Review Problems

Review Problems

Q1

You have been called in to manage a small construction project that has fallen behind schedule. There are 6 tasks left to perform in the project, which you designate “1” through “6”, as follows:

Duration Cost to Shorten by

Task in Weeks 1 Week 2 Weeks 3 Weeks Requires

1

2

3

4

6

7

4

5

$1,000

$500

$2,000

$800

$3,000

$1,200

$3,000

$1,600

$6,000

$2,300

$3,500

$2,000

--

--

1, 2

2

5 8 $3,000 $7,000 $12,000 3, 4

6 6 $1,500 $4,000 $7,000 4

For example, task 3 cannot be started until tasks 1 and 2 are complete, and would normally require 4 weeks to perform. If you want to make task 3 take less time, you have three options:

Spending $2,000 on task 3 shortens it by 1 week (so it takes 3 weeks)

Spending an additional $1,000, for a total of $3,000, shortens task 3 by a total of 2 weeks (so it takes 2 weeks)

Spending an additional $500, for a total of $3,500, shortens task 3 by a total of 3 weeks (so it takes 1 week)

The other rows of the table are interpreted similarly. For each task, shortening by exactly

0, 1, 2, or 3 weeks are your only options. The project was originally supposed to be complete in 15 weeks . However, the customer is willing to extend this deadline if she receives compensation of $5,000 per week. For example, paying her $10,000 would permit you to take 17 weeks to finish the project.

Algebraically formulate a linear programming model to determine the least expensive way to finish the project. Give clear, numeric definitions of your decision variables. You are allowed to skip algebraic simplifications (if any arise).

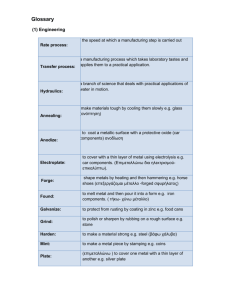

1 3 5

START

Done

4 2 6

Q2

THE XYZ Corp. has a budget $500,000, which it intends to use for buying widgets.

There are three vendors, each with unlimited supply, who offered the following terms.

Vendor 1 stipulates that an order must be no less than 4,000 widgets, and charges a fixed cost of $50,000, and a unit price of $50.

Vendor 2 charges a fixed cost of $20,000. The unit price depends on the quantity as follows. For orders of 500 widgets or less, the unit price is $60. It drops $55 for orders between 501 and 1,000 widgets, and to $50 for orders of 1,001 widgets or more. For example, if we order 600 widgets from Vendor 2, we pay $20,000 + 600 x $55.

Vendor 3 does not charge a fixed cost. The unit price is $75 for an order up to 500 widgets. Then one can buy up to 500 widgets at a unit price of $70. After 1,000 widgets have been bought, any additional widget has a unit price of $65.

XYZ wants to buy from at least two vendors. If XYZ buy from a vendor, it must buy at least 20% of the total quantity.

Formulate a linear mixed integer problem to maximize the number of widgets that

XYZ can buy.

Q3

You are planning the liquidation of a large asset trust over a period of three years. The trust currently has $8 million in cash and owns six real estate and commercial assets, each of which it can sell either now, exactly one year from now, exactly two years from now, or exactly three years from now.

You estimate the net proceeds from selling the assets to be as follows, where all $ amounts are in millions:

Asset

Net value of sale if made 1

Now

In 1 year

In 2 years

$ 10

$ 12

$ 13

2

$ 20

$ 22

$ 25

3

$ 8

$ 8

$ 8

4

$ 12

$ 12

$ 15

5

$ 10

$ 8

$ 9

6

$ 7

$ 9

$ 15

In 3 years $ 14 $ 29 $ 7 $ 17 $ 14 $ 13

For legal reasons, asset 2 cannot be sold after asset 3; asset 2 may only be sold before asset 3, or at the same time.

The net proceeds from each sale go into a bank account that yields 2.2% interest per year.

The initial $8 million in cash is also in this account.

From the bank account, the trust must make the following debt service payments: $15 million one year from now, $16 million two years from now, and $13 million three years from now. You cannot borrow to make these payments; money for each of the payments must come from funds already in the bank account, or from assets the trust is selling at the time the payment is due.

Algebraically formulate a linear mixed integer programming model to maximize the amount of cash the trust will have when it is terminated three years from now.

Q4

Garden State Steel Co. (GSS) blends three kinds of raw materials (called “Metal 1”,

“Metal 2”, and “Metal 3”) into two specialty steels (“Steel 1” and “Steel 2”). The three kinds of raw material are described in the following table:

Metal 2 Metal 3

Metal 1

Carbon

Chromium

Nickel

Cost $/ton

Minimum Order (tons)

4%

12%

6%

$120

700

5%

8%

5%

$90

500

3%

6%

12%

$100

600

For example, Metal 2 costs $90/ton and contains 5% Carbon, 8% Chromium, and 5%

Nickel (the rest is iron). If GSS orders any Metal 2, it must order at least 500 tons.

The blending takes place in a furnace that can handle at most 1400 tons of raw material per week. In the blending process, 10% of the raw material becomes useless waste, which must be disposed of at a cost of $50/ton. The remaining 90% of the raw material becomes steel. All raw material ordered for a given week must be used in the furnace that same week.

The steel produced must satisfy the following specifications:

Steel 1 Steel 2

Carbon

Chromium

Nickel

Maximum Weekly

Production Amount

At most 4%

At least 9%

No specification

800 tons

The following economic data also apply:

Steel 1

At most 5%

No specification

At most 9%

900 tons

Steel 2

Production Setup Cost ($) $8,000 $10,000

Production Cost ($/ton) $25 $30

Selling Price ($/ton) $250 $300

For example, Steel 1, of which GSS may produce at most 800 tons in a week, must contain at most 4% Carbon and at least 9% Chromium. If you decide to make any Steel 1 in a given week, there is a setup cost of $8,000 independent of the exact amount

produced, as well as a production cost of $25 per ton produced. Steel 1 sells for

$250/ton.

Assume that all the steel produced can be sold, and you do not keep any steel inventory from week to week.

Formulate an algebraic optimization model to determine how GSS can plan production to achieve the highest possible weekly profit.

Q5

Your cell phone company, MobTel, is replacing your current calling plan with a choice of three new plans. In every plan, each call lasting one minute or less (a “short call”) is billed as one minute. Calls above one minute (“long calls”) are billed according to their actual duration. Each plan has a fixed number of “Basic Minutes” per month (for example, 400 for Plan 1), which you receive in return for the “Basic Cost” of the plan

($30 in Plan 1). If the total billed duration of calls in a month exceeds the “Basic

Minutes”, you are billed for the excess according to the plan's rate per excess minute

($0.14 in Plan 1). The details of the plans are as follows:

Plan

Basic Minutes

Plan 1 Plan 2 Plan 3

400 450 500

Basic Cost $ 30.00 $ 35.00 $ 40.00

Rate per Excess Minute $ 0.14 $ 0.12 $ 0.10

You cannot “carry over” unused minutes from one month to the next.

Analyzing your last 25 monthly cell phone bills, you observe the following:

5% of your calls are short calls

Long calls average 3.1 minutes in length, with a standard deviation of 1.2 minutes

The pattern of calls per month is shown in the following spreadsheet fragment, taken from the model on the last page of this exam:

5

6

B C D E F G H I J K L M N O P Q R S T U

# of Calls 153 154 155 156 157 158 159 160 161 162 163 164 165 166 167 168 169 170 171

% of Time 4% 4% 8% 4% 8% 8% 12% 8% 8% 8% 8% 4% 4% 0% 4% 0% 4% 0% 4%

(For example, you had 158 calls on 2 of the 25 bills, or 8% of the time. Here, “# of Calls” includes both long and short calls.)

You are interested in minimizing your average monthly spending on mobile phone service. Also, you have budgeted $40/month to spend on the service, and are interested in each plan’s probability of exceeding that budget.

To help choose the best plan, you have started creating an Excel/YASAI simulation spreadsheet. The beginning of the spreadsheet is on the last page of this exam. Columns

F through U are not shown on the last page; the contents of C5:U6 are as given in the spreadsheet fragment above.

(a) What formulas should be in cells B9:B11, to test all three plans?

(b) Complete the spreadsheet model on the next page. Write your formulas in column B, and write explanatory labels in column A. You may make reasonable additional assumptions as needed. Keep in mind the following:

How can you simulate the number of calls in a month?

How can you simulate the number of short calls?

How can you calculate the number of long calls?

How can you simulate the total duration of all long calls?

How can you calculate the bill amount?

What should you do to estimate the probability of exceeding the budget?

18

19

20

21

22

23

24

25

14

15

16

17

A

1 Probability of a Short Call

2 Mean Length of Long Calls

3 S.D. of Length of Long Calls

4

5 Information on # of calls:

6

7

8

9 Basic Minutes

10 Basic Cost

11 Rate for Excess Minutes

12

13

B

Plan Information

500

$ 40.00

$ 0.10

C D

Table continues through column U

E

5%

3.1

1.2

# of Calls

% of Time

153

4%

154

4%

155

8%

Plan 1 Plan 2 Plan 3

400 450 500

$30.00 $35.00 $40.00

$ 0.14 $ 0.12 $ 0.10

Q6

You have a business heat-treating specialty industrial castings. The number of castings you receive for treatment each day is a Poisson random variable with a mean value of

4.1. You process the castings in a super-high-temperature oven that can hold up to 5 castings. This oven uses a heating element that sometimes fails; the probability of failure is as follows:

Day of Use Failure Probability

1 1%

2

3

7%

9%

4

5

15%

25%

After the fifth day of use, the safety regulations for the oven require that the heating element be replaced even if it is still functioning.

On days that the heating element fails, you must wait until tomorrow to reprocess all the castings for that day. Thus, on days that the heating element is working, you have a total processing capacity of up to 5 castings, but on days that it fails, your capacity is effectively 0 castings.

You process the castings on a first-come, first-served basis -- if you cannot finish all the castings waiting to be processed on a given day, you save them in a queue and try to process as many as possible the next day.

You are considering 5 possible policies, parameterized by a number d = 1, 2, 3, 4, or 5.

At the end of the day, if the heating element has been in use for d days and has not failed, you replace it. On days when the element fails, you also replace it at the end of the day.

The economics of the operation are as follows:

The heating element costs $800 to replace if it did not fail

When the element fails, it costs $1500 to replace

You receive $200 in revenue each time you finish processing a casting

You estimate that each day that each casting spends waiting to be processed costs

you $40 in loss of goodwill, storage costs, etc.

You may assume all other costs and revenues to be negligible.

Determine by simulation which value of d gives you the highest expected profit over a

60-day period. You may ignore any costs and revenues from castings left in queue at the end of the period. Use a sample size of at least 500, and assume that you start with a new heating element on the first day.

You are also interested in whether the queue of unprocessed castings left at the end of the day exceeds 10 at any time during the 60-day period. With the optimal value of d , what is the probability of this event?