02/06

advertisement

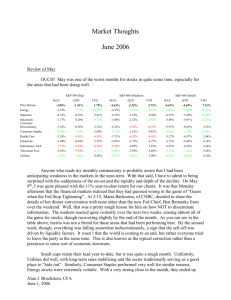

Market Thoughts February 2006 Review of January The market started the year in grand fashion, with the month pretty much doing what all of 2005 did for investors: S&P 500 (Big) Price Return: Energy Materials Industrials Consumer Discretionary Consumer Staples Health Care Financials Information Tech Telecomm Svcs Utilities S&P 400 (Medium) 2005 S&P 600 (Small) JAN 2005 JAN JAN 2.55% 13.85% 4.67% -0.45% 3.00% 29.14% 2.16% 0.36% 5.82% 15.60% 6.38% 6.47% 11.27% 52.01% 0.94% 11.03% 8.32% 16.43% 16.58% 9.66% 2005 6.65% 52.18% 7.47% 11.87% 1.72% -0.17% 1.41% 0.73% 3.19% 3.26% 2.34% -7.35% 1.34% 4.85% 3.72% 0.38% -9.05% 12.76% 1.75% 2.96% 2.88% 4.26% 9.06% -0.50% 3.59% 2.40% 14.90% 17.79% 7.34% 8.37% -10.59% 6.36% 5.95% 5.68% 7.22% 5.44% 7.46% 1.28% 3.88% -0.04% -4.75% 10.96% -1.93% -0.42% -14.73% 4.80% Old themes reemerged, with Energy, Growth, and Small-Cap being the beneficiaries. While in large-cap, Value beat Growth, the opposite occurred. Materials stocks performed well, supported by rising commodity prices. Technology, which I expect to be strong this year, performed well in Mid-Cap and reasonably in Small-Cap, but Intel certainly hurt the relative performance in Large-Cap. Consumer was weak, and Financials lagged as well. Interest rates rose modestly, with the curve maintaining its flatness. Leadership at the Federal Reserve changed after over 18 years, with the FED going another 25bps (to 4.5%) before the reigns were headed to Mr. Bernanke. Curiously, they removed the word “measured” from their directive. Is the end near? Commodity prices were stronger, with the CRB Index rising over 5%. Gold continued its strong showing, rising almost 10%. Oil too rose over 10%, but natural gas has been weak due to warm weather. The Dollar was stable relative to the Yen, but weakened just a bit relative to the Euro. Alan J. Brochstein, CFA February 1, 2006 Outlook The strength that I expected in January materialized, increasing the odds (statistically) that the markets will have a good year. While I thought that Tech stocks would lead the way, they are in a distant 2nd place to Energy. I expect that they will take the lead shortly. The 2005 target that just failed for the QQQQs of 43 was achieved early in the month and did serve as initial resistance. I continue to target an S&P 500 price of 1373 by the end of April and a 14% return for the year, including dividends. I shared a very detailed forecast last month, and there are no changes at this time. Review of Past Focus Stocks I mentioned last month that I would no longer be updating my thoughts regarding my 2005 picks, but I feel pretty proud of them and want to just mention where they are: ISRG (40 to now 137), PLXS (16 to now 28), IMDC (60 to now 92) and ADI (39 to 40). Not bad – a homer, a couple of extra-base hits and a foul-tip! Last month I shared 4 health-care ideas for 2006. The first was Covance (CVD), which was at 48.55 and closed yesterday at 56.81. This premier Contract Research Organization benefits from clinical trial outsourcing, the growth of biotech and small pharma and an increased focus on drug safety. They had an excellent report and outlook, and I have increased my target from 60 to 70 over the next year, representing a multiple of 25X 2007 estimated EPS. Alan J. Brochstein, CFA February 1, 2006 The second stock is Gen-Probe (GPRO), a company that is involved in bloodscreening and diagnostics (primarily for STDs). The big driver, beyond a robust pipeline of new products, is the potential to acquire the blood-screening business from its marketing partner, Chiron, which is being acquired by Novartis. The stock rose modestly from 48.79 to 50.43, and I continue to target 60 over the next year. (Intentionally blank) Alan J. Brochstein, CFA February 1, 2006 The third stock is Given Imaging (GIVN), an Israeli company that trades on the NASDAQ and is focused on diagnostic imaging of the gastrointestinal tract. The stock trades at a steep 49X 2006 projected earnings, but the company could see its earnings come in significantly ahead of projections. Key product is the PillCam SB, which is for the diagnosis of the small intestine. This has become the gold standard for unexplained anemia. The company launched in 2005 the PillCam ESO, which is for diagnosis of the esophagus. While I was initially skeptical of the potential success for this product, I now fully expect that it will eventually become the initial diagnosis tool, replacing the EGD (scope). The ESO allows the great majority of patients to avoid the scope (and the sedation and inconvenience that goes with that procedure), is economical for the doctor and benefits the insurance companies (they reduce the number of $1500 facility charges). While this is very speculative, the company has a very strong balance sheet and is profitable. I think that the company could trade 40X the $1 I expect them to earn in 2007, suggesting 50% upside potential over the next year. The stock rose modestly from 26.10 to 26.53 – everyone is awaiting their EPS report next week. (Intentionally blank) Alan J. Brochstein, CFA February 1, 2006 Finally, Salix Pharmaceuticals (SLXP), a drug company focused on the treatment of gastrointestinal diseases, is poised to reap the benefits of increased exposure (as its market-cap crosses $1 billion) and a recent merger that gives them another product. The company has two very strong products, and the recent acquisition gives them a third drug that has a nextgeneration follow-on that is almost certain to be approved by the FDA by March (for colonoscopy bowel preparation). The stock trades at 21X projected 2006 EPS but is expected to grow EPS over the next few years in excess of 25% (including an increase in the tax-rate). Management is very strong, the balance sheet is pristine and the business model (specialtyfocused marketer) is one that makes sense. I believe that the stock, which has recently pulled back since the merger closed from 22, could see 27 during the coming year. The stock fell slightly on the month from 17.58 to 17.39. New Focus Stock As I mentioned last month, I expect that semiconductors (generally speaking) will perform well in the first part of this year. The most popular gauge is known as the SOX index, though it isn’t investable. It is already up over 12% year-to-date. I am recommending this month that you take a look at SMH, which is an exchange-traded fund (ETF) whose components come from the semiconductor manufacturers or equipment provider industries. It has lagged the SOX over the past month due primarily to its heavier exposure to Intel (INTC). Historically, the two have tracked rather well, though SMH has been somewhat more volatile. Here are the annual price returns for the last several years: SOX SMH 2005 10.7 9.8 2004 -14.7 -19.6 2003 75.7 87.3 Alan J. Brochstein, CFA February 1, 2006 So, the 10% lag thus far is not characteristic of the history. I like the sector because sentiment is not very positive, valuation is fair and, fundamentally, the outlook is strong. In a nutshell, inventories are low, demand is strong and capital equipment requirements are quite high due to technology changes and capacity expansions. I think that SMH could hit 45-50 by this April, though a trade below 37 puts up a yellow flag and below 35 a red one. Below are the components: HOLDR NAME LAST SMH Semiconductor HOLDRS 2/1/2006 11:18:00 AM ET CHANGE 37.61 Detailed Quote % CHANGE 0.31 0.83 Interactive Charting VOLUME GO TO 5,603,600 Download Prospectus Stocks in Semiconductor HOLDRS (SMH) Stock Analog Devices, Inc. Ticker ADI Share Amount 6.00 Current Weighting Last 6.42% 40.23 Net Change 0.46 Altera Corporation ALTR 6.00 3.13% 19.59 0.28 Applied Materials Inc AMAT 26.00 13.14% 19.01 -0.04 Advanced Micro Devices, Inc. AMD 4.00 4.43% 41.63 -0.17 Amkor Technology Inc AMKR 2.00 0.30% 5.73 0.10 Atmel Corp ATML 8.00 0.87% 4.09 0.14 Broadcom Corp BRCM 2.00 3.61% 67.89 -0.31 Intel Corporation INTC 30.00 16.98% 21.28 0.03 KLA-Tencor Corporation Linear Technology Corporation LSI Logic Corporation KLAC 3.00 4.19% 52.51 0.53 LLTC 5.00 4.93% 37.06 -0.15 LSI 5.00 1.22% 9.20 0.05 MU 9.00 3.51% 14.68 0.00 MXIM 5.00 5.46% 41.10 0.06 NSM 6.00 4.49% 28.14 -0.07 Micron Technology Inc. Maxim Integrated Products Inc National Semiconductor Corporation Novellus Systems Inc SanDisk Corporation Go To NVLS 2.00 1.53% 28.80 0.45 SNDK 2.00 3.55% 66.67 -0.69 TER 3.00 1.40% 17.49 0.07 TXN 22.00 16.90% 28.89 -0.34 Teradyne, Inc. Texas Instruments Incorporated Vitesse Semiconductor Corp VTSS 3.00 0.21% 2.62 0.02 Xilinx Inc XLNX 5.00 3.73% 28.09 -0.07 Technically, the stock is sitting on good support based upon volume at various prices over the past year. Additionally, I would characterize the price action over the past year as modestly bullish (higher highs, higher lows. Alan J. Brochstein, CFA February 1, 2006 Alan J. Brochstein, CFA Piedra Capital Houston, TX 713-622-7625 Alan@PiedraCapital.com Alan J. Brochstein, CFA February 1, 2006