Personal Finance Lecture Notes

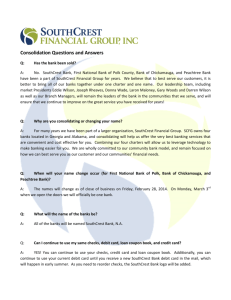

advertisement

Personal Finance Lecture Notes The focus of this unit is on personal financial decision-making. As consumers, individuals are faced with a vast array of personal economic decisions including how to select financial institutions, how to manage money, credit, choosing a career, and risk-management awareness. Accumulating wealth – is distinct from just making a big income. Some people consider themselves wealthy b/c they live in an expensive house & travel the world. Others believe they are wealthy simply b/c they can pay their bills on time. How do you define financial wealth? A Wealth creating asset is a possession that generally increases in value or provides a return (ex. Savings acct., retirement plan, stocks/bonds, house) possessions like car, big screen TV are assets but they aren’t wealth creating assets b/c they don’t earn $ or rise in value. Budget- an itemized summary of probable income & expenses for a given period. A budget allows you to: Understand where you $ goes Ensures you don’t spend more than you make Finds uses for your money that will increase your wealth To develop a budget, you need to: Calculate your monthly income Track your expenses Determine how mush you spend on monthly bills Keys to Building Financial Wealth: Pay yourself first Save Early Save Regularly Control Spending and use of credit. Liability- or debt, is money you owe (ex. Home mortgage, credit card balances, car loan, hospital or medical bills Human Capital- the knowledge, skills, abilities & talents that people acquire through experience, training and education that help workers produce goods & services & help determine their incomeproducing capacity. Why do people invest and save? Net worth = Assets – liabilities; a person’s assests, or what a person owns, minus a person’s liabilities, or what a person owes short-term goals – a goal that a person or organization plans to achieve is less that one year medium term goal – a goal that a person or organization plans to achieve in 1 to 5 years Long term goal – a goal that a person or organization plans to achieve more that 5 years in the future. Financial literacy- basic financial knowledge, including an understanding of banks & the banking system, financial markets, credit 7 credit cards, and tax laws. Saving – income not spent on current consumption or taxes Credit Cards Credit is a loan When establishing credit, go slowly Shop around for best terms Make payments on time Pay off credit card balances each month Annual fee APR- the yearly interest rate charged for the use of credit. A measure of the cost of credit, expressed as a yearly %. Bank issued credit card Bankruptcy Cash advance – cash received from a credit line. A cash advance is generally higher that the APR. Compound interest- interest computed on the sum of the original principal & accrued interest. Credit limit- the maximum amount of credit allowed on an individual credit account. Credit report- a loan & bill payment history, kept by a credit reporting service (Equifax) and used by financial institutions and other potential creditors to determine the likelihood a future debt will be repaid. Minimum monthly payment – the smallest amount of $ accepted by the creditor each billing cycle to keep an account in good standing. Savings – income not spent on current consumption or taxes Surcharge/service charge Wealth- the stock of assets or resources that have economic value Banking ATM-automated teller machine Bank loans Borrower- an individual, business or government that has received & used something belongs to somebody else. With the intention of returning or repaying it – often with interest in the case of borrowed money. . Cashier’s check Commercial banks – financial institutions that receive deposits of money, extend credit, and provide loans. Most banks are profit seeking corporations. Interest charged – on a loan -bank charges you to borrow Interest earned – on savings account – interest bank pays you to use their money Math: 3% interest rate -- $1000 deposit -- $1000 X .03 = $30 Checking accounts- a financial account into which people deposit money & from which they withdraw money by writing checks or using debit or ATM cards. Savings account-an interest-bearing deposit account at a banking establishment tat is not typically used for transactions & has no maturity date. Credit union- not- for profit cooperatives of members with some type of common bond (ex. Employer) Debit card- a card that resembles a credit card that is linked to a checking or savings account. Funds are withdrawn immediately from the linked account with each purchase. Financial institutions- intermediaries that help channel funds from savers to borrowers. Lender- one who lends; may be an individual, a business or government Savings & Loan associations – (It’s A Wonderful Life movie) savings institutions to aid home building. In the 1980’s many S & L mad bad investments & went bankrupt. Risk vs. Return Return – refers to the eventual payoff of the investment. Risk – refers to the chance that an investment might actually end up losing rather than making money. The higher the risk the greater the chance of return. Retirement IRA – Individual Retirement Account. The $ grows tax free until you retire & are ready to withdraw it. Can open an IRA at a bank, brokerage firm, mutual fund, or insurance company. (ex. Roth IRA- don’t deduct $ from current income but after age 59 ½ can withdraw tax free and education IRA- an educational savings account. A grandparent, or parent can contribute up to $500 annually to an education IRA on behalf up child under 18. Contributions not tax deductible. 401(K) – put a % Lender Online banking Money order Retirement- when people stop working a paying job b/c they don’t want to work anymore or b/c they are physically unable due to their age and/or health. Savings accounts Simple interest Traveler’s check Wire transfer Smart card-A smart card, chip card, or integrated circuit card (ICC), is defined as any pocket-sized card with embedded integrated circuits which can process information. Unbanked – people who have no banking accounts common in immigrant populations Under banked- people who may just a savings account, but not other needed accounts Direct deposit- money put directly into your account ex. Paycheck or IRS refund Capital Gains- a profit realized from the sale of property, stocks, or other investments Income- money that comes to you, can be from work, interest, etc. Expenses Mutual fund- established to invest many people’s money in many firms Stocks – owning part of a company Bond – lending you money Diversification- having investments in a variety of financial assets in order to reduce your risk; ex. Stocks, bonds, real estate, CD, art Rule of 72- A rule stating that in order to find the number of years required doubling your money at a given interest rate; you divide the compound return into 72. The result is the approximate number of years that it will take for your investment to double 20-10 Rule Mortgage Foreclosure Risk Return- earnings from a investment, usually expressed as an annual percentage rate. Rate of return- earnings from a financial investment, stated as a % of the amount invested usually calculated on an annual basis. Types of insurance 1. Automobile insurance Types of Coverages : Bodily-Injury Liability Comprehensive Property-Damage Liability Medical Payments Collision Personal Injury Uninsured & Underinsured Motorist 2. Health insurance 3. Disability insurance 4. Life insurance How will varying degrees of knowledge, skills and abilities affect earnings? Skills which are required to be successful in the workplace: Communication Skills: reading, writing, speaking, listening – the basic ability to clearly present your Thoughts are a requirement for virtually all jobs. Organizational Skills: to effectively participate in a wide variety of tasks will require that you keep track Of yourself, your schedule, and any number of things you may need in a given field. You need to be able to prioritize, focusing on important projects, managing details And developing step by step plans to accomplish your goals. Leadership: Employers want people who can come in and make a difference. They want employees Who can rally a team behind them and make things happen. Logic: Some jobs require strong analytical ability, others require creative thinking skills. Still others Require long-term strategic planning or complex problem-solving ability. Regardless, raw Smarts and the ability to think your way to a solution play a key role in the hiring decision. Effort: When the going gets tough, employers want someone willing to go the extra mile and make The personal sacrifice to get the job done correctly and on time. They want individuals who can Stays focused and perform consistently over an extended period of time. Group Skills: Can you work with other people? Regardless of the field, just about everything you do Will be on some kind of team. Entrepreneurship: the rate of change in the world is accelerating dramatically. The ability to take Risks and to create, accept and adapt to change easily and quickly is a valued skill. GPS Objectives: SSEPF1 The student will apply rational decision-making to personal spending and savings choices. a. explain that people respond to positive and negative incentives in predictable ways b. use a rational decision-making model to select one option over another c. create a savings or financial investment plan for a future goal SSEPF2 The student will explain that banks and other financial institutions are businesses which channel Funds from savers to investors. a. compare services offered by different financial institutions b. explain reasons for the spread between interest charged and interest earned (We did in Monetary Policy) c. give examples of the direct relationship between risk and return d. evaluate a variety of savings and investment options, including stocks, bonds and mutual funds SSEPF3 The student will explain how changes in monetary and fiscal policy can impact an individual’s spend Choices. a. give examples of who benefits and who loses from inflation (We did in GDP Unit) b. define progressive, regressive and proportional taxes (we did in Fiscal Policy Unit) c. explain how an increase in sales tax affects different income groups (We did in Fiscal Policy Unit) SSEPF4 The student will evaluate the costs and benefits of using credit. a. list factors that affect credit worthiness b. compare interest rates on loans and credit cards from different institutions c. explain the difference between simple and compound interest rates SSEPF5 The student will describe how insurance and other risk-management strategies protect against Financial loss. a. list various types of insurance such as automobile, health, life, disability and property b. explain the costs and benefits associated with different types of insurance SSEPF6 The student will describe how the earnings of workers are determined in the marketplace. a. identify skills which are required to be successful in the workplace b. explain the significance of investment in education, training and skill development