AS Micro Economics Revision Notes B

advertisement

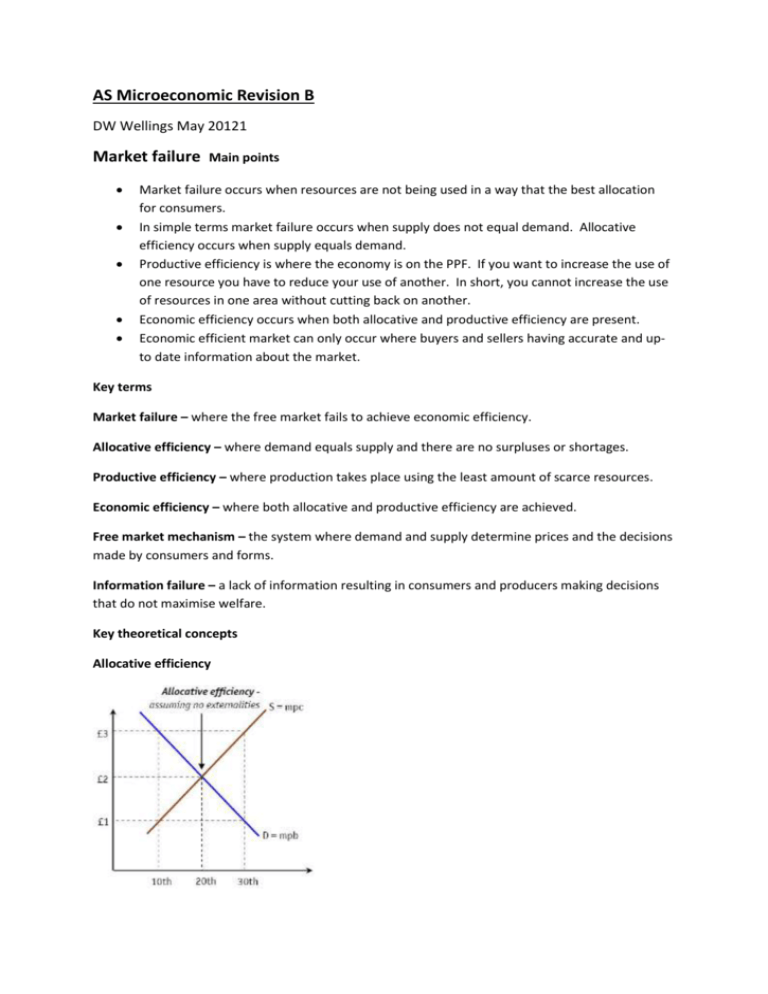

AS Microeconomic Revision B DW Wellings May 20121 Market failure Main points Market failure occurs when resources are not being used in a way that the best allocation for consumers. In simple terms market failure occurs when supply does not equal demand. Allocative efficiency occurs when supply equals demand. Productive efficiency is where the economy is on the PPF. If you want to increase the use of one resource you have to reduce your use of another. In short, you cannot increase the use of resources in one area without cutting back on another. Economic efficiency occurs when both allocative and productive efficiency are present. Economic efficient market can only occur where buyers and sellers having accurate and upto date information about the market. Key terms Market failure – where the free market fails to achieve economic efficiency. Allocative efficiency – where demand equals supply and there are no surpluses or shortages. Productive efficiency – where production takes place using the least amount of scarce resources. Economic efficiency – where both allocative and productive efficiency are achieved. Free market mechanism – the system where demand and supply determine prices and the decisions made by consumers and forms. Information failure – a lack of information resulting in consumers and producers making decisions that do not maximise welfare. Key theoretical concepts Allocative efficiency Costs, benefits and externalities Main points Economists differentiate between private costs and private benefits. Private costs are the costs incurred by private firms through economic activity. Private benefits are the positive results of business activity, such as profit. Economists differentiate between public costs and public benefits. Public costs are the negative effects of economic activity on the rest of society, such as pollution. Public benefits are the positive results of business activity on wider society, such as a local multiplier effect. Negative externalities occur where marginal social costs are greater than private costs. Positive externalities occur where marginal social befit of economic activity exceeds the private benefit. Negative externalities include illegal dumping of waste, and binge drinking. Positive externalities include inoculations, education and training and infrastructure projects. Key terms Private costs and benefits – the costs and benefits incurred by private firms as a result of economic activity. Public costs and benefits – the costs and benefits to third parties as a result of economic activity. Negative externality – this exists where the social cost of an activity is greater than the private cost. Positive externality – this exists where the social benefit of an activity exceeds the private benefit. Key theoretical concepts Positive and negative externalities Public goods, merit goods and government intervention to correct market failure Main points Public goods are goods that are consumed collectively. They have the characteristics of nonexcludability and non-rivalry. Street lights and public parks are good examples of public goods. Quasi-public goods have some of the characteristics of a public good but not all. For example toll roads and bridges are quasi public goods. Merit goods are goods usually provided the government as they will be under- provided in a free market. Examples include heath care and education. Demerit goods are goods that would be overprovided by the free market but are banned by legislation. These include guns, porn and drugs. Governments can intervene by charge firms for negative externalities, providing merit goods, subsidies, tradable permits, indirect taxation and the provision of information. Key terms Public goods – goods that are collectively consumed and have the characteristics of nonexcludability and non-rivalry. Non-excludability – where individual consumers cannot be excluded from consumption. Non-rivalry – where consumption by one person does not affect the consumption of others. Free rider – someone who directly benefits from the consumption of a public good but who does not contribute to its provision. Subsidy – payment from government to encourage production or consumption. Tradable permits – a permit that allows a producer to emit a certain amount of pollution and can be traded with other polluters. Key theoretical concepts The effects of imposing an indirect tax. The effects of introducing a subsidy Price determination of tradable pollution permits. The effects of imposing an indirect tax. The effects of introducing a subsidy Price determination of tradable pollution permits.