RDCGuidelines210907 - Malaysian Industrial Development

advertisement

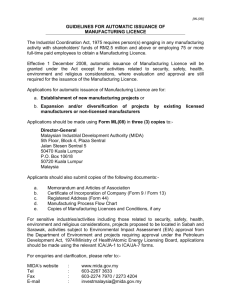

(RDC – 21.9.2007) GUIDELINES FOR APPLICATION FOR STATUS AND/OR INCENTIVE FOR SETTING UP A REGIONAL DISTRIBUTION CENTRE ________________________________________________________________ 1. Definition A regional distribution centre (RDC) is a collection and consolidation centre for finished goods, components and spare parts produced by its own group of companies for its own brand to be distributed to dealers, importers or its subsidiaries or other unrelated companies within or outside the country. Among the activities involved are bulk breaking, repackaging and labeling. 2. Eligibility Criteria for RDC Status To be eligible, the company must fulfill the following criteria: Local incorporation under the Companies Act 1965 A minimum paid-up capital of RM0.5 million A minimum total business spending (operating expenditure) of RM1.5 million per year Incremental usage of Malaysian ports and airports A minimum annual sales turnover of RM50 million by the third year of operation Location in free zones (free industrial zones or free commercial zones) or licensed warehouses (public and private) or licensed manufacturing warehouses As a general rule, sales by an approved RDC to the domestic market are limited to not more than 20% of its annual sales value. A RDC is also allowed to source goods from outside Malaysia for shipment to overseas destinations via drop shipment for up to 30% of its annual sales turnover. 3. Facilities Accorded to RDC An approved RDC status company is accorded the following facilities: - 100% equity holding by the promoter - Expatriate posts based on the requirements of the RDC - Open one or more foreign currency accounts with onshore licensed banks in Malaysia to retain export proceeds in foreign currency with no limits imposed on the overnight balances - Enter into forward foreign exchange contracts with onshore licensed banks to hedge exchange risks based on the projected volume of trade - Customs duty exemption for raw materials, components or finished products brought into free industrial zones, licensed manufacturing warehouses, free 1 commercial zones and bonded warehouses for repackaging, cargo consolidation and integration before distribution to its final consumers. 4. Incentives An approved RDC status company is also eligible for the following tax incentives: - Full tax exemption on its statutory income for 10 years Dividends paid from the exempt income are exempted from tax in the hands of its shareholder However, to qualify for the above incentives, an approved RDC status company must also fulfill the following additional criteria: - - Annual sales turnover of at least RM100 million, of which the annual value of export sales achieve RM80 million and the value of direct export sales achieve RM50 million in respect of the qualifying activities in the basis period for a year of assessment. At least 80% of the RDC products must be exported, including 30% via drop shipment. Sales to the domestic market are limited to 20% of its sales turnover. Sales to free zones (FZs) and licensed manufacturing warehouses (LMWs) are considered as domestic sales. All income tax exemptions are subject to Income Tax (Exemptions) (No. 41) Order 2005. Effective from the year of assessment 2008, expatriates working for IPC are taxed only on that portion of employment income attributable to the number of days they are in the country. 5. Procedure for Application: The application should be submitted in three (3) copies of IPC/RDC-1 Forms to: Director-General Malaysian Industrial Development Authority Manufacturing Services Division 1st Floor, Plaza Sentral Jalan Stesen Sentral 5 Kuala Lumpur Sentral 50470 Kuala Lumpur P.O. Box 10618 50720 Kuala Lumpur MALAYSIA 2 The following documents (where applicable) should be submitted together with the application: o o o o o Certificate of Incorporation Form 24 (return of Allotment of Shares) Form 49 (Particulars of Directors) Latest Annual Report of the company Other relevant information that can support company’s application such as company profile as appendix in the application form Details on the expatriate posts applied for should be submitted using the format attached as the appendix in the application form. For project in Sabah and Sarawak, three (3) copies of the form should also be submitted to the relevant MIDA office as follows: Sabah Sarawak Director MIDA Sabah Office Lot D9.4 & 9.5 9th Floor, Block D, Bangunan KWSP Karamunsing 88100 Kota Kinabalu Sabah, Malaysia Director MIDA Sarawak Office Room 404, 4th Fl. Bangunan Bank Negara Malaysia No 147, Jalan Satok PO Box 716 93714 Kuching Sarawak, Malaysia For enquiries and clarification, please refer to:MIDA’s website Tel Fax E-mail : : : : www.mida.gov.my (603)2267-3633 (603)2273-4216 services@mida.gov.my 3