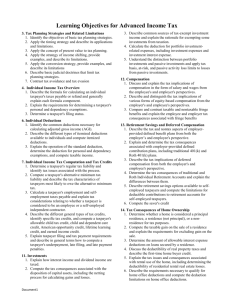

federal income taxation outline

advertisement