1. A situation of danger or difficulty :

crisis

2. A specific activity in a company, e.g. production, marketing, finance : function

3. independent, able to take decisions without consulting … : autonomous

4. independent, able to make decisions without consulting someone at the same level or higher in the chain of

command

: autonomous

5. a person who provides expert advice to a company : consultant

6. a new idea of method : innovation

7. something you plan to do or achieve : objective (noun)

8. when someone is raised to a higher or more important position : promotion

9. the section of the economy under government control : public sector

10. a plan for achieving success : strategy

11. a person with a less important position in an organization : subordinate

12. give someone else responsibility for doing something instead of you : delegate

13. a system of authority with different levels, one above the other, e.g., a series of management positions, whose

: hierarchy/chain of command

14. the power to give instructions to people at the level below in the chain of command : line authority

15. be responsible to someone and take instructions from them : report to

16. (someone) believing that the group is more important than the individual : collectivist

17. reducing demands or changing opinions in order to agree : compromise

18. a face-to-face disagreement or argument : confrontation

19. people of influence or importance with whom you are associated : connections

20. looking directly at the people you are talking to or listening to : eye contact

21. an invented word combining worldwide and regional concerns : glocalization

22. do something when necessary without having already planned it : improvise

23. to cut into someone else's turn to speak : interrupt

24. understanding or knowing without consciously using reason : intuition

25. thought based on reason and judgment rather than feelings and emotions : logic

26. be humiliated or disrespected in public : lose face

27. respect, prestige or importance given to someone : status

28. meet or find unexpectedly or by accident : come across

29. required, obligatory, necessary according to the law : compulsory

30. an officially imposed number or quantity : quota

31. done by choice, without legal obligation : voluntary

32. obeying laws or regulations : compliance

33. the ending or termination of an organization : dissolution

34. trainees, people still learning their job : apprentices

35. someone who changes their beliefs : convert

36. being officially responsible for something : accountability

37. firmly fixed in something or part of something : embedded

holders can make decisions, or give orders and instructions

38. the quality of people's lives : standards of living

39. someone who establishes a company : founder

40. the potential cost of taking a chance : risk premium

41. the value of a business activity : equity

42. causing trouble and stopping something from continuing as usual : disruptive

43. increasing or decreasing more and more quickly as time passes : exponentially

44. the obtaining of supplies : procurement

45. the state of being successful and having a lot of money : prosperity

46. the situation when something is not likely to change : stability

47. providing a large amount of good things : bountiful

48. things that cause difficulties : headaches

49. official rules of the act of controlling something : regulation

50. changing or improving a product or service : reworking

51. getting rid of things which are no longer useful or wanted : scrapping

52. to examine a machine and repair and faulty parts (in the text) : service

53. guarantees: written promises to repair or replace products that develop a fault : warranties

54. places of business for selling goods to customers (shops, stores, kiosks, etc.) : outlets

55. all the different products, brands, and items that a company sells : product mix

56. businesses that sell goods or merchandise to individual customers : retailers

57. a graphic image or symbol specifically created to identify a company or a product : logo

58. wrappers and containers used to enclose and protect a product : packaging

59. the extent to which consumers are aware of a brand, and knows its name : brand recognition

60. surfaces in a store on which goods are displayed : shelves

61. the sales of a company expressed as a percentage of total sales in a given market : market share

62. consumers who buy various competing products rather than being loyal to a particular brand : brand

switchers the sales of a company expressed as a percentage of total sales in a given market

63. all the companies or individuals ("middleman") involved in moving goods or services from producers to

consumers : distribution channel

64. an intermediary that stores manufacturers' goods or merchandise, and sells it to retailers and professional

buyers

: wholesaler

65. dividing a market into distinct groups of buyers who have different requirements or buying habits : market

segmentation

66. making a product (appear to be) different from similar products offered by other sellers, by product differences,

packaging, advertising, etc.

: product differentiation

67. possibilities of filling unsatisfied needs in sectors in which a company can profitably produce goods or services :

market opportunities

68. setting a high price for a new product, to make maximum revenue before competing products appear on the

market

: market skimming

69. someone who contacts existing and potential customers, and tries to persuade them to buy goods or services :

sales representative

70. the attributes or characteristics of a product, such as size, shape, quality, price, reliability, etc. : product

features

71. the extent to which supply or demand (the quantity produced or bought) of a product responds to change of

price : price elasticity

72. the extent to which supply or demand (the quantity produced or bought) of a products responds to changes of

price

: price elasticity

73. the strategy of setting a low price to try to sell a large volume and increase market share : market

penetration

74. companies that design advertising for clients : advertising agencies

75. the advertising of a particular product or service during a particular period of time : advertising campaign

76. the statement of objectives that a client works out with an advertising agency : brief

77. a defined set of customers whose needs a company plans to satisfy : target customers

78. the amount of money a company plans to spend in developing its advertising and buying media time or space :

advertising budget

79. the choice of where to advertise in order to reach the right people : media plan

80. choosing to spend the same amount on advertising as one's competitors : comparative-parity method

81. a small amount of a product given to customers to encourage them to try it : (free) sample

82. free advertising, when satisfied customers recommend products to their friends : word-of-mouth

advertising

83. trying to get customers to forward an online marketing message to other people : viral marketing

84. what an organization can do better than its competitors : competitive advantage

85. able to continue over a period of time : sustainable

86. the sales businesses expect to achieve in a particular period of time : sales forecasts

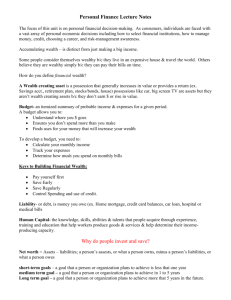

87. where total costs equal total income from sales and the company makes neither a profit nor a loss : break-

even point

88. the total income received by a business before any expenses are paid : revenue

89. an investor's plan for getting their investment back and potentially realizing a profit : exit strategy

90. the people who establish a company or other organization : founders

91. the people who are employed in an organization : personnel (or staff)

92. money placed in a bank: Deposits

93. a sum of money borrowed from a bank: Loan

94. the money invested in a business: Capital

95. certificates representing part-ownership of a company: Stocks or shares

96. certificates of debt issued by governments or companies to raise money: Bonds

97. when one company combines with another one: Merger

98. when one company offers to buy or acquire another one: Takeover bid (hostile or friendly)

99. buying and selling stocks or shares for clients: Stockbroker(n) Stockbroking(v)

stockbrocking

101.all the investments owned by an individual or organization: Portfolio

102.all the investment owned by an individual or organization: portfolio

103. profit made on investment: return

104.the profits made on investments: Returns

105.the profit made on investments: returns

106.unable to pay debts or continue to do business: Bankrupt

107.the ending or relaxing of legal restrictions: Deregulation

100.

buying or selling stocks or shares for clients:

108. a group of companies, operating in different fields, which have joined together: Conglomerate

109.the price paid for borrowing money, paid to the lenders: Interest

110.bank accounts in which cheques(BrE)/checks(AmE) can be written and honored by the bank: Current

account(BrE) Checking account(AmE)

111.accounts in which checks cannot be written but usually offers higher interest rates than current

accounts/checking accounts : Savings or deposit account(BrE) Time or notice account(AmE)

112.machines that dispense cash, accept deposits, by which bills can be paid: Cashpoints(BrE) ATMs Automated

Teller Machines(AmE)

113.promissory notes paid back by banks in which take in place of cash: Chequebook(BrE) Checkbook(AmE)

114.a card that identifies a person as entitled to have food, merchandise, services, etc., billed on a charge account:

Credit card

115.a plastic card that resembles a credit card but functions like a check and through which payments for purchases

or services are made electronically to the bank accounts of participating retailing establishments directly from

those of card holders: Debit card

116.monetary transaction dealing with foreign currency: Buying or selling foreign currency for traveling(BrE)

Travelling(AmE)

117.1.a conveyance of an interest in property as security for the repayment of money borrowed

2.the deed by which such a transaction is effected

3.the rights conferred by it, or the state of the property conveyed: Mortgage-a loan to buy property(BrE) real

estate(AmE)

118.recommendation or suggestion one receives from a professional: Investment advice

119.the possibility to borrow money by spending more than you have in your bank account: Overdraft

120.banking through financial services electronically: Internet banking (payments, transfers)

121.banking through financial services through phone system: Telephone banking (payments, transfers)

122.receives deposits from, and make loans to, individuals and small companies: Commercial banks

123.work with big companies, giving financial advice, raising capital by issuing stocks or shares and bonds, arranging

mergers and takeovers bids, etc:

Investment banks

124.provide wealthy individuals with banking and investment services: Private banks

125.private investment funds for wealthy investors tha use a wider variety of risky investing strategies than

traditional investment funds, in order to achieve higher returns: Hedge funds

126.founded in Islamic countries, offer interest-free banking. They do not pay interest to depositors or charge

interest to borrowers, but invest in companies and share the profits (or losses) with their depositors.:

banks

Islamic

127.car manufacturers, food retailers and department stores offering products like personal loans, credit cards and

insurance:

Non-bank financial intermediaries

128. estimates of people's ability to fulfill their financial commitments: Credit rating

129. estimates of people's ability to fulfil their financial commitments: Credit rating

130.failure to repay a loan: Default

131.with property or another asset used as a guarantee of payment: Collateralized

132.the money generated by an investment: Cash flow

133.cancel a bad debt or a worthless asset from an account: Write off

134.nongovernmental organization: NGO

135.property or other assets used as a guarantee of payment: Collateral

136.the lending of very small amounts of money at low interest, especially to a start-up company or self-employed

person: Microfinance

137.(often called High Street banks in Britain) receive deposits from, and make loans to, individuals and small

companies.: retail banks or commercial banks

138.work with big companies, giving financial advice, raising capital by issuing stocks and shares and bonds,

arranging mergers and takeover bids, and so on.:

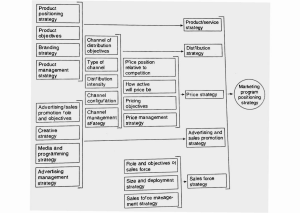

Investment banks

139.which can be used by wealthy individuals provide them Banking and Investment Services.: Private banks

140.are private investment funds for wealthy Investors(both individuals ans institutions) that use a wider variety of

(risky) investing strategies than traditional investment funds, in order to achieve higher returns.: Hedge funds

141. an institution designed to oversee the banking system and regulate the quantity of money in the economy, e.g.

the Fed (US):

central bank

142. a financial institution that accepts demand deposits and makes loans and provides other services for the public;

clearing or retail bank : commercial bank

143. a bank which deals with companies instead of the public, investment bank : merchant bank

144. the combination of two or more companies into one: merger

145. the taking over the control of one company by another: acquisition

146. an arrangement that sb has with a bank to keep money there and take some out: account

147. an amount of money that is paid into a bank or savings account: deposit

148. the act of taking an amount of money out of your bank account: withdrawal

149. money that an organization such as a bank lends and somebody borrows: loan

150. housing loan, a special type of a loan for real estate purchase, buying property: mortgage

151. a report of deposits, withdrawals, and bank balances sent to a depositor by a bank: bank statement

152. cash machine, cashpoint: ATM

153. a plastic card used to make purchases now and pay for them later: credit card

154. allows you to withdraw money or pay for purchases from your checking or savings account: debit card

155. money used in another country: foreign currency

156. money in the form of bills or coins: cash

157. an amount of money paid for employee services every month: salary

158. an amount of money paid to an employee at a specified rate per hour worked: wages

159. deposit, time, notice account: savings account

160. checking account: current account

161. ATM (automated teller machine), cash dispenser: cashpoint

162. possibility to borrow money by spending more than you have in your bank account: overdraft

163. private investment funds for wealthy investors that use a wide variety of risky investing strategies

:

hedge funds

164. investment companies that combine the money from a large group of investors to buy stocks and other

investments to diversify the risk; unit trusts:

mutual funds

165. a bank providing banking and investment services to wealthy individuals: private bank

166. to cancel / abolish a law: repeal

167. wealth in the form of money or property owned by a person or business and human resources of economic

value:

capital

168. certificates representing part-ownership of a company: stocks

169. certificates of debt issues by governments or companies to raise money: bonds

170. an offer to buy shares in order to take over the company: takeover bid

171. buying and selling stocks or shares for clients: stockbroking

172. all the investments owned by an individual or an organization: portfolio

173. someone who has insufficient assets to cover their debts, insolvent: bankrupt

174. describes an asset that cannot be quickly converted into cash without much loss of value: illiquid

175. the removal of some government controls over a market: deregulation

176. a group of diverse companies under common ownership and run as a single organization:

conglomerate

177. a fixed charge for borrowing money: interest

178. a person who starts up and takes on the risk of a business: entrepreneur

179. financial crisis that began from the lending practices made to subprime borrowers, i.e. borrowers who had poor

credit ratings: subprime crisis

180. a state in which there is a short supply of cash to lend to businesses and consumers and interest rates are high;

credit squeeze: credit crunch

181. an estimate, based on previous dealings, of a person's or an organization's ability to fulfill their financial

commitments:

credit rating

182. a security pledged for the repayment of a loan: collateral

183. the practice of offering small, collateral- free loans to individuals who otherwise would not have access to the

capital necessary to begin small businesses or other income-generation activities: microfinance

184. indentifying customers, defininig and developing the products or services they want and distributing them, and

even anticipating and creating customers' needs: marketing

185. the blending of four marketing elements - product, distribution/place, price, and promotion: marketing mix

186. characteristics of a product, e.g. its colour, design, quality, etc.: features of a product

187. a pricing policy whereby a firm charges a relatively low price for a product initially as a way to reach the mass

market: penetration

188. a high price is set to ensure large profits are made and R&D costs recovered before the competitors are able to

produce a similar product:

skimming

189. a pricing strategy based on what all the other competitors are doing; the price can be set at, above, or below

competitors' prices:

competition pricing

190. establishing a single price for all products in a product line: product line pricing

191. selling more than one product together for a single price, e.g. several software packages included in the

purchase of a PC:

bundle pricing

192. pricing goods and services at price points that make the product appear less expensive than it is:

psychological pricing

193. any activity designed to create a favorable image of a business, its products, or its policies: public relations

194. short-term incentives to encourage the purchase or sale of a product or service, e.g. discounts, sales, placing

products, etc.: sales promotion

195. personal presentation by the firm's sales force for the purpose of making sales and building customer

relationships.:

personal selling

196. the selling of goods to final consumers: retail

197. the selling of goods to merchants usually in large quantities: wholesale

198.set of people and organizations responsible for the flow of products and services from the producer to the

ultimate user:

distribution channel

199. the process of dividing a market into meaningful, relatively similar, and identifiable segments or groups:

market segmentation

200. real or imagined differences between competing products in the same industry: product differentiation

201. possibilities of filling unsatisfied needs in sectors in which a company can profitably produce goods or services:

market opportunities

202. the specific characteristics of a product: product features

203. the extent to which supply or demand of a product responds to changes of price: price elasticity

204. as a company produces larger numbers of a particular product, the cost of each of these products goes down:

economies of scale

205. a reduction in costs that a company achieves by producing two or more related products or providing several

services, rather than separate products or services: economies of scope

206. all the companies or individuals ('middlemen') involved in moving goods or services from producers to

consumers: distribution channel

207. making a product (appear to be) different from similar products offered by other sellers, by product differences,

advertising, packaging, etc.:

product differentiation

208. the attributes of characteristics of a product, such as size, shape, quality, price, reliability, etc.:

product features

209. an intermediary that stocks manufacturers' goods or merchandise, and sells it to retailers and professional

buyers:

210.

wholesaler