AP Macroeconomics - Reading Community Schools

AP Macroeconomics i

Text: Ray, Margaret, and David Anderson. Krugman's Macroeconomics for AP . New York: Worth

Publishers/BFW, 2011.

Video Series: Econ U$A series with Discussion

Class Activities/Work:

Completion of graphing and interpretation exercises in Morton, John S. Advanced Placement

Economics , 3rd ed. New York, NY: National Council on Economic Education, 2003 and additional exercises from the NCEE and other sources as necessary.

Selected readings, assignments and discussions from Anderson, David. Economics by Example . New

York: Worth, 2007.

Course Description:

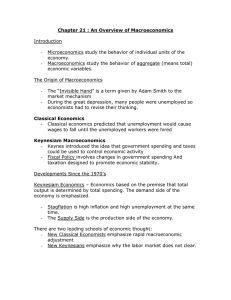

“The purpose of this AP course in Macroeconomics is to give students a thorough understanding of the principles of economics that apply to an economic system as a whole. Such a course places particular emphasis on the study of national income and price-level determination, and also develops students' familiarity with economic performance measures, the financial sector, stabilization policies, economic growth, and international economics.” (AP Course Description Manual 2010)

Text/Materials You Need For Class

Something to keep your assignments organized (agenda book, mobile phone, etc)

Folder

Electronic Folder labeled “Personal Finance” on your desktop with subfolders labeled after each unit.

Pencil

Classroom Rules

Follow all Reading High School rules outlined in your student manual.

Do not in any way disrupt the learning environment for yourself or others. (If you are on YouTube or surfing the Internet when you should not be it is an automatic detention)

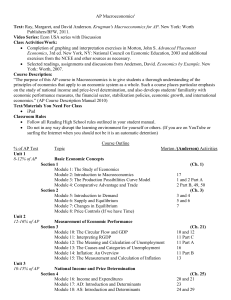

Course Outline

% of AP Test

Unit 1

8-12% of AP

Topic

Section 1

Basic Economic Concepts

Morton / (Anderson) Activities

(Ch. 1)

Unit 2

12-16% of AP

Module 1: The Study of Economics

Module 2: Introduction to Macroeconomics

Module 3: The Production Possibilities Curve Model

Module 4: Comparative Advantage and Trade

Section 2

Module 5: Introduction to Demand

Module 6: Supply and Equilibrium

Module 7: Changes in Equilibrium

Module 8: Price Controls (If we have Time)

Measurement of Economic Performance

Section 3

Module 10: The Circular Flow and GDP

Module 11: Interpreting RGDP

Module 12: The Meaning and Calculation of Unemployment

Module 13: The Causes and Categories of Unemployment

Module 14: Inflation: An Overview

Unit 3

10-15% of AP

Section 4

National Income and Price Determination

Module 15: The Measurement and Calculation of Inflation

17

1 and 2 Part A

5 and 6

7

11 Part A

16

11 Part B

13

(Ch. 21)

10 and 12

11 Part C

2 Part B, 49, 50

3 and 4

(Ch. 3)

(Ch. 25)

Module 16: Income and Expenditures

Module 21: Fiscal Policy and the Multiplier

Module 17: AD: Introduction and Determinants

Module 18: AS: Introduction and Determinants

Module 19: Equilibrium in the AD/AS Model

Module 20: Economic Policy and the AD/AS Model

Unit 4

15-20% of AP

Section 5

Financial Sector

Module 24: The Time Value of Money

Module 22: Saving, Investment and the Financial System

Module 23: The Definition and Measurement of Money

20 and 21

23

24 and 29

25 and 28

27, 30, 43 and 45

31

(Ch. 22)

34 and 35

Module 25: Banking and Money Creation

Module 26: The Fed. History and Structure

Module 27: The Fed. Monetary Policy

Module 28: The Money Market

Unit 5

20-30% of AP

Module 29: The Market for Loanable Funds

Inflation, Unemployment and Stabilization Policies

Section 6

Module 30: Long Run Implications of Fiscal Policy:

Deficits and the Public Debt

Module 31: Monetary Policy and the interest Rate

Module 32: Money, Output and Prices in the Long Run

Module 33: Types of Inflation, Disinflation and Deflation

Module 34: Inflation and Unemployment: The Phillips Curve

43

42

46

Module 35: History and Alternative Views of Macroeconomics 48

Module 36: The Modern Macroeconomic Consensus

37

38

40

39

41 and 44

(Ch. 26)

Unit 6

5-10% of AP Economic Growth and Productivity

Section 7

Module 37: Long Run Economic Growth

Module 38: Productivity and Growth

Module 39: Growth Policy: Why Economic Growth Rates Differ

Module 40: Economic Growth in Macroeconomic Models

Unit 7

10-15% of AP Open Economy: International Trade and Finance

Section 8

Module 41: Capital Flows and the Balance of Payments

47

(Ch. 28)

Module 42: The Foreign Exchange Market

Module 43: Exchange Rate Policy

Module 44: Exchange Rates and Macroeconomic Policy

Module 45: Putting it All Together

(Ch. 27)

51 and 52

53

54 and 55

There will be 9 Tests during this course (8 Section Exams and a Graphing Exam), as well as various quizzes as necessary.

It is expected that all students will take the AP Macroeconomics exam scheduled in May.

There will be review sessions. It is expected that students will be at a minimum of 65% of these review days. Review will include test taking strategy and practice tests as well as content review.

i This is an approved syllabus used for an authorized AP Macroeconomics course , as defined by the College Board:

Approved Syllabus: An approved syllabus is one that has been reviewed by a certified AP Course Audit reviewer and found to include evidence that all AP curricular requirements are addressed.

Authorized Course: A course with a finalized Course Audit form and an approved syllabus is authorized to use the “AP” designation on student transcripts.

Course Audit Form: This online form lists all curricular and resource requirements of the AP course. Through AP Course

Audit accounts, it is completed by the teacher, submitted for school administrator approval, and completed and finalized by the school administrator.