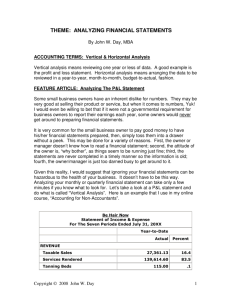

Revenue - the price received, or to be received from a service

advertisement

Assume that we have a new company that only had one transaction, the owner invested $1,000 cash into the business. Cash Owner's Equity $1,000 $1,000 As a result, the company would have $1,000 more assets in the form of cash and $1,000 more owners equity. Assets = Liabilities + Owners Equity +$1,000 = 0 + $1,000 The company gets hired to do its first job, go out and pull all the weeds surrounding a building for a company in town. We finish the job and present a $1,000 bill for performing the service. A company representative for the company where we pulled the weeds asks that we send a bill for our services and we say that would be fine. Ok, did a transaction take place? Did our financial position change? YES. Why? Well, two things come to mind - first we now have the right to collect $1,000 cash from this company. All rights and properties owned by the business are assets. Well then, we have an asset in the form of the right to collect cash. Because it is an informal oral agreement, we refer to this as an Account Receivable. Plus, we have done something for someone, we pulled their weeds and we have upheld our end of the agreement, now we just want to get paid. The price received, or to be received, for goods and services rendered are revenues. Therefore we have some revenues from services rendered (weed pulling). Accounts Receivable Revenue from weed pulling $1,000 $1,000 If we think about our accounts and the accounting equation, we have: Assets = Liabilities + Owners Equity + $1,000 cash + $1,000 accounts receivable = 0 liabilities + $1,000 owners equity (owner investment) + $1000 owners equity (revenue). Perfect. We have $2,000 worth of assets, $1,000 cash and $1,000 accounts receivable and $2,000 worth of owners equity, $1,000 was invested and $1,000 is the result of revenue. And then what happens? At the end of the month, we send the company a bill for $1,000. No answer. Next month we send another bill for $1000. Still no answer. Next month, just before we send out the bills we read the paper and see where this company has declared bankruptcy and when we read the obituaries we see where the person who owned the business has died in a fire from when his home and business building was robbed and burnt to the ground. He has no relatives or insurance. Ok, knowing all this, what value to you think the accounts receivable reported in our accounting records has to our company? The asset account " Accounts Receivable" reports a balance of $1,000 - do you think we will collect it? Well then, what value do you think should be reported in the account "Accounts Receivable"? Since I assume that you agree we do not expect to collect any of the $1,000 and therefore the asset "accounts receivable" has no value to us, the account "accounts receivable" in our accounting records should report a balance of $0. Agree? If we decrease an asset account by $1000, what other account must change? As a result of this receivable having no value, does any other asset change? NO. What about a liability? NO. Something has to change, and if its not an asset or liability, by process of elimination it must be owners equity. Owners equity must decrease by $1,000. Owners Equity Accounts Receivable $1,000 $1,000 Ok, this entry sorta does what we need, it definitely reduces the asset Accounts Receivable down to zero, which is what is should be based upon our expected value. But lets think about owners equity, why does owners equity decrease? Remember, two reasons, first the owner took money out of the business (that didn't happen here) or second that the business incurred an expense. Expenses are using up the assets of the company to carry on the business (yes, an asset was used up) and expenses are incurred to produce revenues (yes, bad debt expenses result from accounts receivable which result from earning revenue but allowing the customer time to pay for the good or service we rendered). It might almost make more sense to you to go back and decrease the revenue so it looks like the original entry was never made: Revenue from weed pulling Accounts Receivable $1,000 $1,000 Now when you look at the two entries together, they simply cancel each other out. But that doesn't tell a complete story. We did, in fact, earn some revenue and we do not want that to get "lost" in our accounting system - but we do need to show that ultimately we had no net income as a result of all the considerations. So, what we do is to record the opposite of a revenue (ie, an expense) and show the decrease in the assets. Bad Debt Expense Accounts Receivable $1,000 $1,000 If we prepared finanacial statements right now, what would they show? Income Stme Revenue from pulling weeds - Bad Debt Expense Net Income Balance Sheet Assets Cash $1,000 ($1,000) -0- $1,000 Liabilities -0- Owners Equity Owners Equity $1,000 This is the basic of recognizing bad debts. Now that we've got the basic entries down, are we satisfied with the accounting treatment we have given to accounts receivable (A/R) and bad debts expense (BDE)? Not exactly. What's the problem? Lets say in year 1 we provide a service on account. A/R $1,000 Fees Earned $1,000 But then 3 years go by before we finally decide this guy to be a bad debt. BDE $1,000 A/R $1,000 What's wrong with that? Well, we reported income in year 1 that never really results materializes, but year 1 income statement reports this positive situation of revenue in its revenues. And poor old year 3, doesn't do anything wrong, but here comes the expense of bad debts. Year 1 income statement is too rosy and year 3 income is penalized for something that didn't occur in year 3 - this was just the year someone decided to give up trying to collect the account. This approach violates the matching principle. Lets solve this problem. The matching principle is stressed in that the revenues are reported in year 1 and the expenses incurred to produce those revenues are not reported that year - they are reported later in any year that a decision-maker finally says, "let's write this receivable off as a bad debt." Therefore, to correct this problem would require the recognition or recording the bad debt expense in the year in which it occurred, the year in which the receivable was recorded. The way this is accomplished is to record an adjusting entry on December 31 of each year for the express purpose of recording the bad debt expense in the year in which it originated. The first half of the adjusting entry is fairly straight forward, you would debit the account bad debt expense - but the question is for what amount? This calculation is simply an estimation based upon past experiences given the current economic environment and establishing an identifiable correlation between bad debts and some observable activity or event. Whew, what does that mean? From a practical perspective it means we would make the following adjusting entry to record the bad debt expense in the year in which the expense originated. Bad Debt Expense $ Estimated Amount And then the question is what account do you credit? Remember that we are making this entry because we think an assets (A/R) has lost its value. You might think we'd just credit the A/R account - but if we actually decreased the A/R by that amount, then we have in fact written it off, but we don't want to do that yet because we have not in fact decided which accounts will be uncollectible, we are simply trying to make an estimation as to the amount of A/R that will be bad, not that we now know that they are. So, instead of crediting the A/R, we will create a new CONTRA ASSET ACCOUNT "Allowance for Doubtful Accounts". The function of this account is to reduce the reported value of the accounts receivable without actually giving up or writing off any specific account. So the other half of the entry is to credit Allowance for Doubtful Accounts $ Estimated Amount This approach will solve the problem presented at the beginning of the paper. During the first year of operations, we provide a service on credit. (I am leaving the $ amounts blank so you focus on the accounts and the interactions between them.) A/R Fees Earned On December 31, we are suspicious of this account being collected so we make an adjusting entry BDE Allow for D/A Ok, so now what is the net effect on the financial statements? The income statement has a revenue reported and an offsetting expense - resulting in no impact on net income. The balance sheet reports an asset A/R which increases total assets and Allow for D/A (a contra asset) which decreases total assets - resulting in no impact on assets. Isn't this what should happen when we record an receivable and revenue that we later think may not come though? And then, in 3 or 4 years once we determine the account to in fact be uncollectible, what entry do we make? Now is the time to actually decrease a specific A/R. And by the way, shouldn't this also decrease the A/R we think will be uncollectible in the future (since they are in fact uncollectible now?) When we determine an account to be uncollectible we Allow for D/A A/R If you decrease and asset and a contra asset, the net effect is no effect on total assets. Think about the last two entries, we recorded the BDE in the year it originated, the Allow for D/A cancels itself out with the debit and credit, and we decrease A/R. When its all said and done we have the following entry BDE Allow for D/A The same entry we started with, but with the use of the allowance account it allows us to record the BDE in the year it originates and gives us all eternity to determine which A/R to write off.