06/06

advertisement

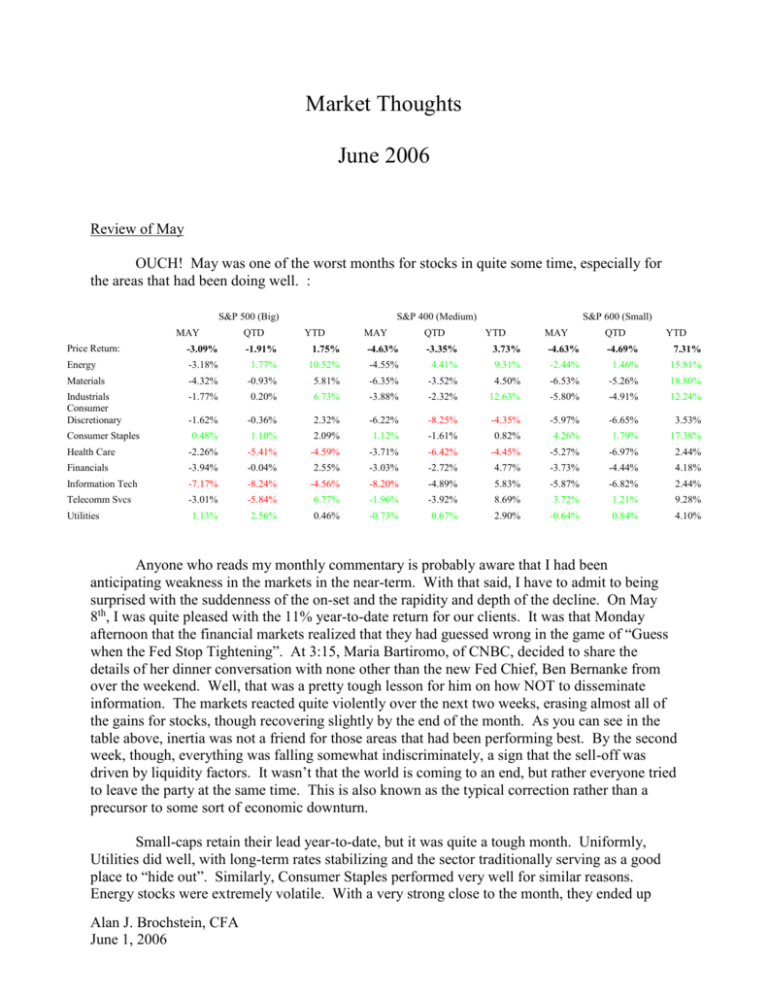

Market Thoughts June 2006 Review of May OUCH! May was one of the worst months for stocks in quite some time, especially for the areas that had been doing well. : S&P 500 (Big) MAY QTD S&P 400 (Medium) YTD MAY QTD S&P 600 (Small) YTD MAY QTD YTD Price Return: -3.09% -1.91% 1.75% -4.63% -3.35% 3.73% -4.63% -4.69% 7.31% Energy -3.18% 1.77% 10.52% -4.55% 4.41% 9.31% -2.44% 1.46% 15.81% Materials -4.32% -0.93% 5.81% -6.35% -3.52% 4.50% -6.53% -5.26% 18.80% Industrials Consumer Discretionary -1.77% 0.20% 6.73% -3.88% -2.32% 12.63% -5.80% -4.91% 12.24% -1.62% -0.36% 2.32% -6.22% -8.25% -4.35% -5.97% -6.65% 3.53% 0.48% 1.10% 2.09% 1.12% -1.61% 0.82% 4.26% 1.79% 17.38% Health Care -2.26% -5.41% -4.59% -3.71% -6.42% -4.45% -5.27% -6.97% 2.44% Financials -3.94% -0.04% 2.55% -3.03% -2.72% 4.77% -3.73% -4.44% 4.18% Information Tech -7.17% -8.24% -4.56% -8.20% -4.89% 5.83% -5.87% -6.82% 2.44% Telecomm Svcs -3.01% -5.84% 6.77% -1.96% -3.92% 8.69% 3.72% 1.21% 9.28% 1.13% 2.56% 0.46% -0.73% 0.67% 2.90% -0.64% 0.84% 4.10% Consumer Staples Utilities Anyone who reads my monthly commentary is probably aware that I had been anticipating weakness in the markets in the near-term. With that said, I have to admit to being surprised with the suddenness of the on-set and the rapidity and depth of the decline. On May 8th, I was quite pleased with the 11% year-to-date return for our clients. It was that Monday afternoon that the financial markets realized that they had guessed wrong in the game of “Guess when the Fed Stop Tightening”. At 3:15, Maria Bartiromo, of CNBC, decided to share the details of her dinner conversation with none other than the new Fed Chief, Ben Bernanke from over the weekend. Well, that was a pretty tough lesson for him on how NOT to disseminate information. The markets reacted quite violently over the next two weeks, erasing almost all of the gains for stocks, though recovering slightly by the end of the month. As you can see in the table above, inertia was not a friend for those areas that had been performing best. By the second week, though, everything was falling somewhat indiscriminately, a sign that the sell-off was driven by liquidity factors. It wasn’t that the world is coming to an end, but rather everyone tried to leave the party at the same time. This is also known as the typical correction rather than a precursor to some sort of economic downturn. Small-caps retain their lead year-to-date, but it was quite a tough month. Uniformly, Utilities did well, with long-term rates stabilizing and the sector traditionally serving as a good place to “hide out”. Similarly, Consumer Staples performed very well for similar reasons. Energy stocks were extremely volatile. With a very strong close to the month, they ended up Alan J. Brochstein, CFA June 1, 2006 performing in line and remain one of the better sectors since December. Other “dirty economy” sectors (Materials and Industrials) remain leaders for 2006, though Materials had a tough month due primarily to the metals. The Consumer Discretionary sector has been very mixed by market cap, reflective of growth struggles for less mature concepts in the smaller caps relative to the larger companies meeting relatively low expectations. Healthcare had a very bad month, especially in smaller capitalizations. Financials performed well in the smaller capitalizations. Technology was a disaster, especially in the large-caps. Microsoft was the culprit for the largecaps, while weakness in semiconductors was responsible for part of the declines in smaller capitalizations. The continuing proliferation of investigations of back-dating of options clearly plagued the Tech sector. Growth had a terrible month, and, contrary to my expectations, Value is winning now year-to-date. Growth investors typically migrate to Consumer Discretionary, Health and Technology. Note the evidence of a massive unwind of longs by small-cap growth investors in the weak performance of those three sectors last month. Interest rates rose very modestly despite another Fed tightening. It is quite remarkable that the Federal Reserve has raised short-term interest rates by 25bps at EVERY SINGLE MEETING since June, 2004, yet the stock market is higher and 30yr interest rates are actually slightly lower since that first hike to 1.25% on 6/30/04. The CRB declined about 3%, with Gold falling slightly and Oil closing about unchanged. The Dollar weakened again relative to the Euro and has now lost about 8% of its value in 2006. Against the Yen, it has declined 3%. Outlook I stated in my year-end commentary that my crystal ball was cloudier than it was in 2005 and that I am not so great at calling market tops. If you recall, my forecast was for a good year for stocks and a good year for the economy. More specifically, though, my original forecast was for early strength, with an interim peak in late March or early April, shallow consolidation and then a strong closing to the year. While the forecast seems to be playing out, the peak did come a bit later than I expected and certainly fell short in terms of the level I projected (it is very hard to get the exact timing or levels – I am actually pleased thus far with my road map). While I continue to stick to my forecast, I certainly am aware that maybe this was THE top. At this point, I believe that the lows may be in, but I am not yet confident enough to call it yet. We are at a traditionally tough spot in the economic cycle, the point where the FED could go “too far”. I continue to think that the market will do well when they are done with the tightening, but I have stated previously and continue to believe that raising short-term rates to 5% is probably not enough to really slow the economy if that is what the Federal Reserve really wants (typically, one would expect that rates would have to exceed the GDP growth rate, which is above 6%). I am not so sure that is the end game. Preventing bubbles (real estate) may actually be the real goal. Sure, they talk about inflation, but is that really a risk? Despite massive increases in resource prices and a very low unemployment rate (4.7%), inflation remains a non-event (except, curiously, at Whole Foods!). So, at this point, I believe that the market is in a classic correction, which will be followed later this year by strength again (the success of the “soft landing”). The greatest risk is that short-rates continue to rise significantly, which could lead to an economic downturn. With elections coming up, I tend to discount that risk. Speaking of elections, though, the fear of increased Democratic representation will probably serve as headwinds over the Alan J. Brochstein, CFA June 1, 2006 summer. At the end of the day, this factor is absolutely irrelevant, but don’t discount the nearterm psychological impact. Looking at some of the sectors, I continue to think that financials should do better in the latter part of the year and wouldn’t chase this recent recovery. The end of a Fed tightening cycle can be tough on banks and other creditors, as it is often accompanied by higher defaults and fewer new lending opportunities. I backed off early-in-the year favorable expectations for consumer stocks, but I have noticed that some of the stores that cater to lower-end consumers have started to recover. The cyclicals – technology and industrials – remain in the best position to capitalize on an economy that will be driven more by spending by corporations. I am noticeably quiet on energy, though with much humility, I continue to think that it ultimately won’t be a third great year. As far as the size of companies having an impact on performance, I continue to modestly favor smaller companies, though the weakening dollar could alter my view. Finally, I continue to expect that the trend of Growth over Value, which began almost a year ago, will persist despite the recent setback. (Intentionally Blank) Alan J. Brochstein, CFA June 1, 2006 Review of Past Focus Stocks At the beginning of the year, I shared 4 health-care ideas for 2006. I have added two technology ideas and another health-care idea last month. As a reminder, I jumped ship two months on one of my original ideas (SLXP), which has continued to deteriorate and serves as a great reminder of why one needs to cut one’s losses early rather than late. Reviewing the remaining ideas, Covance (CVD), which was at 48.55 at year-end, closed last month at 58.35 and ended the month at 59.07 (yes, up!), remains very attractive despite the advance. This premier Contract Research Organization benefits from clinical trial outsourcing, the growth of biotech and small pharma and an increased focus on drug safety. They had an excellent report and outlook in January and then a decent one in April. The high-volume pullback was due primarily to the company only maintaining its original outlook for 2006. They announced what appears to be a very opportunistic acquisition that expands their capacity. I have increased my target from 60 to 70 over the next year, representing a multiple of 25X 2007 estimated EPS (excluding options expense). This is my favorite industry in the healthcare sector, as we have owned a peer, PPDI, for 30 months now as well. Another January idea was Gen-Probe (GPRO), a company that is involved in bloodscreening and diagnostics (primarily for STDs). The big driver, beyond a robust pipeline of new products, is the potential to acquire the blood-screening business from its marketing partner, Chiron, which is being acquired by Novartis. They have some exciting initiatives to apply their technology to the additional markets of biotech manufacturing and water safety, both of which could be substantial longer-term drivers, especially considering that the target markets are Alan J. Brochstein, CFA June 1, 2006 significantly lower than what they currently address. They also recently began marketing a test for prostate cancer. The higher specificity (less false positives than the standard PSA test, leading to fewer biopsies) is what should drive adoption. The stock also is a potential beneficiary of increased HIV testing being recommended. Their Q1 report in early May was fine, and my dinner meeting with the CFO reinforced my view that this is a well-run company with significant opportunity to grow long-term. This stock also advanced during this challenging month and has appreciated to 54 from 48.79 since year-end. I continue to target 60 over the next year. The third original stock is Given Imaging (GIVN), an Israeli company that trades on the NASDAQ and is focused on diagnostic imaging of the gastrointestinal tract. I was either early or quite possibly wrong on this one, though I continue to believe that this company should perform well over longer time-frames. Key product is the PillCam SB, which is for the diagnosis of the small intestine. This has become the gold standard for unexplained anemia. The company launched in 2005 the PillCam ESO, which is for diagnosis of the esophagus. While I was initially skeptical of the potential success for this product, I now fully expect that it will eventually become the initial diagnosis tool, replacing the EGD (scope). The ESO allows the great majority of patients to avoid the scope (and the sedation and inconvenience that goes with that procedure), is economical for the doctor and benefits the insurance companies (they reduce the number of $1500 facility charges). The company’s next (and last) product will be for the colon. While this is very speculative, the company has a very strong balance sheet and is profitable. GIVN recently reduced guidance due to taking several initiatives to assure its growth in coming years. I had stated that the stock, which I originally recommended at year-end at 26.10, needed to break 24 to become technically attractive again, broke down. While I do think that this could become timelier in the future, I am no longer going to update this idea. Again, a good lesson in sell discipline… Alan J. Brochstein, CFA June 1, 2006 I shared an additional idea four months ago, an exchange-traded fund (ETF) focused on semiconductor and semiconductor capital equipment companies, SMH. As I conveyed at the beginning of the year, I like the sector because sentiment is not very positive, valuation is fair and, fundamentally, the outlook is strong. In a nutshell, inventories are low, demand is strong and capital equipment requirements are quite high due to technology changes and capacity expansions. The early-in-the-year weakness in Intel (INTC) created a divergence between this index and the SOX index, though the gap narrowed by over 2% in February and another 3% in March. This was a pyrrhic victory, as the long call stunk, though SMH regained 1/2 of its underperformance, declining 5% less than SOX since I discussed it on 1/31. With that said, this trade is no longer compelling. I had warned last month that if 35 broke, the technicals were no longer positive. I don’t think that there is significant downside, and the most likely scenario is that I am getting whipsawed. I personally have sold some of this to fund some other ideas, but I retain exposure and am looking to potentially sell on strength (unless it gets quickly back above 35). To be clear, I am long but neutral – not my favorite position! Alan J. Brochstein, CFA June 1, 2006 Two months ago, I discussed APH, which had a great report in April and rallied sharply. I expect that the stock, already up from 52.18 a month ago, can get to 66 (instead of the 61 I had suggested) over the next year. I had mentioned that I thought that the significant driver of EPS over the near term would be better-than-expected results from a rather large acquisition that they recently completed. This in fact was the case in Q1, but there is more to come. I had mentioned the strong support at 45 and 48. I now believe that 53 should be considered the support level. The company is very exposed to the cell phone market as well as many broad industrial and military applications, all of which appear to be robust. Alan J. Brochstein, CFA June 1, 2006 On April 18th, I sent a mid-month email regarding a stock that is WAY out of my league in terms of what I do professionally and quite speculative but definitely worth investigating. Acusphere (ACUS, which was at 6.05 when I sent the email) appeared to me to be under heavy accumulation from what I would consider smart money. This process appears to be rather early. The IPO has been a bust, but the company is getting closer to commercialization of a product currently in P3 trials. Their product is a contrast agent to be used in nuclear stress tests and hits the trifecta that I seek when looking for healthcare investments: Good for the patient (saves a lot of time and avoids dealing with radiation), good for the payer (cheaper) and good for the doctor (the cardiologist doesn’t have to send the patient elsewhere). The company addresses a very large market – 9mm procedures a year. The company will be releasing data from one of its two Phase 3 trials next week. I have been disappointed by a couple of things. First of all, the stock went below the level (5.60) that I felt was necessary to hold (either a sign that I should get out that I am not so great at setting stops!). Secondly, the ownership structure in the first quarter (this data comes out quarterly, and, importantly, precedes the equity offering from April) wasn’t as exciting as in December, with very few new buyers of substance. As you can see in the chart below, we are right on top of the bolus of volume since the IPO. The recent pullback was due to the company raising money to finance the expansion of manufacturing facilities (prior to my email in April). I think that the stock needs to trade through 6.50 next week on the data release to justify continued involvement. Key to this thing working will be having good data (non-inferiority – seems like a lay-up), finding a good U.S. marketing partner (already has a European partner) and making a timely filing with the FDA in 2007 so that it gets to market in 2008. There are some other things in development, but this is what counts. I am hoping to see 10. Alan J. Brochstein, CFA June 1, 2006 Final Thought I am disgusted by the controversy unfolding surrounding the granting of options to key executives. Just when we thought that the excesses of the late 90s were behind us, we are learning that the leaders of many companies, who already had a very sweet deal in terms of “heads I win, tails you lose” options compensation, rigged the game to be even more favorable than we could have imagined. For those not following closely, the issue involves the setting of the strike price (the price at which the executive can buy the stock in the future) retrospectively after a stock had moved up significantly. I would liken it to being able to place a bet on the favorite in the third quarter of a football game at the original line despite their being way ahead. As this practice seems to have touched several of the companies in which our clients invest, I am struggling with how to react. The more that it seems like an industry practice as opposed to company-specific behavior, I suppose the less I should care. I do wonder though what this says about the character of the management teams. I struggle with how to assess significance, relevance and culpability. As one who firmly believes that the integrity of the management team is a critical element to the success of the company and hence the stock, I clearly don’t dismiss this as merely “headline risk”. Have a great month! Alan J. Brochstein, CFA Piedra Capital Houston, TX 713-622-7625 Alan@PiedraCapital.com Alan J. Brochstein, CFA June 1, 2006