176624372000*C4102491599 000*DgroupByDate*J2*N1000731&newsLang=en&beanID=1700974478&viewID=news_view>. 20 Corey Dade, “FedEx Says Profit Gains May Be Sluggish”, The Wall Street Journal Online, March 21, 2007 <http://online.wsj.com/preview_login.html?url=http%3A%2F%2Fonline.wsj.com%2Farticle%2FSB117447927173 444010.html%3Fmod%3Dyahoo_hs%26ru%3Dyahoo>. 21 “Form 10-Q for FEDEX CORP”, Yahoo Finance Website, March 23, 2007 <http://biz.yahoo.com/e/070323/ fdx10-q.html>. 22 “Analyst Cuts Price Target on FedEx, Economy Playing a Role”, Yahoo Finance Website, The Associated Press, March 29, 2007 <http://biz.yahoo.com/ap/070329/fedex_ahead_of_the_bell.html?.v=1>. 18 Page 7 Mike Fulton Financial Research Report on FedEx Corporation Friday, April 6, 2007 (Stock Market Closed) N: - FedEx unit to buy logistics service provider in Hungary.23 Wednesday, April 11, 2007 O: - FedEx settles racial bias suit for $53.5M.24 - FedEx Loses $3 Million Sexual Harassment Case, a Day After Settling Race Claim25 Previous Close: 108.82 Closing Price: - Open: - High: - Low: - Volume: - Previous Close: 108.33 Closing Price: 107.21 Open: 108.20 High: 108.91 Low: Volume: 106.72 1,711,500 During the 3-month evaluation period, the most notable news event occurred on March 21st when FedEx reported a 2 percent dip in their 3rd quarter earnings. That day, 5,472,500 shares stock traded, which was 288% above the average daily trading volume of 1,901, 632 for that period. The closing price had dropped only 1.17% from the previous day’s close. This seemed to indicate traders found this to be a buy opportunity in view of the unpleasant news report. On February 27th, the stock market as whole suffered significant loses as the DOW plummeted 400 points. FedEx closed down 2.88% with a trading volume of 2,766,200 shares. On the positive side, FedEx stock traded up when several different analysts upgraded their ratings during the 3-month period. Another comparison is made by looking at FedEx and UPS as compared to the Dow Jones Industrials Average (DJIA), Standards and Poors (S&P), and the National Association of “FedEx unit to buy logistics service provider in Hungary”, Rueters Website, April 6, 2007 <http://www.reuters.com/article/mergersNews/idUSBNG29757520070406>. 24 “FedEx settles racial bias suit for $53.5M”, CNNMoney.com, April 10, 2007, <http://money.cnn.com/ 2007/04/11/news/companies/fedex.reut/index.htm?source=yahoo_quote >. 25 “FedEx Loses $3M Sex Harass Verdict”, Yahoo Finance Website, The Associated Press, April 11, 2007 <http://biz.yahoo.com/ap/070411/fedex_lawsuits.html?.v=1>. 23 Page 8 Mike Fulton Financial Research Report on FedEx Corporation Securities Dealers Automated Quotations (NASDAQ). The United Parcel Service (UPS) is a direct competitor of FedEx. By comparing the two side-by-side, it is possible to see how the economic conditions of the freight services industry affects both equally or not. Any significant difference would be more related to the business aspects of the individual company rather than economic conditions. The chart shown in figure 5 indicates FedEx was outperforming UPS, the DJIA, the S&P, and the NASDAQ early in the year. As the next 2 months pass, FedEx begins level out in comparison. Figure 5 Internal and external news events had a trivial impact on FedEx’s stock prices in shortterm trades. The largest singe day drop from a previous day’s close was 3.40%. The greatest gain was 3.44%. The greatest price risk for same day trades was 3.62%. The Motley Fool published a brief statement on June 13, 2003 regarding how news affects stock prices. Columnist Selena Maranjian wrote “It largely depends on what investors have been expecting, Page 9 Mike Fulton Financial Research Report on FedEx Corporation since current expectations are generally already factored into the current stock price. Sometimes news isn't really news to most people. When that's the case, there isn't much effect on the stock price.”26 FedEx Financial Profile: FedEx is a ‘public’ company and is required to disclose financial and other significant information to the public in compliance with the “truth in securities law” from the Securities Exchange Act of 1934. Financial Data from FedEx’s Annual Report (SEC form 10-K) is evaluated. The goal is to understand FedEx’s financial health and determine where the company may be headed. FedEx’s fiscal year begins June 1st and concludes May 31st of the following year. Their most recent annual report disclosed the financial year 2006, which gave an account of FedEx’s fiscal records from June 1, 2005 to May 31, 2006. Their corporate website provides investor’s with downloadable reports dating back to 199827. Data from their 2006 annual report is analyzed using tools learned in class; MSEM 603. Key ratios are calculated by using formulas given in the class text: Ross, Westerfield, Jordan. Essentials of Corporate Finance. 5th Edition. 2007. The calculated ratios, shown in Table 1 below, are made by direct interpretations from the balance sheet and income statement provided in FedEx’s annual report. It is notable the numbers vary from slightly different to significantly different to those found on Yahoo!’s website. Yahoo! uses data provided by Capital IQ, which is a division of Standard’s and Poor’s28. A study of how Captital IQ derives their figures would be essential to understanding Maranjian , Selena, “How News Affects Stock Prices”, The Motley Fool Website, Fool’s School Daily Q&A, June 13, 2003 <http://www.fool.com/foolu/askfoolu/2003/askfoolu030613.htm>. 27 “Annual Reports”, FedEx Corporate Website, April 15, 2007 <http://www.fedex.com/us/investorrelations/ financialinfo/2006annualreport/?link=4>. 28 “Key Statistics: FDX”, Yahoo Finance Website, April 15, 2007 <http://finance.yahoo.com/q/ks?s=FDX>. 26 Page 10 Mike Fulton Financial Research Report on FedEx Corporation the differences. Capital IQ has standardized their reporting method and would attest that their figures are leveled for an accurate comparison to other publicly traded stocks. Key Ratios for FedEx as of 31May, 2006 Short-Term Solvency Long-Term Solvency Asset Management Profitability Measures Market Value Measures Current Ratio 1.181 Total Debt Ratio 0.423 Capital Intensity Ratio 0.703 Profit Margin 0.056 Price-Earnings Ratio 18.335 Cash Ratio 0.354 Debt-Equity Ratio 0.732 Return on Assets 0.080 Market to Book Ratio 1.782 Equity Multiplier 1.732 Return on Equity 0.138 Times Interest Earned Ratio 21.415 Cash Coverage Ratio 32.33 Table 1 The key ratios from Table 1 would serve best to compare FedEx reports from the previous 2 years including 2004 and 2005. Table 2 below shows how these figures compare. Year to Year Comparison of Ratios for FedEx Current Ratio Cash Ratio Total Debt Ratio Debt-Equity Ratio Capital Intensity Profit Margin Return on Assets Return on Equity 2006 2005 2004 1.181 0.354 0.423 0.732 0.703 0.056 0.080 0.138 1.113 0.219 0.411 0.698 0.695 0.056 0.087 0.150 1.050 0.127 0.568 0.432 0.774 0.034 0.044 0.077 Table 2 Page 11 Mike Fulton Financial Research Report on FedEx Corporation The most interesting change is the increasing Debt-Equity Ratio. This is showing how FedEx has increased debt more than having increased equity over the last three years. Return on Equity has also increased since 2004 showing higher income returns while lowering the equity position. Does this indicate FedEx intends to add more short-term debt to generate higher income? This is probably why the cash position has been increased to cover increasing shortterm liabilities. There are other factors to consider while evaluating FedEx’s financial profile. For an investor seeking income cash flows, FedEx is offering quarterly dividends. The most recent dividend pay out was $0.09 per share. FedEx began paying out dividends on June 7th, 2002. The first payout was $0.05 per share. A total of twenty dividends have been paid out to date. Since 2002, the dividend payout has increased by a total of 80%. Table 3 below shows the changes in annual dividends paid. FedEx Annual Dividends Paid 2002 2003 2004 2005 2006 Dividends per share 0.20 0.22 0.28 0.032 0.36 % Change from last - 10% 27.2% 14.3% 12.5% Table 3 Other factors would include comparing FedEx to other companies in the same industry sector; UPS, Kitty Hawk, ABX Air, and Pacific CMA to name a few. Key performance indicators include Market Cap, P/E, ROE, Div Yield, Net Profit Margin, and more are used to gauge how FedEx fairs in the industry. The author reserves this research for another time. Page 12 Mike Fulton Financial Research Report on FedEx Corporation Conclusions: Before investing, it is wise to check into analyst opinions and public perceptions about FedEx. Consider the business point of view of those who use FedEx to ship their products. Look over investor information offered on FedEx’s website including stock information, financial information, and corporate governance. Look to other sources and seek help from subject matter experts to help evaluate the information. Page 13 Mike Fulton Financial Research Report on FedEx Corporation Bibliography BusinessWeek.com., A.P. Newswire, “FedEx plans new domestic China service”, March 19, 2007 <http://www.businessweek.com/ap/financialnews/D8NVHCI80.htm>. CNNMoney.com. “America’s Most Admired Companies 2007”, April 10, 2007, <http:// money.cnn.com/ magazines/ fortune/mostadmired/2007/index.html>. CNNMoney.com. “FedEx settles racial bias suit for $53.5M”, April 11, 2007, <http:// money.cnn.com/2007/04/11/news/companies/fedex.reut/index.htm?source=yahoo_quote >. Ducker, Michael, Sr. Exec VP of International, Topic: China Strategy, Telephone Interview with Author, April 4, 2007, 10:50 am. FedEx Corporation: About FedEx. “About Links”, April 9, 2007 <http://www.fedex.com/ us/about/today/history/?link=4>. FedEx Corporation: About FedEx. “Investor Relations”, April 15, 2007 < http:// www.fedex.com/us/investorrelations/>. Forbes.com. “FedEx Expands In China”, March 1, 2007, < http://www.forbes.com/2007/03/01/ fedex-network-takeovers-markets-equity-cx_er_0301markets07.html?partner= yahootix> Maranjian , Selena, Fool.com. “How News Affects Stock Prices”, June 13, 2003, <http:// www.fool.com/foolu/askfoolu/2003/askfoolu030613.htm >. Ross, Westerfield, Jordan. Essentiasl of Corporate Finance. 5th Edition. New York: McGrawHill Irwin, 2007. Rueters.com “FedEx unit to buy logistics service provider in Hungary”, April 6, 2007 <http://www.reuters.com/article/mergersNews/idUSBNG29757520070406>. Page 14