Macroeconomics Overview: Key Concepts & Economic Questions

advertisement

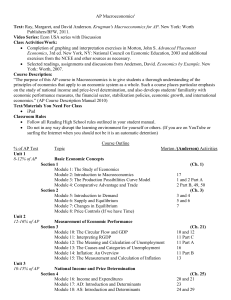

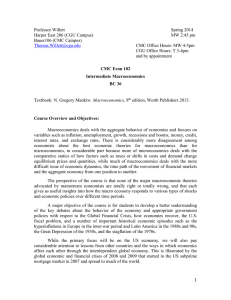

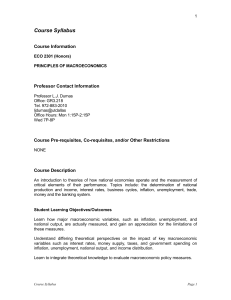

Chapter 21 : An Overview of Macroeconomics Introduction - Microeconomics study the behavior of individual units of the economy. Macroeconomics study the behavior of aggregate (means total) economic variables. The Origin of Macroeconomics - The “Invisible Hand” is a term given by Adam Smith to the market mechanism During the great depression, many people were unemployed so economists had to revise their thinking. Classical Economics - Classical economics predicted that unemployment would cause wages to fall until the unemployed workers were hired Keynesiam Macroeconomics - Keynes introduced the idea that government spending and taxes could be used to control economic activity - Fiscal Policy involves changes in government spending And taxation designed to promote economic stability. Developments Since the 1970’s Keynesiam Economics – Economics based on the premise that total output is determined by total spending. The demand side of the economy is emphasized. - Stagflation is high inflation and high unemployment at the same time. The Supply Side is the production side of the economy. There are two leading schools of economic thought: - New Classical Economists emphasize rapid macroeconomic adjustment - New Keynesians emphasize why the labor market does not clear. Great Macroeconomic Questions - Great macroeconomic questions are unemployment, inflation, the business cycle, the international economy, and economic growth. Unemployment - Unemployment is a situation in which people are unable to find jobs. Inflation - Inflation is a sustained increase in the average level of prices over time. Aggregate Output - The Aggregate Output is a measure of the total production of goods and services. - Business Cycles are alternative periods of ups and downs in economic activity (total output) - Economists hoped to fine tune the economy, or control some of the ups and downs. International Economy - Over the past several years, the economies of the world have become more interdependent then ever. Trading blocs are being formed and countries are looking for markets outside their own borders Economic Growth - Economic growth requires not only that we use our resources efficiently, but also that we increase our productive capacity. - Economic Growth is an increase in per capita output. The Importance of Macroeconomics - Macroeconomic policy is when deliberate action is taken by the government to achieve certain economic objectives. Both Governments and businesses use macroeconomics in their decision-making The central bank implements monetary policy (manipulation of the quantity of money and credit) in order to achieve stability. Governments implement incomes policies (direct controls on wages and prices) to attempt to curd inflation. Macroeconomic Market Interaction Households, firms, and government interact economically through: - The Product Market where goods and services are traded. - The Labor Market where labor services are exchanged for wages. - The Financial Market where funds are lent and borrowed. - The three markets are interrelated Corporations issue bonds and stocks in order to raise funds. The government borrows money by selling bonds and treasury bills. The Circular Flow The circular flow is the flow of income, resources, goods, and services between economic sectors. - Investors receive dividends and/or interest when they lend money in the financial market. Transfer payments do not represent a reward for productive services. The circular flow shows that the spending of one sector becomes a receipt by some other sector. The Behaviour of the Canadian Economy Growth of Output - The Gross Domestic Product (GDP) is the value of all the goods and services produced in a country during a period of time. The Unemployment Rate - The Canadian economy has experienced inflationary and recessionary periods, but it has performed reasonably well. - The Unemployment Rate is the number of people unemployed expressed as a percentage of the labor force. The Behaviour of the Price Level - Price Indexes show changes in prices over a period of time.