US Economy Down Not Out - Pockets

advertisement

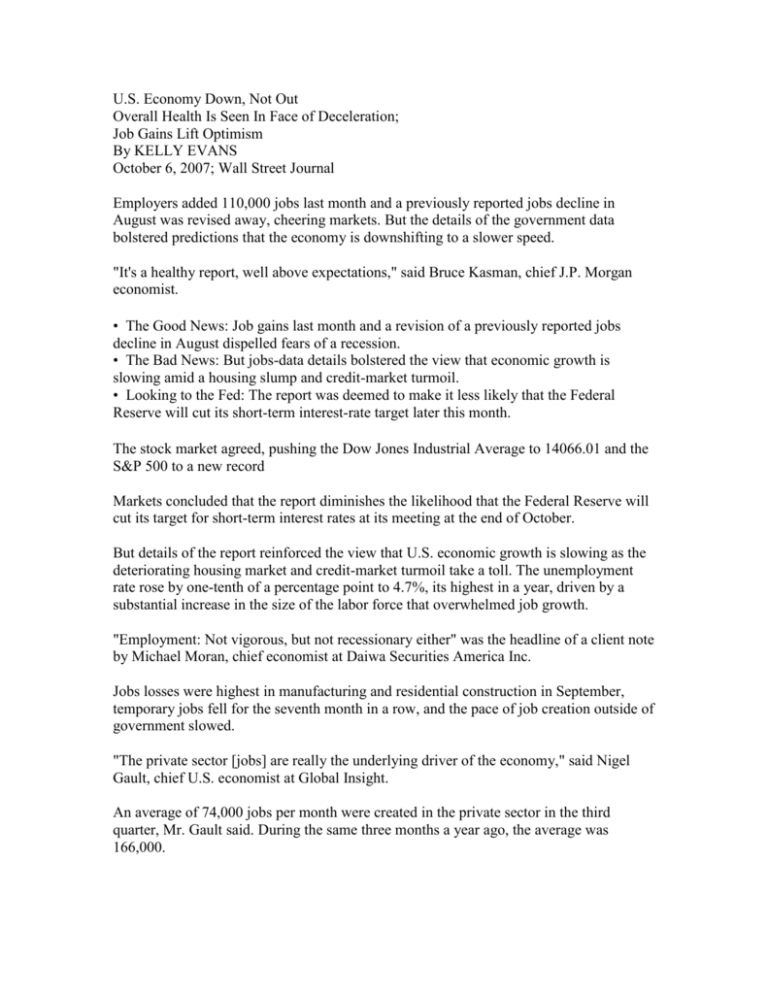

U.S. Economy Down, Not Out Overall Health Is Seen In Face of Deceleration; Job Gains Lift Optimism By KELLY EVANS October 6, 2007; Wall Street Journal Employers added 110,000 jobs last month and a previously reported jobs decline in August was revised away, cheering markets. But the details of the government data bolstered predictions that the economy is downshifting to a slower speed. "It's a healthy report, well above expectations," said Bruce Kasman, chief J.P. Morgan economist. • The Good News: Job gains last month and a revision of a previously reported jobs decline in August dispelled fears of a recession. • The Bad News: But jobs-data details bolstered the view that economic growth is slowing amid a housing slump and credit-market turmoil. • Looking to the Fed: The report was deemed to make it less likely that the Federal Reserve will cut its short-term interest-rate target later this month. The stock market agreed, pushing the Dow Jones Industrial Average to 14066.01 and the S&P 500 to a new record Markets concluded that the report diminishes the likelihood that the Federal Reserve will cut its target for short-term interest rates at its meeting at the end of October. But details of the report reinforced the view that U.S. economic growth is slowing as the deteriorating housing market and credit-market turmoil take a toll. The unemployment rate rose by one-tenth of a percentage point to 4.7%, its highest in a year, driven by a substantial increase in the size of the labor force that overwhelmed job growth. "Employment: Not vigorous, but not recessionary either" was the headline of a client note by Michael Moran, chief economist at Daiwa Securities America Inc. Jobs losses were highest in manufacturing and residential construction in September, temporary jobs fell for the seventh month in a row, and the pace of job creation outside of government slowed. "The private sector [jobs] are really the underlying driver of the economy," said Nigel Gault, chief U.S. economist at Global Insight. An average of 74,000 jobs per month were created in the private sector in the third quarter, Mr. Gault said. During the same three months a year ago, the average was 166,000. With the latest data, forecasters at Macroeconomic Advisers, a St. Louis firm, estimate that the economy grew at an annual rate of 3.1% in the third quarter, down from the second quarter's 3.8%. The employment report is among the most closely watched of the government's economic indicators. "The real reason we focus so much on the employment report at this point is because job growth is the main factor helping to underpin income growth," said David Greenlaw, chief U.S. fixed-income economist at Morgan Stanley. He said that as the declining housing market creates a negative "wealth effect" on consumers, wage growth is one of the few remaining sources driving consumer spending, the engine of economic growth. The Labor Department also said employers added 89,000 jobs in August, erasing its previous estimate of a 4,000-job decline. It also said employers added 93,000 jobs in July, up from the previously reported 68,000. The unanticipated decline in payrolls in August that was reported last month contributed to the Fed's decision to cut interest rates by half a percentage point at their September meeting. "If the Fed had this data instead of the original August data, would they have still gone [half a point]? We'll never know," said Mr. Greenlaw, "but that's the talk floating around trading rooms." Much of the revision was caused by recalibrating seasonal fluctuations in government employment, including teaching. REAL TIME ECONOMICS "The revision is all about the government [employment] numbers," Mr. Gault said. "Basically the government is telling us the statisticians got it wrong the first time and now they fixed it, but that doesn't tell us that much about the underlying health of the economy." In a speech in Philadelphia, Fed Vice Chairman Donald Kohn said, "Once we get through the near-term weakness caused by the extra downleg from the housing contraction and any spillover from tighter credit conditions, I am looking for moderate growth with high levels of employment." But Mr. Kohn cautioned, "You should view these forecasts even more skeptically than usual....We do not know how financial markets will evolve, and we do not know how households and businesses will respond to financial developments." Mr. Kohn, acknowledging that many observers had expected a quarter-point rate cut in September, defended the bigger move as "not an unreasonable first approximation of what might be required to keep the economy on a sustainable growth path" in the face of uncertainty about how quickly markets would recover. "I thought," he added, "that economic performance would be better served by the Federal Reserve taking its chances on responding too much, or too rapidly, to the turmoil in financial markets rather than acting too little, or too slowly." The Labor Department said average hourly earnings rose by 7 cents last month, a gain of 4.1% since last September, a bullish sign for consumer spending but a worrisome one for those preoccupied with the risk that inflation is accelerating. In a separate report, the Fed said consumer borrowing grew 6% in August from a year earlier, the fastest in three months. Consumer credit outstanding increased by $12.2 billion in August to $2.47 trillion, after climbing by $9.6 billion in July. Non-revolving credit, such as car and boat loans, grew by $6 billion to $1.55 trillion. Revolving credit, which mainly reflects credit-card financing, grew $6.1 billion in August to $915.5 billion. Even before the Fed's rate cut, the average rate on new-car loans from auto-finance companies fell to 4.15% in August from 4.74%. The average maturity on new car loans grew to 62.6 months, more than five years, from 58.6 months in July. Write to Kelly Evans at kelly.evans@wsj.com