Chapter 8: Receivables

advertisement

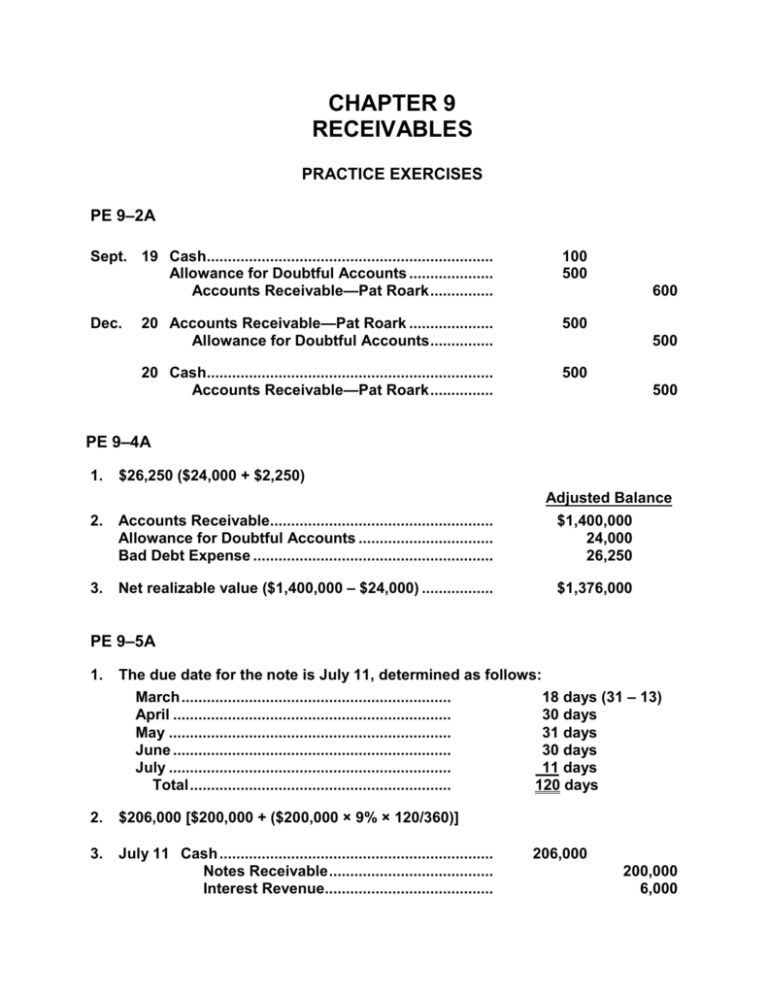

CHAPTER 9 RECEIVABLES PRACTICE EXERCISES PE 9–2A Sept. 19 Cash.................................................................... Allowance for Doubtful Accounts .................... Accounts Receivable—Pat Roark ............... 100 500 Dec. 20 Accounts Receivable—Pat Roark .................... Allowance for Doubtful Accounts ............... 500 20 Cash.................................................................... Accounts Receivable—Pat Roark ............... 500 600 500 500 PE 9–4A 1. $26,250 ($24,000 + $2,250) 2. Accounts Receivable..................................................... Allowance for Doubtful Accounts ................................ Bad Debt Expense ......................................................... 3. Net realizable value ($1,400,000 – $24,000) ................. Adjusted Balance $1,400,000 24,000 26,250 $1,376,000 PE 9–5A 1. The due date for the note is July 11, determined as follows: March ................................................................ 18 days (31 – 13) April .................................................................. 30 days May ................................................................... 31 days June .................................................................. 30 days July ................................................................... 11 days Total .............................................................. 120 days 2. $206,000 [$200,000 + ($200,000 × 9% × 120/360)] 3. July 11 Cash ................................................................. Notes Receivable ....................................... Interest Revenue........................................ 206,000 200,000 6,000 EXERCISES Ex. 9–8 a. Customer Cottonwood Industries Fargo Company Garfield Inc. Sadler Company Twitty Company Due Date July 6 September 17 October 17 November 2 December 23 Number of Days Past Due 147 days (25 + 31 + 30 + 31 + 30) 74 days (13 + 31 + 30) 44 days (14 + 30) 28 days Not past due b. A 1 2 3 4 5 6 Customer Abbott Brothers Inc. Alonso Company 21 22 23 24 25 26 27 28 Ziel Company Subtotals Cottonwood Industries Fargo Company Garfield Inc. Sadler Company Twitty Company Totals B C D E F Aging-of-Receivables Schedule November 30 Days Past Due Not Past Balance Due 1–30 31–60 61–90 2,000 2,000 1,500 1,500 5,000 807,500 14,300 17,700 8,500 10,000 25,000 883,000 475,000 180,000 5,000 78,500 42,300 G Over 90 31,700 14,300 17,700 8,500 10,000 25,000 500,000 190,000 87,000 60,000 46,000 Ex. 9–9 Days Past Due Total receivables Percentage uncollectible Allowance for Doubtful Accounts Balance Not Past Due 1–30 883,000 500,000 77,800 31–60 61–90 Over 90 190,000 87,000 60,000 46,000 1% 6% 20% 35% 50% 5,000 11,400 17,400 21,000 23,000 Ex. 9–10 Nov. 30 Bad Debt Expense ............................................. Allowance for Doubtful Accounts ............... Uncollectible accounts estimate. ($77,800 – $16,175) 61,625 61,625 Ex. 9–25 1. The interest receivable should be reported separately as a current asset. It should not be deducted from notes receivable. 2. The allowance for doubtful accounts should be deducted from accounts receivable. A corrected partial balance sheet would be as follows: JENNETT COMPANY Balance Sheet December 31, 2010 Assets Current assets: Cash ............................................................................ Notes receivable ........................................................ Accounts receivable .................................................. Less allowance for doubtful accounts ............... Interest receivable ..................................................... $ 95,000 250,000 $398,000 36,000 362,000 15,000 Appendix Ex. 9–26 a. $61,800 [$60,000 + ($60,000 × 9% × 120/360)] b. 60 days [120 – (24 + 30 + 6)] c. $1,236 ($61,800 × 12% × 60/360) d. $60,564 ($61,800 – $1,236) e. Cash ............................................................................ Interest Revenue................................................... Notes Receivable .................................................. 60,564 564 60,000 Appendix Ex. 9–27 Mar. 1 31 Notes Receivable .................................................. Accounts Receivable—Gymboree Company 40,000 Cash....................................................................... Notes Receivable ............................................ Interest Revenue ............................................. 40,120* *Computations Maturity value $40,000 + ($40,000 × 8% × 90/360) ................. Discount ($40,800 × 10% × 60/360) .................... Proceeds .............................................................. May 30 Accounts Receivable—Gymboree Company ..... Cash ................................................................. 40,000 40,000 120 $40,800 680 $40,120 41,000* 41,000 *$40,800 + $200 June 29 Cash....................................................................... Accounts Receivable—Gymboree Company Interest Revenue ............................................. *$41,000 + ($41,000 × 0.12 × 30/360) = $41,410 41,410* 41,000 410 Ex. 9–28 a. and b. Net sales Accounts receivable Average accounts receivable Accounts receivable turnover Average daily sales Days’ sales in receivables c. 2007 $4,295,400 $511,900 $514,250 8.4 $11,768.2 43.7 2006 $3,746,300 $516,600 [($511,900 + $516,600)/2] $523,551.5 ($4,295,400/$514,250) 7.2 ($4,295,400/365) 10,263.8 ($514,250/$11,768.2) 51.0 [($516,600 + $530,503)/2] ($3,746,300/$523,551.5) ($3,746,300/365) ($523,551.5/$10,263.8) The accounts receivable turnover indicates an increase in the efficiency of collecting accounts receivable by increasing from 7.2 to 8.4, a favorable trend. The days’ sales in receivables also indicates an increase in the efficiency of collecting accounts receivable by decreasing from 51.0 to 43.7, also indicating a favorable trend. Before reaching a definitive conclusion, the ratios should be compared with industry averages and similar firms.